by Calculated Risk on 7/30/2012 09:29:00 PM

Monday, July 30, 2012

FHFA Nears Decision on Debt Forgiveness, and Tuesday: Case-Shiller House Prices

From Nick Timiraos at the WSJ: Data Show Fannie, Freddie Savings From Debt Forgiveness

As the regulator for Fannie Mae and Freddie Mac nears its decision on whether to approve debt forgiveness for troubled borrowers, a new analysis by the regulator suggests that taxpayers could actually benefit from the move...FHFA acting director Edward DeMarco focused on this last point in his speech in April:

In April, the agency said that loan forgiveness would save about $1.7 billion for the companies, relative to other types of relief. At the time, the agency said that because the Treasury was paying to subsidize those write-downs, the relief would still cost taxpayers $2.1 billion, offsetting any savings to the companies.

But the latest analysis done by the agency found that such write-downs would generate $3.6 billion in savings for the companies, under certain assumptions, according to people familiar with the analysis. Even after subtracting the cost of the Treasury subsidies, the program would save $1 billion, these people said. As many as 500,000 borrowers could be eligible, these people said.

...

The FHFA has raised other concerns beyond the cost of such write-downs. Chief among them is the fear that more borrowers, upon hearing that Fannie and Freddie are instituting a debt-forgiveness program, might default to seek more generous terms.

One factor that needs to be considered is the borrower incentive effects. That means, will some percentage of borrowers who are current on their loans, be encouraged to either claim a hardship or actually go delinquent to capture the benefits of principal forgiveness?The FHFA might decide that the risk from "strategic modifiers" outweighs the possible savings.

...

It is difficult to model these borrower incentive effects with any precision. What we can do is give a sense of how many current borrowers would have to become “strategic modifiers” for the NPV economic benefit provided by the HAMP triple PRA incentives to be eliminated. In this context, a “strategic modifier” would be a borrower that either claims a financial hardship or misses two consecutive mortgage payments in order to attempt to qualify for HAMP and a principal forgiveness modification.

Also from Nick Timiraos at the WSJ Are Home Prices Rising? A Price-Index Primer

On Tuesday:

• At 8:30 AM ET, the Personal Income and Outlays report for June will be released by the BEA. The consensus is for a 0.2% increase in personal income in June, and for 0.1% increase in personal spending, and for the Core PCE price index to increase 0.2%.

• At 9:00 AM, S&P/Case-Shiller House Price Index for May is scheduled to be released. The consensus is for a 1.4% decrease year-over-year in Composite 20 prices (NSA) in May. The Zillow forecast is for the Composite 20 to decline 1.0% year-over-year, and for prices to increase 0.8% month-to-month seasonally adjusted.

• At 9:45 AM: Chicago Purchasing Managers Index for July will be released. The consensus is for a decrease to 52.5, down from 52.9 in June.

• Also at 10:00 AM, the Conference Board's consumer confidence index for July. The consensus is for a decrease to 61.5 from 62.0 last month.

And the final question for the July economic contest:

More FOMC Preview

by Calculated Risk on 7/30/2012 08:09:00 PM

Most of this article is about the ECB and there isn't anything new on the Fed, from Jon Hilsenrath and Brian Blackstone at the WSJ: Heat Rises on Central Banks

The two-day Federal Open Market Committee meeting convenes Tuesday, following signs that Fed officials have become more willing to act to address disappointingly slow U.S. economic growth.From Goldman Sachs analysts today:

...

The Fed could unveil a new program for buying mortgage or government securities to bring down long-term interest rates, or take other actions to spur growth, or simply promise to do more later if necessary. Officials might wait until September, when they will formally update their economic forecasts, before deciding anything significant.

Although a new Fed asset purchase program is a possibility in the near term if the data continue to disappoint, our central expectation is for a return to QE in December or early 2013.

...

We expect an extension of the current “exceptionally low…at least through late 2014” interest rate guidance to "mid 2015." Such a shift would roughly restore the forward guidance to the same three-year horizon as at the January FOMC meeting, when the "late 2014" formulation was first adopted. We would, however, regard this rate extension as a relatively modest step.

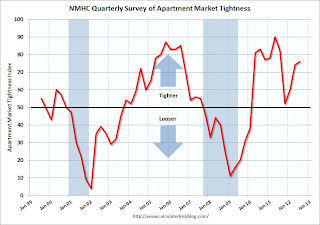

NMHC Apartment Survey: Market Conditions Tighten in Q2 2012

by Calculated Risk on 7/30/2012 04:51:00 PM

From the National Multi Housing Council (NMHC): Apartment Market Hot Streak Continues

For the sixth quarter in a row, the apartment industry improved across all indexes in the National Multi Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The survey’s indexes measuring Market Tightness (76), Sales Volume (54), Equity Financing (58) and Debt Financing (77) all measured at 50 or higher, indicating growth from the previous quarter.

“The apartment sector’s strength continues unabated,” said NMHC Chief Economist Mark Obrinsky. “Even as new construction ramps up, higher demand for apartment residences still outstrips new supply with no letup in sight. Despite the need for new apartments, acquisition and construction finance remains constrained in all but the best properties in the top markets.”

...

Majority report increased market tightness. The Market Tightness Index edged up to 76 from 74. For the first time in a year, more than half (55 percent) of respondents said that markets were tighter. By contrast, only 2 percent reported the markets as loosening and 43 percent reported no change over the past three months.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. The index has indicated tighter market conditions for the last ten quarters and suggests falling vacancy rates and or rising rents.

This fits with the recent Reis data showing apartment vacancy rates fell in Q2 2012 to 4.7%, down from 4.9% in Q1 2012, and down from 9.0% at the end of 2009. This was the lowest vacancy rate in the Reis survey in over 10 years.

This survey indicates demand for apartments is still strong. And even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be more completions in 2012 than in 2011, but it looks like another strong year for the apartment industry.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010 - and will probably be useful in indicating when the vacancy rate will stop falling.

Lawler on Manufactured Housing

by Calculated Risk on 7/30/2012 01:47:00 PM

From Tom Lawler:

The Commerce Department estimated that manufactured housing shipments ran at a seasonally adjusted annual rate of 54,000 in June, down from 56,000 in May. In the first five months of 2012 manufactured housing shipments ran at a SAAR of 57,000, up from 51,600 in 2011 but just a fraction of the pace prior to last decade’s collapse.

The Commerce Department also estimated that manufactured housing placements ran at a SAAR of 47,000 in May, down from 51,000 in April. In the first five months of 2012 manufactured housing shipments ran at a SAAR of 52,200, up from 47,000 in 2011.

| Manufactured Housing Shipments (Annual Average, 000's) | |

|---|---|

| 1961-1970 | 255.6 |

| 1971-1980 | 348.5 |

| 1981-1990 | 243.7 |

| 1991-2000 | 296.8 |

| 2001-2006 | 154 |

| 2006-2010 | 78.9 |

| 2011 | 51.6 |

| 2012YTD | 57 |

Click on graph for larger image.

Click on graph for larger image.Here is a graph from Lawler showing the annual manufactured housing shipments since 1959. The column for 2012 is the annual sales rate for the first six months of the year.

Although sales are running at about a 10% increase over last year, shipments in 2012 will still be the fourth lowest on record behind only 2009, 2010, and 2011.

Dallas Fed: "Slower Growth" in July Regional Manufacturing Activity

by Calculated Risk on 7/30/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Posts Slower Growth Amid Weaker View of General Business Activity

Texas factory activity continued to increase in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 15.5 to 12, suggesting slightly slower output growth.This was below expectations of a 2.5 reading for the general business activity index.

The new orders index was positive for the second month in a row, although it moved down from 7.9 to 1.4. Similarly, the shipments index posted its second consecutive positive reading but edged down from 9.6 to 7.4. ... The general business activity plummeted to -13.2 after climbing into positive territory in June. Nearly 30 percent of manufacturers noted a worsening in the level of business activity in July, pushing the index to its lowest reading in 10 months.

...

Labor market indicators reflected stronger labor demand. Employment growth continued in July, although the index edged down from 13.7 to 11.8. ... The hours worked index was 4.1, up slightly from its June reading.

The regional manufacturing surveys were mostly weak in July. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

The ISM index for July will be released Wednesday, August 1st, and these surveys suggest another weak reading. The consensus is for an increase to 50.1, up from 49.7 in June. (below 50 is contraction).

Europe Update

by Calculated Risk on 7/30/2012 09:10:00 AM

Spanish 10 year bond yields are down to 6.61% this morning. Italian yields are at 6.03%.

A few articles and comments on Europe, first from Tim Duy: Fed Watch: The Euromess Continues

Excitement is almost guaranteed this week, with both the Federal Reserve and the European Central Bank pondering their next moves. At the moment, I am more fascinated with the latter, as it represents the more fast moving policy failure for the moment. In response to that disaster to date, it is now widely expected that the ECB will deliver a significant policy expansion, possibly accepting its responsibility of lender of last resort for sovereign debt in the Eurozone. I think it is widely believed that this will be the turning point in Europe. In some ways, yes, as it would keep the threat of imminent dissolution at bay. But the Eurozone will still be fundamentally hobbled by a devotion to re-balancing via austerity-driven internal devaluation. This does not offer a promising long-run outcome.From Paul Krugman: Crash of the Bumblebee

First of all, Europe’s single currency is a deeply flawed construction. And Mr. Draghi, to his credit, actually acknowledged that. “The euro is like a bumblebee,” he declared. “This is a mystery of nature because it shouldn’t fly but instead it does. So the euro was a bumblebee that flew very well for several years.” But now it has stopped flying. What can be done? The answer, he suggested, is “to graduate to a real bee.”From Reuters: Euro zone crisis heads for September crunch

Never mind the dubious biology, we get the point. In the long run, the euro will be workable only if the European Union becomes much more like a unified country.

...

But the creation of a United States of Europe won’t happen soon, if ever, while the crisis of the euro is now. So what can be done to save the currency?

Over the past couple of years, Europe has muddled through a long series of crunch moments in its debt crisis, but this September is shaping up as a "make-or-break" month as policymakers run desperately short of options to save the common currency.From the WSJ: Greece Seen Facing €30 Billion Shortfall

Crisis or no crisis, many European policymakers will take their summer holidays in August. When they return, a number of crucial events, decisions and deadlines will be waiting.

Greece's chronic recession and the receding hope of an economic recovery in the next two years have blown a hole of at least 30 billion euros ($36.85 billion) in its financial rescue plan, officials familiar with the situation said.

The officials argued that the findings indicate a need for official creditors to write down their claims by at least that amount if they want to keep Greece in the euro zone, as well as finding new money to fund the country for longer. The officials represented two of four parties to the talks: the Greek government and the "troika" of the European Union, European Central Bank and International Monetary Fund.

...

"The haircut on private holders has proved not to be enough," said one official involved in the next round of talks.

Sunday, July 29, 2012

Monday: Dallas Fed Manufacturing Survey

by Calculated Risk on 7/29/2012 09:51:00 PM

This will be a busy week with the two day FOMC meeting ending on Wednesday, the ECB meeting in Europe on Thursday, and several key economic releases including the July employment report on Friday.

First from Reuters: Juncker: Euro zone leaders, ECB to act on euro - paper

[Eurogroup head Jean-Claude] Juncker told Germany's Sueddeutsche Zeitung and France's Le Figaro in reports made available on Sunday that leaders would decide in the next few days what measures to take to tackle Spanish bond yields which last week touched euro-era highs. They had "no time to lose," he said.• On Monday, at 10:30 AM ET, the Dallas Fed Manufacturing Survey for July will be released. This is the last of regional surveys for July. The consensus is for 2.5 for the general business activity index, down from 5.8 in June.

The Asian markets are green tonight, with the Nikkei up 0.8% and the Shanghai Composite up 0.1%. Check out the chart for the Shanghai composite - the index has been drifting down for 2+ years and is at the levels of early 2009.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P future are down about 5, and the DOW futures down about 30.

Oil: WTI futures are at $90.04(this is down from $109.77 in February, but up last week) and Brent is at $106.51 per barrel.

Yesterday:

• Summary for Week Ending July 27th

• Schedule for Week of July 29th

And the final question for the July economic contest:

FOMC Preview: QE3 now or later?

by Calculated Risk on 7/29/2012 06:19:00 PM

There is a chance that the FOMC will announce QE3 this week although some analysts expect QE3 in September and others after the election in November.

As an example, from Merrill Lynch last week:

There is quite a bit of uncertainty about the exact timing and shape of forthcoming Fed easing. Although there is a good chance of some QE3 at next week’s FOMC meeting, we still think it is an extension of the forward guidance language through “at least late 2015” is (slightly) more likely This would resemble the policy pattern last year, and would keep the Fed’s options open. It also would allow the Fed to make a compelling case that bad data, not politics, are driving QE3.The "politics" argument cuts both ways - delaying action when projections show unemployment too high for years, and inflation too low - is also giving in to "politics".

Some arguments for waiting until September 13th are:

1) There will be more data available (two more employment reports for July and August, and the 2nd estimate of Q2 GDP on August 29th). Of course "waiting" always allows for "more data" - so people can always use this argument.

2) Housing data has been improving, and residential investment is usually the best leading indicator for the economy.

3) The FOMC members will update projections in September, and Fed Chairman Ben Bernanke will hold a news conference to explain the reasons for any action. There is no news conference scheduled following the meeting this week.

4) There are also some arguments that seasonal factors are distorting the recent data.

Probably the most compelling reason for waiting is the housing argument, but even though housing is recovering, the housing market is still very weak.

And the most recent projections are already becoming "untenable" (as Atlanta Fed President Lockhart recently noted). Here were the projections for GDP:

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

Based on the Q2 advance GDP report released on Friday, GDP would have to increase at a 2.1% to 3.1% in the 2nd half of 2012 to meet the FOMC projections for 2012. That suggests a further downward revision in FOMC projections in September.

And the June projections were already very low - "shocking" as Tim Duy wrote) The FOMC members see unemployment in the 7% to 7.7% range at the end of 2014, and inflation also below target through 2014.

The data supports QE3 this week, but the data also supported QE3 in June. One of the reasons I thought QE3 was unlikely in June was the lack of foreshadowing from the Fed. There have been plenty of hints since then, so QE3 is very possible this week - but still uncertain.

Yesterday:

• Summary for Week Ending July 27th

• Schedule for Week of July 29th

When will the Case-Shiller house price index turn positive Year-over-year?

by Calculated Risk on 7/29/2012 10:14:00 AM

The CoreLogic index turned positive year-over-year in March: CoreLogic® Home Price Index Shows Year-Over-Year Increase of Just Over One Percent

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 1.1 percent in April 2012 compared to April 2011. This was the second consecutive year-over-year increase this year ...And the FHFA index turned positive year-over-year in February: FHFA House Price Index Up 0.3 Percent in February

For the 12 months ending in February, U.S. prices rose 0.4 percent, the first 12-month increase since the July 2006 - July 2007 interval.However we are still waiting on Case-Shiller.

On Friday I posted Zillow's forecasts for the May Case-Shiller indexes to be released this coming Tuesday. The year-over-year (YoY) decline in Case-Shiller prices has been getting smaller all year, and the Zillow forecast suggests the YoY decline will be even smaller in the May report - and be the smallest YoY decline since the expiration of the housing tax credit.

I looked at the recent improvement in prices (comparing the month-to-month changes for the NSA index to last year). If the Zillow forecast is close, at the current pace of improvement, it looks like the YoY change will turn positive in the July report - it could even happen in the June report (to be released next month).

Click on graph for larger image.

Click on graph for larger image. Here is a graph of the YoY change in the Case-Shiller Composite 10 and 20 indexes. In April, the indexes were down 2.2% and 1.9%, respectively.

Zillow is forecasting the Composite 10 index will be down 1.3% YoY in the May report, and the Composite 20 index will be down 1.0%.

Earlier this year, when I argued prices were near the bottom for the Not Seasonally Adjusted (NSA) repeat sales indexes, I thought the year-over-year change would turn positive late this year or early in 2013. Right now it looks like the July report.

Saturday, July 28, 2012

Unofficial Problem Bank list declines to 900 Institutions

by Calculated Risk on 7/28/2012 08:57:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 27, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions through June 2012, which led to many change to the Unofficial Problem Bank List. For the week, there were seven removals and two additions leaving the list at 900 institutions with assets of $349.5 billion. A year ago, the list held 995 institutions with $415.4 billion in assets. For the month of July 2012, there were 12 additions and 29 removals, with 20 from action termination, six from failure, two from unassisted mergers, and one from voluntary liquidation.Earlier:

The seven removals this week came from action termination including Community Commerce Bank, Claremont, CA ($299 million); Traverse City State Bank, Traverse City, MI ($188 million); Security Bank, S.B., Springfield, IL ($160 million); Professional Bank, Coral Gables, FL ($152 million); Progrowth Bank, Nicollet, MN ($133 million); Capital Community Bank, Provo, UT ($122 million); and Colonial American Bank, Horsham, PA ($60 million). Professional Bank is only the 5th bank from Florida to be removed from the list because of action termination. Oregon and Georgia have only seen one bank and two banks, respectively, removed from the list. For the second week in a row, there was a failure in Georgia -- Jasper Banking Company, Jasper, GA -- that failed without being under an formal enforcement action.

The two additions were South Valley Bank & Trust, Klamath Falls, OR ($854 million) and First Security Bank of Helena, Helena, MT ($42 million).

The FDIC [issued] Prompt Corrective Action orders against Sevier County Bank, Sevierville, TN ($323 million) and Westside Community Bank, University Place, WA ($113 million).

• Summary for Week Ending July 27th

• Schedule for Week of July 29th