by Calculated Risk on 7/06/2012 12:42:00 PM

Friday, July 06, 2012

Reis: Mall Vacancy Rate declines slightly in Q2

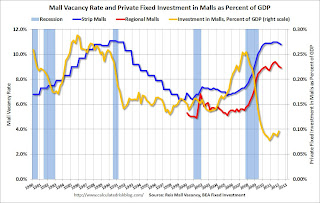

Reis reported that the vacancy rate for regional malls declined slightly to 8.9% in Q2 from 9.0% in Q1. This is down from a cycle peak of 9.4% in Q3 of last year.

For Neighborhood and Community malls (strip malls), the vacancy rate declined to 10.8% in Q2, from 10.9% in Q1. For strip malls, the vacancy rate peaked at 11.0% in Q2 of last year.

Comments from Reis Senior Economist Ryan Severino:

[Strip mall] The national vacancy rate fell by 10 bps during the second quarter to 10.8%. This is the second consecutive quarterly decline in the vacancy rate after vacancies had generally been rising between the second quarter of 2005 and the fourth quarter of 2011. Although demand for space remains weak, new construction remains moored at such low levels that even weak demand is sufficient to push vacancy rates downward. Only 572,000 SF of neighborhood and community center space were delivered during the quarter. That is the second-lowest quarterly figure on record since Reis began publishing quarterly data in 1999 and a fairly substantial decline from the already scant 1.554 million SF that were delivered during the first quarter.

Despite the second consecutive quarterly vacancy decline, Reis is not yet convinced that a recovery for shopping centers has commenced. Just as much of the recent improvement in the market is owed to limited increases in supply as the somewhat resurgent demand. New completions remain just above historically low levels. With supply growth once again falling back to such trivial levels, the modest demand we observed pushed vacancy down slightly. Two consecutive quarters of vacancy decline is a notable result, but nonetheless only represents the nascent stages of stabilization. With construction projected to remain at low levels, Reis expects vacancies to continue moving slowly downward in 2012 as demand for space outpaces new construction.

...

Regional malls posted another quarter of modest improvement, with national vacancies declining by 10 bps to 8.9%. This is the third consecutive quarter with a vacancy decline. Asking rents grew by 0.3%, marking the fifth consecutive quarter of rent increases. Although regional malls continue to perform better then neighborhood and community centers at this juncture, demand for space remains weak.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

The yellow line shows mall investment as a percent of GDP. This isn't zero because this includes renovations and improvements. New mall investment has essentially stopped following the financial crisis.

The good news is, as Severino noted, "new [mall] completions remain just above historically low levels", and, with very little new supply, the vacancy rate will probably continue to decline slowly.

Mall vacancy data courtesy of Reis.

Earlier on employment:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs

Employment: Another Weak Report (more graphs)

by Calculated Risk on 7/06/2012 10:54:00 AM

Another month, another disappointing employment report.

The economy has added 902,000 jobs over the first half of the year (952,000 private sector jobs). At this pace, the economy would add around 1.9 million private sector jobs in 2012; less than the 2.1 million added in 2011.

However job growth has really slowed over the last three months with only 225,000 payroll jobs added (a 900,000 annual pace), and only 274,000 private sector jobs (a 1.1 million annual pace). This is very sluggish employment growth.

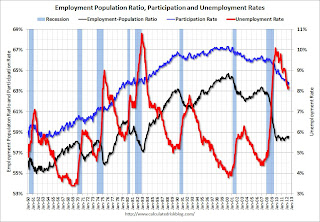

The unemployment rate was unchanged at 8.2% in June The household survey showed a another increase in employment (128,000 jobs added), and since the participation rate was unchanged at 63.8%, that was just enough to keep with the increase in the labor force.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased slightly to 14.9%.

The bottom line is this was another disappointing employment report. Here are a few more graph ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move back to or above 80% as the economy recovers. So far the ratio has only increased slightly from a low of 74.7% to 75.6% in June (this was down slightly in June.)

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

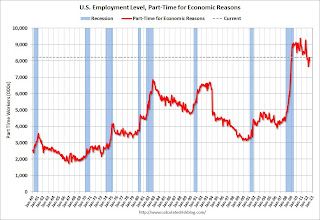

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 8.2 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in June to 8.21 millon.

These workers are included in the alternate measure of labor underutilization (U-6) that increased in June to 14.9%, up from 14.8% in May.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.37 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.41 million in May. This is generally trending down, but very slowly. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

So far in 2012 - through June - state and local government have lost 20,000 jobs (3,000 jobs were added in June). In the first six months of 2011, state and local governments lost 133,000 payroll jobs - and 230,000 for the year. So the layoffs have slowed.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011.Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is still losing workers (52,000 over the last 12 months and another 7,000 in June alone), but it looks like state and local government employment losses might be ending (or at least slowing sharply).

Overall this was another weak report.

June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

by Calculated Risk on 7/06/2012 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to edge up in June (+80,000), and the unemployment rate was unchanged at 8.2 percent, the U.S. Bureau of Labor Statistics reported today.

...

Both the civilian labor force participation rate and the employment-population ratio were unchanged in June at 63.8 and 58.6 percent, respectively.

...

The change in total nonfarm payroll employment for April was revised from +77,000 to +68,000, and the change for May was revised from +69,000 to +77,000.

Click on graph for larger image.

Click on graph for larger image.This was another weak month, and the revisions for the previous two months were offsetting.

This was below expectations of 90,000 payroll jobs added.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was unchanged at 8.2% (red line).

The Labor Force Participation Rate was unchanged at 63.8% in June (blue line). This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 63.8% in June (blue line). This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio was unchanged at 58.6% in June (black line).

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 90,000). More later ...

Thursday, July 05, 2012

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 7/05/2012 10:23:00 PM

With an 8%+ unemployment rate, every day should be about jobs ...

• At 8:30 AM ET, the Employment Report for June will be released. The consensus is for an increase of 90,000 non-farm payroll jobs in June, up from the 69,000 jobs added in May. Earlier today I wrote Employment Situation Preview. Here are some comments from Goldman Sachs:

We expect a middling June employment report to be released on Friday morning, with a 125,000 gain in nonfarm payrolls and a flat 8.2% unemployment rate. We raised our payroll number from 75,000 earlier today in response to 1) more online help-wanted advertising, 2) fewer layoff announcements, 3) a better ADP, 4) slightly lower initial jobless claims in the latest (post-survey) week, and 5) decent readings in the employment components of the ISM manufacturing and nonmanufacturing survey (despite disappointments in most other components).And from Patti Domm at CNBC: June Jobs Report Could Put the Fed in Play

If the report broadly matches our expectations, it would probably dampen speculation about an imminent return to balance sheet expansion from the Federal Reserve.

“I think the whisper is closer to 110,000, 120,000," said John Briggs, senior Treasury strategist at RBS. "Anything between 80,000 and 130,000 doesn’t matter. It shouldn’t be a major market mover,” he said. However, Briggs said the equity market is being supported by the idea of Fed easing and a really good number might actually be a negative to some in risk markets.• Early: Reis is expected to release their Q2 Mall vacancy report.

If the number is better than expected, “I don’t think that would take QE off the table. It would just have us waiting for the July 17 testimony” of Fed Chairman Ben Bernanke before Congress, he said.

Consumer Bankruptcy filings Decrease 13 Percent in First Half of 2012

by Calculated Risk on 7/05/2012 05:09:00 PM

From the American Bankruptcy Institute: Bankruptcy Filings Fall 14 Percent for the First Half of 2012, Commercial Filings Drop 22 Percent

The 601,184 total noncommercial filings for the first half of 2012 represented a 13 percent drop from the noncommercial filing total of 691,902 for the first half of 2011. Total commercial filings during the first six months of the year were 30,946, representing a 22 percent decrease from the 39,598 filings during the same period in 2011.

“We are on pace for perhaps the lowest total new bankruptcies since before the financial crisis in 2008,” said ABI Executive Director Samuel J. Gerdano. “With sustained low interest rates and weak consumer spending, we expect bankruptcies to stay at relatively low levels through the end of 2012.”

The 99,057 total bankruptcy filings for the month of June represented an 18 percent decrease compared to the 120,698 filings in June 2011.

Click on graph for larger image.

Click on graph for larger image.This graph shows the non-business bankruptcy filings by quarter using quarterly data from the ABI.

Note: The spike in 2005 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation).

It is possible that consumer bankruptcy filings peaked in 2010, but filings might increase again next year as pre-bankruptcy act filers file bankruptcy again.

Earlier:

• Reis: Apartment Vacancy Rate falls to 4.7% in Q2

• ADP: Private Employment increased 176,000 in June

• Weekly Initial Unemployment Claims decline to 374,000

• ISM Non-Manufacturing Index declines, indicates slower expansion in June

• Employment Situation Preview

Employment Situation Preview

by Calculated Risk on 7/05/2012 01:10:00 PM

With only 77,000 payroll jobs added in April, and just 69,000 in May - and evidence that the economy slowed further in June - the June employment report to be released tomorrow is especially important. Another weak report, combined with sluggish Q2 GDP numbers to be released later this month, would increase the likelihood of QE3 being announced on August 1st.

However the weak payroll numbers for the last two months might have been "payback" for the mild weather in January and February. And not all is bleak. Vehicle sales were solid in June, and the sluggish recovery in housing is ongoing.

Bloomberg is showing the consensus is for an increase of 90,000 payroll jobs in June, and for the unemployment rate to remain unchanged at 8.2%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 176,000 private sector payroll jobs in June. This would seem to suggest that the consensus for the increase in total payroll employment is too low, although the ADP report hasn't been very useful in predicting the BLS report for any one month. Also, ADP doesn't include government payrolls, and government payrolls have been shrinking for some time.

• The ISM manufacturing employment index decreased slightly in June to 56.6%, down from 56.9% in May. A historical correlation between the ISM index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing increased about 16,000 in June.

The ISM service employment index increased in June to 52.3%, up from 50.8% in May. Based on a historical correlation between the ISM non-manufacturing employment index and the BLS employment report for service, this reading suggests the gain of around 120,000 private payroll jobs for services in June.

Combined the ISM surveys suggest an employment report above the consensus.

• Initial weekly unemployment claims averaged about 385,000 in June, up slightly from the 380,000 average for April and May. This was the highest average this year, and about the same level as in November and December of last year when the economy added 190,000 jobs per month.

For the BLS reference week (includes the 12th of the month), initial claims were at 392,000; the highest this year.

• The final June Reuters / University of Michigan consumer sentiment index declined to 73.2, down from the May reading of 79.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. Gasoline prices have been falling, so this decline suggests a weaker labor market.

• The small business index from Intuit showed 70,000 payroll jobs added, up from 40,000 in May.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Unchanged in June

U.S. unemployment, as measured by Gallup without seasonal adjustment, was 8.0% in June, unchanged from May, but significantly better than the 8.7% from a year ago. Gallup's seasonally adjusted number, based on applying an estimate of the government's June adjustment, is 7.8%, an improvement from 8.3% in May, and down considerably from 8.5% in June 2011. Both the unadjusted and the adjusted numbers are at least tied for the lowest Gallup has recorded since it began collecting employment data in 2010.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). Note: So far the Gallup numbers haven't been useful in predicting the BLS unemployment rate.

• Conclusion: The overall feeling is that the economy weakened further in June, and that would seem to suggest another weak employment report this month. However, if the "payback" is over (as several analysts have argued), the number of payroll jobs could be better than the last couple of months.

Recently I've taken the "under" on the employment report, but looking at these data points surprised me a little. The combined ISM reports suggest a number in the 130,000+ range, and the ADP report (private only), suggest the consensus is too low. And the Intuit numbers improved sharply. Note: The ISM survey is conducted all month, with most respondents replying at the end of the month - so the timing doesn't line up with the BLS reference week.

On the negative side, weekly claims increased in June to the highest level this year, and consumer sentiment declined - even with falling gasoline prices.

There always seems to be some randomness to the employment report, but this month I'll take the over (over 90,000 payroll jobs).

For the economic contest in July:

ISM Non-Manufacturing Index declines, indicates slower expansion in June

by Calculated Risk on 7/05/2012 10:07:00 AM

The June ISM Non-manufacturing index was at 52.1%, down from 53.7% in May. The employment index increased in June to 52.3%, up from 50.8% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 30th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 52.1 percent in June, 1.6 percentage points lower than the 53.7 percent registered in May. This indicates continued growth this month at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 51.7 percent, which is 3.9 percentage points lower than the 55.6 percent reported in May, reflecting growth for the 35th consecutive month. The New Orders Index decreased by 2.2 percentage points to 53.3 percent, and the Employment Index increased by 1.5 percentage points to 52.3 percent, indicating continued growth in employment at a faster rate. The Prices Index decreased 0.9 percentage point to 48.9 percent, indicating lower month-over-month prices for the second consecutive month. According to the NMI, 12 non-manufacturing industries reported growth in June. Respondents' comments are mixed and vary by industry and company."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.0% and indicates slower expansion in June than in May.

Weekly Initial Unemployment Claims decline to 374,000

by Calculated Risk on 7/05/2012 08:37:00 AM

The DOL reports:

In the week ending June 30, the advance figure for seasonally adjusted initial claims was 374,000, a decrease of 14,000 from the previous week's revised figure of 388,000. The 4-week moving average was 385,750, a decrease of 1,500 from the previous week's revised average of 387,250.The previous week was revised up from 386,000 to 388,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined slightly to 385,750.

This is just off the high for the year.

And here is a long term graph of weekly claims:

This was below the consensus forecast of 386,000. This is just one week of improvement, and the four week average suggests some renewed weakness in the labor market.

This was below the consensus forecast of 386,000. This is just one week of improvement, and the four week average suggests some renewed weakness in the labor market.ADP: Private Employment increased 176,000 in June

by Calculated Risk on 7/05/2012 08:20:00 AM

ADP reports:

According to today‟s ADP National Employment Report, employment in the nonfarm private business sector rose 176,000 from May to June on a seasonally adjusted basis. Employment in the private, service-providing sector rose 160,000 in June, after rising a revised 137,000 in May.This was way above the consensus forecast of an increase of 95,000 private sector jobs in June. The BLS reports on Friday, and the consensus is for an increase of 90,000 payroll jobs in June, on a seasonally adjusted (SA) basis.

According to Joel Prakken, chairman of Macroeconomic Advisers, LLC, “The gain in private employment is strong enough to suggest that the national unemployment rate may have declined in June. Today‟s estimate, if reinforced by a comparable reading on employment from the Bureau of Labor Statistics tomorrow, likely will ease concerns that the economy is heading into a downturn.”

Prakken added: “There seems little doubt that recent employment gains have been restrained by heightened uncertainty over the European financial crisis and by growing concerns about domestic fiscal policy. However, the acceleration of employment since April does lend credence to the argument that unseasonably warm weather boosted employment during the winter months, with a "payback" spread over April and May.”

ADP hasn't been very useful in predicting the BLS report, but this suggests a stronger than consensus report.

Note - it was rate cutting day too: ECB cuts rates.

China cuts rates.

BOE expands QE.

MBA: Mortgage Applications Decrease, Record Low Mortgage Rates

by Calculated Risk on 7/05/2012 07:00:00 AM

From the MBA: Mortgage Applications Decrease Driven by a Drop in Refinances in Latest MBA Weekly Survey

The Refinance Index was down about 8 percent overall this week, largely driven by a significant drop in refinance applications for government loans. The HARP 2.0 share of refinance applications has been 24 percent over the past two weeks, up slightly from 20 percent three weeks ago. The seasonally adjusted Purchase Index increased less than 1 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.86 percent from 3.88 percent, with points increasing to 0.41 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This is the lowest 30-year fixed rate since MBA began tracking the series.

Click on graph for larger image.

Click on graph for larger image.The decline in refinance activity was from a very high level. This just offset the surge in refinance activity two weeks ago related to the change in FHA streamline refinancing.

The purchase index is mostly moving sideways.