by Calculated Risk on 7/06/2012 12:42:00 PM

Friday, July 06, 2012

Reis: Mall Vacancy Rate declines slightly in Q2

Reis reported that the vacancy rate for regional malls declined slightly to 8.9% in Q2 from 9.0% in Q1. This is down from a cycle peak of 9.4% in Q3 of last year.

For Neighborhood and Community malls (strip malls), the vacancy rate declined to 10.8% in Q2, from 10.9% in Q1. For strip malls, the vacancy rate peaked at 11.0% in Q2 of last year.

Comments from Reis Senior Economist Ryan Severino:

[Strip mall] The national vacancy rate fell by 10 bps during the second quarter to 10.8%. This is the second consecutive quarterly decline in the vacancy rate after vacancies had generally been rising between the second quarter of 2005 and the fourth quarter of 2011. Although demand for space remains weak, new construction remains moored at such low levels that even weak demand is sufficient to push vacancy rates downward. Only 572,000 SF of neighborhood and community center space were delivered during the quarter. That is the second-lowest quarterly figure on record since Reis began publishing quarterly data in 1999 and a fairly substantial decline from the already scant 1.554 million SF that were delivered during the first quarter.

Despite the second consecutive quarterly vacancy decline, Reis is not yet convinced that a recovery for shopping centers has commenced. Just as much of the recent improvement in the market is owed to limited increases in supply as the somewhat resurgent demand. New completions remain just above historically low levels. With supply growth once again falling back to such trivial levels, the modest demand we observed pushed vacancy down slightly. Two consecutive quarters of vacancy decline is a notable result, but nonetheless only represents the nascent stages of stabilization. With construction projected to remain at low levels, Reis expects vacancies to continue moving slowly downward in 2012 as demand for space outpaces new construction.

...

Regional malls posted another quarter of modest improvement, with national vacancies declining by 10 bps to 8.9%. This is the third consecutive quarter with a vacancy decline. Asking rents grew by 0.3%, marking the fifth consecutive quarter of rent increases. Although regional malls continue to perform better then neighborhood and community centers at this juncture, demand for space remains weak.

Click on graph for larger image.

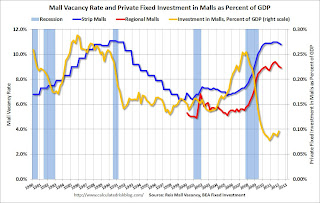

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

The yellow line shows mall investment as a percent of GDP. This isn't zero because this includes renovations and improvements. New mall investment has essentially stopped following the financial crisis.

The good news is, as Severino noted, "new [mall] completions remain just above historically low levels", and, with very little new supply, the vacancy rate will probably continue to decline slowly.

Mall vacancy data courtesy of Reis.

Earlier on employment:

• June Employment Report: 80,000 Jobs, 8.2% Unemployment Rate

• Employment: Another Weak Report (more graphs)

• All Employment Graphs