by Calculated Risk on 4/09/2012 01:27:00 PM

Monday, April 09, 2012

Hamilton: Current economic conditions

Professor Hamilton reviews the current situation at Econbrowser: Current economic conditions

An excerpt on the impact oil and gasoline prices:

One of the big concerns of many analysts was that rising oil prices of the last 5 months might significantly slow down economic growth. My view is that the main mechanism by which oil prices can sometimes have a disproportionately disruptive effect on the economy is if they result in sudden shifts in the patterns of spending. One typical channel is a plunge in sales of the larger vehicles manufactured in the U.S., which then leads to further losses of income and jobs in the auto sector. But the evidence suggests that an oil price increase that just reverses a previous oil price decrease-- and that is basically what we've experienced so far in 2012-- is not nearly as disruptive as if the price were rocketing into uncharted territory. One reason for this is that recent consumers' vehicle purchase plans were already taking into account the possibility that $4 gas could soon return.See Hamilton's post for much more on oil.

Hamilton concludes: "the economy undeniably continues to grow, the rate of that growth continues to disappoint".

LPS: House Price Index declined 0.9% in January

by Calculated Risk on 4/09/2012 09:14:00 AM

Notes: The timing of different house prices indexes can be a little confusing. LPS uses January closings - other indexes usually report sales recorded in a month, and there is frequently a lag between closings and recording - so this is closer to what other indexes report for February (without the weighting of several months).

From LPS: LPS Home Price Index Shows U.S. Home Price Decline of 0.9 Percent in January; Early Data Suggests Slowing Likely in February, to 0.3 Percent Drop

LPS ...that starting with this month’s report, results are based on an updated view that more accurately tracks price changes for non-distressed homes. In addition to foreclosure price data the LPS HPI now accounts for the impact of short sale on estimates of normal market prices.LPS excludes both foreclosures and short sales from the index - so this is non-distressed properties only. From LPS:

The updated LPS HPI national average home price for transactions during January 2012 declined 0.9 percent to a price level not seen since March 2003.

Among the 26 MSAs for which LPS and the Bureau of Labor Statistics both provide data, average prices in January increased only in Washington, D.C.Note: Based on early data, LPS expects to report prices fell 0.3% in February.

Fourteen of these MSAs saw declines of more than 1.0%, and three, San Francisco, Cleveland and Chicago declined more than 1.5%.

Sunday, April 08, 2012

Sunday Night Futures and FHFA Speech on Tuesday

by Calculated Risk on 4/08/2012 10:31:00 PM

A couple of updates to the weekly schedule:

Monday: LPS House Price Index for January.

Tuesday, 9:30 AM ET: Speech by FHFA acting director Edward DeMarco: "Addressing the Weak Housing Market: Is Principal Reduction the Answer?" at the The Brookings Institution, 1775 Massachusetts Ave., NW Washington, DC.

The Spanish 10 year yield is up to 5.76%.

The Asian markets are red tonight. The Nikkei is down about 1.1%, the Shanghai Composite is down 0.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down 17, and Dow futures are down 140.

Oil: WTI futures are down to $101.99 and Brent is down to $122.38 per barrel.

Yesterday:

• Summary for Week Ending April 6th

• Schedule for Week of April 8th

More: Mall Vacancy Rate declines slightly in Q1

by Calculated Risk on 4/08/2012 01:01:00 PM

On Friday I noted that Reis reported the mall vacancy rate declined slightly in Q1. The strip mall vacancy rate declined to 10.9% from 11.0% in Q4 2011, and the regional mall vacancy rate declined to 9.0% from 9.2% in Q4.

Here are a few more comments and a long term graph from Reis.

Comments from Reis Senior Economist Ryan Severino:

[Strip mall] Vacancies finally began to fall during the first quarter, declining by 10 bps. This is the first quarterly decline in the vacancy rate since the second quarter of 2005. In the periods leading up to the recession, excess building was to blame for the increase in vacancies. Since the advent of the recession, supply growth has been virtually nonexistent, but anemic demand drove vacancies upward.

Despite the first quarterly decline in vacancy since 2005, Reis is not yet convinced that a recovery for shopping centers has commenced. However, this says just as much about the limited increases in supply as it does about resurgent demand. New completions remain near historically low levels. With such low levels of supply growth, any semblance of healthy demand would have pushed vacancy rates downward in a more pronounced fashion. ... With construction projected to remain at low levels, Reis expects vacancies to begin moving downwards slowly in 2012 as demand for space slowly begins to return.

...

Regional malls posted relatively healthy results in the first quarter, with national vacancies declining by 20 bps to 9.0% This was the second consecutive quarter of vacancy declines. Asking rents grew by 0.2%, marking the third consecutive quarter of rent increases. Although regional malls are faring better then neighborhood and community centers at this juncture, this has as much to do with supply as demand. While demand for malls, particularly higher‐quality malls, is arguably stronger than demand for neighborhood and community center space, regional malls did not experience massive supply increases before the recession the way neighborhood and community centers did. In fact, the first new regional mall in the U.S. in six years opened during the first quarter of 2012.

The outlook for 2012 remains muddled. Although demand appears to be gathering strength, the developments are not uniformly positive. Best Buy recently announced that it was closing 50 big‐box stores, but opening 100 new, smaller Best Buy Mobile stores. Although the net effect is a reduction in occupied square footage, it will have a detrimental impact on power centers while benefitting other subtypes such as regional malls.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the '00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to a higher vacancy rate even before the recession, and then a sharp increase during the recession and financial crisis.

Mall investment has essentially stopped following the financial crisis.

The good news is, as Severino noted, mall "completions remain near historically low levels", and the vacancy rate will probably continue to decline slowly.

Mall vacancy data courtesy of Reis.

Yesterday:

• Summary for Week Ending April 6th

• Schedule for Week of April 8th

Housing Story: Owning vs. Renting

by Calculated Risk on 4/08/2012 09:09:00 AM

From Eric Wolff at the North County Times: 'This is crazy': Home ownership cheaper than renting

Monthly payments on a house are now cheaper than monthly rents on a similar house in most of North San Diego and Southwest Riverside counties, according to an analysis of county-supplied and Realtor data by the North County Times.These comparisons aren't perfect, however the price-to-rent ratio (that doesn't include interest rates) is back to normal too, so stories like this aren't a surprise.

... prices for houses plummeted and interest rates fell below 4 percent, a 40-year low. The combination of factors has created a house market in North San Diego and Southwest Riverside county in which homeowners are getting a better deal than renters, at least after they've paid their down payment.

"I don't think this has ever happened before," said G.U. Krueger, a principal economist for HousingEcon.com. "It's a function of the huge housing price collapse which has left a lot of people in the lurch."

Or, as Carlsbad real estate agent Tyson Lund put it: "This is crazy."

...

There are, of course, a host of caveats not included in the calculation. The analysis does not amortize the down payment on the house, nor does it include the maintenance costs that homeowners accrue to keep their homes in good repair, though many economists argue the mortgage interest tax deduction offered by the federal government balances those expenses. Still, the calculation depends on a homebuyer having enough money to make a down payment, and sufficient credit to get a loan. In 2011, banks raised the bar on those to whom they'd lend, making it difficult for many people to get mortgages. ... "If rates were back to 5.5 percent or 6 percent, then the mortgages become more expensive than rents. I would not call 4 percent a normalized housing market," [Nathan Moeder, a principal at The London Group] said in an email. "Today, people are able to afford more home because of the interest rates."

Saturday, April 07, 2012

HUD Secretary on Principal Reductions

by Calculated Risk on 4/07/2012 08:17:00 PM

HUD Secretary Shaun Donovan will be on C-SPAN Sunday morning (see here).

Here are some comments on Fannie and Freddie principal reductions:

Q: Why should Fannie and Freddie be forced to do write-downs?A few days ago, FHFA acting director Edward DeMarco said:

DONOVAN: This isn’t about force. This is about making the right decision for homeowners and for the taxpayer. We believe and there is a lot of agreement, many economists, those who have looked closely at this data who believe where you have someone who is deeply underwater, where you’re in a situation where there is really no light at the end of the tunnel, no sense that even if you’re paying your mortgage for three, four, five years or even a decade, that you’ll get back to building equity again. Families will give up at some point. We think the data shows that. Really the issue here is about the numbers and the analysis and whether this is not only good for homeowners but also good for the taxpayer. And we believe with the changes that we’ve made over the last few months that the case is compelling. And my experience with Ed DeMarco is whatever his personal feelings are, he is dedicated to making sure that he follows the law and what the conservator is required to do. And we believe based on the analysis that we’ve done that the evidence is that principal write-downs should happen in cases where it’s not only good for the homeowner but also good for the taxpayer.

Q: Three out of four deeply underwater borrowers with loans backed by Fannie and Freddie are paying. How concerned are you that some of those borrowers may stop paying if you offer debt reduction to borrowers who are delinquent?

DONOVAN: The vast majority of homeowners don’t operate that way. They know that their home is where they’re going to raise their kids. They’re part of a community there. The home is much more than an investment. And so we really know this from studies we’ve done, that the vast majority of folks, these families, aren’t going to just put all of that at risk to default on purpose on their homes.

And so what we’re really talking about is a small group of folks, maybe demographically single folks who aren’t giving up those same things, who see that there may be from defaulting that you know they could move across the street or other things. So there is a small group. But we shouldn’t punish the vast majority of folks where strategic default isn’t really a risk, just to fix what may be really a risk with a small percentage.

This isn’t that hard a problem to design around. Take the mortgage-servicing settlement that we recently reached. In that case what we’re doing is putting in place protections so that we avoid some of the risks of strategic default. For example, in that case many of the servicers are simply going to set a date at which you’re eligible based on delinquency and what that means is there’s nothing you can do. You can’t make yourself eligible. You can’t start to default on your mortgage and all of a sudden start to get a windfall from that by getting a principal reduction. And so while I understand the concerns about this, I think one the vast majority of homeowners are not at risk for strategic default. And two, even for those where there is some risk, there is a way to design it so that … it avoids those risks.

[W]e are currently evaluating the recent Treasury Department proposal to HAMP regarding principal forgiveness and expect a decision this month.So a decision will probably be made very soon.

Earlier:

• Summary for Week Ending April 6th

• Schedule for Week of April 8th

Unofficial Problem Bank List and Quarterly Transition Matrix

by Calculated Risk on 4/07/2012 05:25:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 6, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Quiet week for the Unofficial Problem Bank List as there were only two removals. The changes leave the list with 946 institutions with assets of $376.5 billion. A year ago, the list 982 institutions with assets of $433.2 billion. The action against First Savings Bank Northwest, Renton, WA ($1.0 billion Ticker: FFNW) was replaced by an informal action and Pilsen State Bank, Lincolnville, KS ($11 million) was dissolved through an unassisted merger.

With the passage of the first quarter of 2012, it is time to update the Unofficial Problem Bank List transition matrix. The list debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table). Over the past 32 months, 230 institutions or about 59 percent of the institutions on the original list have been removed with 137 from failure, 71 from action termination, 20 from unassisted merger, and two from voluntary liquidation. About 35 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List.

Since the publication of the original list, another 1,122 institutions have been added. However, only 789 of those additions remain on the current list as 333 institutions have been removed in the interim. Of the 333 inter-period removals, 178 were from failure, 72 were from an unassisted merger, 78 from action termination, and five from voluntary liquidation.

In total, 1,511 institutions have made an appearance on the Unofficial Problem Bank List and 315 or 20.8 percent have failed. Of the 563 total removals, the primary way of exit from the list is failure at 315 institutions or 56 percent. Only 149 or around 27 percent have been able to rehabilitate themselves to see their respective action terminated. Alternatively, another 92 or nearly 16 percent found merger partners most likely to avoid failure. Total assets that have appeared on the list amount to $789.8 billion and $282.3 billion have been removed due to failure. The average asset size of removals from failure is $896 million.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 71 | (19,039,409) | |

| Unassisted Merger | 20 | (3,401,337) | |

| Voluntary Liquidation | 2 | (4,855,164) | |

| Failures | 137 | (178,872,611) | |

| Asset Change | (14,066,292) | ||

| Still on List at 3/31/2012 | 167 | 56,078,616 | |

| Additions | 789 | 321,473,577 | |

| End (3/31/2012) | 948 | 377,552,193 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 78 | 44,376,836 | |

| Unassisted Merger | 72 | 42,937,646 | |

| Voluntary Liquidation | 5 | 1,259,188 | |

| Failures | 178 | 103,460,185 | |

| Total | 333 | 192,033,855 | |

| 1Institutions not on 8/7/2009 or 3/31/2012 list but appeared on a list between these dates. | |||

Schedule for Week of April 8th

by Calculated Risk on 4/07/2012 01:28:00 PM

Earlier:

• Summary for Week Ending April 6th

The key reports for this week are the February Trade Balance report, to be released on Thursday, and the March Consumer Price Index (CPI), to be released on Friday.

FHFA acting director Edward DeMarco is speaking on Tuesday: "Addressing the Weak Housing Market: Is Principal Reduction the Answer?"

There will be several speeches by Fed officials, including both Fed Chairman Ben Berananke, and Fed Vice Chairman Janet Yellen.

Morning: LPS House Price Index for January.

7:15 PM ET: Speech by Fed Chairman Ben Bernanke, "Fostering Financial Stability", At the 2012 Federal Reserve Bank of Atlanta Financial Markets Conference, Stone Mountain, Georgia

7:30 AM: NFIB Small Business Optimism Index for March.

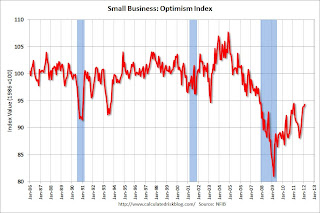

7:30 AM: NFIB Small Business Optimism Index for March. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 94.3 in February from 93.9 in January. This is the sixth increase in a row after for the index, and the index is now at second highest level since December 2007. The consensus is for an increase to 94.8.

9:30 AM ET: Speech by FHFA acting director Edward DeMarco: "Addressing the Weak Housing Market: Is Principal Reduction the Answer?" at the The Brookings Institution, 1775 Massachusetts Ave., NW Washington, DC.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings were unchanged in January, and the number of job openings (yellow) has generally been trending up, and are up about 21% year-over-year compared to January 2011.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.6% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Import and Export Prices for February. The consensus is a for a 0.9% increase in import prices.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

6:15 PM: Speech by Fed Vice Chair Janet Yellen, "The Economic Outlook and Monetary Policy", At the Money Marketeers of New York University Dinner Meeting, New York, New York

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase slightly to 359,000.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. Both exports and imports increased in January. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 8% compared to January 2011; imports just passed the pre-recession high and imports are up about 8% compared to January 2011.

The consensus is for the U.S. trade deficit to decrease to $51.7 billion in February, up from from $52.6 billion in January. Export activity to Europe will be closely watched due to economic weakness.

8:30 AM: Producer Price Index for March. The consensus is for a 0.3% increase in producer prices (0.2% increase in core).

8:30 AM: Consumer Price Index for March. The consensus is a 0.3% increase in prices. The consensus for core CPI to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (perliminary for April). The consensus is for sentiment to be unchanged at 76.2.

1:00 PM: Speech by Fed Chairman Ben Bernanke, "Reflections on the Crisis and the Policy Response", At the Russell Sage Foundation and The Century Foundation Conference on "Rethinking Finance," New York, New York

Summary for Week ending April 6th

by Calculated Risk on 4/07/2012 07:43:00 AM

The March employment report was below expectations with only 120,000 payroll jobs added. The unemployment rate declined slightly to 8.2%. U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 14.5% from 14.9% in February.

Is this the beginning of even slower employment growth, or was this just noise? That is a key question and will put additional pressure on the April report.

In 2011, the economy added 1.84 million payroll jobs (2.1 million private sector), and, even after the weak March report, the economy is on pace to add over 2.5 million payroll jobs this year. That is still sluggish growth given the slack in the system, but better than 2011.

Other reports below expectations included March auto sales, February construction spending, and the March ISM service survey. The ISM manufacturing survey was slightly above expectations.

A couple of other positives: initial weekly unemployment claims continued to decline, and, for commercial real estate, the office and mall vacancy rates are now declining.

Overall it was a disappointing week and suggests sluggish growth.

Here is a summary in graphs:

• March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

Click on graph for larger image.

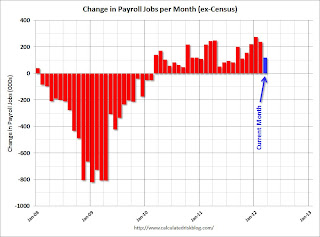

Click on graph for larger image.

This graph shows the jobs added or lost per month (excluding temporary Census jobs) since the beginning of 2008.

From the BLS: "Nonfarm payroll employment rose by 120,000 in March, and the unemployment rate was little changed at 8.2 percent, the U.S. Bureau of Labor Statistics reported today."

The second graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate was declined to 8.2% (red line).

The Labor Force Participation Rate decreased to 63.8% in March (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Labor Force Participation Rate decreased to 63.8% in March (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the decline is due to demographics.

The Employment-Population ratio decreased slightly to 58.5% in March (black line).

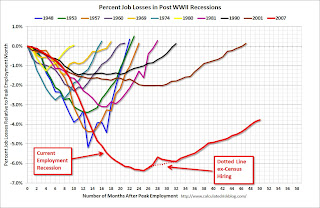

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The third graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - much worst than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was weaker payroll growth than expected (expected was 201,000).

• ISM Manufacturing index indicates slightly faster expansion in March

PMI was at 53.4% in March, up from 52.4% in February. The employment index was at 56.1%, up from 53.2%, and new orders index was at 54.5%, down from 54.9%.

PMI was at 53.4% in March, up from 52.4% in February. The employment index was at 56.1%, up from 53.2%, and new orders index was at 54.5%, down from 54.9%. Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 53.0%. This suggests manufacturing expanded at a faster rate in March than in February. It appears manufacturing employment expanded in March with the employment index at 56.1%.

• ISM Non-Manufacturing Index indicates slower expansion in March

The March ISM Non-manufacturing index was at 56.0%, down from 57.3% in February. The employment index increased in March to 56.7%, up from 55.7% in February. Note: Above 50 indicates expansion, below 50 contraction.

The March ISM Non-manufacturing index was at 56.0%, down from 57.3% in February. The employment index increased in March to 56.7%, up from 55.7% in February. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.7% and indicates slightly slower expansion in March than in February.

• U.S. Light Vehicle Sales at 14.4 million annual rate in March

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.37 million SAAR in March. That is up 10.4% from March 2011, but down 4.4% from the sales rate last month (15.03 million SAAR in Feb 2012).

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.37 million SAAR in March. That is up 10.4% from March 2011, but down 4.4% from the sales rate last month (15.03 million SAAR in Feb 2012).This graph shows light vehicle sales since the BEA started keeping data in 1967.

March was above the August 2009 rate with the spike in sales from "cash-for-clunkers". Only February had a higher sales rates since early 2008. This was below the consensus forecast of 14.7 million SAAR.

Even though this was below expectations, growth in auto sales will make another strong positive contribution to GDP in Q1 2012.

• Construction Spending declined in February

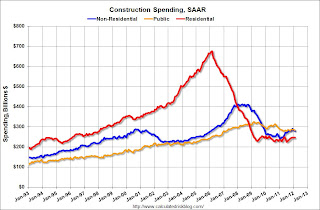

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.Private residential spending is 63.5% below the peak in early 2006, and up 10% from the recent low. Non-residential spending is 32% below the peak in January 2008, and up about 15% from the recent low.

Public construction spending is now 13% below the peak in March 2009.

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and this suggest the bottom is in for residential investment.

• Reis: Office, Mall and Apartment Vacancy Rates

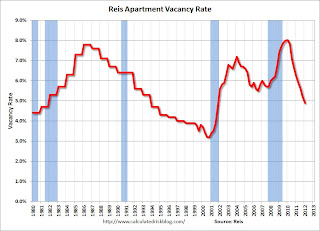

Reis reported the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.

Reis reported the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.This graph shows the apartment vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the apartment sector (just like for offices) with the very loose lending that led to the S&L crisis. Once the lending stopped, starts of built-for-rent units slowed, and the vacancy rate started to decline.

Following the financial crisis, starts and completions of multi-family units fell to record lows (there were a record low number of completions last year). Builders have increased construction, but it usually takes over a year to complete a multi-family building, so this new supply hasn't reached the market yet. As Reis noted, the number of completions will increase this year, but the vacancy rate will probably decline further.

This will also impact on house prices. The upward pressure on rents will make the price-to-rent ratio a little more favorable for buying.

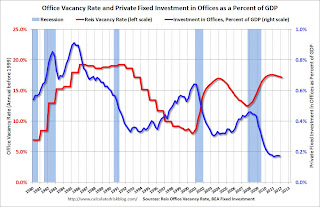

Reis reported the office vacancy rate declined slightly to 17.2% in Q1 from 17.3% in Q4 2011. The vacancy rate was at 17.6% in Q1 2011.

Reis reported the office vacancy rate declined slightly to 17.2% in Q1 from 17.3% in Q4 2011. The vacancy rate was at 17.6% in Q1 2011.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the office sector even as the vacancy rate was rising. This was due to the very loose lending that led to the S&L crisis.

In the '90s, office investment picked up as the vacancy rate fell. Following the bursting of the stock bubble, the vacancy rate increased sharply and office investment declined.

During the housing bubble, office investment started to increase even before the vacancy rate had fallen below 14%. This was due to loose lending - again. Investment essentially stopped following the financial crisis.

The good news is there is very little new office construction right now and the vacancy rate will probably continue to decline.

Ries reported the regional mall vacancy rate declined to 9.0% in Q1, and the strip mall vacancy rate declined to 10.9% from 11.0%.

Ries reported the regional mall vacancy rate declined to 9.0% in Q1, and the strip mall vacancy rate declined to 10.9% from 11.0%.This graph shows the vacancy rate for regional and strip malls since Q1 2000.

It appears the vacancy rate is starting to decline, but very slowly. Just like for office space, there is almost no new supply of malls being built.

• Weekly Initial Unemployment Claims decline to 357,000

The DOL reports:

The DOL reports:In the week ending March 31, the advance figure for seasonally adjusted initial claims was 357,000, a decrease of 6,000 from the previous week's revised figure of 363,000. The 4-week moving average was 361,750, a decrease of 4,250 from the previous week's revised average of 366,000.The previous week was revised up to 363,000 from 359,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 361,750.

The 4-week moving average is at the lowest level since early 2008.

• Other Economic Stories ...

• FOMC Minutes: No Push for QE3

• Federal Reserve Issues Statement on Rental of REOs

• Trulia announces new "mix adjusted" House Asking Price Monitor, Prices up 1.4% from Q4

• Ceridian-UCLA: Diesel Fuel index increased 0.3% in March

• ADP: Private Employment increased 209,000 in March

• LPS: February Foreclosure Starts and Sales Reversed Prior Month’s Increases

Friday, April 06, 2012

Stand-up economist Yoram Bauman: S*** happens: the economics version

by Calculated Risk on 4/06/2012 10:32:00 PM

Language warning on video below ...

Earlier Employment posts:

• March Employment Report: 120,000 Jobs, 8.2% Unemployment Rate

• Employment Summary and Discussion

• Construction Employment, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• All Employment Graphs