by Calculated Risk on 4/07/2012 01:28:00 PM

Saturday, April 07, 2012

Schedule for Week of April 8th

Earlier:

• Summary for Week Ending April 6th

The key reports for this week are the February Trade Balance report, to be released on Thursday, and the March Consumer Price Index (CPI), to be released on Friday.

FHFA acting director Edward DeMarco is speaking on Tuesday: "Addressing the Weak Housing Market: Is Principal Reduction the Answer?"

There will be several speeches by Fed officials, including both Fed Chairman Ben Berananke, and Fed Vice Chairman Janet Yellen.

Morning: LPS House Price Index for January.

7:15 PM ET: Speech by Fed Chairman Ben Bernanke, "Fostering Financial Stability", At the 2012 Federal Reserve Bank of Atlanta Financial Markets Conference, Stone Mountain, Georgia

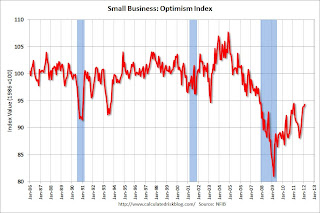

7:30 AM: NFIB Small Business Optimism Index for March.

7:30 AM: NFIB Small Business Optimism Index for March. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 94.3 in February from 93.9 in January. This is the sixth increase in a row after for the index, and the index is now at second highest level since December 2007. The consensus is for an increase to 94.8.

9:30 AM ET: Speech by FHFA acting director Edward DeMarco: "Addressing the Weak Housing Market: Is Principal Reduction the Answer?" at the The Brookings Institution, 1775 Massachusetts Ave., NW Washington, DC.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings were unchanged in January, and the number of job openings (yellow) has generally been trending up, and are up about 21% year-over-year compared to January 2011.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.6% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:30 AM: Import and Export Prices for February. The consensus is a for a 0.9% increase in import prices.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

6:15 PM: Speech by Fed Vice Chair Janet Yellen, "The Economic Outlook and Monetary Policy", At the Money Marketeers of New York University Dinner Meeting, New York, New York

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase slightly to 359,000.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. Both exports and imports increased in January. Imports stalled in the middle of 2011, but increased towards the end of the year (seasonally adjusted). Exports are well above the pre-recession peak and up 8% compared to January 2011; imports just passed the pre-recession high and imports are up about 8% compared to January 2011.

The consensus is for the U.S. trade deficit to decrease to $51.7 billion in February, up from from $52.6 billion in January. Export activity to Europe will be closely watched due to economic weakness.

8:30 AM: Producer Price Index for March. The consensus is for a 0.3% increase in producer prices (0.2% increase in core).

8:30 AM: Consumer Price Index for March. The consensus is a 0.3% increase in prices. The consensus for core CPI to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (perliminary for April). The consensus is for sentiment to be unchanged at 76.2.

1:00 PM: Speech by Fed Chairman Ben Bernanke, "Reflections on the Crisis and the Policy Response", At the Russell Sage Foundation and The Century Foundation Conference on "Rethinking Finance," New York, New York