by Calculated Risk on 2/23/2012 08:30:00 AM

Thursday, February 23, 2012

Weekly Initial Unemployment Claims unchanged at 351,000

The DOL reports:

In the week ending February 18, the advance figure for seasonally adjusted initial claims was 351,000, unchanged from the previous week's revised figure of 351,000. The 4-week moving average was 359,000, a decrease of 7,000 from the previous week's revised average of 366,000.The previous week was revised up to 351,000 from 348,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 359,000.

The 4-week moving average is at the lowest level since early 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down.

Note: Nomura analysts argue some of the recent improvement is related to seasonal distortions, see Financial Times Alphaville: US jobs and seasonality: the DeLorean edition.

Wednesday, February 22, 2012

Policy Status Update

by Calculated Risk on 2/22/2012 09:15:00 PM

Back in January I listed several policies and agreements that were expected soon. Here is a status update ...

• Extension of payroll tax cut and extended unemployment benefits: Signed into law today by President Obama.

• Mortgage Servicer Settlement. Announced, but still waiting for documents on the National Mortgage Settlement website.

• REO to Rental Program: A pilot program was announced on Feb 1st, from the FHFA: FHFA Announces Interested Investors May Pre-Qualify For REO Initiative. Reuters reported last week: Freddie Mac pitches REO plan to mortgage-bond investors

Freddie Mac has begun talks with institutional mortgage-bond investors interested in buying hundreds of distressed single-family residential properties across the US in order to convert them to rental units, according to people with knowledge of the discussions.And the NAR chief economist Lawrenece Yun said today:

Freddie Mac is making efforts to fast-track its own version of a proposed US foreclosure-rental program ...

"A government proposal to turn bank-owned properties into rentals on a large scale does not appear to be needed at this time.”It still isn't clear how soon this program will be in place (or the size).

• A surge in refinance activity in March from HARP. Still waiting ...

And on Europe:

• Greek debt deal: Announced, but there are several hurdles over the next couple of weeks.

• The second round of the ECB's 3 year Long Term Refinancing Operation (LTRO) will be held on February 29th.

FNC House Prices, Zillow's forecast for Case-Shiller

by Calculated Risk on 2/22/2012 04:52:00 PM

Note: The Case-Shiller House Price index for December will be released Tuesday, Feb 28th. CoreLogic has already reported that prices declined 1.4% in December (NSA, including foreclosures). It appears that the Case-Shiller indexes (both SA and NSA) were at new post-bubble lows in December.

• Today from FNC: December Residential Property Values Decline 0.7%

Based on the latest data on non-distressed home sales (existing and new homes) through December, FNC’s national RPI shows that single-family home prices fell in December to a seasonally unadjusted rate of 0.7%. ... As a gauge of underlying home value, the RPI excludes sales of foreclosed homes, which are frequently sold with large price discounts reflecting poor property conditions.The FNC index tables for four composite indexes and 30 cities are here.

...

All three RPI composites (the National, 30-MSA, and 10-MSA indices) show month-to-month declines in December, ranging from -0.7% at the national level to -1.1% in the nation’s top 10 housing markets.

The indices’ year-to-year trends generally show the pace of price declines slowing. The national RPI indicates that December home prices declined at a seasonally adjusted rate of 3.5%, the smallest year-to-year declines since May 2010 when home prices rebounded under the federal homebuyer tax credits program. The year-to-year declines at the nation’s top housing markets, as indicated by the 30- and 10-MSA composites, have also decelerated to their slowest pace.

• Zillow Forecast: Zillow Forecast: December Case-Shiller Composite-20 Expected to Show 4.0% Decline from One Year Ago

Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will decline by 4.0 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will decline by 3.9 percent. The seasonally adjusted (SA) month-over-month change from November to December will be -0.5 percent and -0.6 percent for the 20 and 10-City Composite Home Price Index (SA), respectively.Case-Shiller will probably report house prices were at a new post-bubble lows in December for both the seasonally adjusted (SA) index and the Not Seasonally Adjusted (NSA) index.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (actual) | December 2010 | 156.04 | 155.91 | 142.39 | 142.32 |

| November 2011 | 151.9 | 150.89 | 138.49 | 137.52 | |

| Zillow December Forecast | YoY | -3.9% | -3.9% | -4.0% | -4.0% |

| MoM | -1.3% | -0.6% | -1.3% | -0.5% | |

| Zillow Forecasts1 | 150 | 149.9 | 136.7 | 136.7 | |

| Post Bubble Lows | 150.44 | 150.89 | 137.64 | 137.52 | |

| Date of Low | April 2009 | November 2011 | March 2011 | November 2011 | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

AIA: Architecture Billings Index indicated expansion in January

by Calculated Risk on 2/22/2012 01:48:00 PM

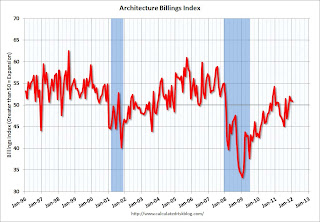

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Remains Positive for Third Straight Month

On the heels of consecutive months of strengthening business conditions, the Architecture Billings Index (ABI) has now reached positive territory three months in a row. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI score was 50.9, following a mark of 51.0 in December. This score reflects a slight increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.2, down just a notch from a reading of 61.5 the previous month.

“Even though we had a similar upturn in design billings in late 2010 and early 2011, this recent showing is encouraging because it is being reflected across most regions of the country and across the major construction sectors,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But because we still continue to hear about struggling firms and some continued uncertainty in the market, we expect overall economic improvements in the design and construction sector to be modest in the coming months.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 2/22/2012 11:54:00 AM

First a comment from Michelle Meyer and Ethan Harris at Merrill Lynch:

One of the most encouraging aspects of the report was the continued drop in inventory. The number of homes on the market for sale fell further in January after plunging 11.5% in December. This has left inventory almost 21% below the level last January. Combined with the recent gain in home sales, months supply has tumbled to 6.1 months, the lowest since April 2006. However, we expect this to be a temporary cyclical low. Part of the drop in inventory reflects delays in the foreclosure process which has slowed the flow of distressed properties into the market. We think the foreclosure process will accelerate, which will speed up the flow of distressed inventory. We expect supply to edge back to 8 months this year.The NAR reported inventory fell to 2.31 million in January. This is down 20.6% from January 2011, and this is about 8% above the inventory level in January 2005 (mid-2005 was when inventory started increasing sharply). This decline in inventory was a significant story in 2011.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.This year (dark red for January) inventory is at the lowest level for a January since 2005. Inventory is still elevated - especially with the much lower sales rate - but lower inventory levels put less downward pressure on house prices (of course the level of distressed properties is still very high, and there is a significant shadow inventory).

Part of the reason inventory has fallen is because there are fewer foreclosures listed for sale. Merrill Lynch analysts think supply will edge back up to 8 months-of-supply as the lenders increase foreclosure activity.

There is also a seasonal pattern. Inventory usually starts increasing in February and March, and peaks in July and August. The seasonal increase in inventory will be something to watch this spring and summer, but the Merrill forecast would mean that inventory increases to over 3 million units this summer (assuming sales at the current rate). I don't think we will see inventory that high.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are slightly above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.

Sales NSA (red column) are slightly above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales were unchanged at 31 percent in January; they were 32 percent in January 2011. Investors account for the bulk of cash transactions.Earlier:

Investors purchased 23 percent of homes in January, up from 21 percent in December; they were 23 percent in January 2011.

• Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

• Existing Home Sales graphs

Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

by Calculated Risk on 2/22/2012 10:00:00 AM

The NAR reports: Existing-Home Sales Rise Again in January, Inventory Down

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 4.3 percent to a seasonally adjusted annual rate of 4.57 million in January from a downwardly revised 4.38 million-unit pace in December and are 0.7 percent above a spike to 4.54 million in January 2011.

...

Total housing inventory at the end of January fell 0.4 percent to 2.31 million existing homes available for sale, which represents a 6.1-month supply at the current sales pace, down from a 6.4-month supply in December.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January 2012 (4.57 million SAAR) were 4.3% higher than last month, and were 0.7% above the January 2011 rate.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 2.31 million in January from 2.32 million in December. This is the lowest level of inventory since March 2005.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 20.6% year-over-year in January from January 2011. This is the eleventh consecutive month with a YoY decrease in inventory.

Inventory decreased 20.6% year-over-year in January from January 2011. This is the eleventh consecutive month with a YoY decrease in inventory.Months of supply decreased to 6.1 months in January, down from 6.4 months in December.

MBA: Purchase Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/22/2012 08:21:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 4.8 percent from the previous week. The seasonally adjusted Purchase Index decreased 2.9 percent from one week earlier.The purchase index is still moving sideways at a very low level.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.09 percent from 4.08 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500)increased to 4.32 percent from 4.30 percent ...

Tuesday, February 21, 2012

Home Depot on Housing

by Calculated Risk on 2/21/2012 08:24:00 PM

There were some interesting comments from the Home Depot CEO today (transcript with via Seeking Alpha). Home Dept CEO Francis Blake talked about the favorable weather, but he thought there was more:

There are some interesting challenges in setting expectations for 2012. First, the macro data on housing suggest uncertainty. ... The Fed has noted that housing remains a drag on economic recovery with factors such as delayed household formation and credit supply, contributing to a continued imbalance between housing supply and demand. The Fed has suggested the policy actions will be needed to fix this, but it wouldn't appear that any major policy changes are likely in the near-term.And in the Q&A:

Second, despite this, the performance of our business particularly in the back half of 2011, would suggest the strengthening market. This quarter's comps were achieved against a very strong fourth quarter comp in 2010 and exceeded our internal forecast. But we're mindful that this past December and January were the fourth warmest on record, with much of the nice weather occurring across the heavily populated eastern U.S. Better weather translates into improved sales for exterior categories like building materials and also translates into increased customer transactions, which lift the entire business.

Dennis McGill, Zelman & Associates: Just a question focused on some of the regions, you mentioned California being at the company average and Florida being above and 2 areas that we wouldn't normally attribute to being volatile from the weather standpoint. So just wondering if you could elaborate there, particularly in California, where it seemed like weather was pretty steady year-over-year, especially with some of the housing metrics improving in those markets?In other comments, Blake mentioned that we've seen a little improvement before, but those were policy related (like the housing tax credit).

CEO Blake: Dennis, I think that's exactly the point. I mean, wanted to call out California and Florida because they really aren't weather-related. And so that's an indication that there was more than just weather ... And I think just exactly as you said, that those markets are more reflective of not a housing recovery, but a stabilization in the markets that we've seen over the last 2 years, as they've just -- they've gotten kind off there, off the floor in effect on housing.

CEO Blake: [W]e are now not -- we have no government programs to cloud what's happening. ... And the way we look at it is, there are some positives that you definitely see on housing.He mentioned some negatives too, but it seems like they are seeing some improvement.

LPS: Number of delinquent mortgage loans declined in January, In foreclosure increases slightly

by Calculated Risk on 2/21/2012 04:02:00 PM

LPS released their First Look report for January today. LPS reported that the percent (and number) of loans delinquent declined in January from December, but that the percent (and number) of loans in the foreclosure process increased slightly.

The following table shows the LPS numbers for January 2012, and also for last month (Dec 2011) and one year ago (Jan 2011).

| LPS: Loans Delinquent and in Foreclosure | |||

|---|---|---|---|

| Jan-12 | Dec-11 | Jan-11 | |

| Delinquent | 7.97% | 8.15% | 8.90% |

| In Foreclosure | 4.15% | 4.11% | 4.16% |

| Less than 90 days | 2,226,000 | 2,309,000 | 2,551,000 |

| More than 90 days | 1,772,000 | 1,792,000 | 2,168,000 |

| In foreclosure | 2,084,000 | 2,066,000 | 2,203,000 |

| Total | 6,082,000 | 6,167,000 | 6,922,000 |

At the current rate of decline, the number of delinquent lonas will be back to "normal" in about three years (around 4.5% to 5% of loans are delinquent even in good times). However the number of loans in the foreclosure process hasn't change year-over-year - although that will probably change soon with the mortgage servicer settlement (around 0.5% of loans in foreclosure is "normal").

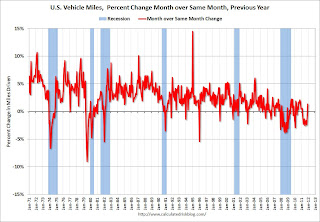

DOT: Vehicle Miles Driven increased 1.3% in December

by Calculated Risk on 2/21/2012 11:57:00 AM

Note: Vehicle miles have moved sideways for over four years. And gasoline consumption has declined slightly over the same period. For a discussion of the causes, see NDD's post at the Bonddad blog this morning: Why the decline in gasoline demand doesn't mean a recession -- yet. Among other points, NDD writes: "It appears that gasoline conservation is a top priority of consumers." and he provides a list (with data): Ridership of mass transit is up, online retail purchases have increased, automakers are selling more fuel efficient cars, teen driving is down, and more.

The Department of Transportation (DOT) reported:

• Travel on all roads and streets changed by +1.3% (3.2 billion vehicle miles) for December 2011 as compared with December 2010.The following graph shows the rolling 12 month total vehicle miles driven.

• Cumulative Travel for 2011 changed by -1.2% (-35.7 billion vehicle miles).

Even with a small year-over-year increase in December, the rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 49 months - and still counting!

The second graph shows the year-over-year change from the same month in the previous year.

This is the first year-over-year increase in miles driven since February 2011.

This is the first year-over-year increase in miles driven since February 2011.With the recent increases in gasoline prices, we might see year-over-year declines again in January or February. But this doesn't mean a recession - instead, as NDD notes, it appears that behavior is changing, and also that the fleet is becoming more efficient ... and, of course, growth is still sluggish and holding back driving too.