by Calculated Risk on 2/22/2012 01:48:00 PM

Wednesday, February 22, 2012

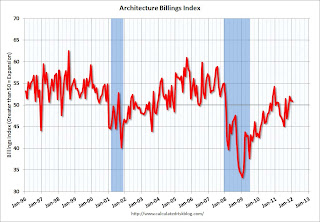

AIA: Architecture Billings Index indicated expansion in January

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Remains Positive for Third Straight Month

On the heels of consecutive months of strengthening business conditions, the Architecture Billings Index (ABI) has now reached positive territory three months in a row. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI score was 50.9, following a mark of 51.0 in December. This score reflects a slight increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.2, down just a notch from a reading of 61.5 the previous month.

“Even though we had a similar upturn in design billings in late 2010 and early 2011, this recent showing is encouraging because it is being reflected across most regions of the country and across the major construction sectors,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But because we still continue to hear about struggling firms and some continued uncertainty in the market, we expect overall economic improvements in the design and construction sector to be modest in the coming months.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.9 in January (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing later in 2012.