by Calculated Risk on 2/17/2012 05:56:00 PM

Friday, February 17, 2012

Report: Existing Home inventory down 23.3% year-over-year

Note: Cardiff Garcia at FT Alphaville has some comments on inventory from several analysts: The decline of US housing inventory

Here is another report on inventory ... from Realtor.com: Real Estate Trends for January 2012

According to real estate data released today by Realtor.com, the national inventory of for-sale single family homes, condominiums, townhouses and co-ops (SFH/CTHCOPS) declined -6.59% from December to January, and is now down -23.20% compared to a year ago. The median age of the inventory also declined on both an annual and monthly basis, and is now -4.80% below the levels observed in January 2011.The NAR report doesn't always match up with other inventory reports - and there is some variability in how inventory is reported (some report include contingent short sales, some don't) - but it does appear inventory is down sharply in most areas. (Contingent short sale inventory is also down sharply).

...

For-sale inventories of SFH/CTHCOPS in January 2012 declined in all but one of the 146 MSAs monitored by Realtor.com compared to a year ago when for-sale inventories in more than half of all markets (85) dropped by 20% or more. ... Springfield, IL, was the only market to register a year-over-year increase in for-sale inventory. However, areas that showed the least signs of improvement tended to be concentrated in the Northeast corridor.

...

The median age of the inventory exceeded 120 days in 46 markets in January, down from 60 markets in December. While many of the markets with the oldest inventories are resort communities, particularly in Florida and the Carolinas, others are in industrialized areas that are experiencing the brunt of the economic downturn.

Lawler: Early Read on January Existing Home Sales

by Calculated Risk on 2/17/2012 01:55:00 PM

Economist Tom Lawler is forecasting that the National Association of Realtors (NAR) will report sales of 4.66 million on a seasonally adjusted annual rate (SAAR) basis for January. The NAR is scheduled to report existing home sales on Wednesday, Feb 22nd at 10 AM ET.

This is a slight increase from the 4.61 million rate in December, and essentially unchanged from the 4.64 million rate reported in January 2011.

Tom didn't send me an estimate for inventory, but based on other reports, I expect inventory to decline slightly from the 2.38 million houses for sale reported for December.

This sales rate, combined with a decline in inventory, could put months-of-supply under 6 months for the first time since early 2006.

Note: Even though there is a seasonal pattern for inventory (inventory usually bottoms in January and peaks in the summer), the months-of-supply metric is calculated using the seasonally adjusted sales rate and the not seasonally adjusted inventory. So the months-of-supply will probably increase again over the next 6 months.

Key Measures of Inflation in January

by Calculated Risk on 2/17/2012 01:26:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in January on a seasonally adjusted basis ... The index for all items less food and energy increased 0.2 percent in January.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index 0.2% (3.0% annualized rate) in January. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.9% annualized rate) during the month.Note: The Cleveland Fed has the median CPI details for January here.

...

The CPI less food and energy increased 0.2% (2.7% annualized rate) on a seasonally adjusted basis.

On a monthly basis, the rate of increase was above the Fed's target.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.6%, and core CPI rose 2.3%. Core PCE is for December and increased 1.85% year-over-year.

These measures show inflation is still above the Fed's 2% target.

Housing Starts and the Unemployment Rate

by Calculated Risk on 2/17/2012 11:22:00 AM

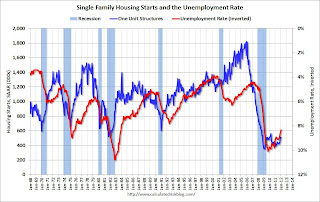

An update by request: The following graph shows single family housing starts (through January) and the unemployment rate (inverted) also through January. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing recently. This was one of the reasons the unemployment rate has remained elevated.

Click on graph for larger image.

Click on graph for larger image.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However this time, with the huge overhang of existing housing units, this key sector hasn't been participating. The good news is single family starts should increase modestly in 2012, and construction employment should also increase.

BLS: CPI increases 0.2% in January

by Calculated Risk on 2/17/2012 08:35:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in January on a seasonally adjusted basis ... Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment. ...I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was below the consensus forecast of a 0.3% increase in CPI.

The index for all items less food and energy increased 0.2 percent in January. The shelter index increased 0.2 percent, with the indexes for rent, owners' equivalent rent, and lodging away from home all rising 0.2 percent.

Thursday, February 16, 2012

Earlier: Philly Fed "Regional manufacturing activity continued to expand in February"

by Calculated Risk on 2/16/2012 10:26:00 PM

Earlier from the Philly Fed: February 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index ofThis indicates expansion in Febraury, at a faster pace than in January, and slightly above the consensus forecast of +8.4.

current activity, edged higher from a reading of 7.3 in January to 10.2, its highest level since October. ... The new orders index was positive for the fifth consecutive month and increased from 6.9 to 11.7.

...

The current employment index, which has been positive for six consecutive months, fell from a reading of 11.6 in January to 1.1 this month, suggesting little overall growth in employment.

...

The future general activity index fell from a reading of 49.0 in January to 33.3 this month. The index, which has increased for five consecutive months, remains at a relatively high level.

Click on graph for larger image.

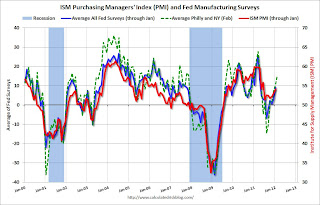

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through February. The ISM and total Fed surveys are through January.

The average of the Empire State and Philly Fed surveys increased again in February, and is at the highest level since April 2011.

Earlier:

• Weekly Initial Unemployment Claims decline to 348,000

• Housing Starts increase in January

• MBA: Mortgage Delinquencies decline in Q4

• Q4 MBA National Delinquency Survey Comments

Percent of mortgage loans In-Foreclosure by State

by Calculated Risk on 2/16/2012 07:36:00 PM

The MBA noted that judicial states generally have the most loans in the foreclosure process. The graph below shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process.

Nevada is an exception. But Nevada had the largest quarterly decline, and for the first time in years is not in the #2 spot behind Florida - Nevada has dropped to #4.

Other hard hit states, like California and Arizona, have also seen significant improvement. California and Arizona started 2011 in the 6th and 7th spot (respectively) with percent of loans in foreclosure, and have fallen all the way to 23rd and 17th by Q4.

Click on graph for larger image.

Click on graph for larger image.

Florida, New Jersey, Illinois, Nevada, Maine, New York and Connecticut are the top seven states with percent of loans in the foreclosure process. And Vermont, Maryland, Hawaii, Maine, Connecticut and New York saw the largest increases in Q4.

With the mortgage servicer settlement, I expect the number of loans in foreclosure to start to decline in all states.

Earlier:

• Weekly Initial Unemployment Claims decline to 348,000

• Housing Starts increase in January

• MBA: Mortgage Delinquencies decline in Q4

• Q4 MBA National Delinquency Survey Comments

Multi-family Starts and Completions, and Quarterly Starts by Intent

by Calculated Risk on 2/16/2012 02:37:00 PM

With the recent increase in single family housing starts, a key question is: Are the home builders starting too many homes? The answer is no.

Part of the increase for starts in December and January can be explained by the unseasonably warm weather in most of the country. The reported number is seasonally adjusted, and usually January is the weakest month of the year for housing starts - so nice weather can make a difference. Building activity will pick up in March, and that will be a key month for starts.

However the builders are also responding to sales. As I've noted before, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The Q4 2011 quarterly report was released today and showed there were 64,000 single family starts, built for sale, in Q4 2011, and that was slightly below the 68,000 new homes sold for the same quarter. This data is Not Seasonally Adjusted (NSA).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.

Single family starts built for sale were down seasonally in Q4 compared to Q3, but starts were up about 10% compared to Q4 2010. Even with the year-over-year increase, this was still close to the record low. Owner built starts were up slightly year-over-year, and condos built for sale are still very low.

The 'units built for rent' has increased significantly and is up about 67% year-over-year.

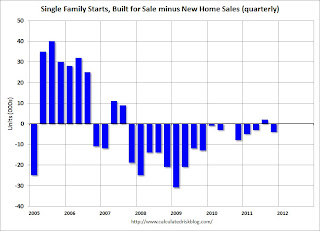

The second graphs shows the difference (quarterly) between single family starts, built for sale and new home sales.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory they built up in 2005 and 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory they built up in 2005 and 2006.

For the last two years, the builders have sold a few more homes than they started, and inventory levels are now at record lows. In Q4, builders started 4 thousand fewer homes than they sold.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations.

And here is an update to the graph comparing multi-family starts and completions. Note: it usually takes over a year on average to complete a multi-family project, so there is a lag between multi-family starts and completions. This graph uses a 12 month rolling total.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing since mid-2010. Completions (red line) are now following starts up.

It is important to emphasize that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI).

Earlier:

• Weekly Initial Unemployment Claims decline to 348,000

• Housing Starts increase in January

• MBA: Mortgage Delinquencies decline in Q4

• Q4 MBA National Delinquency Survey Comments

Q4 MBA National Delinquency Survey Comments

by Calculated Risk on 2/16/2012 10:57:00 AM

A few comments from Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education, and Michael Fratantoni, MBA's Vice President, Single-Family Research and Policy Development, on the conference call.

• Delinquencies were down in all buckets except the 30 day, and that was just a small increase.

• There were improvements in key categories: subprime fixed and ARMs, and Prime ARMs. The exception was FHA loans, and that is being driven by the large number of loans made in recent years.

• As far as delinquencies, Brinkmann said we are "halfway back" to normal of around 5% historically. This does not include the "in foreclosure" bucket; loans in foreclosure are still near record highs.

• On the possible impact of the possible mortgage settlement, Brinkmann said he expects the "in foreclosure" bucket to start declining.

• Non-judicial foreclosure states have improved much quicker than judicial states, and some non-judicial states are back to normal already.

• For state with the highest percentage of loans in foreclosure, the only non-judicial state in the top 17 states is Nevada. The top states are: Florida (14.27%), New Jersey (8.21%), Illinois (7.41%), Nevada (7.03%), Maine (5.92%) and New York (5.88%). California (3.45%) and Arizona (3.68%) are both below the national average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.22% from 3.19% in Q3. This is at about 2007 levels.

Delinquent loans in the 60 day bucket decreased to 1.25% from 1.30% in Q4. This is the lowest level since Q4 2007.

There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.11% from 3.50% in Q3 2011. This is the lowest level since 2008, but still way above normal (probably around 1% would be normal).

The percent of loans in the foreclosure process declined slightly to 4.38% from 4.43%.

The key problem remains the very high level of seriously delinquent loans and loans in the foreclosure process.

Note: the MBA's National Delinquency Survey (NDS) covers about "42.9 million first-lien mortgages on one- to four-unit residential properties" and is "estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives about 5.8 million loans delinquent or in the foreclosure process.

MBA: Mortgage Delinquencies decline in Q4

by Calculated Risk on 2/16/2012 10:00:00 AM

The MBA reported that 11.96 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2011 (delinquencies seasonally adjusted). This is down from 12.41 percent in Q3 2011 and is the lowest level since 2008.

From the MBA: Delinquencies and Foreclosures Decline in Latest MBA Mortgage Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 7.58 percent of all loans outstanding as of the end of the fourth quarter of 2011, a decrease of 41 basis points from the third quarter of 2011, and a decrease of 67 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased five basis points to 8.15 percent this quarter from 8.20 percent last quarter.Note: 7.58% (SA) and 4.38% equals 11.96%.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.99 percent, down nine basis points from last quarter and down 28 basis points from one year ago. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.38 percent, down five basis points from the third quarter and 26 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.73 percent, a decrease of 16 basis points from last quarter, and a decrease of 87 basis points from the fourth quarter of last year.

...

"Mortgage performance continued to improve in the fourth quarter, reflecting the improvement we saw in the job market and broader economy. The total delinquency rate and foreclosure starts rate decreased and are back down to levels from three years ago. A major reason is that the loans that are seriously delinquent are predominantly made up of loans originated prior to 2008 and this pool is steadily growing smaller as a percent of total loans outstanding. In addition, employment is the key driver of mortgage performance and the mortgage delinquency rate is actually falling faster than the unemployment rate is declining,” said Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education.

“People often ask where we are in the housing recovery and how far we still have to go. This year-end report is a good time to take stock. By several measures, mortgage delinquencies are about half way back to long-term, pre-recession levels. The total delinquency rate peaked at 10.1 percent in the first quarter of 2010. It now stands at 7.6 percent, about half way to the longer-term pre-recession average of roughly 5 percent. The rate of foreclosure starts peaked in the third quarter of 2009 at 1.4 percent but has now dropped to 1 percent, about half way to the longer-term average of slightly under .5 percent. When it comes to real estate, however, all national measures are essentially meaningless since the important measures are local ones. This is certainly true here where the delinquency measures in some markets are much closer to their longer term averages while other markets have much further to go.

“The one exception is the percentage of loans in foreclosure which, while down somewhat at 4.4 percent, is still much closer to the all-time high of 4.6 percent reached in the fourth quarter of 2010 than the longer-term average of roughly 1.2 percent, despite the drop in delinquencies and foreclosure starts. Here the differences are clearly attributable to local conditions and legal structures. States with non-judicial foreclosure systems are seeing the backlog of foreclosures clear more rapidly and are down to an average rate of 2.8 percent. In contrast, the percentage of loans in foreclosure in the judicial system states has hit an all-time high of 6.8 percent, almost two and a half times higher than rate for non-judicial states.

I'll have more later after the conference call this morning.