by Calculated Risk on 2/16/2012 10:26:00 PM

Thursday, February 16, 2012

Earlier: Philly Fed "Regional manufacturing activity continued to expand in February"

Earlier from the Philly Fed: February 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index ofThis indicates expansion in Febraury, at a faster pace than in January, and slightly above the consensus forecast of +8.4.

current activity, edged higher from a reading of 7.3 in January to 10.2, its highest level since October. ... The new orders index was positive for the fifth consecutive month and increased from 6.9 to 11.7.

...

The current employment index, which has been positive for six consecutive months, fell from a reading of 11.6 in January to 1.1 this month, suggesting little overall growth in employment.

...

The future general activity index fell from a reading of 49.0 in January to 33.3 this month. The index, which has increased for five consecutive months, remains at a relatively high level.

Click on graph for larger image.

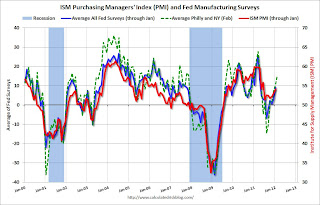

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through February. The ISM and total Fed surveys are through January.

The average of the Empire State and Philly Fed surveys increased again in February, and is at the highest level since April 2011.

Earlier:

• Weekly Initial Unemployment Claims decline to 348,000

• Housing Starts increase in January

• MBA: Mortgage Delinquencies decline in Q4

• Q4 MBA National Delinquency Survey Comments

Percent of mortgage loans In-Foreclosure by State

by Calculated Risk on 2/16/2012 07:36:00 PM

The MBA noted that judicial states generally have the most loans in the foreclosure process. The graph below shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process.

Nevada is an exception. But Nevada had the largest quarterly decline, and for the first time in years is not in the #2 spot behind Florida - Nevada has dropped to #4.

Other hard hit states, like California and Arizona, have also seen significant improvement. California and Arizona started 2011 in the 6th and 7th spot (respectively) with percent of loans in foreclosure, and have fallen all the way to 23rd and 17th by Q4.

Click on graph for larger image.

Click on graph for larger image.

Florida, New Jersey, Illinois, Nevada, Maine, New York and Connecticut are the top seven states with percent of loans in the foreclosure process. And Vermont, Maryland, Hawaii, Maine, Connecticut and New York saw the largest increases in Q4.

With the mortgage servicer settlement, I expect the number of loans in foreclosure to start to decline in all states.

Earlier:

• Weekly Initial Unemployment Claims decline to 348,000

• Housing Starts increase in January

• MBA: Mortgage Delinquencies decline in Q4

• Q4 MBA National Delinquency Survey Comments

Multi-family Starts and Completions, and Quarterly Starts by Intent

by Calculated Risk on 2/16/2012 02:37:00 PM

With the recent increase in single family housing starts, a key question is: Are the home builders starting too many homes? The answer is no.

Part of the increase for starts in December and January can be explained by the unseasonably warm weather in most of the country. The reported number is seasonally adjusted, and usually January is the weakest month of the year for housing starts - so nice weather can make a difference. Building activity will pick up in March, and that will be a key month for starts.

However the builders are also responding to sales. As I've noted before, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The Q4 2011 quarterly report was released today and showed there were 64,000 single family starts, built for sale, in Q4 2011, and that was slightly below the 68,000 new homes sold for the same quarter. This data is Not Seasonally Adjusted (NSA).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.

Single family starts built for sale were down seasonally in Q4 compared to Q3, but starts were up about 10% compared to Q4 2010. Even with the year-over-year increase, this was still close to the record low. Owner built starts were up slightly year-over-year, and condos built for sale are still very low.

The 'units built for rent' has increased significantly and is up about 67% year-over-year.

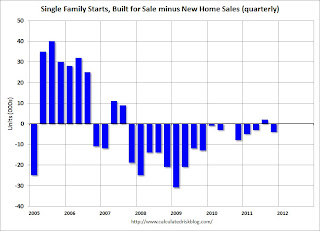

The second graphs shows the difference (quarterly) between single family starts, built for sale and new home sales.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory they built up in 2005 and 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory they built up in 2005 and 2006.

For the last two years, the builders have sold a few more homes than they started, and inventory levels are now at record lows. In Q4, builders started 4 thousand fewer homes than they sold.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations.

And here is an update to the graph comparing multi-family starts and completions. Note: it usually takes over a year on average to complete a multi-family project, so there is a lag between multi-family starts and completions. This graph uses a 12 month rolling total.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing since mid-2010. Completions (red line) are now following starts up.

It is important to emphasize that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI).

Earlier:

• Weekly Initial Unemployment Claims decline to 348,000

• Housing Starts increase in January

• MBA: Mortgage Delinquencies decline in Q4

• Q4 MBA National Delinquency Survey Comments

Q4 MBA National Delinquency Survey Comments

by Calculated Risk on 2/16/2012 10:57:00 AM

A few comments from Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education, and Michael Fratantoni, MBA's Vice President, Single-Family Research and Policy Development, on the conference call.

• Delinquencies were down in all buckets except the 30 day, and that was just a small increase.

• There were improvements in key categories: subprime fixed and ARMs, and Prime ARMs. The exception was FHA loans, and that is being driven by the large number of loans made in recent years.

• As far as delinquencies, Brinkmann said we are "halfway back" to normal of around 5% historically. This does not include the "in foreclosure" bucket; loans in foreclosure are still near record highs.

• On the possible impact of the possible mortgage settlement, Brinkmann said he expects the "in foreclosure" bucket to start declining.

• Non-judicial foreclosure states have improved much quicker than judicial states, and some non-judicial states are back to normal already.

• For state with the highest percentage of loans in foreclosure, the only non-judicial state in the top 17 states is Nevada. The top states are: Florida (14.27%), New Jersey (8.21%), Illinois (7.41%), Nevada (7.03%), Maine (5.92%) and New York (5.88%). California (3.45%) and Arizona (3.68%) are both below the national average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.22% from 3.19% in Q3. This is at about 2007 levels.

Delinquent loans in the 60 day bucket decreased to 1.25% from 1.30% in Q4. This is the lowest level since Q4 2007.

There was a decrease in the 90+ day delinquent bucket too. This decreased to 3.11% from 3.50% in Q3 2011. This is the lowest level since 2008, but still way above normal (probably around 1% would be normal).

The percent of loans in the foreclosure process declined slightly to 4.38% from 4.43%.

The key problem remains the very high level of seriously delinquent loans and loans in the foreclosure process.

Note: the MBA's National Delinquency Survey (NDS) covers about "42.9 million first-lien mortgages on one- to four-unit residential properties" and is "estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives about 5.8 million loans delinquent or in the foreclosure process.

MBA: Mortgage Delinquencies decline in Q4

by Calculated Risk on 2/16/2012 10:00:00 AM

The MBA reported that 11.96 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2011 (delinquencies seasonally adjusted). This is down from 12.41 percent in Q3 2011 and is the lowest level since 2008.

From the MBA: Delinquencies and Foreclosures Decline in Latest MBA Mortgage Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 7.58 percent of all loans outstanding as of the end of the fourth quarter of 2011, a decrease of 41 basis points from the third quarter of 2011, and a decrease of 67 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate decreased five basis points to 8.15 percent this quarter from 8.20 percent last quarter.Note: 7.58% (SA) and 4.38% equals 11.96%.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.99 percent, down nine basis points from last quarter and down 28 basis points from one year ago. The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.38 percent, down five basis points from the third quarter and 26 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.73 percent, a decrease of 16 basis points from last quarter, and a decrease of 87 basis points from the fourth quarter of last year.

...

"Mortgage performance continued to improve in the fourth quarter, reflecting the improvement we saw in the job market and broader economy. The total delinquency rate and foreclosure starts rate decreased and are back down to levels from three years ago. A major reason is that the loans that are seriously delinquent are predominantly made up of loans originated prior to 2008 and this pool is steadily growing smaller as a percent of total loans outstanding. In addition, employment is the key driver of mortgage performance and the mortgage delinquency rate is actually falling faster than the unemployment rate is declining,” said Jay Brinkmann, MBA’s Chief Economist and Senior Vice President for Research and Education.

“People often ask where we are in the housing recovery and how far we still have to go. This year-end report is a good time to take stock. By several measures, mortgage delinquencies are about half way back to long-term, pre-recession levels. The total delinquency rate peaked at 10.1 percent in the first quarter of 2010. It now stands at 7.6 percent, about half way to the longer-term pre-recession average of roughly 5 percent. The rate of foreclosure starts peaked in the third quarter of 2009 at 1.4 percent but has now dropped to 1 percent, about half way to the longer-term average of slightly under .5 percent. When it comes to real estate, however, all national measures are essentially meaningless since the important measures are local ones. This is certainly true here where the delinquency measures in some markets are much closer to their longer term averages while other markets have much further to go.

“The one exception is the percentage of loans in foreclosure which, while down somewhat at 4.4 percent, is still much closer to the all-time high of 4.6 percent reached in the fourth quarter of 2010 than the longer-term average of roughly 1.2 percent, despite the drop in delinquencies and foreclosure starts. Here the differences are clearly attributable to local conditions and legal structures. States with non-judicial foreclosure systems are seeing the backlog of foreclosures clear more rapidly and are down to an average rate of 2.8 percent. In contrast, the percentage of loans in foreclosure in the judicial system states has hit an all-time high of 6.8 percent, almost two and a half times higher than rate for non-judicial states.

I'll have more later after the conference call this morning.

Housing Starts increase in January

by Calculated Risk on 2/16/2012 08:54:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 699,000. This is 1.5 percent (±16.8%)* above the revised December estimate of 689,000 and is 9.9 percent (±14.2%)* above the January 2011 rate of 636,000.

Single-family housing starts in January were at a rate of 508,000; this is 1.0 percent (±19.0%)* below the revised December figure of 513,000. The January rate for units in buildings with five units or more was 175,000.

CR Note: Single-family starts were revised up for November and December (by 43 thousand in December).

Building Permits:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 676,000. This is 0.7 percent (±1.2%)* above the revised December rate of 671,000 and is 19.0 percent (±2.4%) above the January 2011 estimate of 568,000.

Single-family authorizations in January were at a rate of 445,000; this is 0.9 percent (±1.1%)* above the revised December figure of 441,000. Authorizations of units in buildings with five units or more were at a rate of 208,000 in January.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 699 thousand (SAAR) in January, up 1.5% from the revised December rate of 689 thousand (SAAR). Note that December was revised up from 657 thousand.

Single-family starts declined 1.0% to 508 thousand in January, however December was revised up by 43 thousand from 470 thousand. There were the first two months above 500 thousand since the expiration of the tax credit.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after sideways for about two years and a half years..

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after sideways for about two years and a half years..It now appears both multi-family and single-family starts are moving up, but from very low levels.

This was above expectations of 670 thousand starts in January. I'll have more on housing starts and completions later.

Weekly Initial Unemployment Claims decline to 348,000

by Calculated Risk on 2/16/2012 08:30:00 AM

The DOL reports:

In the week ending February 11, the advance figure for seasonally adjusted initial claims was 348,000, a decrease of 13,000 from the previous week's revised figure of 361,000. The 4-week moving average was 365,250, a decrease of 1,750 from the previous week's revised average of 367,000.The previous week was revised up to 361,000 from 358,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 365,250.

The 4-week moving average is at the lowest level since early 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down and is now well below 400 thousand.

Wednesday, February 15, 2012

DataQuick: Southland Home Sales Flat, Record Investor Buying

by Calculated Risk on 2/15/2012 09:36:00 PM

This report is only for Southern California, but it contains useful information for analyzing the housing market. Plenty of "records" in January: Record investor buying, record percentage of short sales, and record low new home sales. Note: DataQuick reports new home sales at closing and the Census Bureau reports when contracts are signed - so this is for contracts signed about six months ago.

From DataQuick: Southland Home Sales Flat, Prices Edge Down

A total of 14,523 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 24.5 percent from 19,247 in December, and up 0.4 percent from 14,458 in January 2011, according to DataQuick of San Diego.The National Association of Realtors (NAR) will report January existing home sales next Wednesday, February 22nd.

Sales have increased year-over-year for five of the last six months. The sharp sales decline from December is normal for the season.

Last month’s sales count was 17.8 percent below the 17,671 average for all the months of January since 1988.

A total of 669 newly built homes sold in January, the lowest number for any month since DataQuick started keeping track in 1988.

“January numbers have never been very good at providing an indication of what upcoming activity will be like. For that we need to wait until March. What we can determine is that the mortgage market remains dysfunctional. It will be interesting to see how a potential surge of refinance activity plays into the purchase market once the administration’s new guidelines are implemented,” said John Walsh, DataQuick president.

...

Distressed sales made up more than half of January’s resale market. ... Foreclosure resales ... made up 32.6 percent of resales last month ... Short sales ... made up an estimated 21.3 percent of Southland resales last month. That was a high for the current real estate cycle and compares with 19.6 percent in both December and January 2011.

...

Absentee buyers – mostly investors and some second-home purchasers – bought a record 26.8 percent of the Southland homes sold in January, paying a median $193,500. The Inland Empire saw absentee purchases rise to a record 33.6 percent of all sales.

LA area Port Traffic mostly unchanged year-over-year in January

by Calculated Risk on 2/15/2012 05:55:00 PM

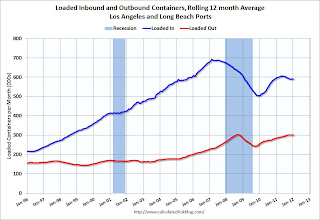

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for January. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up 0.1% from December, and outbound traffic is flat.

On a rolling 12 month basis, outbound traffic is moving "sideways" for the last 4 or 5 of months, and it appears inbound traffic has halted the recent decline.

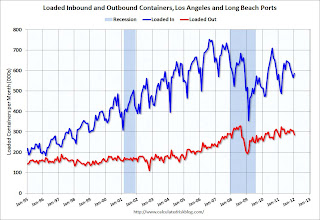

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of January, loaded inbound traffic was up 1% compared to January 2011, and loaded outbound traffic was flat compared to January 2010.

For the month of January, loaded inbound traffic was up 1% compared to January 2011, and loaded outbound traffic was flat compared to January 2010.

On both a rolling 12 month and year-over-year basis, imports and exports were mostly unchanged.

Lawler: Short Sales increased significantly in Q4

by Calculated Risk on 2/15/2012 03:43:00 PM

Hope Now released its December report which estimates delinquencies, foreclosure starts, completed foreclosure sales, loan modifications, and other loan “workout” plans for the US first-lien residential mortgage market. According to the report, Hope Now estimates that completed foreclosure sales totaled 842,777 last year, down about 21.2% from 2010. While Hope Now does not explicitly release estimates for short sales/DILs, it does release estimates for (1) “other workout plans,” which is the sum of repayment plans initiated, “other” (non-mod) retention plans completed, and “liquidation plans” – which are short sales and DILs; and (2) separate estimates for repayment plans and other retention plans. One can thus “solve” for Hope Now’s estimates for short sales/DILs.

Using my proprietary “subtraction” software, I was able to derive Hope Now’s estimates for short sales/DILs in 2011 – 397,280, up over 12% from 2010. HN’s short sales/DILs estimate hit an all-time monthly high of 40,533 in December, and last quarter’s estimate of 110,123 was the highest quarter on record. Other industry data suggest that DILs in both years were “diddly,” so bottom line short sales appear to have increased significantly last quarter.

Of last year’s estimated 842,777 completed foreclosure sales, 628,014 were owner-occupied properties, down about 20% from 2010, and 208,933 were non-owner-occupied properties, down about 26.4% from 2010. HN’s data do not allow one to break out short sales/DILs by occupancy.

Hope Now industry-wide estimates are based on activity of its members. Hope Now’s “derived” estimates of short sales/DILs are not available prior to 2010. Based on other industry data, however, I have my own estimates for 2008 and 2009, so here are some estimates of completed foreclosure sales and short sales/DILs for 2008, 2009, 2010, and 2011.

| Completed Foreclosure Sales and Short Sales (estimates, thousands) | |||||

|---|---|---|---|---|---|

| 2007 | 2008 | 2009 | 2010 | 2011 | |

| Completed Foreclosure Sales | 514 | 914 | 949 | 1,070 | 843 |

| Short Sales/DILs | N.A. | 103 | 274 | 354 | 397 |

| Total | N.A. | 1,017 | 1,223 | 1,424 | 1,240 |

CR Note: I added 2007 foreclosure numbers. It appears short sales were running at a rate of just under 500 thousand per year at the end of 2011. The shift from foreclosures to short sales is continuing (although short sale shenanigans are still rampant). Jim the Realtor noted the shift to short sales today while discussing an REO:

"This might be - this is, there is no question about it - the last REO listing I'll ever have in Carmel Valley. They have turned off the spigot. Foreclosures are going the way of the dodo bird. It is going to be short sales from now on."Carmel Valley is a fairly high end area of San Diego, and the lenders might be targeting higher end areas for short sales - but Jim's comments highlight the trend toward short sales.