by Calculated Risk on 12/22/2011 04:00:00 PM

Thursday, December 22, 2011

More House Price Indexes show price declines in October

The Case-Shiller House Price index for October will be released Tuesday, Dec 27th. Based on released data, it appears the seasonally adjusted Case-Shiller indexes will fall to new post-bubble lows in October (but not the NSA indexes). Here are a few other recently released indexes:

• Yesterday from FNC: Home Prices Continue to Weaken: Down 0.6% in October

FNC’s latest Residential Price Index™ (RPI), released Wednesday, indicates that October U.S. home prices continued to weaken at a modest pace despite recent positive home-sales data. The trend is a reminder that the housing market remains constrained by weak economic fundamentals and the overhang of distressed properties. October marks the third month of continued price declines and is unfortunately accompanied by a moderate downward index revision to the previous month.The FNC index tables for three composite indexes and 30 cities are here.

Based on the latest data on non-distressed home sales (existing and new homes) through October, FNC’s national RPI shows that single-family home prices fell in October to a seasonally unadjusted rate of 0.6%. The September index value is revised downward from -0.4% to -0.9%.

• From Radar Logic today Home Prices Decline Year-Over-Year in October for Fifth Year in a Rowa

Home prices fell 5.4 percent year over year through October 20, making 2011 the fifth year in a row in which the 25-metropolitan-statistical-area (MSA) RPX Composite price has declined year over year in October. The Composite price declined 2.0 percent on a month-over-month basis, the largest such decline in three years.• CoreLogic reported earlier this month for October: CoreLogic: House Price Index declined 1.3% in October basis

...

The S&P/Case-Shiller 10-City composite for September 2011, published last month, was 155.73 and the 20-City composite was 141.97. The October 2011 10-City composite index, to be published next Tuesday, will be about 152, and the 20-City index will be roughly 139.

October Home Price Index (HPI®) which shows that home prices in the U.S. decreased 1.3 percent on a month-over-month basis, the third consecutive monthly decline. According to the CoreLogic HPI, national home prices, including distressed sales, also declined by 3.9 percent on a year-over-year basis in October 2011 compared to October 2010.• From FHFA today: FHFA House Price Index Falls 0.2 Percent in October

U.S. house prices fell 0.2 percent on a seasonally adjusted basis from September to October, according to the Federal Housing Finance Agency’s monthly House Price Index.... For the 12 months ending in October, U.S. prices fell 2.8• From Zillow: Zillow Forecast: October Case-Shiller Composite-20 Expected to Show 3.5% Decline from One Year Ago

percent.

The Case-Shiller Composite Home Price Indices for October will be released on Tuesday, the 27th of December. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted, NSA) will decline by 3.5 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will show a year-over-year decline of 3.2 percent. The seasonally adjusted (SA) month-over-month change from September to October will be -0.8 percent and -0.7 percent for the 20 and 10-City Composite Home Price Index (SA), respectively.Based on the Radar Logic and Zillow forecasts, the Case-Shiller (SA) indexes will be at new post bubble lows in October (not the NSA indexes yet).

Chicago Fed: Economic activity index declined in November

by Calculated Risk on 12/22/2011 02:10:00 PM

Catching up: Earlier today, the BEA released the third estimate for Q3 GDP showing real GDP growth of 1.8% in Q3, revised down from 2.0%. A large portion of the revision was from personal consumption expenditures.

The Chicago Fed release the national activity index (a composite index of other indicators): Index shows economic activity decreased in November

Led by declines in production-related indicators, the Chicago Fed National Activity Index decreased to –0.37 in November from –0.11 in October. Two of the four broad categories of indicators that make up the index decreased from October, and only the employment, unemployment, and hours category was positive in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, remained level, at –0.24, from October to November. November’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. Likewise, the economic slack reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Philly Fed State Coincident Indexes increase in November

by Calculated Risk on 12/22/2011 12:05:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2011. In the past month, the indexes increased in 44 states, decreased in four, and remained unchanged in two (Hawaii and Wyoming) for a one-month diffusion index of 80. Over the past three months, the indexes increased in 43 states, decreased in six, and remained unchanged in one (Hawaii) for a three-month diffusion index of 74.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In November, 45 states had increasing activity, up from 44 in October. This is the highest level since April.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green earlier this year - but this is an improvement from a few months ago.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green earlier this year - but this is an improvement from a few months ago.Earlier:

• Weekly Initial Unemployment Claims decline to 364,000

• Final December Consumer Sentiment at 69.9

Final December Consumer Sentiment at 69.9

by Calculated Risk on 12/22/2011 09:55:00 AM

The final December Reuters / University of Michigan consumer sentiment index increased to 69.9, up from the preliminary reading of 67.7, and up from the November reading of 64.1.

Click on graph for larger image.

Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices. Gasoline prices are falling, but still high, and the unemployment rate is also falling - but still very high.

Most of the recent sharp decline was event driven due to the debt ceiling debate, and sentiment has rebounded as expected. Now it is all about jobs - and gasoline prices.

Sentiment is still very weak, although above the consensus forecast of 68.0.

Weekly Initial Unemployment Claims decline to 364,000

by Calculated Risk on 12/22/2011 08:30:00 AM

The DOL reports:

In the week ending December 17, the advance figure for seasonally adjusted initial claims was 364,000, a decrease of 4,000 from the previous week's revised figure of 368,000. The 4-week moving average was 380,250, a decrease of 8,000 from the previous week's revised average of 388,250.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 380,250.

This is the lowest level for weekly claims - and the lowest level for the 4-week average - since early 2008.

And here is a long term graph of weekly claims:

This survey was for the BLS reference week for the employment report, so this suggests an increase in payroll jobs in December (compared to November).

This survey was for the BLS reference week for the employment report, so this suggests an increase in payroll jobs in December (compared to November). This was below the consensus forecast of 380,000 initial claims.

Wednesday, December 21, 2011

ATA Trucking Index increased 0.3% in November

by Calculated Risk on 12/21/2011 10:11:00 PM

From ATA: ATA Truck Tonnage Index Edged 0.3% Higher in November

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 0.3% in November after rising a revised 0.4% in October 2011. October’s increase was slightly less than the 0.5% gain ATA reported on November 22, 2011. The latest gain put the SA index at 116.6 (2000=100) in November, up from the October level of 116.3.

...

Compared with November 2010, SA tonnage was up 6.0%, the largest year-over-year gain since a 6.5% increase in June 2011.

...

“Over the last three months, tonnage is up 2.3% and stands at the highest level since January of this year.” [ATA Chief Economist Bob Costello said], “Two primary factors have helped truck tonnage in recent months. First, manufacturing output, which generates a significant amount of truck freight, has generally been increasing. Second, retail inventories are very lean, which is helping freight as well since retailers don’t have much excess stock and need to replenish when sales go up.”

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. This index has started increasing again after stalling earlier this year.

Earlier:

• Existing Home Sales in November: 4.42 million SAAR, 7.0 months of supply

• Existing Home Sales Revisions

• CoreLogic: Existing Home Shadow Inventory remains at 1.6 million units

• Existing Home Sales graphs

Lawler: The NAR “benchmark revision story” is not over!

by Calculated Risk on 12/21/2011 06:13:00 PM

NOTE: Large tables are here in excel.

From housing economist Tom Lawler on the NAR revisions:

Seasonally Adjusted Existing Home Sales Up 4% in November; Benchmark Revisions Reduce 2007-10 Sales by 14.3%; Regional Revisions Seem “Funny,” Suggest Issues with Past Data as Well

The National Association of Realtors estimated that US existing home sales ran at a seasonally adjusted annual rate of 4.42 million in November, a figure that reflected that NAR’s long-awaited “benchmark” downward revisions in sales for 2007 through 2010. November’s revised sales pace was up 4% on a SA basis from October’s pace, and was pretty close to my estimate incorporating revisions. The NAR also reported that its estimate of the inventory of existing homes for sale at the end of November was 2.580 million, an estimate that also reflected benchmark revisions (the NAR had previously noted that it was not revising its “months’ supply” measure, and as a result inventories would be revised down by the same % as sales). The November inventory estimate was down 5.8% from October (vs. my projection of a 5% drop); down 18.1% from a year ago; and the lowest inventory level since the spring of 2005.

November’s median existing home sales price in November was $164,200, down 3.5% from last November, while the median existing home sales price was $164,100, down 4.0% from a year ago. This YOY decline was just a tad smaller than I had projected. As previously reported, the NAR did not revise historical median sales prices (save for October 2011).

As I had expected, the NAR used data from the American Community Survey (and from the American Housing Survey) to “guesstimate” home sales, rather than using actual property records – in large part because the latter are either not available in many parts of the country, or the data quality are poor. The NAR did note, however, that “an increasing use of public records data may be appropriate in the future,” which is absolutely the case.

The NAR released revisions to annual sales, monthly seasonally adjusted sales, and monthly unadjusted sales. However, the annual revised sales reported don’t match the sum of unadjusted monthly sales, and because of rounding the sum of SF sales and condo sales does not match total sales in every year. As a result, I am going to report the “revised” sales as the sum of unadjusted sales estimates.

For the nation as a whole, existing home sales were as follows:

| Revised | Previous | % Change | |

|---|---|---|---|

| 2007 | 5,022,000 | 5,652,000 | -11.1% |

| 2008 | 4,124,000 | 4,913,000 | -16.1% |

| 2009 | 4,334,000 | 5,156,000 | -15.9% |

| 2010 | 4,182,000 | 4,907,000 | -14.8% |

At first glance these “national” numbers don’t appear that far off from other estimates based on property records, “grossing up” the totals to reflect geographic coverage.

However, the revisions in existing home sales by broad region suggest that something “looks funny,” and/or that data prior to 2006 in some regions need to be revised as well.

See Table 2 in Excel file

Huh? Sales in the Northeast were revised down by a TON more than any other region, while sales in the West were revised down by a TON less! That seems “sorta weird,” IF the reasons for the revisions were as the NAR suggested. The modest revisions in the West were especially surprising, given that property records data in California – which are comprehensive and of good quality – suggested that the NAR’s estimate of California existing home sales in, say, 2008 was off by more than 20%!

To be sure, there was evidence of NAR sales “over-estimates” in one major Northeast state – Massachusetts – with the “overstatements” date back to at least 2000. Here, e.g., is an excerpt from the September 23, 2009 LEHC report.

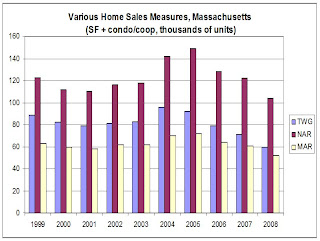

Three Measures of Home Sales in Massachusetts

Below is a chart showing annual data on various measures of home sales in Massachusetts. NAR is the National Association of Realtors estimate of existing home sales (single family plus condos/coops); MAR is the Massachusetts Association of Realtors tally of homes (single family plus condo/coop) sold by member realtors; and TWG is The Warren Group’s tally of new and existing homes sold (single family and condo/coop) based on deeds recorded in the state. TWG only includes “arms-length” transactions, and does NOT include a transaction where a lender takes over a foreclosed property – but it DOES include subsequent sales of REO to third parties.

Click on graph for larger image.

Click on graph for larger image.Inquiring minds want to know (1) why is the NAR number so high? (and the answer may data back to the “benchmarking” process for 1999); (2) is it REALLY true (based on the NAR figures) that realtors only partake in 50% of Massachusetts home sales?; and (3) if sales through MLS have risen relative to total sales (as data in a number of states suggest over the last few years), have the NAR’s estimates of existing home sales been overstating actual sales? (The NAR’s estimate for total existing home sales is based on sales data from a sample of realtor associations/Boards/MLS.).

And on how to answer the home sales question on Mass ... let us pray.

So ... property records data had for over a decade suggested that the NAR’s estimate of existing home sales in Massachusetts, and that the NAR’s PREVIOUS benchmarking methodology, especially for condo sales, might be to blame. So maybe the sharp downward revision in Northeast sales is sorta appropriate – but the data also suggest needed downward revisions in past years as well.

And speaking of condos vs. SF, [in Table 3] are the benchmark revisions for existing SF and existing condo sales, both total and by region.

See Table 3 in excel file.

Holy smoke, condo sales in the Northeast were revised down by over 50% --- FIFTY PERCENT – in each of the last four years, while condo sales in the West were revised UP a boatload!

Now if the 2007 revisions were really reasonable by region, AND if data prior to 2006 by region were “just fine,” here is what 2006 vs. 2007 sales would look like by region.

See table 4.

So … the plunge in home sales in 2007 was not only heavily concentrated in the Northeast, but condo sales in the Northeast in 2007 fell by almost 58% from 2006, while condo sales in the West JUMPED by about 33%? I don’t THINK so!

Clearly, the methodology using ACS data for owner-occupied SF sales and combined ACS and AHS data for condo sales and investor/vacant home sales, produced massively different revisions by regions and by housing type that don’t “smell” right – especially for condo sales.

Of course, this doesn’t mean they are “off” per se; the old benchmarking methodology seemed especially “iffy” for SF and condo/co-op investor/vacant home sales, as does the current methodology.

So ... while the NATIONAL existing home sales estimates prior to 2007 don’t seem far off from national estimates based on grossed-up property records, the regional data seems to suggest that a time series using the “old” data prior to 2006 and the “revised” data from 2007 to 2011 has some “issues.”

What would be most useful would be for the NAR to release its revised existing home sales estimates BY STATE, so that folks could compare the NAR’s estimate for states where solid property records data exist TO the property records data for those states, as well as compare the “old” 2006 data to the “revised” 2007 data.

Clearly, the “benchmark revision story” is not over!

Earlier:

• Existing Home Sales in November: 4.42 million SAAR, 7.0 months of supply

• Existing Home Sales Revisions

• CoreLogic: Existing Home Shadow Inventory remains at 1.6 million units

• Existing Home Sales graphs

Impact of NAR Revisions on GDP

by Calculated Risk on 12/21/2011 03:48:00 PM

The NAR mentioned today:

For the total period of 2007 through 2010, sales and inventory were downwardly revised by 14.3 percent. The revisions are expected to have a minor impact on future revisions to Gross Domestic Product.Several readers have asked about the impact on GDP. The answer is very little.

When a previously occupied home is sold, nothing is "produced" except some commissions and fees. So the only significant contribution to GDP is the brokers' commissions. Since the BEA uses the NAR existing home sales report to estimate brokers' commissions, commissions will be revised down for 2007 through 2011. Brokers' commissions are a component of Residential Investment.

The following table shows an estimate of these downward revisions. As an example, brokers' commissions in 2007 will be revised down to $76.9 billion from $86.6 billion, and Residential Investment and GDP will be revised down by the same amount (my estimate)

But real GDP annualized growth will mostly be unchanged for the last several years. Since GDP growth is the change from one period to the next, the most impact will come to years with the largest changes in the NAR revisions (from 2006 to 2007). It is possible 2007 will be revised down slightly. There will be no change to real GDP growth in 2011.

| Impact of NAR revisions on GDP (Billions) | ||||||

|---|---|---|---|---|---|---|

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| NAR Downward Revision | 0 | -11.1% | -15.5% | -16.0% | -14.6% | -14.4% |

| Brokers' commissions on sale of structures | 101.5 | 86.6 | 66.9 | 58.6 | 55.2 | |

| Revised, Brokers' commissions | 101.5 | 76.9 | 56.5 | 49.2 | 47.1 | |

| Residential Investment | 761.9 | 628.7 | 472.4 | 354.7 | 338.1 | |

| Revised, Residential Investment | 761.9 | 619.1 | 462.0 | 345.3 | 330.0 | |

| Gross domestic product | 13,377.2 | 14,028.7 | 14,291.5 | 13,939 | 14,526.5 | |

| Revised, GDP | 13,377.2 | 14,019.1 | 14,281.1 | 13,929.6 | 14,518.4 | |

| GDP Real Growth Rate | 2.7% | 1.9% | -0.3% | -3.5% | 3.0% | |

| Revised, GDP Real Growth Rate | 2.7% | 1.8% | -0.3% | -3.5% | 3.0% | |

Earlier:

• Existing Home Sales in November: 4.42 million SAAR, 7.0 months of supply

• Existing Home Sales Revisions

• CoreLogic: Existing Home Shadow Inventory remains at 1.6 million units

• Existing Home Sales graphs

AIA: Architecture Billings Index increased in November

by Calculated Risk on 12/21/2011 01:52:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Climbs into Positive Territory for First Time in Four Months

Continuing the positive momentum of a nearly three point bump in October, the Architecture Billings Index (ABI) reached its first positive mark since August. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the November ABI score was 52.0, following a score of 49.4 in October. This score reflects an overall increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 65.0, up dramatically from a reading of 57.3 the previous month.

“This is a heartening development for the design and construction industry that only a few years ago accounted for nearly ten percent of overall GDP but has fallen to slightly less than six percent,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Hopefully, this uptick in billings is a sign that a recovery phase is in the works. However, given the volatility that we’ve seen nationally and internationally recently, we’ll need to see several more months of positive readings before we’ll have much confidence that the U.S. construction recession is ending.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index increased to 52.0 in November from 49.4 in October. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in 2012, but perhaps stabilizing later in 2012 - if this doesn't take another dip.

Earlier:

• Existing Home Sales in November: 4.42 million SAAR, 7.0 months of supply

• Existing Home Sales Revisions

• CoreLogic: Existing Home Shadow Inventory remains at 1.6 million units

• Existing Home Sales graphs

Existing Home Sales Revisions

by Calculated Risk on 12/21/2011 11:30:00 AM

The NAR released the benchmark revisions today. From the NAR:

Also released today are benchmark revisions to historic existing-home sales. The 2010 benchmark shows there were 4,190,000 existing-home sales last year, a 14.6 percent revision from the previously projected 4,908,000 sales. For the total period of 2007 through 2010, sales and inventory were downwardly revised by 14.3 percent. The revisions are expected to have a minor impact on future revisions to Gross Domestic Product.The impact on GDP is from a reduction in the estimate for Brokers' commissions on sale of structures. That reduction will be minor.

Here are a couple of graphs to illustrate the revisions:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the revised sales rate (seasonally adjusted annual rate), and the pre-revision sales rate in blue.

The NAR has characterized this as "drift", but this shows a fairly sharp downward revision to 2007 data.

The second graph shows the revision to inventory.

The second graph shows the revision to inventory.Inventory has been revised down sharply for years 2007 through 2011. As expected, with the downward revision, inventory is now at late 2005 levels.

The next graph shows inventory by month since 2004. In 2004 (black line), inventory was fairly flat and declined at the end of the year. In 2005 (dark blue line), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

With the revisions, inventory in 2011 (dark red) is below the level of November 2005.

With the revisions, inventory in 2011 (dark red) is below the level of November 2005.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Of course this doesn't include "shadow inventory". In an earlier release this morning, CoreLogic estimated the shadow inventory as 1.6 million units.

CoreLogic ... reported today that the current residential shadow inventory as of October 2011 remained at 1.6 million units, representing a supply of 5 months.

The red columns are for 2011.

The red columns are for 2011. Earlier:

• Existing Home Sales in November: 4.42 million SAAR, 7.0 months of supply

• Existing Home Sales graphs