by Calculated Risk on 12/18/2011 07:45:00 PM

Sunday, December 18, 2011

Financial Times interview with ECB president Mario Draghi

From the Financial Times: Draghi warns on eurozone break-up

Here is the transcript of the interview with ECB president Mario Draghi. A few excerpts:

Financial Times: ... these austerity programmes are very harsh. Don’t think that some countries are really in effect in a debtor’s prison?There are alternatives, as an example see Tim Duy's Europe Still Heading For Collapse

Mario Draghi: Do you see any alternative?

FT: They could leave the eurozone?

MD: ... Leaving the euro area, devaluing your currency, you create a big inflation, and at the end of that road, the country would have to undertake the same reforms that were due to begin with, but in a much weaker position.

This sounds like "an endless vista of austerity", and that will not survive the polling booths for long.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

• Ten Economic Questions for 2012

Ten Economic Questions for 2012

by Calculated Risk on 12/18/2011 02:01:00 PM

Last year I listed Ten Economic Questions for 2011. These are still important questions for 2012, so once again I'll try to add some thoughts on these questions - and a few predictions - before the end of year.

1) House Prices: How much further will house prices fall on the national repeat sales indexes (Case-Shiller, CoreLogic)?

2) Residential Investment: Residential investment (RI) made a modest positive contribution to GDP growth in 2011, the first positive contribution since 2005. RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. Historically RI has been the best leading indicator for the economy, but the growth in RI will probably be modest again in 2012. How much will RI increase in 2012?

3) Distressed house sales: Foreclosure activity is still very high, although activity slowed in 2011 because of "foreclosure gate" issues. The number of REOs (Real Estate Owned by lenders) also declined in 2011. Will foreclosure activity pick up in 2012?

4) Economic growth: It appeared GDP growth would increase a little in 2011, but then the economy was hit by a series of shocks including extreme weather (significant snow storms, flooding, hurricane Irene), the oil price increase related to the "Arab Spring", the tsunami in Japan, and the debt ceiling debate in D.C. during late July and early August. Even with all these shocks, 2011 real GDP growth was still positive, but below trend.

Heading into 2012 there are significant downside risks from the European financial crisis and from U.S. fiscal tightening. Will the U.S. economy grow in 2012? Or will there be another recession?

5) Employment: The U.S. economy added about 132 thousands payroll jobs per month in 2011 through November (156 thousand private sector). Although this was an improvement from 2010, this was still weak payroll growth for a recovery. How many payroll jobs will be added in 2012?

6) Unemployment Rate: The unemployment rate is still elevated at 8.6% in November. Last year, my prediction was for the unemployment rate to still be above 9% in December 2011. I thought the participation rate would increase a little in 2011 - however the participation rate continued to decline - and that pushed down the unemployment rate.

I still think we will see some bounce back in the participation rate - and that will put upward pressure on the unemployment rate. What will the unemployment rate be in December 2012?

7) State and Local Governments: It is starting to look like there will be less drag in 2012 than in 2011. How much of a drag will state and local budget problems have on economic growth and employment?

8) Europe and the Euro: What will happen in Europe in 2012? How much of a drag will the problems in Europe have on U.S. growth?

9) Inflation: Will the inflation rate rise or fall in 2012?

10) Monetary Policy: Will the Fed introduce QE3? Will the Fed change their communication strategy and include the likely future path of the Fed Funds rate?

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

State Budget Cuts: Nearing the End?

by Calculated Risk on 12/18/2011 09:42:00 AM

There are more budget cuts coming in California, but the cuts may be nearing the end. The ongoing state and local budget cuts have been a significant drag on economic and employment growth for the last several years.

From the San Francisco Chronicle: California leaders say time for cuts may be ending

General fund spending has dropped by $17 billion since 2007 - from a high of nearly $103 billion - and the cuts continued as recently as last week ... [and Gov. Jerry Brown] warned the bad news wasn't over: Next month he'll unveil a budget proposal with yet more spending cuts.State and local governments have cut 227,000 payroll jobs this year through November, after cutting 249,000 jobs last year - and more cuts are coming. And state and local governments have been a drag on GDP for four consecutive years, subtracting about 0.3% from GDP growth this year (through Q3). There is more cutting ahead, but the pace of cutting should slow in 2012 - and there will be less drag on GDP and employment.

... in the past year, the governor and lawmakers have put a significant dent in the problem. In November 2010, the Legislative Analyst's Office projected that California would have budget deficits of around $20 billion per year over the next five years if the governor and Legislature did not take decisive action. ... Last month, the legislative analyst projected future deficits at under $6 billion per year ... More action is sure to come. Brown last week said he would propose billions more in spending cuts when he proposes a budget next month for the year beginning July 1.

In addition to that, voters will be asked in November whether to approve tax increases worth $7 billion per year over the next five years, including in the next fiscal year.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

Saturday, December 17, 2011

Inland Empire: Unemployment Rate now declining

by Calculated Risk on 12/17/2011 09:21:00 PM

I've been tracking the employment situation in California's Inland Empire since 2005. I expected housing and construction dependent areas like the Inland Empire to be hit hard during the housing bust. Sure enough, the Inland Empire was considered "ground zero" for the housing bust (along with Las Vegas, Phoenix, Sacramento, most of Florida and several other areas). Now the employment situation is finally starting to improve a little.

From the North County Times: [Local] Job picture improves in November as economy begins to heal

California's jobless rate dipped to 11.3 percent in November from 11.7 percent the previous month, with 6,600 jobs added ... The state's jobless rate was the lowest since May 2009.In 2005, I wrote:

...

Riverside County's unemployment rate fell to 12.8 percent in November, down from a revised 13.7 percent in October and sharply lower than the year-ago estimate of 14.8 percent.

Of all the areas experiencing a housing boom, the areas most at risk have had the greatest increase in real estate related jobs. These jobs include home construction, real estate agents, mortgage brokers, inspectors and more. ... I believe that areas like the Inland Empire will suffer the most when housing activity slows.And in 2006, in response to a sanguine forecast from a local economist, I wrote: Housing: Inverted Reasoning?

[W]hat happens during a housing bust? Just look at the unemployment rate in the previous bust.

The unemployment rate in California rose from 5.2% to 10.4% in just over two years. For the Inland Empire, the unemployment rate rose from 4.8% to double digits in the same period, peaking at 12.4%. ... As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of construction employment and the unemployment rate for the Inland Empire.

With the housing bust, the percent construction employment declined sharply and the unemployment rate peaked at 15.1%. Hey, Hoocoodanode?

But now it appears the California economy is starting to slowly improve - even in the Inland Empire. The unemployment rate is falling, and it appears construction employment has bottomed.

But look at the Inland Empire unemployment rate following the previous housing bust (early 90s). The unemployment rate only declined gradually over several years. That is probably what will happen this time too - I expect the areas that were most dependent on housing and construction during the bubble to see the slowest employment recovery over the next few years.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

Unofficial Problem Bank list declines to 974 institutions

by Calculated Risk on 12/17/2011 04:49:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 16, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

After a four week hiatus, the FDIC got back to closings. Also, the OCC got back to releasing its enforcement activities on the first Friday after the 15th of the month. As a result, there were several changes to the Unofficial Problem Bank List this week. In all, there were five removals and two additions, which leave the list standing at 974 institutions with assets of $398.3 billion. A year ago, the list held 920 institutions with assets of $411.4 billion.

The removals include one cure, two unassisted mergers, and two failures. The OCC terminated an action against BNC National Bank, Glendale, AZ ($667 million Ticker: BNCC). Viking Bank, Seattle, WA ($387 million) and AmericaUnited Bank and Trust Company USA, Schaumburg, IL found merger partners. The two failures were Western National Bank, Phoenix, AZ ($163 million) and Premier Community Bank of the Emerald Coast, Crestview, FL ($126 million).

Given the calendar, the FDIC is likely [finished] with closings in 2011. If so, the year will end with 92 failures at an initial estimated cost of $7.2 billion for liquidating assets of $35.9 billion, which translates into a resolution cost of about 20% of failed bank assets. Buyers were willing to pay a deposit premium in only 22 of the resolutions and loss share agreements were done in 57 resolutions covering $17.9 billion of failed assets acquired.

The additions include First Federal Savings and Loan Association of McMinnville, McMinnville, OR ($346 million) and SouthernTrust Bank, Goreville, IL ($52 million).

The OCC converted a few Formal Agreements or previously OTS issued Supervisory Agreements to Consent Orders. Next Friday, we anticipate the FDIC will release its enforcement action activity for the month of November.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of bank failures by week (cumulative) for the last several years.

In 2008, 25 banks failed, 140 banks failed in 2009, 157 in 2010, and 92 in 2011. As "surferdude" noted, this is probably the last of the closings for 2011.

Earlier:

• Summary for Week ending Dec 16th

• Schedule for Week of Dec 18th

Schedule for Week of Dec 18th

by Calculated Risk on 12/17/2011 12:41:00 PM

Earlier:

• Summary for Week ending Dec 16th

There are three key housing reports that will be released this week: December homebuilder confidence on Monday, November existing home sales (and benchmark revisions) on Wednesday, and November new home sales on Friday.

Other key U.S. economic reports include the third estimate of Q3 GDP on Thursday, and the November Personal Income and Outlays report on Friday.

10 AM ET: The December NAHB homebuilder survey. The consensus is for a reading of 20, unchanged from November. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

8:30 AM: Housing Starts for November.

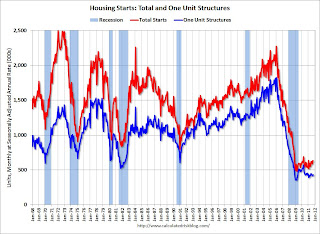

8:30 AM: Housing Starts for November. After collapsing following the housing bubble, single family housing starts have been moving sideways for almost three years. However multi-family starts have been increasing all year.

The consensus is for a slight increase in total housing starts to 630,000 (SAAR) from 628,000 (SAAR) in October. This consensus might be a little low based on the uptick in permits and the recent increases in the homebuilder confidence survey.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for November 2011

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak since early August, although this doesn't include cash buyers.

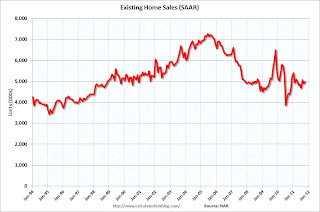

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). Important: This release will include the benchmark revisions for 2007 through 2011.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). Important: This release will include the benchmark revisions for 2007 through 2011.The consensus is for a 2% increase in sales. This would be around 5.08 million based on the reported sales in October, but sales will be much lower after the downward revisions.

Economist Tom Lawler estimates the NAR will report a 1.8% increase in sales from October. He expects a downward revision of about 13%, so he expects the NAR to report sales of around 4.4 million SAAR in November.

Expected: The Moody's/REAL Commercial Property Price Index (commercial real estate price index) for October.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 380,000 from 366,000 last week. Last week was the lowest level for the 4-week average of weekly claims since July 2008.

8:30 AM: Gross Domestic Product, 3rd quarter 2011 (third estimate). This is the third estimate from the BEA. The consensus is that real GDP increased 2.0% annualized in Q3, unchanged from the 2nd estimate.

8:30 AM ET: Chicago Fed National Activity Index (November). This is a composite index of other data.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a slight increase to 68.0 from the preliminary reading of 67.7.

10:00 AM: FHFA House Price Index for October 2011. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Conference Board Leading Indicators for October. The consensus is for a 0.3% increase in this index.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders. This might be a little stronger than consensus because of an increase in commercial aircraft orders.

8:30 AM: Personal Income and Outlays for November. The graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars).

8:30 AM: Personal Income and Outlays for November. The graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars). PCE increased 0.1% in October, and real PCE increased 0.1%. The price index for PCE decreased 0.1 percent in October.

The consensus is for a 0.2% increase in personal income in November, and a 0.3% increase in personal spending, and for the Core PCE price index to increase 0.1%.

10:00 AM ET: New Home Sales for November from the Census Bureau.

10:00 AM ET: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight increase in sales to 313 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 307 thousand in October. This consensus might be a little low based on the homebuilder confidence survey.

Summary for Week ending Dec 16th

by Calculated Risk on 12/17/2011 08:11:00 AM

If it wasn’t for Europe, the economic outlook might be improving a little. Unfortunately this was another tough week in Europe, and the European financial crisis is dragging down global economic growth.

The good news this week included a decline in initial weekly unemployment claims (the 4-week average is now at the lowest level since July 2008), and a pickup in the Empire State and Philly Fed manufacturing surveys. Also small business optimism increased in November. However industrial production and retail sales were a little weaker than expected.

Here is a summary of last week in graphs:

• Retail Sales increased 0.2% in November

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales were up 0.2% from October to November (seasonally adjusted, after revisions), and sales were up 6.7% from November 2010. Retail sales excluding autos increased 0.2% in November.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 20.0% from the bottom, and now 5.5% above the pre-recession peak (not inflation adjusted)

• Industrial Production decreased 0.2% in November, Capacity Utilization decreased

Industrial production decreased 0.2 percent in November. Capacity utilization for total industry decreased to 77.8 percent.

Industrial production decreased 0.2 percent in November. Capacity utilization for total industry decreased to 77.8 percent. This graph shows Capacity Utilization. This series is up 10.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

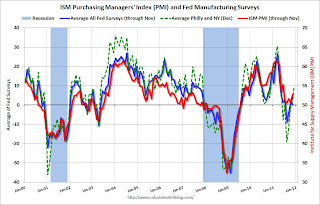

• Empire State and Philly Fed Manufacturing Indexes show improvement in December

From the NY Fed: Empire State Manufacturing Survey "The general business conditions index rose nine points to 9.5" and from the Philly Fed: December 2011 Business Outlook Survey "the survey’s broadest measure of manufacturing conditions, remained positive for the third consecutive month and increased from 3.6 in November to 10.3"

From the NY Fed: Empire State Manufacturing Survey "The general business conditions index rose nine points to 9.5" and from the Philly Fed: December 2011 Business Outlook Survey "the survey’s broadest measure of manufacturing conditions, remained positive for the third consecutive month and increased from 3.6 in November to 10.3" Both surveys indicated expansion in December, and at a faster pace than in November. Both indexes were above the consensus forecasts.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through December. The ISM and total Fed surveys are through November.

The average of the Empire State and Philly Fed surveys increased again in December and suggests the December ISM index will be in the mid 50s.

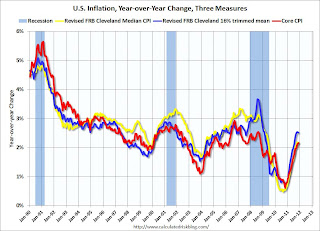

• Key Measures of Inflation mostly lower in November

This graph shows the year-over-year change for these three key measures of inflation (core CPI, median CPI, and trimmed-mean CPI).

This graph shows the year-over-year change for these three key measures of inflation (core CPI, median CPI, and trimmed-mean CPI). On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 2.5%, and core CPI rose 2.2%. These measures of inflation have stopped increasing, and are slightly above the Fed's target.

On a monthly basis, the rate of increase is mostly below the Fed's target. On a monthly basis, the median Consumer Price Index increased 1.1% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 1.0% annualized, and core CPI increased 2.1% annualized.

• Weekly Initial Unemployment Claims declined to 366,000

The DOL reported "In the week ending December 10, the advance figure for seasonally adjusted initial claims was 366,000, a decrease of 19,000 from the previous week's revised figure of 385,000. The 4-week moving average was 387,750, a decrease of 6,500 from the previous week's revised average of 394,250." The following graph shows the 4-week moving average of weekly claims since January 2000.

The DOL reported "In the week ending December 10, the advance figure for seasonally adjusted initial claims was 366,000, a decrease of 19,000 from the previous week's revised figure of 385,000. The 4-week moving average was 387,750, a decrease of 6,500 from the previous week's revised average of 394,250." The following graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 387,750.

This is the lowest level for weekly claims - and the lowest level for the 4-week average - since early 2008.

• BLS: Job Openings "essentially unchanged" in October

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings declined slightly in October, but the number of job openings (yellow) has generally been trending up, and are up about 13% year-over-year compared to October 2010.

Quits declined in October, but have mostly been trending up - and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

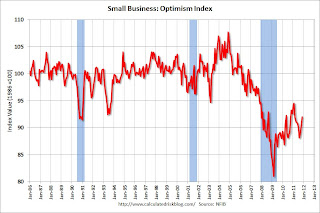

• NFIB: Small Business Optimism Index increases in November

From the National Federation of Independent Business (NFIB): Small-Business Confidence Rises for Third Consecutive Month: Is Hope for the Economy on the Horizon?

From the National Federation of Independent Business (NFIB): Small-Business Confidence Rises for Third Consecutive Month: Is Hope for the Economy on the Horizon? Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

This graph shows the small business optimism index since 1986. The index increased to 92.0 in November from 90.2 in October. This is the third increase in a row after declining for six consecutive months.

• Other Economic Stories ...

• From the WSJ: Realtors to Revise 2007-2011 Sales Data Lower

• Pulse of Commerce Index Increased 0.1 Percent in November

• FOMC Statement: Economy expanding "moderately", Global growth slowing

• Lawler on NAR Revisions for 2007 through 2011

• The Excess Vacant Housing Supply

Friday, December 16, 2011

Report: Deal reached on two month extension of Payroll Tax Cut

by Calculated Risk on 12/16/2011 09:35:00 PM

From the NY Times: Senate Leaders Agree on 2-Month Extension of Payroll Tax Cut

Senate leaders said on Friday night that they had reached a deal that would extend a payroll tax cut for two months ... The agreement would also speed the decision process for the construction of an oil pipeline from Canada to the Gulf Coast ...I expect these provisions - the payroll tax cut and the extension of the emergency unemployment insurance benefits - to eventually be extended for all of 2012.

The Senate agreement would also allow jobless workers to continue receiving unemployment insurance benefits as permitted by current law for two months. For the same period, there would be no cut or increase in fees paid to doctors for treating Medicare patients.

Earlier:

• Lawler: Early Read on Existing Home Sales: Given the Benchmark Revision, a “Challenge”

• Key Measures of Inflation mostly slow in November

Bank Failure #92 in 2011: Western National Bank, Phoenix, Arizona

by Calculated Risk on 12/16/2011 07:20:00 PM

From the FDIC: Washington Federal, Seattle, Washington, Assumes All of the Deposits of Western National Bank, Phoenix, Arizona

As of September 30, 2011, Western National Bank had approximately $162.9 million in total assets and $144.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $37.6 million. ... Western National Bank is the 92nd FDIC-insured institution to fail in the nation this year, and the third in Arizona.Two today so far ... this is probably the last closing day of the year.

Bank Failure #91 in 2011: Premier Community Bank of the Emerald Coast

by Calculated Risk on 12/16/2011 06:23:00 PM

Don't look behind the curtain!

Hoped Emerald Coast Bank

by Soylent Green is People

From the FDIC: Summit Bank, National Association, Panama City, Florida, Assumes All of the Deposits of Premier Community Bank of the Emerald Coast, Crestview, Florida

As of September 30, 2011, Premier Community Bank of the Emerald Coast had approximately $126.0 million in total assets and $112.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.2 million. ... Premier Community Bank of the Emerald Coast is the 91st FDIC-insured institution to fail in the nation this year, and the thirteenth in Florida.Not so premier ...

Earlier:

• Lawler: Early Read on Existing Home Sales: Given the Benchmark Revision, a “Challenge”

• Key Measures of Inflation mostly slow in November