by Calculated Risk on 11/02/2011 03:57:00 PM

Wednesday, November 02, 2011

A few comments on the Bernanke Press Briefing

• The video of the press conference will be available soon.

• Bernanke made it clear the Fed stands ready to take additional policy action. This would probably be additional buying of agency (Fannie & Freddie) MBS.

Sudeep Reddy at the WSJ has some notes: Recap: Ben Bernanke’s November Press Conference and this is the key section:

"The outlook remains unsatisfactory over the next few years," [Bernanke] says, and at the Fed "we'll continue to ask ourselves" whether additional stimulus is warranted. Doing more "remains on the table," he says.Although Bernanke was noncommittal, and always pointed out that further action would be a committee decision, I believe his comments mean the Fed will act if the outlook doesn't improve soon as compared to their current forecast. Their current forecast is already pretty dismal - clearly "unsatisfactory".

• Here are the Fed's current forecasts. In the previous post, I included these forecasts and the earlier forecasts for this year to show the steady downgrade.

• Bernanke twice repeated that "it would be helpful if the Fed got some help from other parts of the government" on trying to stimulate the economy in the short term. He was clearly referring to a new jobs program.

Bernanke Press Briefing 2:15 PM ET

by Calculated Risk on 11/02/2011 02:15:00 PM

Below is a live video feed for Ben Bernanke's press conference.

UPDATE: The forecast updates have been added below the video.

The FOMC statement was released at 12:30 PM. The FOMC noted that "economic growth strengthened somewhat in the third quarter" although "recent indicators point to continuing weakness in overall labor market conditions, and the unemployment rate remains elevated". They also noted "Inflation appears to have moderated since earlier in the year".

Here are the new FOMC projections.

GDP growth was revised down to around 1.7% this year.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2011 | 2012 | 2013 | 2014 |

| Jan 2011 Projections | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 | NA |

| April 2011 Projections | 3.1 to 3.3 | 3.5 to 4.2 | 3.5 to 4.3 | NA |

| June 2011 Projections | 2.7 to 2.9 | 3.3 to 3.7 | 3.5 to 4.2 | NA |

| November 2011 Projections | 1.6 to 1.7 | 2.5 to 2.9 | 3.0 to 3.5 | 3.0 to 3.9 |

The unemployment rate was revised up to 9.0% to 9.1% (this is Q4 unemployment rate). The FOMC thinks the unemployment rate will still be around 8% at the end of 2013 and in the 6.8% to 7.7% in 2014!

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2011 | 2012 | 2013 | 2014 |

| Jan 2011 Projections | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 | NA |

| April 2011 Projections | 8.4 to 8.7 | 7.6 to 7.9 | 6.8 to 7.2 | NA |

| June 2011 Projections | 8.6 to 8.9 | 7.8 to 8.2 | 7.0 to 7.5 | NA |

| November 2011 Projections | 9.0 to 9.1 | 8.5 to 8.7 | 7.8 to 8.2 | 6.8 to 7.7 |

Inflation was revised up for 2011.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2011 | 2012 | 2013 | 2014 |

| Jan 2011 Projections | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 | NA |

| April 2011 Projections | 2.1 to 2.8 | 1.2 to 2.0 | 1.4 to 2.0 | NA |

| June 2011 Projections | 2.3 to 2.5 | 1.5 to 2.0 | 1.5 to 2.0 | NA |

| November 2011 Projections | 2.7 to 2.9 | 1.4 to 2.0 | 1.5 to 2.0 | 1.5 to 2.0 |

But core inflation is seen at levels still below the FOMC target.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2011 | 2012 | 2013 | 2014 |

| Jan 2011 Projections | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 | NA |

| April 2011 Projections | 1.3 to 1.6 | 1.3 to 1.8 | 1.4 to 2.0 | NA |

| June 2011 Projections | 1.5 to 1.8 | 1.4 to 2.0 | 1.4 to 2.0 | NA |

| November 2011 Projections | 1.8 to 1.9 | 1.5 to 2.0 | 1.4 to 1.9 | 1.5 to 2.0 |

FOMC Statement: No change, "economic growth strengthened somewhat"

by Calculated Risk on 11/02/2011 12:33:00 PM

Fed Chairman Ben Bernanke will hold a press briefing at 2:15 PM ET.

From the Federal Reserve:

Information received since the Federal Open Market Committee met in September indicates that economic growth strengthened somewhat in the third quarter, reflecting in part a reversal of the temporary factors that had weighed on growth earlier in the year. Nonetheless, recent indicators point to continuing weakness in overall labor market conditions, and the unemployment rate remains elevated. Household spending has increased at a somewhat faster pace in recent months. Business investment in equipment and software has continued to expand, but investment in nonresidential structures is still weak, and the housing sector remains depressed. Inflation appears to have moderated since earlier in the year as prices of energy and some commodities have declined from their peaks. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee continues to expect a moderate pace of economic growth over coming quarters and consequently anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, there are significant downside risks to the economic outlook, including strains in global financial markets. The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate further. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to continue its program to extend the average maturity of its holdings of securities as announced in September. The Committee is maintaining its existing policies of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The Committee also decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools to promote a stronger economic recovery in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Charles L. Evans, who supported additional policy accommodation at this time.

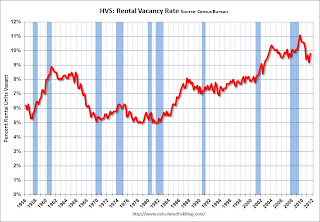

HVS: Q3 Homeownership and Vacancy Rates

by Calculated Risk on 11/02/2011 10:31:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q3 this morning.

As Tom Lawler has been discussing (see posts at bottom), this is from a fairly small sample, and the homeownership and vacancy rates are higher than estimated in other reports (like Census 2010). This report is commonly used by analysts to estimate the excess vacant supply for housing, but it doesn't appear to be useful for that purpose.

It might show the trend, but I wouldn't rely on the absolute numbers.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 66.3%, up from to 65.9% in Q2 2011.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The Census researchers are investigating differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, and plan to report the results of this research at the 2012 Federal Committee on Statistical Methodological Research Conference this coming January: “Evaluation of Gross Vacancy Rates from the Decennial Census Versus Current Surveys.”

The Census researchers are investigating differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, and plan to report the results of this research at the 2012 Federal Committee on Statistical Methodological Research Conference this coming January: “Evaluation of Gross Vacancy Rates from the Decennial Census Versus Current Surveys.”

The HVS homeowner vacancy rate declined to 2.4% from 2.5% in Q2.

The homeowner vacancy rate has probably peaked and is slowly declining. However - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate increased to 9.8% from 9.2% in Q2.

The rental vacancy rate increased to 9.8% from 9.2% in Q2.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and that survey has been showing the trend is down.

Here are some previous posts about some of the HVS issues by economist Tom Lawler:

• Lawler to Census on Housing Data: "Splainin" Needed Not Just on Vacancy Rate

• Census Bureau on Homeownership Rate: We've got “Some 'Splainin' to Do”

• Be careful with the Housing Vacancies and Homeownership report

• Lawler: Census 2010 and the US Homeownership Rate

• Lawler: Census 2010 Demographic Profile: Highlights, Excess Housing Supply Estimate, and Comparison to HVS

• Lawler: The “Excess Supply of Housing” War

• Lawler: Census Releases Demographic Profile of 12 States and DC: Confirms Bias of HVS

• Lawler: Census 2010 and Excess Vacant Housing Units

• Lawler: On Census Housing Stock/Household Data

• Lawler: Housing Vacancy Survey appears to massively overstate number of vacant housing units

• Lawler: US Households: Why Researchers / Analysts are “Confused”

ADP: Private Employment increased 110,000 in October

by Calculated Risk on 11/02/2011 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 110,000 from September to October on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated advance in employment from August to September was revised up to 116,000 from the initially reported 91,000.This was slightly above the consensus forecast of an increase of 100,000 private sector jobs in October. The BLS reports on Friday, and the consensus is for an increase of 90,000 payroll jobs in September, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector rose 114,000 in October. Although down a bit from an increase of 122,000 in September, this increase marks more than 20 consecutive months of employment gains. Employment in the private, goods-producing sector declined 4,000 in October, while manufacturing employment declined by 8,000.

Government payrolls have been shrinking by about 35,000 on average per month this year. So this suggests around 110,000 private nonfarm payroll jobs added, minus 35,000 government workers - or around 75,000 total jobs added in October. Of course ADP hasn't been very useful in predicting the BLS report.

MBA: Mortgage Purchase Application Index increased slightly

by Calculated Risk on 11/02/2011 07:24:00 AM

From Reuters: Mortgage applications barely up last week: MBA

The MBA's seasonally adjusted gauge of loan requests for home purchases rose 1.8 percent, while the index of refinancing applications was off 0.2 percent.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

Fixed 30-year mortgage rates averaged 4.31 percent, down 2 basis points from 4.33 percent.

Click on graph for larger image.

Click on graph for larger image.The purchase index is at about the same level as in 1996, and the 4-week average is at the lowest level this year. This does not include cash buyers, but this suggests weaker home sales in November and December.

Tuesday, November 01, 2011

Greece: Who knows?

by Calculated Risk on 11/01/2011 10:32:00 PM

Looks the referendum is back on ... but who knows?

From Reuters: Greece Says Vote on Bailout Is Still On

"The referendum will be a clear mandate and a clear message in and outside Greece on our European course and participation in the euro," [Prime Minister George Papandreou] said, according to a statement released by his office. "No one will be able to doubt Greece's course within the euro."And from the WSJ: Greek Premier Faces Revolt

Papandreou said Greece's partners will support its policies and urged a meeting of G20 leaders this week in Cannes to agree policies that "make sure democracy is above market appetites."

By Tuesday evening, Mr. Papandreou appeared to lack enough support in Parliament to hold a referendum on the rescue package for Greece that European leaders agreed on last week. But while prospects for his high-risk referendum receded, he was also fighting to hold on to power, leaving Europe fretting about the political instability in the country at the heart of the euro-zone crisis.And from the Financial Times: Leaders race to save eurozone deal

Indeed, Mr. Papandreou in a statement issued around 1 a.m. Wednesday in Athens insisted that the referendum would go ahead and would give his economic overhauls a strong mandate.

... Angela Merkel, Germany’s chancellor, and Nicolas Sarkozy, France’s president, summoned George Papandreou, Greek prime minister, to emergency talks in Cannes on Wednesday ... In a joint communiqué, the French and German leaders said they were “determined to ensure the implementation without delay of the decisions adopted at the eurozone summit”, saying they were “more necessary than ever today”.Earlier:

excerpt with permission

• ISM Manufacturing index indicates slower expansion in October

• Construction Spending increased slightly in September

• U.S. Light Vehicle Sales at 13.26 million SAAR in October, Highest since Aug 2009

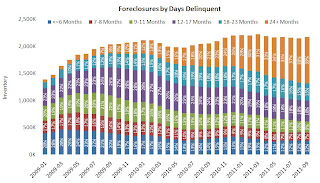

LPS: Foreclosure timelines increase, Mortgage delinquency rate declines slightly in September

by Calculated Risk on 11/01/2011 05:57:00 PM

From LPS Applied Analytics: LPS' Mortgage Monitor Report Shows Significant Difference in Inventories, Timelines Between Judicial and Non-Judicial States

The September Mortgage Monitor report released by Lender Processing Services, Inc. continues to show significant differences between states that process foreclosures following a judicial vs. non-judicial foreclosure process. ... The time from last payment to foreclosure sale in judicial states is 761 days, which is six months longer than in non-judicial states.According to LPS, 8.09% of mortgages were delinquent in September, down from 8.13% in August, and down from 9.27% in September 2010.

...

Overall, foreclosure starts in September were slightly below the three-year average. Foreclosure timelines continue to increase across the board – almost 40 percent of loans in foreclosure have not made a payment in two years, and 72 percent have not made a payment in a year or more. New problem loan rates increased sharply over the last two months, with 1.6 percent of loans that were current six months ago now 60 or more days delinquent or in foreclosure.

LPS reports that 4.18% of mortgages were in the foreclosure process, up from 4.11% in August, and up from 3.84% in September 2010. This gives a total of 12.27% delinquent or in foreclosure. It breaks down as:

• 2.36 million loans less than 90 days delinquent.

• 1.84 million loans 90+ days delinquent.

• 2.17 million loans in foreclosure process.

For a total of 6.37 million loans delinquent or in foreclosure in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 8.09% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.18% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.17 million) - and, for judicial states, the average loan in foreclosure has been delinquent for 761 days (six months less for non-judicial states).

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by origination channel.

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by origination channel.The total number of loans 90+ delinquent is back to 2008 levels. Most people focus on the GSE seriously delinquent loans, but the private and portfolio loans have much high delinquency rates.

The third graph shows the number of loans in foreclosure by duration of delinquency.

The third graph shows the number of loans in foreclosure by duration of delinquency.There are 2.17 million loans in the foreclosure process and about 39% have been delinquent for more than 2 years, and another 33% have been delinquent for 1 to 2 years. Many of these loans are still in process review.

Although the delinquency rate is trending down slowly, the percent of loans in the foreclosure process seems stuck at a very high level.

Earlier:

• ISM Manufacturing index indicates slower expansion in October

• Construction Spending increased slightly in September

• U.S. Light Vehicle Sales at 13.26 million SAAR in October, Highest since Aug 2009

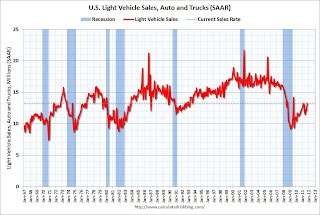

U.S. Light Vehicle Sales at 13.26 million SAAR in October, Highest since Aug 2009

by Calculated Risk on 11/01/2011 04:35:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.26 million SAAR in October. That is up 9.2% from October 2010, and up 1.7% from the sales rate last month (13.04 million SAAR in Sept 2011).

This was slightly above the consensus forecast of 13.2 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 13.26 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

This was just above the February sales and the highest sales rate since August 2009 ("Cash-for-clunkers")

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and if November and December are at the October rate, sales will be up 6.5% in Q4 over Q3.

Preliminary Vehicle Sales for October

by Calculated Risk on 11/01/2011 02:30:00 PM

Note: DJ is quoting an unnamed Greek official saying the referendum is "basically dead".

The early auto sales reports are a little mixed, but it appears sales will be over 13 million SAAR (the consensus is for 13.2 million SAAR). The high for the year was 13.2 million SAAR in February.

I'll post a graph of October auto sales around 4 PM ET.

From the WSJ: October U.S. Auto Sales Hit Yearly Peak

U.S. auto sales surged in October to their fastest pace of year ... GM sales analyst Don Johnson said he expects the sales pace to remain above 13 million vehicles in the final two months of 2011, and to move higher next year.From Bloomberg: Big Three Auto Sales Rise Less Than Estimates

General Motors Co. (GM) and Ford Motor Co. (F) said U.S. deliveries increased less than analysts’ estimates that called for the best sales month since February.Earlier:

• ISM Manufacturing index indicates slower expansion in October

• Construction Spending increased slightly in September