by Calculated Risk on 11/01/2011 05:57:00 PM

Tuesday, November 01, 2011

LPS: Foreclosure timelines increase, Mortgage delinquency rate declines slightly in September

From LPS Applied Analytics: LPS' Mortgage Monitor Report Shows Significant Difference in Inventories, Timelines Between Judicial and Non-Judicial States

The September Mortgage Monitor report released by Lender Processing Services, Inc. continues to show significant differences between states that process foreclosures following a judicial vs. non-judicial foreclosure process. ... The time from last payment to foreclosure sale in judicial states is 761 days, which is six months longer than in non-judicial states.According to LPS, 8.09% of mortgages were delinquent in September, down from 8.13% in August, and down from 9.27% in September 2010.

...

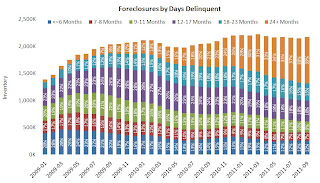

Overall, foreclosure starts in September were slightly below the three-year average. Foreclosure timelines continue to increase across the board – almost 40 percent of loans in foreclosure have not made a payment in two years, and 72 percent have not made a payment in a year or more. New problem loan rates increased sharply over the last two months, with 1.6 percent of loans that were current six months ago now 60 or more days delinquent or in foreclosure.

LPS reports that 4.18% of mortgages were in the foreclosure process, up from 4.11% in August, and up from 3.84% in September 2010. This gives a total of 12.27% delinquent or in foreclosure. It breaks down as:

• 2.36 million loans less than 90 days delinquent.

• 1.84 million loans 90+ days delinquent.

• 2.17 million loans in foreclosure process.

For a total of 6.37 million loans delinquent or in foreclosure in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 8.09% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.18% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.17 million) - and, for judicial states, the average loan in foreclosure has been delinquent for 761 days (six months less for non-judicial states).

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by origination channel.

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by origination channel.The total number of loans 90+ delinquent is back to 2008 levels. Most people focus on the GSE seriously delinquent loans, but the private and portfolio loans have much high delinquency rates.

The third graph shows the number of loans in foreclosure by duration of delinquency.

The third graph shows the number of loans in foreclosure by duration of delinquency.There are 2.17 million loans in the foreclosure process and about 39% have been delinquent for more than 2 years, and another 33% have been delinquent for 1 to 2 years. Many of these loans are still in process review.

Although the delinquency rate is trending down slowly, the percent of loans in the foreclosure process seems stuck at a very high level.

Earlier:

• ISM Manufacturing index indicates slower expansion in October

• Construction Spending increased slightly in September

• U.S. Light Vehicle Sales at 13.26 million SAAR in October, Highest since Aug 2009