by Calculated Risk on 10/20/2011 01:51:00 PM

Thursday, October 20, 2011

Sarkozy: 2nd European Leader Summit to Adopt Plan

Via Google Translate:

FRANCO-GERMAN PRESSAnd in French:

The President and German Chancellor spoke today by telephone to prepare the European dates in the coming days.

The President and the Chancellor have agreed to provide a comprehensive and ambitious global response to the current crisis in the euro area.

This response will include the following:

- The operational implementation of new forms of intervention EFSF.

- A plan to strengthen the capital of European banks.

- The implementation of the economic governance of the euro area and the strengthening of economic integration.

For a lasting solution to the situation in Greece, the Greek authorities will have to make ambitious commitments to address the situation of their economies as part of a new program. Based on the report of the troika and the analysis of debt sustainability Greece, France and Germany call for immediately undertake negotiations with the private sector to reach an agreement for strengthening sustainability.

The President and the Chancellor will meet Saturday night in Brussels ahead of the European Council summit in the euro area on Sunday.

France and Germany have agreed that all elements of this ambitious and comprehensive response will be discussed in depth at the summit on Sunday in order to be finally adopted by the Heads of State and Government at a second meeting later than Wednesday.

COMMUNIQUÉ FRANCO-ALLEMANDEarlier:

Le président de la République et la chancelière allemande se sont entretenus ce jour par téléphone pour préparer les échéances européennes de ces prochains jours.

Le président et la chancelière ont marqué leur accord complet pour apporter une réponse globale et ambitieuse à la crise que traverse actuellement la zone euro.

Cette réponse comportera notamment les éléments suivants :

- la mise en œuvre opérationnelle des nouvelles modalités d’intervention du FESF.

- Un plan de renforcement du capital des banques européennes.

- La mise en place de la gouvernance économique de la zone euro et le renforcement de l’intégration économique.

En vue d’une solution durable à la situation de la Grèce, les autorités grecques devront prendre des engagements ambitieux pour redresser la situation de leur économie dans le cadre d’un nouveau programme. Sur la base du rapport de la troïka et de l’analyse de la soutenabilité de la dette grecque, la France et l’Allemagne demandent que les négociations s’engagent immédiatement avec le secteur privé pour trouver un accord permettant de renforcer cette soutenabilité.

Le président de la République et la chancelière se retrouveront samedi soir à Bruxelles en amont du Conseil européen et du sommet de la zone euro de dimanche.

La France et l’Allemagne sont convenues que l’ensemble des éléments de cette réponse globale et ambitieuse sera examiné de manière approfondie lors du sommet de dimanche pour pouvoir être adopté définitivement par les chefs d’Etat et de gouvernement lors d’une deuxième rencontre au plus tard mercredi.

• Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

• Philly Fed Survey shows Expansion, Existing Home Sales NSA Graph

• Existing Home Sales graphs

Philly Fed Survey shows Expansion, Existing Home Sales NSA Graph

by Calculated Risk on 10/20/2011 11:45:00 AM

The high frequency data and surveys continue to indicate some improvement. Earlier this morning, the 4-week average of initial weekly unemployment claims fell to the lowest level since April - although still elevated - and now the Philly Fed manufacturing survey indicated expansion for the first time in three months - although still weak.

Even if there has been a little rebound from the economic shock in early August, due to the threat of a U.S. default, the rebound is just to sluggish growth. And there are significant downside risks from the European crisis and premature tightening in the U.S.

As a reminder, my most used post title over the last few years has been "Jobs, jobs, jobs", and even if we see sluggish growth, jobs remain priority #1 in the U.S.

• From the Philly Fed: October 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from ‐17.5 in September to 8.7, the first positive reading in three months. The current new orders index paralleled the rise in the general activity index, increasing 19 points and returning to positive territory. The shipments index also recorded a positive reading, increasing from ‐22.8 in September to 13.6 this month.This indicates expansion in October, and was well above the consensus forecast of -9.0.

...

The current employment index remained slightly positive but decreased 4 points from its reading in September. The average workweek index increased notably from ‐13.7 to 3.1.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

The average of the Empire State and Philly Fed surveys rebounded in October, and is now slightly positive.

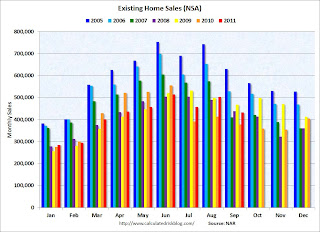

• The following graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2011.

The red columns are for 2011. Sales NSA are above last September - of course sales declined sharply last year following the expiration of the tax credit in June 2010.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales accounted for 30 percent of purchase activity in September, up from 29 percent in August and 29 percent also in September 2010; investors make up the bulk of cash purchases.Earlier:

• Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

• Existing Home Sales graphs

Existing Home Sales in September: 4.91 million SAAR, 8.5 months of supply

by Calculated Risk on 10/20/2011 10:00:00 AM

The NAR reports: Existing-Home Sales Off in September but Higher Than a Year Ago

Total existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, declined 3.0 percent to a seasonally adjusted annual rate of 4.91 million in September from an upwardly revised 5.06 million in August, but are 11.3 percent above the 4.41 million unit pace in September 2010.

...

Total housing inventory at the end of September declined 2.0 percent to 3.48 million existing homes available for sale, which represents an 8.5-month supply at the current sales pace, compared with an 8.4-month supply in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2011 (4.91 million SAAR) were 3.0% lower than last month, and were 11.3% above the September 2010 rate.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.48 million in September from 3.55 million in August.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.0% year-over-year in September from September 2010. This is the eight consecutive month with a YoY decrease in inventory.

Inventory decreased 13.0% year-over-year in September from September 2010. This is the eight consecutive month with a YoY decrease in inventory.Months of supply increased to 8.5 months in September, up from 8.4 months in August. This is much higher than normal. These sales numbers were close to the consensus.

I'll have more soon ...

Weekly Initial Unemployment Claims: 4-Week average lowest since April

by Calculated Risk on 10/20/2011 08:30:00 AM

The DOL reports:

In the week ending October 15, the advance figure for seasonally adjusted initial claims was 403,000, a decrease of 6,000 from the previous week's revised figure of 409,000. The 4-week moving average was 403,000, a decrease of 6,250 from the previous week's revised average of 409,250.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 403,000.

This is the lowest level for the 4-week average of weekly claims since April, and this was slightly above the consensus forecast. This is still elevated, and still above the post-recession lows of earlier this year.

Wednesday, October 19, 2011

Europe Update: Prepare to be underwhelmed

by Calculated Risk on 10/19/2011 09:35:00 PM

A few articles ahead of the meeting this weekend ...

From the Financial Times: Eurozone leaders meet in Frankfurt

France’s president Nicolas Sarkozy flew to Frankfurt on Wednesday night for an emergency meeting with leading players in the eurozone crisis including German chancellor Angela Merkel, as Franco-German differences bedevilled attempts to agree a comprehensive package of measures.From the NY Times: Leaders in Europe Take Time From a Farewell to Negotiate a Bailout Deal

excerpt with permission

Angela Merkel, the chancellor of Germany, tried to play down expectations, saying that it would not be possible “to erase the mistakes of the past in just one stroke.” A European summit meeting Sunday ... will be just “one point” in “a long journey.”From the WSJ: Doubts Grow on Euro Fund

European officials are discussing a scenario in which governments issuing bonds would borrow from the bailout fund to guarantee a portion of the bond issues—a move that would increase debts for already troubled economies.And from the Financial Times: EU bank recap could be only €80bn. The IMF was calling for a €200bn plan, and some estimates were for €275bn. Maybe they should do another stress test and announce all the banks passed - that has worked well before - Not!

Pressure is rising ahead of a weekend summit of European leaders billed as critical to stemming the region's deepening debt crisis.

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

LA Port Traffic in September: Exports increase year-over-year, Imports Down

by Calculated Risk on 10/19/2011 06:13:00 PM

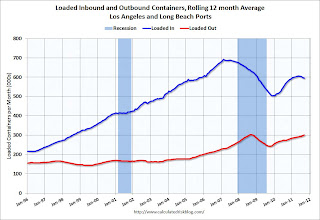

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for August. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is down 0.3% from August, and outbound traffic is up 0.9%.

Inbound traffic is "rolling over" and this might suggest that retailers are cautious about the coming holiday season. However, the National Retail Federation says that imports will be pick up in October:

[T]he [import] statistics were skewed because of high-than-normal numbers in 2010 when fears of shortages in shipping capacity caused many retailers to bring holiday merchandise into the country earlier than usual.The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

...

“After a summer of trying to compare apples to oranges, retail cargo is back to normal [in October],” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “October is the historic peak of the shipping cycle each year, and retailers are bringing merchandise into the country on their usual schedule and at normal levels again instead of being forced to move cargo early."

For the month of September, loaded inbound traffic was down 4% compared to September 2010, and loaded outbound traffic was up 12% compared to September 2010.

For the month of September, loaded inbound traffic was down 4% compared to September 2010, and loaded outbound traffic was up 12% compared to September 2010. Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but are still below the peak in 2008.

Imports have been soft - this is the 4th month in a row with a year-over-year decline in imports. However, if the NRF is correct, imports will pick up in October to the highest level this year.

Merle Hazard: "Diamond Jim"

by Calculated Risk on 10/19/2011 04:03:00 PM

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

A new song from blog favorite Merle Hazard about banking regulation. A creative joint venture of Merle Hazard & Marcy Shaffer (see Marcy's site for lyrics). Song by Merle Hazard, Marcy Shaffer and Curtis Threadneedle.

And from Paul Solman at the PBS NewsHour site, including a link to his 12 1/2 minute interview with former IMF chief economist Simon Johnson, discussing the song.

Fed's Beige Book: Pace of economic growth "modest" or "slight""

by Calculated Risk on 10/19/2011 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicate that overall economic activity continued to expand in September, although many Districts described the pace of growth as "modest" or "slight" and contacts generally noted weaker or less certain outlooks for business conditions. The reports suggest that consumer spending was up slightly in most Districts, with auto sales and tourism leading the way in several of them. Business spending increased somewhat, particularly for construction and mining equipment and auto dealer inventories, but many Districts noted restraint in hiring and capital spending plans.And on real estate:

...

Consumer spending was up slightly in September. The majority of Districts reported increases in auto sales, with the largest improvements in San Francisco and New York.

...

Respondents indicated that labor market conditions were little changed, on balance, in September. ... Most Districts reported that wage pressures remained subdued.

All twelve Districts reported that real estate and construction activity was little changed on balance from the prior report. Residential construction remained at low levels, particularly for single-family homes. That said, Philadelphia, Cleveland, and Minneapolis noted small increases in single-family construction, and construction of multifamily dwellings continued to increase at a moderate pace in Boston, Philadelphia, Cleveland, Kansas City, Dallas, and San Francisco. Home sales remained weak overall, and home prices were reported to be either flat or declining across all of the Districts. In contrast, rental demand continued to rise in a number of Districts.This was based on data gathered on or before October 7th. More sluggish growth ...

Commercial real estate conditions remained weak overall, although commercial construction increased at a slow pace in most Districts.

Earlier:

• Housing Starts increased in September

• Rate of increase slows for Key Measures of Inflation in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

Rate of increase slows for Key Measures of Inflation in September

by Calculated Risk on 10/19/2011 01:06:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in September on a seasonally adjusted basis ... The index for all items less food and energy increased 0.1 percent in September, its smallest increase since March.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in September. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.5% annualized rate) during the month.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for September here.

Over the last 12 months, the median CPI rose 2.1%, the trimmed-mean CPI rose 2.5%, the CPI rose 3.9%, and the CPI less food and energy rose 2.0%

On a year-over-year basis, these measures of inflation are increasing, and are around the Fed's target.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a monthly basis, the median Consumer Price Index increased 2.3% at an annualized rate, the 16% trimmed-mean Consumer Price Index increased 2.5% annualized in July, and core CPI increased 0.7% annualized.

These key price measures increased at a lower rate than in August.

Earlier:

• Housing Starts increased in September

• AIA: Architecture Billings Index declined in September

• 2012 Social Security Cost-Of-Living Adjustment approximately 3.6% increase

AIA: Architecture Billings Index declined in September

by Calculated Risk on 10/19/2011 11:07:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Another Drop for Architecture Billings Index

Following the first positive score in four months, the Architecture Billings Index (ABI) reversed direction again in September. ... The American Institute of Architects (AIA) reported the September ABI score was 46.9, following a score of 51.4 in August. This score reflects a sharp decrease in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 54.3, down from a reading of 56.9 the previous month.

“It appears that the positive conditions seen last month were more of an aberration,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The economy is weak enough at present that design activity is bouncing around more than usual; one strong month can be followed by a weak one. The economy needs to be stronger to generate sustained growth in design activity.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index declined to 46.9 in September from 51.4 in August. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the recent contraction suggests further declines in CRE investment in 2012.