by Calculated Risk on 10/03/2011 10:28:00 PM

Monday, October 03, 2011

Unofficial Problem Bank List Quarterly Transition Matrix

A busy day ... here are the earlier posts:

• ISM Manufacturing index increases in September

• Construction Spending increased in August

• U.S. Light Vehicle Sales at 13.1 million SAAR in September

• LPS: Foreclosure Starts increased in August, Seriously Delinquent Mortgage Loans fall to 2008 levels

CR Note: Surferdude808 started compiling the unofficial problem bank list over two years ago. Thanks!

From surferdude808:

With the third quarter of 2011 coming to an end this past Friday, it is time to update the Unofficial Problem Bank List transition matrix. The list debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table below). Over the past 25 months, about 54 percent or 210 institutions have been removed from the original list with 129 from failure, 62 from action termination, and 19 from unassisted merger. More than 33 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List.

Since the publication of the original list, another 1,052 institutions have been added. However, only 807 of those 1,052 additions remain on the current list as 245 institutions have been removed in the interim. Of the 245 inter-period removals, 155 were from failure, 55 were from an unassisted merger, 33 from action termination, and two from voluntary liquidation.

In total, 1,441 institutions have made an appearance on the Unofficial Problem Bank List and 284 or 19.7 percent have failed. Of the 455 total removals, the primary way of exit from the list is failure at 284 or nearly 63 percent. Only 95 or around 21 percent have been able to rehabilitate themselves to see their respective action terminated. Alternatively, another 74 or 16 percent found merger partners most likely to avoid failure. Total assets that have appeared on the list amount to $777.8 billion and $272.4 billion have been removed due to failure. The average asset size of removals from failure is $959 million.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 62 | (14,365,497) | |

| Unassisted Merger | 19 | (3,290,170) | |

| Voluntary Liquidation | 0 | - | |

| Failures | 129 | (174,696,774) | |

| Asset Change | (19,508,778) | ||

| Still on List at 9/30/2011 | 179 | 64,452,210 | |

| Additions | 986 | 340,680,808 | |

| End (9/30/2011) | 1001 | 405,133,018 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 33 | 23,221,613 | |

| Unassisted Merger | 55 | 39,058,992 | |

| Voluntary Liquidation | 2 | 833,567 | |

| Failures | 155 | 97,669,948 | |

| Total | 245 | 160,784,120 | |

| 1Institutions not on 8/7/2009 or 9/30/2011 list but appeared on a list between these dates. | |||

LPS: Foreclosure Starts increased in August, Seriously Delinquent Mortgage Loans fall to 2008 levels

by Calculated Risk on 10/03/2011 06:56:00 PM

From LPS Applied Analytics: LPS' Mortgage Monitor Report Shows Foreclosure Starts Rose Nearly 20 Percent in August, But Down More Than 12 Percent From Same Time Last Year

The August Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure starts were up in August by nearly 20 percent compared to July 2011 results, with first-time foreclosure starts reaching 2011 highs. Overall, foreclosure starts remained down more than 12 percent from this time last year. At the same time, of the approximately 4 million loans that are either 90 or more days delinquent or in foreclosure, the number in the 90 or more days category has shrunk to levels not seen since 2008.According to LPS, 8.13% of mortgages were delinquent in August, down from 8.34% in July, and down from 9.22% in August 2010.

The August data also showed that, of loans that were current six months prior, 1.4 percent had become seriously delinquent, a rate of less than half of the peak of 2.9 percent in 2009. ...

August results showed an all-time high in the number of loans shifting from foreclosure back into delinquent status, suggesting that process reviews and potential loss mitigation activity are continuing. As a result, foreclosure timelines continue to increase, with the average loan in foreclosure having been delinquent for a record 611 days.

LPS reports that 4.11% of mortgages were in the foreclosure process, unchanged from July, and up from 3.8% in August 2010. This gives a total of 12.24% delinquent or in foreclosure. It breaks down as:

• 2.38 million loans less than 90 days delinquent.

• 1.87 million loans 90+ days delinquent.

• 2.15 million loans in foreclosure process.

For a total of 6.40 million loans delinquent or in foreclosure in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 8.13% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.15 million) - and the average loan in foreclosure has been delinquent for a record 611 days!

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by duration of delinquency.

This graph provided by LPS Applied Analytics shows the number of loans 90 days delinquent by duration of delinquency.The total number of loans 90+ delinquent is back to 2008 levels, but about 42% of these loans have been delinquent for more than 12 months and are still not in foreclosure. That is close to 800,000 loans.

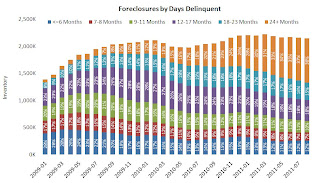

The third graph shows the number of loans in foreclosure by duration of delinquency.

The third graph shows the number of loans in foreclosure by duration of delinquency.There are 2.15 million loans in the foreclosure process and about 38% have been delinquent for more than 2 years, and another 33% have been delinquent for 1 to 2 years. Many of these loans are still in process review.

There was some good news: cure rates are increasing for all categories, “first-time” delinquencies have declined, and the number of seriously delinquent loans is back to 2008 levels. However there are still 2.15 million loans in the foreclosure process and another 1.87 million 90+ days delinquent.

Earlier:

• ISM Manufacturing index increases in September

• Construction Spending increased in August

• U.S. Light Vehicle Sales at 13.1 million SAAR in September

U.S. Light Vehicle Sales at 13.1 million SAAR in September

by Calculated Risk on 10/03/2011 03:59:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.1 million SAAR in September. That is up 11.2% from September 2010, and up 8.3% from the sales rate last month (12.1 million SAAR in Aug 2011).

This was well above the consensus forecast of 12.6 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 13.1 million SAAR from Autodata Corp).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This was close to the sales rate in April and close to the high for the year.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a positive contribution to Q3 GDP as sales bounced back from the May and June lows. Sales in Q3 have averaged 12.5 million SAAR, above the 12.1 million SAAR average in Q2.

Earlier:

• ISM Manufacturing index increases in September

• Construction Spending increased in August

Europe Update

by Calculated Risk on 10/03/2011 02:39:00 PM

The Euro-zone finance ministers are meeting in Luxembourg today. There will be no decision on Greece; they will wait until after the inspectors issue a report next week. There is an emergency finance minister meeting tentatively scheduled on October 13th to vote on the next loan installment for Greece.

Over the weekend, Greek officials announced public sectors cuts - and that they would miss the deficit targets for 2011 and 2012.

On the meeting today from the WSJ: EU to Discuss Leveraging Rescue Fund

Euro-zone finance ministers Monday will discuss leveraging the region's bailout fund, possibly with the help of the European Central Bank, Economics Commissioner Olli Rehn said Monday.The Greek 2 year yield is down to 62.2%. The Greek 1 year yield is at 128%.

...

"We are reviewing options of optimizing the use of the EFSF in order to have more out of it and make it more effective as a financial firewall to contain contagion," said Mr. Rehn, the EU's top official for economic and monetary affairs.

The Portuguese 2 year yield is up to 17.6% and the Irish 2 year yield is down sharply to 6.8%. Clearly Portugal is perceived as next in line - and Ireland appears to be doing better.

The Spanish 10 year yield is at 5.1% and the Italian 10 year yield is at 5.5%.

Construction Spending increased in August

by Calculated Risk on 10/03/2011 11:19:00 AM

Catching up ... this morning from the Census Bureau reported that overall construction spending increased in August:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2011 was estimated at a seasonally adjusted annual rate of $799.1 billion, 1.4 percent (±2.1%)* above the revised July estimate of $788.3 billion. The August figure is 0.9 percent (±1.9%)* above the August 2010 estimate of $791.7 billion.Private construction spending increased in August:

Spending on private construction was at a seasonally adjusted annual rate of $511.0 billion, 0.4 percent (±1.3%)* above the revised July estimate of $508.9 billion. Residential construction was at a seasonally adjusted annual rate of $237.8 billion in August, 0.7 percent (±1.3%)* above the revised July estimate of $236.2 billion.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 64.8% below the peak in early 2006, and non-residential spending is 34% below the peak in January 2008.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling as the stimulus spending ends. The improvements in private non-residential are mostly due to energy spending (power and electric).

Earlier:

• ISM Manufacturing index increases in September

Weekend:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd

• A few preliminary comments on the September Employment Report

ISM Manufacturing index increases in September

by Calculated Risk on 10/03/2011 10:00:00 AM

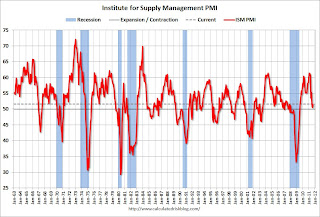

PMI was at 51.6% in September, up from 50.6% in August. The employment index was at 53.8%, up from 51.8%, and new orders index was unchanged at 49.6%.

From the Institute for Supply Management: September 2011 Manufacturing ISM Report On Business®

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 51.6 percent, an increase of 1 percentage point from August, indicating expansion in the manufacturing sector for the 26th consecutive month, at a slightly higher rate. The Production Index registered 51.2 percent, indicating a return to growth after contracting in August for the first time since May of 2009. The New Orders Index remained unchanged from August at 49.6 percent, indicating contraction for the third consecutive month. The Backlog of Orders Index decreased 4.5 percentage points to 41.5 percent, contracting for the fourth consecutive month and reaching its lowest level since April 2009, when it registered 40.5 percent. Comments from respondents generally reflect concern over the sluggish economy, political and policy uncertainty in Washington, and forecasts of ongoing high unemployment that will continue to put pressure on demand for manufactured products."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 50.5% and suggests manufacturing expanded at a slightly higher rate in September than in August. It appears manufacturing employment expanded in September with the employment index increasing to 53.8%, up from 51.8% in August.

Chrysler: U.S. September sales increase 27% year-over-year

by Calculated Risk on 10/03/2011 08:48:00 AM

From MarketWatch: Chrysler's U.S. Sept. sales rise 27%

Chrysler Group LLC's U.S. auto sales climbed 27% as the manufacturer posted its strongest September since 2007 and saw double-digit sales increases among its biggest brands.The key number for the economy is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers. Once all the reports are released, I'll post a graph of the estimated total September light vehicle sales (SAAR) - usually around 4 PM ET.

...

Chrysler ... also estimated the industry's U.S. sales in September at a seasonally adjusted annualized rate of 13.2 million.

The consensus is for an increase to 12.6 million SAAR, from 12.1 million in August, however I think we will see a stronger increase based on recent manufacturer and dealer reports. This will probably be the strongest month for auto sales since April (13.13 million SAAR) - before the tsunami in Japan.

I'll add the reports from the other major auto companies as updates to this post.

Update: From MarketWatch: GM U.S. vehicle sales total 207,145 in Sept., up 20%

From MarketWatch: Ford Sept. U.S. sales rise 9%

Weekend:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd

• A few preliminary comments on the September Employment Report

Sunday Night: Europe and Futures

by Calculated Risk on 10/03/2011 12:50:00 AM

• An overview on Europe from the NY Times: Toil and Trouble Over the Caldron That Is Greece

In the short term, Greece remains the central problem. ... Europe’s strategy, to the extent it can be discerned, is to put off restructuring Greece’s debt as long as possible and build up enough backing for a bailout fund so that banks with large exposure to the sovereign debt of Greece and other troubled euro-zone countries, like Portugal, Ireland, Italy and Spain, can survive an all-but-inevitable Greek default.What a mess.

...

When speaking privately, officials concede that Greece’s debt ... is unsustainable and that lenders will probably have to write some of it off. A “haircut” of 50 percent, followed by a recapitalization of banks if necessary, is the outcome most commonly mentioned.

Germany and France are not prepared to consider doing that yet, though, in part because relieving the pressure on Greece would remove its incentive to overhaul its finances and make its economy more competitive. ... Equally important, Germany and France want to delay any Greek default, orderly or not, until they have bolstered the rescue fund and taken other steps to protect Italy, the biggest economy in southern Europe.

The Asian markets are red tonight with the Nikkei down 2.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 8 points, and Dow futures are down about 65 points.

Oil: WTI futures are down to $78 and Brent is down under $102 per barrel.

Yesterday:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd

Sunday, October 02, 2011

Greece to cut 30,000 public sector jobs, miss deficit targets

by Calculated Risk on 10/02/2011 04:46:00 PM

From the Financial Times: Greek cabinet approves budget cuts

[Finance Minister] Venizelos has agreed to eliminate 30,000 public sector jobs by December ... About 23,000 workers nearing retirement will lose their positions. Another 7,000 will be made redundant after mergers and restructurings ... “Given that we’re taking such tough measures ... the sixth tranche is assured.” [said Venizelos]Cutting jobs means putting workers into "reserve" and they are still paid 60% of their salary.

excerpt with permission

And from Deutche Welle: Greece misses EU and IMF deficit targets

Greece announced late Sunday that its budget deficit will reach 8.5 percent of gross domestic product (GDP) this year, below the initial target of 7.6 percent.The troika is still working on pay cuts for higher-paid officials.

According to a statement issued by the Finance Ministry, Greece will manage to bring the budget deficit down to 6.8 per cent of GDP next year, but it will still miss the bailout target of 6.5 per cent of GDP.

"Because three critical months remain for the completion of the financial year 2011, and the final estimate of 8.5 per cent of GDP deficit can be achieved if the state mechanism and citizens respond accordingly," the finance ministry statement said.

Yesterday:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd

A few preliminary comments on the September Employment Report

by Calculated Risk on 10/02/2011 12:32:00 PM

Yesterday:

• Summary for Week Ending Sept 30th

• Schedule for Week of Oct 2nd

The September employment report will be released on Friday and the consensus is for an increase of 65,000 non-farm payroll jobs in September, up from the zero jobs added in August. Goldman Sachs is forecasting an increase of 50,000 jobs in September.

A key point to remember is that the Verizon labor dispute subtracted 45,000 jobs from the August report and those jobs will be added back in the September report. So even if September was the same as August, we would see 45,000 more jobs added.

Note: The Verizon labor dispute didn't show up in the ADP employment report because the ADP counts employees on the payroll even if they aren't working.

Another key point is that the manufacturing surveys (a small percentage of overall employment) mostly suggested employment expansion in September - and an improvement from August (See table below). Also the Chicago PMI indicated stronger employment expansion in September than in August.

However weekly initial unemployment claims for the BLS reference week were higher in September than in August - suggesting more layoffs. Still - overall - it appears September was somewhat better than August.

Here is a table for the various employment components from several surveys in September starting in August 2007 (before the recession). Here is the spreadsheet in excel. Most of these surveys are just for manufacturing (Fed surveys), however the Chicago PMI includes both manufacturing and services.

Note: Above 50 is expansion for the Chicago PMI, above 0 is expansion for the Fed manufacturing surveys.

| Employment Surveys through Sept 2011Above 50 is expansion for Chicago PMI, All others above zero | |||||||

|---|---|---|---|---|---|---|---|

| Chicago PMI | NY Fed (Empire State) | Philly Fed | Richmond Fed | Kansas City Fed | Dallas Fed | Avg Fed Mfg Surveys | |

| Aug-07 | 53.2 | 11.8 | 14.7 | -1 | 0 | 1.6 | 5.4 |

| Sep-07 | 51.8 | 19.2 | 4.3 | 0 | -1 | 7.2 | 5.9 |

| Oct-07 | 50.2 | 17.4 | 7.3 | -3 | -2 | 5.8 | 5.1 |

| Nov-07 | 52.6 | 7.1 | 4.0 | -2 | -5 | 2.0 | 1.2 |

| Dec-07 | 49.3 | 5.0 | 1.3 | 4 | 4 | -3.3 | 2.2 |

| Jan-08 | 47.0 | 2.4 | 1.5 | -2 | 12 | 9.0 | 4.6 |

| Feb-08 | 33.5 | -2.1 | 6.2 | -2 | 1 | 5.5 | 1.7 |

| Mar-08 | 44.6 | 4.5 | 0.6 | -7 | -3 | 4.6 | -0.1 |

| Apr-08 | 35.3 | 0.0 | -4.2 | -14 | 0 | 2.0 | -3.2 |

| May-08 | 41.2 | 1.1 | -1.9 | -10 | -2 | -5.9 | -3.7 |

| Jun-08 | 46.7 | 1.2 | -8.7 | -14 | -13 | -4.4 | -7.8 |

| Jul-08 | 45.9 | -6.3 | -6.2 | -4 | 1 | 7.1 | -1.7 |

| Aug-08 | 39.2 | -4.5 | -8.4 | -19 | -3 | -5.3 | -8.0 |

| Sep-08 | 49.1 | -4.6 | -4.5 | -21 | -11 | -5.1 | -9.2 |

| Oct-08 | 41.5 | -3.7 | -22.3 | -22 | -14 | -11.5 | -14.7 |

| Nov-08 | 33.4 | -28.9 | -26.5 | -25 | -22 | -20.1 | -24.5 |

| Dec-08 | 39.6 | -23.4 | -31.3 | -34 | -32 | -21.0 | -28.3 |

| Jan-09 | 34.8 | -26.1 | -37.1 | -29 | -34 | -28.2 | -30.9 |

| Feb-09 | 25.2 | -39.1 | -41.0 | -33 | -33 | -40.1 | -37.2 |

| Mar-09 | 28.1 | -38.2 | -49.6 | -29 | -35 | -50.3 | -40.4 |

| Apr-09 | 31.8 | -28.1 | -38.8 | -28 | -23 | -39.7 | -31.5 |

| May-09 | 25.0 | -23.9 | -29.8 | -17 | -16 | -34.1 | -24.2 |

| Jun-09 | 28.9 | -21.8 | -23.2 | -13 | -13 | -27.8 | -19.8 |

| Jul-09 | 35.3 | -20.8 | -23.7 | -14 | -16 | -23.4 | -19.6 |

| Aug-09 | 38.7 | -7.5 | -18.1 | -12 | -10 | -15.4 | -12.6 |

| Sep-09 | 38.8 | -8.3 | -16.1 | -4 | -2 | -8.9 | -7.9 |

| Oct-09 | 38.3 | 10.4 | -10.4 | -4 | -4 | -12.2 | -4.0 |

| Nov-09 | 41.9 | 1.3 | -3.5 | -10 | -2 | -15.8 | -6.0 |

| Dec-09 | 51.2 | -5.3 | 3.7 | 2 | -4 | -3.8 | -1.5 |

| Jan-10 | 59.8 | 4.0 | 6.2 | 2 | 2 | -3.7 | 2.1 |

| Feb-10 | 53.0 | 5.6 | 8.0 | 7 | -2 | -4.2 | 2.9 |

| Mar-10 | 53.1 | 12.4 | 9.3 | 8 | 2 | 4.5 | 7.2 |

| Apr-10 | 57.2 | 20.3 | 7.4 | 19 | 5 | 11.6 | 12.7 |

| May-10 | 49.2 | 22.4 | 3.4 | 7 | 2 | 13.8 | 9.7 |

| Jun-10 | 54.2 | 12.4 | -1.0 | 2 | 0 | 7.1 | 4.1 |

| Jul-10 | 56.6 | 7.9 | 6.6 | 8 | 5 | 7.2 | 6.9 |

| Aug-10 | 55.5 | 14.3 | -3.9 | 3 | -1 | -3.3 | 1.8 |

| Sep-10 | 53.4 | 14.9 | 1.4 | -1 | -2 | 3.7 | 3.4 |

| Oct-10 | 54.6 | 21.7 | 1.4 | 5 | 0 | -2.5 | 5.1 |

| Nov-10 | 56.3 | 9.1 | 11.7 | 10 | 8 | 7.1 | 9.2 |

| Dec-10 | 60.2 | -3.4 | 4.3 | 15 | 11 | 16.1 | 8.6 |

| Jan-11 | 64.1 | 8.4 | 17.6 | 14 | 8 | 9.3 | 11.5 |

| Feb-11 | 59.8 | 3.6 | 23.6 | 15 | 23 | 10.5 | 15.1 |

| Mar-11 | 65.6 | 9.1 | 18.2 | 16 | 25 | 11.6 | 16.0 |

| Apr-11 | 63.7 | 23.1 | 12.3 | 12 | 17 | 13.4 | 15.6 |

| May-11 | 60.8 | 24.7 | 22.1 | 16 | 9 | 11.6 | 16.7 |

| Jun-11 | 58.7 | 10.2 | 4.1 | 14 | 17 | 5.3 | 10.1 |

| Jul-11 | 51.5 | 1.1 | 8.9 | 4 | 4 | 12.1 | 6.0 |

| Aug-11 | 52.1 | 3.3 | -5.2 | 1 | 8 | 5.4 | 2.5 |

| Sep-11 | 60.6 | -5.4 | 5.8 | 7 | 12 | 13.4 | 6.6 |