by Calculated Risk on 10/01/2011 02:11:00 PM

Saturday, October 01, 2011

Schedule for Week of Oct 2nd

Earlier:

• Summary for Week Ending Sept 30th

The key report this week will be the employment situation report for September on Friday. Also Fed Chairman Ben Bernanke's Congressional testimony on Tuesday will be closely watched.

Other key reports includes the September ISM manufacturing index on Monday, auto sales also on Monday - and for housing analysts - the release of the Census 2010 housing statistics on Thursday.

Note: Reis is expected to release their Q3 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, rising vacancy rates for regional malls, and no change in the office vacancy rate.

10:00 AM ET: ISM Manufacturing Index for September.

10:00 AM ET: ISM Manufacturing Index for September. The consensus is for a decrease to 50.5 from 50.6 in August.

10:00 AM: Construction Spending for August. The consensus is for a 0.2% decline in construction spending.

All day: Light vehicle sales for September. Light vehicle sales are expected to increase to 12.6 million (Seasonally Adjusted Annual Rate), from 12.1 million in August.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate. Edmunds is forecasting 12.9 million:

An estimated 1,038,052 new cars will be sold in September for a projected Seasonally Adjusted Annual Rate (SAAR) of 12.9 million light vehicles, forecasts Edmunds.com ... The sales pace marks the highest monthly SAAR since the 13.2 million light vehicles reported in April. That was the last full month before supply disruptions stemming from the Japanese earthquake had a true impact on sales.

9 AM ET: Speech by Fed Governor Sarah Bloom Raskin, "Policy Opportunities and Challenges in Crafting a Foreclosure Response", At the Maryland State Bar Association Advanced Real Property Institute, Columbia, Maryland

10 AM: Testimony by Fed Chairman Ben Bernanke, "Economic Outlook and Recent Monetary Policy Actions", Before the Joint Economic Committee, United States Congress, Washington, D.C.

10:00 AM ET: Manufacturers' Shipments, Inventories and Orders for August. The consensus is for a 0.3% decrease in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak over the last month.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 90,000 payroll jobs added in September, down slightly from the 91,000 reported in August.

10:00 AM: ISM non-Manufacturing Index for September. The consensus is for a decrease to 52.9 in September.

10:00 AM: ISM non-Manufacturing Index for September. The consensus is for a decrease to 52.9 in September.The August ISM Non-manufacturing index was at 53.5%, up from 52.7% in July.

The employment index decreased in August to 51.6%, down from 52.5% in July.

Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 410,000 from 391,000 last week.

1:00 PM: Census 2010: Statistics on Nation’s Housing Characteristics. This includes details on the nation’s housing characteristics, including housing inventory, where homeowners and renters are located, and distribution and types of vacant units.

8:30 AM: Employment Report for September.

The consensus is for an increase of 65,000 non-farm payroll jobs in September, up from the 0 jobs added in August.

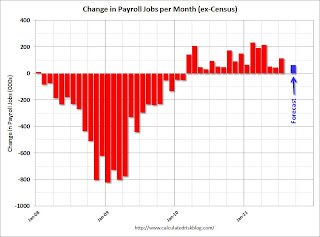

The consensus is for an increase of 65,000 non-farm payroll jobs in September, up from the 0 jobs added in August. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The consensus forecast for September is in blue.

The consensus is for the unemployment rate to increase to 9.2% in September.

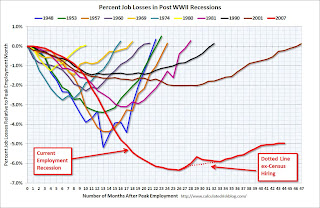

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through August.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through August. Through the first eight months of 2011, the economy added 872,000 total non-farm jobs or just 109 thousand per month. The economy has added 1,162,000 private sector jobs this year, or about 145 thousand per month.

Note: The Verizon labor dispute subtracted 45,000 payroll jobs in August. This dispute is over and these jobs will be added back in the September report.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for August.

3:00 PM: Consumer Credit for August. The consensus is for a $8 billion increase in consumer credit.