by Calculated Risk on 9/28/2011 07:22:00 AM

Wednesday, September 28, 2011

MBA: Mortgage Purchase Application Index increases

Note: The graph below includes the enhanced sample discussed last week. "The survey captures more than 75% of all U.S. retail and consumer direct mortgage applications, compared to 50% previously." For a discussion of the changes, see: Presentation to Discuss Enhancements to MBA’s Weekly Applications Survey.

There is also additional data. The weekly survey now includes mortgage rates for both conforming and jumbo loans. There is also a new Monthly Profile report (see sample here: Monthly Profile of State and National Mortgage Activity). This report breaks down the monthly application data by product type, size of loans, and state data. This appears very useful for short-term prepay modeling given the differences across states. This report is only available to subscribers.

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 11.2 percent from the previous week. The seasonally adjusted Purchase Index increased 2.6 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Mortgage rates declined last week, at least partially in response to the Fed's announcement that they would shift their portfolio towards longer-term Treasury securities, and that they would resume buying mortgage-backed securities," said Mike Fratantoni, MBA's Vice President of Research and Economics. "With lower rates, refinance application volume increased to its highest level since August 19, 2011. Purchase application volume also increased. However, the increase was in conventional purchase applications, which were up by 4.9 percent. Purchase applications for government loans fell by 0.6 percent over the week, likely influenced by the pending decline in FHA loan limits."

...

The average loan size of all loans for home purchase in the US was $212,700 in August 2011, up from $211,200 in July 2011. The average loan size for a refinance was $241,300, up from $209,200 in July.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.25 percent from 4.29 percent, with points decreasing to 0.35 from 0.41 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 4.51 percent from 4.55 percent, with points decreasing to 0.38 from 0.46 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.August was an especially weak month for this index. This increase was pretty small, and although this doesn't include the large number of cash buyers, this suggests fairly weak home sales in September and October.

Tuesday, September 27, 2011

Europe Update: Nothing Settled Yet

by Calculated Risk on 9/27/2011 08:34:00 PM

A few articles ...

From the WSJ: Greece Passes Property-Tax Law, Clearing a Path for Additional Aid

Greece's parliament approved a new property-tax law in a closely watched vote Tuesday ... The approval of the property tax is expected to open the way for the return to Athens this week of a troika of inspectors from the International Monetary Fund, the European Union and the European Central Bank.The next step will be the return of the inspectors ... and the vote on the EFSF in Germany.

From the NY Times: Merkel Rallies Wary Coalition Ahead of Vote on Greek Aid

[L]awmakers in Slovenia voted Tuesday to approve their share of the rescue fund’s guarantees. Finland’s Parliament is expected to reluctantly approve the fund measure in a vote on WednesdayThe German parliament will vote on Thursday and Friday.

[T]he German finance minister, Wolfgang Schäuble, ruled out an increase in the size of the euro zone bailout fund, though not necessarily an increase in its ability to borrow. ... Mr. Schäuble also said Tuesday that it was likely that the rescue mechanism would be further “enhanced,” though he would not give details.And the Financial Times is reporting: Split opens over Greek bail-out terms. Apparently some officials (Germany and a few others) are arguing that the private sector should take a larger haircut. So this isn't settled yet.

Eurozone finance ministers had originally hoped to sign off on the next aid tranche to Greece on Monday, but a decision is now expected to delay the next €8bn payment until an emergency meeting in two weeks.Greece apparently has enough cash until mid-October ...

excerpt with permission

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

• Real House Prices and House Price-to-Rent

ATA Trucking Index decreased slightly in August

by Calculated Risk on 9/27/2011 04:53:00 PM

From ATA: ATA Truck Tonnage Index Edged 0.2% Lower in August

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index declined 0.2% in August after falling a revised 0.8% in July 2011. July’s decrease was less than the 1.3% ATA reported on August 23, 2011. The latest drop put the SA index at 114.4 (2000=100) in August, down from the July level of 114.6.

...

Compared with August 2010, SA tonnage was up a solid 5.2%. In July, the tonnage index was 4.5% above a year earlier.

“Freight has been going sideways for much of this year, but it isn’t falling significantly either, which suggests the U.S. economy just might skirt another recession,” ATA Chief Economist Bob Costello said.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.Moving sideways all year ...

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

• Real House Prices and House Price-to-Rent

Real House Prices and House Price-to-Rent

by Calculated Risk on 9/27/2011 01:42:00 PM

An update: Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through July) and CoreLogic House Price Indexes (through July) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to July 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to August 2000, and the CoreLogic index back to July 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to July 2000.

Earlier:

• CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

• Case Shiller: Home Prices increased Seasonally in July

CoreLogic: Existing Home Shadow Inventory Declines to 1.6 million units

by Calculated Risk on 9/27/2011 11:15:00 AM

From CoreLogic: CoreLogic® Reports Shadow Inventory Continues to Decline

CoreLogic ... reported today that the current residential shadow inventory as of July 2011 declined slightly to 1.6 million units, representing a supply of 5 months. This is down from 1.9 million units, a supply of 6 months, from a year ago, and follows a decline from April 2011 when shadow inventory stood at 1.7 million units. The moderate decline in shadow inventory is being driven by a pace of new delinquencies that is slower than the disposition pace of distressed assets.

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLSs) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders.

...

Of the 1.6 million properties currently in the shadow inventory, 770,000 units are seriously delinquent (2.2-months’ supply) [down from 790,000 units in April], 430,000 are in some stage of foreclosure (1.2-months’ supply) [down from 440,000] and 390,000 are already in REO (1.1-months’ supply) [down from 440,000].

...

Mark Fleming, chief economist for CoreLogic, commented, “The steady improvement in the shadow inventory is a positive development for the housing market. However, continued price declines, high levels of negative equity and a sluggish labor market will keep the shadow supply elevated for an extended period of time.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

So the key number in this report is that as of July, there were 1.6 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

Note: The unlisted REO seems a little high since total REO has dropped sharply over the last couple of quarters.

Earlier:

• Case Shiller: Home Prices increased Seasonally in July

Case Shiller: Home Prices increased Seasonally in July

by Calculated Risk on 9/27/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July (actually a 3 month average of May, June and July).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data. The composite indexes were up about 0.9% in July (from June) Not Seasonally Adjusted (NSA), but flat Seasonally Adjusted (SA).

From S&P: Home Prices Continue to Show Seasonal Strength According to the S&P/Case-Shiller Home Price Indices

Data through June 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed a fourth consecutive month of increases for the 10- and 20-City Composites, with both up 0.9% in July over June. Seventeen of the 20 MSAs and both Composites posted positive monthly increases; Las Vegas and Phoenix were down over the month and Denver was unchanged.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32% from the peak, and down slightly in July (SA). The Composite 10 is 1.4% above the June 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and up slightly in July (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

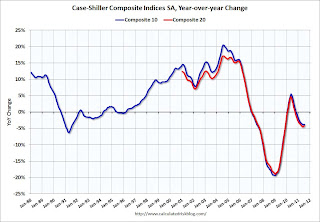

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.8% compared to July 2010.

The Composite 20 SA is down 4.2% compared to July 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in July seasonally adjusted. Prices in Las Vegas are off 59.2% from the peak, and prices in Dallas only off 9.5% from the peak.As S&P noted, prices increased in 17 of 20 cities not seasonally adjusted (NSA). However seasonally adjusted, prices only increased in 9 cities.

Most of this prices increase was mostly seasonal. As S&P's David Blitzer said: "This is still a seasonal period of stronger demand for houses, so monthly price increases are expected ... ". The question is what happens later this year. I'll have more later ...

Merkel: Germany will help stabilize Greece

by Calculated Risk on 9/27/2011 08:41:00 AM

From the NY Times: German Leader Reaffirms Backing for Greece

Promising that Athens would live up to its commitments, the Greek prime minister urged Europe to pull together to take the steps needed to head off a potentially disastrous escalation in the sovereign debt crisis.And from the Financial Times: Rolling blog: the eurozone crisis

In a speech to the same group of German business leaders, Chancellor Angela Merkel said Germany would provide all the help it could to stabilize Greece.

...

Mrs. Merkel urged lawmakers to back the bill “in a spirit of friendship, a spirit of partnership, not in a spirit of imposing something.”

“If Europe isn’t doing well, then over the medium term Germany won’t do well,” she said.

Our Athens reporter, Dimitris Kontogiannis, has set out the main details of the property tax ...It sounds like the property tax will pass - and that the German parliament will approve the changes to the EFSF on Thursday.

• The new tax will apply, with a few exceptions, to all electricity-powered buildings

• Those who refuse to pay will have their electricity cut off...

• The government estimates the new tax could raise €2bn-€2.5bn a year...

Monday, September 26, 2011

Europe: A few key dates

by Calculated Risk on 9/26/2011 10:21:00 PM

To help keep track ...

• There is a vote on Tuesday in Greece concerning the new property tax around 12 PM ET (there will be protests too). I think this also includes some cuts in public sector too.

• Prime Minister George Papandreou will be in Germany on Tuesday for a meeting with Chancellor Angela Merkel.

• The "troika" inspectors (EU-IMF-ECB) will not return until the new legislation is passed.

• The EU Finance Ministers meet on Monday, October 3rd, and there is very little time for the inspectors to complete their work and still allow the Finance Ministers to vote on the release of the next loan installment. Greece needs the disbursement by mid-October to meet their obligations through the end of the year.

• On Thursday, the German Parliament will vote on increasing the European Financial Stability Facility (EFSF) according to the agreement reached on July 21st.

On August Home Sales:

• New Home Sales decline slightly in August

• Last week: Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

On Pace for Record Low New Home Sales in 2011

by Calculated Risk on 9/26/2011 07:35:00 PM

Alejandro Lazo at the LA Times wrote today: New home sales stuck at the bottom in August

"This year is shaping up to be the worst year on record for new home sales," [Patrick Newport, U.S. economist with IHS Global Insight] wrote in a note.The Census Bureau started tracking New Home sales in 1963, and the record low was 412,000 in 1982 - until that record was broken in 2009 - and then again in 2010 - and it looks another new record in 2011.

Here is a table of the last ten years - remember that sales in 2009 and 2010 were boosted by the tax credit.

| New Home Sales | ||

|---|---|---|

| Year | Total | Total through August |

| 2000 | 877 | 608 |

| 2001 | 908 | 644 |

| 2002 | 973 | 670 |

| 2003 | 1,086 | 759 |

| 2004 | 1,203 | 841 |

| 2005 | 1,283 | 906 |

| 2006 | 1,051 | 756 |

| 2007 | 776 | 577 |

| 2008 | 485 | 365 |

| 2009 | 375 | 261 |

| 2010 | 323 | 231 |

| 2011 | 3031 | 211 |

| 1Current 2011 Pace | ||

On August Home Sales:

• New Home Sales decline slightly in August

• Last week: Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales

Report: Plan to increase European Bank Capital

by Calculated Risk on 9/26/2011 03:55:00 PM

From CNBC: Officials Working on a Sovereign Debt TARP for Europe?

European officials are working on a detailed plan aimed at shoring up European bank stability, according to an official who spoke with CNBC’s Steve Liesman.More details at the article.

The plan appears to have a lot of moving parts. It would involve money from the European Financial Stability Facility (EFSF), a bailout vehicle created in 2010 to alleviate the sovereign debt crisis in Europe, to capitalize a special purpose vehicle that would be created by the European Investment Bank, a bank owned by the member states of the European Union.

The Greek 2 year yield was up to 71%. The Greek 1 year yield is at 138%.

The Portuguese 2 year yield is up to 18.2% and the Irish 2 year yield was down to 8.8%.

The Italian 10 year yield was up slightly to 5.6%.

On August Home Sales:

• New Home Sales decline slightly in August

• Last week: Existing Home Sales in August: 5.0 million SAAR, 8.5 months of supply

• Graph Galleries: New Home Sales and Existing Home Sales