by Calculated Risk on 8/22/2011 06:25:00 PM

Monday, August 22, 2011

Mortgage Delinquencies by State: Range and Current

Earlier I posted a graph on mortgage delinquencies by state. This raised a question of how the current delinquency rate compares to before the crisis - and also a comparison to the peak of the delinquency crisis in each state.

The following graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line). The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some states have made progress: Arizona, Michigan, Nevada and California. Other states, like New Jersey and New York, have made little or no progress in reducing serious delinquencies.

Arizona, Michigan, Nevada and California are all non-judicial foreclosure states. States with little progress like New Jersey, New York, Illinois and Florida are all judicial states.

Note: This data is for 42 states only and D.C.

The second graph shows total delinquencies (including less than 90 days) and in-foreclosure.

The second graph shows total delinquencies (including less than 90 days) and in-foreclosure.

Even though there has been some progress in a few states, there is a long way to go to get back to the Q1 2007 rates.

Earlier:

• MBA: Mortgage Delinquencies increased slightly in Q2

• MBA Delinquency Survey: Comments and State Data

Research: Aging Population will probably lower Stock Market P/E Ratio

by Calculated Risk on 8/22/2011 03:37:00 PM

From the San Francisco Fed: Boomer Retirement: Headwinds for U.S. Equity Markets?

This Economic Letter examines the extent to which the aging of the U.S. population creates headwinds for the stock market. We review statistical evidence concerning the historical relationship between U.S. demographics and equity values, and examine the implications of these demographic trends for the future path of equity values.There are two diagrams in the economic letter. This is probably another reason many boomers will never retire ...

...

[E]vidence suggests that U.S. equity values are closely related to the age distribution of the population. Since demographic trends are largely predictable, we can forecast the path that the P/E ratio is likely to follow in the next few decades based on the predicted M/O ratio.

...

What does the model say about the future trajectory of the P/E ratio? ... To obtain this future P/E* path, we calculate the projected M/O ratio from 2011 to 2030 by feeding Census Bureau projected population data into the estimated model. Figure 2 shows that P/E* should decline persistently from about 15 in 2010 to about 8.4 in 2025, before recovering to 9.14 in 2030.

Earlier:

• MBA: Mortgage Delinquencies increased slightly in Q2

• MBA Delinquency Survey: Comments and State Data

MBA Delinquency Survey: Comments and State Data

by Calculated Risk on 8/22/2011 12:25:00 PM

A couple of comments from MBA chief economist Jay Brinkmann on the conference call:

• The bad news is short term delinquencies increased in Q2. The not-so-bad news is long serious delinquencies declined slightly.

• Because of the high level of delinquencies, there are some questions about the accuracy of the seasonal adjustment.

• Florida has almost 25% of all loans in the U.S. in the foreclosure process. California is 2nd with 10.6%, but the percent of loans in-foreclosure in California (3.62%) is actually below the national average (4.43%).

• Judicial foreclosure states usually have the highest percentage of loans in the foreclosure process.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.

Florida, Nevada, New Jersey and Illinois are the top four states with percent of loans in the foreclosure process.

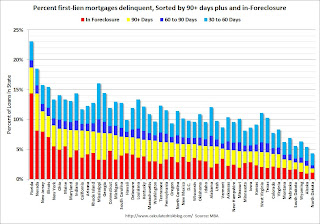

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Ohio and Maine.

I'll post some more graphs later to show which states are seeing improvement.

Note: the MBA's National Delinquency Survey (NDS) covered "MBA’s National Delinquency Survey covers about 43.9 million first-lien mortgages on one- to four-unit residential properties" and the "The NDS is estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives almost 50 million total first lien mortgages or about 6.4 million delinquent or in foreclosure.

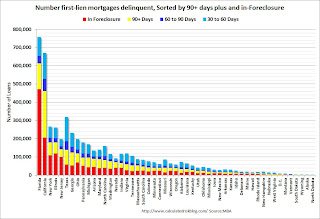

The third graph shows the number of loans delinquent in each state (as opposed to the percent). California is the largest state, so it is no surprise that the number of delinquent loans is very high (I'd expect California to always be #1). In that sense this graph is misleading - in reality California is in about the same shape as Indiana and Rhode Island (previous graph).

The third graph shows the number of loans delinquent in each state (as opposed to the percent). California is the largest state, so it is no surprise that the number of delinquent loans is very high (I'd expect California to always be #1). In that sense this graph is misleading - in reality California is in about the same shape as Indiana and Rhode Island (previous graph).

Florida has 7.6% of all loans, but almost 25% of all loans in-foreclosure and 18% of all seriously delinquent loans. In most ways, dividing this by states is arbitrary - except the foreclosure process matters.

Earlier:

• MBA: Mortgage Delinquencies increased slightly in Q2

MBA: Mortgage Delinquencies increased slightly in Q2

by Calculated Risk on 8/22/2011 10:30:00 AM

The MBA reported that 12.87 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2011 (seasonally adjusted). This is up slightly from 12.84 percent in Q1 2011.

From the MBA: Delinquencies Rise, Foreclosures Fall in Latest MBA Mortgage Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.44 percent of all loans outstanding as of the end of the second quarter of 2011, an increase of 12 basis points from the first quarter of 2011, and a decrease of 141 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey. ...Note: 8.44% (SA) and 4.43% equals 12.87%.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 4.43 percent, down 9 basis points from the first quarter and 14 basis points lower than one year ago. The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 7.85 percent, a decrease of 25 basis points from last quarter, and a decrease of 126 basis points from the second quarter of last year.

"While overall mortgage delinquencies increased only slightly between the first and second quarters of this year, it is clear that the downward trend we saw through most of 2010 has stopped. Mortgage delinquencies are no longer improving and are now showing some signs of worsening," said Jay Brinkmann, MBA's Chief Economist. "The good news is the continued decline in long-term delinquencies, those mortgages that are three payments or more past due. The bad news is that drop is offset by an increase in newly delinquent loans one payment past due."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.46% from 3.35% in Q1. This is probably related to the increase in the unemployment rate.

Delinquent loans in the 60 day bucket increased slightly to 1.37% from 1.35%.

There was a slight decrease in the 90+ day delinquent bucket. This decreased to 3.61% from 3.65% in Q1 2011.

The percent of loans in the foreclosure process decreased to 4.43%.

So short term delinquencies ticked up, and the 90+ day and in-foreclosure rates declined. I'll have more later after the conference call this morning.

Chicago Fed: Economic growth below trend in July

by Calculated Risk on 8/22/2011 08:30:00 AM

This is a composite index from the Chicago Fed: Index shows economic activity improved in July

Led by improvements in production-related indicators, the Chicago Fed National Activity Index increased to –0.06 in July from –0.38 in June. Three of the four broad categories of indicators that make up the index improved in July; only the sales, orders, and inventories category deteriorated from June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

...

The index’s three-month moving average, CFNAI-MA3, increased to –0.29 in July from –0.54 in June. July’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was still growing in July, but below trend.

Weekend:

• Summary for Week ending August 19th (with plenty of graphs)

• Schedule for Week of Aug 21st

• Some preliminary thoughts on Bernanke's 2011 Jackson Hole Speech

Sunday, August 21, 2011

Libya Updates

by Calculated Risk on 8/21/2011 08:08:00 PM

For discussion:

• From al Jazeera: Libya Live Blog. At 8 PM ET:

Al Jazeera's Zeina Khodr is in Green Square:• From Reuters Top News

"There's a party in the Libyan capital tonight. The people are in charge of the city. They've decided the square is now called Martyr's Square, the original name/.

"They're shouting "we're free" and shooting at a poster of Gaddafi."

• From the NY Times: Latest Updates on the Battle for Tripoli

• From the Telegraph: Libya live

• From the WSJ: Live Blog: Libyan Rebels Pour Into Tripoli

Earlier:

• Summary for Week ending August 19th (with plenty of graphs)

• Schedule for Week of Aug 21st

• Some preliminary thoughts on Bernanke's 2011 Jackson Hole Speech

New Song: Split-Rated

by Calculated Risk on 8/21/2011 05:00:00 PM

"Split-Rated" is a new song from Curtis Threadneedle, Merle Hazard and Marcy Shaffer. (Merle says they have another song in the works).

Lyrics by Curtis and Marcy. Merle wrote and arranged the music, performed by Curtis Threadneedle with Merle's band including Wolf Jackson (guitar) and Frances Cunningham (mandolin).

Websites: Curtis Threadneedle, Marcy Shaffer, and Merle Hazard. Some other songs include Merle's "Double Dippin" and Marcy's "Bearish"

Earlier:

• Summary for Week ending August 19th (with plenty of graphs)

• Schedule for Week of Aug 21st

• Some preliminary thoughts on Bernanke's 2011 Jackson Hole Speech

Some preliminary thoughts on Bernanke's 2011 Jackson Hole Speech

by Calculated Risk on 8/21/2011 01:07:00 PM

As I mentioned in the weekly schedule, the most anticipated event this coming week is Fed Chairman Bernanke's speech at Jackson Hole on Friday.

Here are some preliminary thoughts about the speech ...

• Last year Bernanke paved the way for QE2 with his Jackson Hole speech on August 27, 2010. Bernanke outlined three possible policy options for additional monetary accommodation: 1) additional purchases of longer-term securities (QE2), 2) change extended period language (the FOMC just did this), and 3) lower the rate of interest that the Fed pays banks on the reserves.

• It is likely that Bernanke will again outline policy options for further easing. It appears that Bernanke will once again discuss the possibility of additional purchases of longer-term securities (QE3), and some analysts have suggested that Bernanke will also discuss changing the composition of the balance sheet (keeping the size of the balance sheet stable, but changing the mix toward longer term securities). There will probably be some discussion of other options - like a higher inflation target - but just like last year, Bernanke will probably argue against these options.

• Bernanke will NOT commit to any option. Any further easing will be announced by the FOMC. However Bernanke might provide clues as he did last year. Here is what he said:

Under what conditions would the FOMC make further use of these or related policy tools? At this juncture, the Committee has not agreed on specific criteria or triggers for further action, but I can make two general observations.He might change these comments a little this year.

First, the FOMC will strongly resist deviations from price stability in the downward direction. ...

Second, regardless of the risks of deflation, the FOMC will do all that it can to ensure continuation of the economic recovery. ...

• Economic outlook: Bernanke will probably make statements consistent with the recent FOMC statement:

"The Committee now expects a somewhat slower pace of recovery over coming quarters than it did at the time of the previous meeting and anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, downside risks to the economic outlook have increased."Since the FOMC expects the unemployment rate to decline gradually, they probably expect trend growth (as opposed to the very slow growth that many analysts expect). That is consistent with comments from NY Fed President William Dudley this week:

Some of the weakness in economic activity in the first half of the year was due to temporary factors such as the hit to household income from higher food and energy prices, and supply chain disruptions following the tragic earthquake in Japan. These restraining forces have abated and thus, we should see stronger growth in the second half. But it is clear that not all of the weakness was due to these one-time factors—and in light of this, I have revised down my expectations for the pace of recovery going forward.And from Cleveland Fed President Sandra Pianalto:

My latest forecast is for the economy to grow at a rate of about 2 percent this year, and about 3 percent in each of the next two years. Our economy has to grow at about a 2-1/2 percent clip just to absorb new labor force entrants and to keep the unemployment rate from rising.That is still weak growth, but more optimistic than many analysts.

• My guess is Bernanke will outline some policy options, and probably focus on changing the composition of the balance sheet as the first choice. Additional asset purchases (QE3) will probably be discussed too.

Yesterday:

• Summary for Week ending August 19th (with plenty of graphs)

• Schedule for Week of Aug 21st

Update on Gasoline Prices

by Calculated Risk on 8/21/2011 09:38:00 AM

With the recent decline in oil prices, most analysts are forecasting a sharp decline in gasoline prices over the next few weeks. (Update: the graph shows WTI, but gasoline prices are impacted by Brent international prices - and Brent hasn't fallen as far as WTI).

Gasoline prices jumped from about $3.10 per gallon in early February to over $3.50 per gallon in early March as WTI oil prices increased from about $84 per barrel to over $100 per barrel. Since oil prices have declined back to the early February levels (Bloomberg: WTI is at $82 per barrel and Brent is at $108), gasoline prices will probably decline too.

Note: Professor Hamilton recently noted an asymmetric response to changes in oil prices ("although oil price increases were often associated with economic recessions, oil price decreases did not bring about corresponding economic booms."). But a decline in gasoline prices will help a little.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Summary for Week ending August 19th (with plenty of graphs)

• Schedule for Week of Aug 21st

Saturday, August 20, 2011

The New Retirement Plan: No Retirement

by Calculated Risk on 8/20/2011 09:17:00 PM

From Rachel Ensign at the WSJ: For Many Seniors, There May Be No Retirement

Already battered nest eggs took another beating this month with the market's wild swings. With interest rates essentially at zero since 2008, income from Treasurys and certificates of deposit is pretty paltry. ... On top of that, housing prices [leave] homeowners with much less equity to tap.Here is the survey mentioned in the article: The New Retirement: Working

• The survey found that for many Americans, the foundation of their retirement strategy is simply not to retire, to work considerably longer than the traditional retirement age, or work in retirement:Earlier:

–39 percent of workers plan to work past age 70 or do not plan to retire

–54 percent of workers expect to plan to continue working when they retire

–40 percent now expect to work longer and retire at an older age since the recession

• Workers’ greatest fears about retirement include “outliving my savings and investments” and “not being able to meet the financial needs of my family.”

• Most workers will continue working out of financial necessity:

–Workers estimate their retirement savings needs at $600,000 (median), but in comparison, fewer than one-third (30 percent) have currently saved more than $100,000 in all household retirement accounts

–Most workers, regardless of age or household income, agree that they could work until age 65 and still not have enough money saved to meet their retirement needs

–Of those who plan on working past the traditional retirement age of 65, the most commonly cited reasons are of need versus choice

–Many workers (31 percent) anticipate that they will need to provide financial support to family members

• Summary for Week ending August 19th (with plenty of graphs)

• Schedule for Week of Aug 21st