by Calculated Risk on 7/30/2011 04:58:00 PM

Saturday, July 30, 2011

Schedule for Week of July 31st

Earlier:

• Summary for Week ending July 29th

The key report for this week will be the July employment report to be released on Friday, August 5th. The ISM manufacturing report will be released on Monday, and the ISM non-manufacturing report on Wednesday. Also the automakers report July vehicle sales on Tuesday.

Note: It is unclear if the employment report will be delayed if Congress fails to raise the debt ceiling (government employees could continue working without pay).

10:00 AM ET: ISM Manufacturing Index for July. The consensus is for a decrease to 54.3 from 55.3 in June.

10:00 AM: Construction Spending for June. The consensus is for no change in construction spending.

8:30 AM: Personal Income and Outlays for June. The consensus is for a 0.2% increase in personal income in June, and a 0.1% increase in personal spending, and for the Core PCE price index to increase 0.2%. The revisions will show significantly lower consumption earlier this year.

All day: Light vehicle sales for July. Light vehicle sales are expected to increase to 11.9 million (Seasonally Adjusted Annual Rate), from 11.4 million in June.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate. Edmunds is forecasting: "Toyota appears to be well on its way toward recovery following its new car sales and inventory struggles over the past few months, according to Edmunds.com’s July 2011 U.S. automotive sales forecast.

...

Edmunds.com estimates ... a Seasonally Adjusted Annualized Rate (SAAR) of 12.3 million light vehicles, nearly one million more than the 11.4 million SAAR reported in June."

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through summer (not counting all cash purchases).

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for +100,000 payroll jobs in July, down from the +157,000 reported in June.

10:00 AM: ISM non-Manufacturing Index for July. The consensus is for a slight increase to 54.0 in July.

10:00 AM: ISM non-Manufacturing Index for July. The consensus is for a slight increase to 54.0 in July. This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index. The June ISM Non-manufacturing index was at 53.3%, down from 54.6% in May. The employment index increased in June to 54.1%, up from 54.0% in May. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for June (Factory Orders). The consensus is for a 1.0% decrease in orders.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 403,000 from 398,000 last week.

8:30 AM: Employment Report for July.

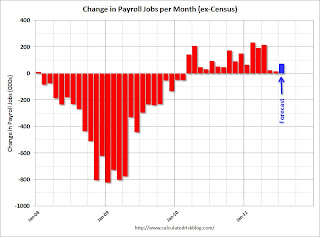

The consensus is for an increase of 75,000 non-farm payroll jobs in July, up from the 18,000 jobs added in June. I'll take the under.

The consensus is for an increase of 75,000 non-farm payroll jobs in July, up from the 18,000 jobs added in June. I'll take the under.This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The consensus forecast for July is in blue.

The consensus is for the unemployment rate to hold steady at 9.2% in July.

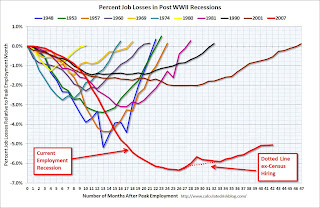

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions. This shows the severe job losses during the recent recession.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions. This shows the severe job losses during the recent recession. Through the first six months of 2011, the economy has added 757,000 total non-farm jobs or just 126 thousand per month. There have been 945,000 private sector jobs added, or about 158 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.98 million fewer payroll jobs than at the beginning of the 2007 recession.

3:00 PM: Consumer Credit for June. The consensus is for a $5.1 billion increase in consumer credit.

Summary for Week ending July 29th

by Calculated Risk on 7/30/2011 10:45:00 AM

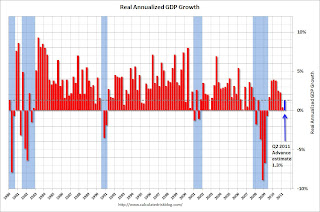

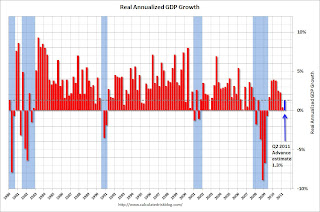

The big economic story of the week was the Q2 GDP release. The Bureau of Economic Analysis (BEA) reported that real GDP growth increased a sluggish 1.3% annualized in Q2, and that growth was revised down to just 0.4% in Q1. Also the revisions indicated the recession was significantly worse than in earlier estimates.

On the political front, the U.S. government is still working towards raising the debt ceiling by this coming Tuesday. There are clear indications that the discussions in Washington have negatively impacted the economy over the last couple of weeks. Goldman Sachs economists write last night that their forecasts for ‘growth in Q4 and 2012 are under review for probably downgrade’. They argued the dysfunction in Washington is impacting confidence: “The inability of policymakers to agree on a measure to lift the federal debt ceiling has damaged consumer confidence, not to mention our own confidence ..."

In other news, sales of new homes are still moving sideways – and house prices, according to Case-Shiller, increased seasonally in May. The regional manufacturing surveys were slightly stronger in July than in June – but that isn’t saying much. Overall the economy remains very sluggish.

Here is a summary in graphs:

• New Home Sales in June at 312,000 Annual Rate

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reported New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 312 thousand. This was down from a revised 315 thousand in May (revised from 319 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

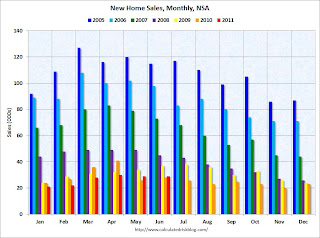

This graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

This graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In June 2011 (red column), 29 thousand new homes were sold (NSA). The record low for June was 28 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for June was 115 thousand in 2005.

This was below the consensus forecast of 321 thousand, and was just above the record low for the month of June - and new home sales have averaged only 300 thousand SAAR over the 14 months since the expiration of the tax credit ... moving sideways at a very low level.

• Case Shiller: Home Prices increase in May

From S&P: Some More Seasonal Improvement in Home Prices

From S&P: Some More Seasonal Improvement in Home Prices

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.8% from the peak, and up slightly in May (SA). The Composite 10 is 1.7% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and down slightly in May (SA). The Composite 20 is slightly above the March 2011 post-bubble bottom seasonally adjusted.

Here are the price declines from the peak for each city included in S&P/Case-Shiller indices.

Here are the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in May seasonally adjusted. Prices in Las Vegas are off 59% from the peak, and prices in Dallas only off 9.5% from the peak.

From S&P (NSA):

As of May 2011, 16 of the 20 MSAs and both Composites posted positive monthly changes. Phoenix was flat. Detroit, Las Vegas and Tampa were the markets where levels fell in May versus April, with Detroit down by 2.8% and Las Vegas posting its eighth consecutive monthly decline. These three cities also posted new index level lows in May 2011. They are now 51.2%, 59.3% and 47.5% below their 2005-6 peak levels, respectively.• Real House Prices and Price-to-Rent

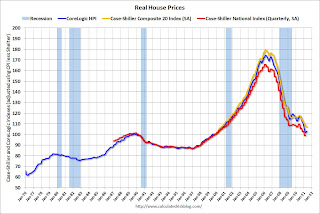

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through May) and CoreLogic House Price Indexes (through May) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

This graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through May) and CoreLogic House Price Indexes (through May) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to August 2000, and the CoreLogic index back to March 2000. In real terms, all appreciation in the last decade is gone.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May). This graph shows the price to rent ratio (January 1998 = 1.0). On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to March 2000.

For more on home sales and house prices, here are the previous posts:

On June Home Sales:

• New Home Sales in June at 312,000 Annual Rate

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Home Sales: Distressing Gap

• Graph Galleries: New Home Sales and Existing Home Sales

On House Prices:

• Case Shiller: Home Prices increase in May

• Real House Prices and Price-to-Rent

• Graph Galleries: Home Prices

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

Note: This release contained a number of revisions. The recession was significantly worse than in earlier estimates. Last quarter (Q1) was revised down to just 0.4% real GDP growth.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q2 at 1.3% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q2 at 1.3% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.Not only has growth slowed, but the recession was significantly worse than earlier estimates suggested.

The following graph is constructed as a percent of the previous peak. This shows when GDP has bottomed - and when GDP has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.4% below the previous pre-recession peak. At the worst point, real GDP was off 5.1% from the 2007 peak. Since the most common definition of a depression is a 10%+ decline in real GDP, the 2007 recession was not a depression. Note: There is no formal definition of a depression. Some people use other definitions such as the duration below the previous peak. By that definition, using both GDP and employment, this seems like the "Lesser depression", but not by the common definition.

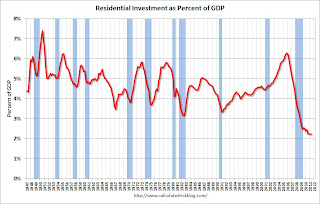

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.4% below the previous pre-recession peak. At the worst point, real GDP was off 5.1% from the 2007 peak. Since the most common definition of a depression is a 10%+ decline in real GDP, the 2007 recession was not a depression. Note: There is no formal definition of a depression. Some people use other definitions such as the duration below the previous peak. By that definition, using both GDP and employment, this seems like the "Lesser depression", but not by the common definition. This graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

This graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Note: red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

For more on GDP, here are the posts:

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

• Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

• GDP: Investment Contributions (several graphs)

• ATA Trucking index increased 2.8% in June

From ATA Trucking: ATA Truck Tonnage Index Jumped 2.8% in June

From ATA Trucking: ATA Truck Tonnage Index Jumped 2.8% in JuneThe American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.8% in June after decreasing a revised 2.0% in May 2011. May’s drop was slightly less than the 2.3% ATA reported on June 27, 2011. The latest gain put the SA index at 115.8 (2000=100) in June, up from the May level of 112.6 and the highest since January 2011.Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

The dashed line is the current level of the index.

• Regional Manufacturing Surveys and the ISM index

This graph compares the regional manufacturing surveys and the ISM manufacturing index:

The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).The regional surveys were slightly better in July than in June. The ISM index for July will be released Monday, August 1st.

• Other Economic Stories ...

• From the Chicago Fed: Index shows economic growth again below average in June

• From the Dallas Fed: Texas Manufacturing Activity Picks Up

• From the Kansas City Fed: Manufacturing Sector Slows After Solid Rebound in June

• The Chicago Purchasing Managers reported activity stabilized in July

• Fed's Beige Book: "Pace of economic growth has moderated"

• Rumor: NAR Considering Introducing Repeat Sales Index

• From the NAR: Pending Home Sales Rise in June

• HVS: Q2 Homeownership and Vacancy Rates

Have a great weekend!

Unofficial Problem Bank list increases to 995 Institutions

by Calculated Risk on 7/30/2011 08:36:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 29, 2011.

Changes and comments from surferdude808:

After eight additions and six removals this week, the Unofficial Problem Bank List includes 995 institutions with assets of $415.4 billion. Last week the list had 993 institutions with assets of $415.7 billion. For the month, the list experienced a net decline of six institutions and an asset drop of $3.9 billion.Yesterday ...

The removals this week include the three failures and three cures. The removals from failure were Integra Bank National Association, Evansville, IN ($2.2 billion Ticker: IBNK); BankMeridian, N.A., Columbia, SC ($240 million); and Virginia Business Bank, Richmond, VA ($96 million). The action terminations were Heartland Bank, Leawood, KS ($131 million); The Hicksville Bank, Hicksville, OH ($119 million); and State Bank of Paw Paw, Paw Paw, IL ($23 million).

Among the eight additions are U. S. Century Bank, Doral, FL ($1.7 billion); First Bank, Clewiston, FL ($249 million); Community Trust & Banking Company, Ooltewah, TN ($147 million); and Flagship Bank Minnesota, Wayzata, MN ($122 million).

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

• Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

• GDP: Investment Contributions (several graphs)

• HVS: Q2 Homeownership and Vacancy Rates

Friday, July 29, 2011

Fannie Mae and Freddie Mac Serious Delinquency Rates decline in June

by Calculated Risk on 7/29/2011 09:25:00 PM

Fannie Mae reported that the serious delinquency rate decreased to 4.08% in June, down from 4.14% in May. This is down from 4.99% in June of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate decreased to 3.50% in June from 3.53% in May. This is down from 3.96% in May 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent.

Now the serious delinquency rate is falling as Fannie and Freddie work through the backlog of loans and either modify the loan, foreclose, short sale, or the loan cures. But there is a long way to go ...

The normal serious delinquency rate is under 1%. At the current rate of decline, Fannie will be back to "normal" in 2014, and Freddie will be back to "normal" in 2017 or so!

Bank Failure #61: Integra Bank, National Association, Evansville, Indiana

by Calculated Risk on 7/29/2011 07:16:00 PM

An integrity failure.

From low integers

by Soylent Green is People

From the FDIC: Old National Bank, Evansville, Indiana, Assumes All of the Deposits of Integra Bank, National Association, Evansville, Indiana

As of March 31, 2011, Integra Bank, National Association had approximately $2.2 billion in total assets and $1.9 billion in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $170.7 million. ... Integra Bank, National Association is the 61st FDIC-insured institution to fail in the nation this year, and the first in Indiana.A pretty big failure ...

Bank Failures #59 & 60 in 2011: Virginia and South Carolina

by Calculated Risk on 7/29/2011 05:39:00 PM

A Business Bank in retreat

Crumbled capital.

by Soylent Green is People

From the FDIC: Xenith Bank, Richmond, Virginia, Assumes All of the Deposits of Virginia Business Bank, Richmond, Virginia

As of March 31, 2011, Virginia Business Bank had approximately $95.8 million in total assets and $85.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.3 million. ... Virginia Business Bank is the 59th FDIC-insured institution to fail in the nation this year, and the first in Virginia.From the FDIC: SCBT, National Association, Orangeburg, South Carolina, Assumes All of the Deposits of BankMeridian, N.A., Columbia, South Carolina

As of March 31, 2011, BankMeridian, N.A. had approximately $239.8 million in total assets and $215.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $65.4 million. ... BankMeridian, N.A. is the 60th FDIC-insured institution to fail in the nation this year, and the third in South Carolina.

HVS: Q2 Homeownership and Vacancy Rates

by Calculated Risk on 7/29/2011 02:53:00 PM

The Census Bureau released the Housing Vacancies and Homeownership report for Q2 this morning.

As Tom Lawler has been discussing (see posts at bottom), this is from a fairly small sample, and the homeownership and vacancy rates are higher than estimated in other reports (like Census 2010). This report is commonly used by analysts to estimate the excess vacant supply for housing, but it doesn't appear to be useful for that purpose.

It does show the trend, but I wouldn't rely on the absolute numbers.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate declined to 65.9%, down from 66.4% in Q1 2010.

From Tom Lawler:

The HVS has consistently overstated overall US housing vacancy rates, and consistently understated the number of US households – mainly “missing” millions of renter households – for over a decade. Census 2010 “found” 116,716,292 US households for April 1, 2010, 75,986,074 of which were owner-occupied households, and 40,730,218 of which were renter-occupied households.CR note: we will get the Census 2010 age group homeownership rates soon.

While the HVS numbers don’t “correlate” all that well, a decent “best guess” for the US homeownership rate last quarter would probably be around 64.2%, or about the same as in 1990. Given the substantial aging of the population over the last two decades, that would imply that homeownership rates for most age groups last quarter were the lowest since the 1980’s.

The HVS homeowner vacancy rate declined to 2.5% from 2.6% in Q1.

The HVS homeowner vacancy rate declined to 2.5% from 2.6% in Q1.From Lawler:

The “homeowner vacancy rate” from the HVS last quarter was 2.5%, down from 2.6% in the previous quarter but unchanged from a year ago. The HVS homeowner vacancy rate in the first half of 2010 was 2.55%, compared to the decennial Census estimate as of April 1, 2010 of 2.4%.

Lawler:

Lawler: This survey also produced an estimated rental vacancy rate last quarter of 9.2%, down from 9.7% in the previous quarter and 10.6% in the second quarter of last year. The HVS estimate of the US rental vacancy rate for the first half of 2010 was 10.6%, compared to the decennial Census estimates as of Apri1 1, 2010 of 9.2%. Last quarter’s HVS rental vacancy rate was the lowest since the third quarter of 2002.This report does suggest that the homeownership rate and vacancy rates are falling.

Here are some previous posts about some of the HVS issues by economist Tom Lawler:

• Census Bureau on Homeownership Rate: We've got “Some 'Splainin' to Do”

• Be careful with the Housing Vacancies and Homeownership report

• Lawler: Census 2010 and the US Homeownership Rate

• Lawler: Census 2010 Demographic Profile: Highlights, Excess Housing Supply Estimate, and Comparison to HVS

• Lawler: The “Excess Supply of Housing” War

• Lawler: Census Releases Demographic Profile of 12 States and DC: Confirms Bias of HVS

• Lawler: Census 2010 and Excess Vacant Housing Units

• Lawler: On Census Housing Stock/Household Data

• Lawler: Housing Vacancy Survey appears to massively overstate number of vacant housing units

• Lawler: US Households: Why Researchers / Analysts are “Confused”

GDP: Investment Contributions

by Calculated Risk on 7/29/2011 11:35:00 AM

According to the Bureau of Economic Analysis (BEA), real GDP is still below the pre-recession peak. The estimate for real GDP in Q2 (2005 dollars) is $13,270.1 billion, still 0.4% below the $13,326 billion in Q4 2007.

The following graph is constructed as a percent of the previous peak. This shows when GDP has bottomed - and when GDP has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

At the worst point, real GDP was off 5.1% from the 2007 peak. Since the most common definition of a depression is a 10%+ decline in real GDP, the 2007 recession was not a depression. Note: There is no formal definition of a depression. Some people use other definitions such as the duration below the previous peak. By that definition, using both GDP and employment, this seems like the "Lesser depression", but not by the common definition.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.4% below the previous pre-recession peak.

Note: There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA will release GDI with the 2nd GDP estimate.

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Residential Investment (RI) made a positive contribution to GDP in Q2 2011, however the four quarter rolling average is still negative. The rolling four quarter average for RI will probably turn positive in Q3.

Residential Investment (RI) made a positive contribution to GDP in Q2 2011, however the four quarter rolling average is still negative. The rolling four quarter average for RI will probably turn positive in Q3.

Equipment and software investment has made a significant positive contribution to GDP for eight straight quarters (it is coincident).

The contribution from nonresidential investment in structures was positive in Q2. Nonresidential investment in structures typically lags the recovery, however investment in energy and power is masking weakness in office, mall and hotel investment (the underlying details will be released next week).

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

Residential Investment (RI) increased slightly in Q2, and as a percent of GDP, RI is just above the record low set last quarter.

Residential Investment (RI) increased slightly in Q2, and as a percent of GDP, RI is just above the record low set last quarter.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I expect RI to increase in 2011 and add to both GDP and employment growth - for the first time since 2005 (even with the weak first half, this appears correct).

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

Equipment and software investment has been increasing sharply, however investment growth only increased in Q2 at a 5.7% annualized rate - the slowest rate since investment declined in Q2 2009.

Non-residential investment in structures increased in Q2, and is just above the record low. I'll add details for investment in offices, malls and hotels next week.

Earlier ...

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

• Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

by Calculated Risk on 7/29/2011 09:55:00 AM

• From the Chicago Business Barometer™: The overall index decreased to 58.8 in July from 61.1 in June. This was below consensus expectations of 60.2. Note: any number above 50 shows expansion.

The employment index decreased to 51.5 from 58.7.

• GDP: Not only has growth slowed, but the recession was significantly worse than earlier estimates suggested. Real GDP is still not back to the pre-recession peak.

The following graph shows the current estimate of real GDP and the pre-revision estimate (blue). I'll have more later on GDP.

• The final July Reuters / University of Michigan consumer sentiment index declined slightly to 63.7 from the preliminary reading of 63.8 - and down sharply from 71.5 in June.

• The final July Reuters / University of Michigan consumer sentiment index declined slightly to 63.7 from the preliminary reading of 63.8 - and down sharply from 71.5 in June.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.

Earlier ...

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

by Calculated Risk on 7/29/2011 08:30:00 AM

Note: This release contains a number of revisions. The recession was significantly worse than in earlier estimates. Last quarter (Q1) was revised down to just 0.4% real GDP growth.

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.3 percent in the second quarter of 2011, (that is, from the first quarter to the second quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.4 percent.The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q2 at 1.3% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.A few key numbers:

• Real personal consumption expenditures increased 0.1 percent in the second quarter, compared with an increase of 2.1 percent in the first.

• Investment: "Real nonresidential fixed investment increased 6.3 percent in the second quarter, compared with an increase of 2.1 percent in the first. Nonresidential structures increased 8.1 percent, in contrast to a decrease of 14.3 percent. Equipment and software increased 5.7 percent, compared with an increase of 8.7 percent. Real residential fixed investment increased 3.8 percent, in contrast to a decrease of 2.4 percent."

• Real federal government consumption expenditures and gross investment increased 2.2 percent in the second quarter, in contrast to a decrease of 9.4 percent in the first.

I'll have much more ...