by Calculated Risk on 7/29/2011 11:35:00 AM

Friday, July 29, 2011

GDP: Investment Contributions

According to the Bureau of Economic Analysis (BEA), real GDP is still below the pre-recession peak. The estimate for real GDP in Q2 (2005 dollars) is $13,270.1 billion, still 0.4% below the $13,326 billion in Q4 2007.

The following graph is constructed as a percent of the previous peak. This shows when GDP has bottomed - and when GDP has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

At the worst point, real GDP was off 5.1% from the 2007 peak. Since the most common definition of a depression is a 10%+ decline in real GDP, the 2007 recession was not a depression. Note: There is no formal definition of a depression. Some people use other definitions such as the duration below the previous peak. By that definition, using both GDP and employment, this seems like the "Lesser depression", but not by the common definition.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.4% below the previous pre-recession peak.

Note: There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA will release GDI with the 2nd GDP estimate.

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Residential Investment (RI) made a positive contribution to GDP in Q2 2011, however the four quarter rolling average is still negative. The rolling four quarter average for RI will probably turn positive in Q3.

Residential Investment (RI) made a positive contribution to GDP in Q2 2011, however the four quarter rolling average is still negative. The rolling four quarter average for RI will probably turn positive in Q3.

Equipment and software investment has made a significant positive contribution to GDP for eight straight quarters (it is coincident).

The contribution from nonresidential investment in structures was positive in Q2. Nonresidential investment in structures typically lags the recovery, however investment in energy and power is masking weakness in office, mall and hotel investment (the underlying details will be released next week).

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

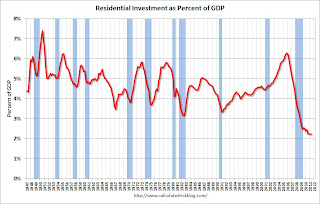

Residential Investment (RI) increased slightly in Q2, and as a percent of GDP, RI is just above the record low set last quarter.

Residential Investment (RI) increased slightly in Q2, and as a percent of GDP, RI is just above the record low set last quarter.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I expect RI to increase in 2011 and add to both GDP and employment growth - for the first time since 2005 (even with the weak first half, this appears correct).

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

Equipment and software investment has been increasing sharply, however investment growth only increased in Q2 at a 5.7% annualized rate - the slowest rate since investment declined in Q2 2009.

Non-residential investment in structures increased in Q2, and is just above the record low. I'll add details for investment in offices, malls and hotels next week.

Earlier ...

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

• Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

Real GDP still below Pre-Recession Peak, Chicago PMI declines, Consumer Sentiment Weak

by Calculated Risk on 7/29/2011 09:55:00 AM

• From the Chicago Business Barometer™: The overall index decreased to 58.8 in July from 61.1 in June. This was below consensus expectations of 60.2. Note: any number above 50 shows expansion.

The employment index decreased to 51.5 from 58.7.

• GDP: Not only has growth slowed, but the recession was significantly worse than earlier estimates suggested. Real GDP is still not back to the pre-recession peak.

The following graph shows the current estimate of real GDP and the pre-revision estimate (blue). I'll have more later on GDP.

• The final July Reuters / University of Michigan consumer sentiment index declined slightly to 63.7 from the preliminary reading of 63.8 - and down sharply from 71.5 in June.

• The final July Reuters / University of Michigan consumer sentiment index declined slightly to 63.7 from the preliminary reading of 63.8 - and down sharply from 71.5 in June.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.

Earlier ...

• Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

Advance Estimate: Real Annualized GDP Grew at 1.3% in Q2

by Calculated Risk on 7/29/2011 08:30:00 AM

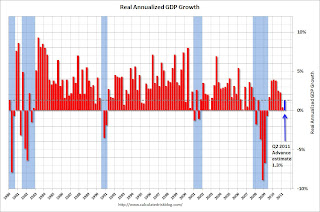

Note: This release contains a number of revisions. The recession was significantly worse than in earlier estimates. Last quarter (Q1) was revised down to just 0.4% real GDP growth.

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.3 percent in the second quarter of 2011, (that is, from the first quarter to the second quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.4 percent.The following graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q2 at 1.3% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.A few key numbers:

• Real personal consumption expenditures increased 0.1 percent in the second quarter, compared with an increase of 2.1 percent in the first.

• Investment: "Real nonresidential fixed investment increased 6.3 percent in the second quarter, compared with an increase of 2.1 percent in the first. Nonresidential structures increased 8.1 percent, in contrast to a decrease of 14.3 percent. Equipment and software increased 5.7 percent, compared with an increase of 8.7 percent. Real residential fixed investment increased 3.8 percent, in contrast to a decrease of 2.4 percent."

• Real federal government consumption expenditures and gross investment increased 2.2 percent in the second quarter, in contrast to a decrease of 9.4 percent in the first.

I'll have much more ...

Thursday, July 28, 2011

Debt Ceiling Charade impacting Short-Term Credit Markets

by Calculated Risk on 7/28/2011 10:36:00 PM

From the NY Times DealBook: Debt Ceiling Impasse Rattles Short-Term Credit Markets

Over the last week, big banks and companies have withdrawn $37.5 billion from money market funds that invest in Treasury debt and other ultra-safe securities, the biggest weekly drop this year. Meanwhile, in the vast market for repurchase agreements, in which many financial firms make short-term loans to one another, borrowers are beginning to demand higher yields.From the WSJ: Default Worries Dry Up Lending

Banks ... are scrambling to design emergency plans to avoid a trading logjam in the huge markets for Treasurys and short-term funding facilities if Congress fails to raise the U.S. borrowing limits by next Tuesday's deadline.From CNBC: Will Debt Feud Clip Future Economic Growth?

...

Trading executives from the largest Wall Street dealers agreed on a Wednesday conference call, conducted by the industry trade group the Securities Industry Financial Markets Association, to a number of procedures to trade Treasury bonds if the U.S. misses a payment on its debt.

Washington's political feuding over the deficit has damaged business and consumer sentiment in an already weak economy ...I've heard comments from several executives this week that business has slowed sharply over the last week. People are getting nervous.

I've been trying to ignore the charade - obviously Congress will agree to raise the debt ceiling and pay the bills - but it is now impacting the economy.

Housing Starts: Impact of Changes in Household Size

by Calculated Risk on 7/28/2011 06:26:00 PM

I've seen several people compare total housing starts with previous decades and ask: "Why is there still excess supply?"

Below is the long term graph of both total housing starts and single unit starts. If we look at the graph, we notice that there were more starts at the peak in the '70s than during the recent housing bubble.

Obviously there were many more multi-unit housing starts in the '70s - and that is a clue.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The key to the number of housing starts is household formation.

Household formation is a function of changes in population, and also of changes in household size. During the '70s, the baby boomers started moving out of their parents' homes, and there was a dramatic decrease in the number of persons per household. And that led to a huge demand for apartments (the surge in total starts).

The table below shows the number of persons per household for every decade from 1950 through 2010 (based on the decennial census data). Also using the decennial census data we can calculate the number of households needed because of 1) population growth, and 2) changes in household size:

| Decennial Census, Population and Households in Millions | ||||||

|---|---|---|---|---|---|---|

| Census | Population | Households | Persons per household | Increase in Households over decade | Increase in Households due to Population Growth | Increase in Households due to change in Household Size |

| 1950 | 150.7 | 42.8 | 3.52 | --- | --- | --- |

| 1960 | 179.3 | 53.0 | 3.38 | 10.2 | 8.1 | 2.1 |

| 1970 | 203.2 | 63.4 | 3.21 | 10.4 | 7.1 | 3.3 |

| 1980 | 226.5 | 80.4 | 2.82 | 17.0 | 7.3 | 9.7 |

| 1990 | 248.7 | 91.9 | 2.71 | 11.5 | 7.9 | 3.6 |

| 2000 | 281.4 | 105.5 | 2.67 | 13.6 | 12.1 | 1.5 |

| 2010 | 308.7 | 116.7 | 2.65 | 11.2 | 10.2 | 1.0 |

Because of the changes in household size, the U.S. needed far more additional housing units in the '70s than in the '00s. In the decade ending in 1980, there were 17 million households added. A majority of those households were added because of the decrease in the number of persons per household (boomers moving out!).

Unfortunately it is difficult to estimate the number of housing units needed in a given time period, even if we know the number of new households being formed (and we don't have timely data on household formation!). We also have to account for scrappage (demolitions), mobile homes and second homes. And this assume no excess supply - and right now there is a significant excess supply.

A simple formula would be:

Housing Starts + mobile homes needed = Households formed + scrappage + second homes added.

So if 1 million households are formed in a year, 200 thousand homes demolished (probably close), and say 100 thousand 2nd homes added, then the total housing starts plus mobile homes added would be 1.3 million.

Note: this doesn't account for location (most homes are not transportable), and the desires of each household (a mobile home isn't a substitute for a 4,000 square foot home).

So we can't just compare housing starts in different decades without looking at household formation. I'll have more on this ...

Fed's Williams: The Economic Outlook

by Calculated Risk on 7/28/2011 02:44:00 PM

From San Francisco Fed President John Williams: The Outlook for the Economy and Monetary Policy

Some excerpts on housing:

One of the most important currents holding back recovery has been housing. The collapse of the housing market touched off the financial crisis and recession. In most recessions, housing construction falls sharply, but then leads the economy back when growth resumes. As you well know, that snapback hasn’t occurred this time. Before the crisis, residential investment as a share of the economy was at its highest level since the Korean War. Today, housing construction remains moribund and residential investment as a share of the economy has fallen to its lowest level since World War II.These are key points: Usually housing is a key engine of recovery, but not this time because of the massive supply overhang. And looking forward:

On one level, that’s not surprising. We simply built too many—in fact, millions too many—houses during the boom and we are still feeling the effects of this overhang. Consider housing prices. From their peak in 2006 until early 2009, home prices nationwide fell by nearly a third. When you exclude distressed sales, prices appeared to bottom out in 2009 and early 2010. New housing starts also appeared to stabilize in 2009, after plummeting some 75 percent during the housing crash. ...

The $64,000 question is when will the housing market finally recover? One daunting challenge for such a recovery is the huge number of homes in foreclosure. Almost 7 million homes have entered into foreclosure since the first quarter of 2008 and some 2 million are still in the foreclosure process. In addition, there is a shadow inventory of homes currently owned by delinquent borrowers. When you add up unsold new houses left over from the boom, homes for sale by owners, foreclosed residences for sale by lenders, and the shadow inventory of houses at risk of distressed sale, you come up with a massive supply overhang.

Over time, more reasonable prices and an improving economy ought to bring buyers off the sidelines and set the stage for recovery. But high unemployment and anemic wage gains are leaving people worried about their income prospects and cautious about buying homes. Also, the dramatic plunge in home valuations since 2006 has made some first-time homebuyers wary about entering the market because of worries that prices might fall further.

It’s only a matter of time before we work off the inventory overhang and construction picks up. How much time it takes will depend in part on what happens with foreclosed properties. If we begin making progress on working down the foreclosure inventory, then single-family housing starts could plausibly rise from their current level of about 400,000 per year to an average level of perhaps 1.1 million per year in three or four years, according to research at the San Francisco Fed.4 To put this in perspective, such an increase would boost real gross domestic product, or GDP, by at least 1 percent.This is why I continue to focus on the excess supply. This is a key number for housing and the U.S. economy. See The “Excess Supply of Housing” War

4 By contrast, if we can't work down the foreclosure inventory, then a return to normal construction levels could be delayed several more years. See Hedberg and Krainer (2011).

Kansas City Manufacturing Survey: Manufacturing activity slows in July

by Calculated Risk on 7/28/2011 11:00:00 AM

From the Kansas City Fed: Manufacturing Sector Slows After Solid Rebound in June

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing slowed in July after a solid rebound in June, but producers remain generally upbeat about future activity.This is the last of the regional Fed surveys for July. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were fairly weak again this month, although slightly stronger than in June (in aggregate).

“Factory activity in our region grew at a slower pace in July after rebounding solidly in June,” said Wilkerson. “Several firms blamed the slowdown on customers being cautious until the national debt ceiling debate is resolved. However, expectations for orders, hiring and capital spending, later in the year, generally remained as solid as in recent months.”

...

The month-over-month composite index was 3 in July, down from 14 in June but up from 1 in May. ... Most month-over-month indexes fell in July. The production index plunged from 25 to 0, and the shipments, new orders, and order backlog indexes also decreased. The employment index dropped from 17 to 4, and the new orders for exports index posted a negative reading for the first time since mid-2009.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

The regional surveys were slightly better in July than in June. The ISM index for July will be released Monday, August 1st.

Pending Home Sales increase in June

by Calculated Risk on 7/28/2011 10:00:00 AM

From the NAR: Pending Home Sales Rise in June

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, rose 2.4 percent to 90.9 in June from 88.8 in May and is 19.8 percent above the 75.9 reading in June 2010, which was the low point immediately following expiration of the home buyer tax credit. The data reflects contracts but not closings.This was very close to Tom Lawler's forecast of a 2.6% increase. This suggests an increase in reported existing home sales in July and August (depending on the number of cancellations).

...

The PHSI in the Northeast slipped 0.4 percent to 68.9 in June but is 19.4 percent higher than June 2010. In the Midwest the index fell 3.7 percent to 79.7 in June but is 26.4 percent above a year ago. Pending home sales in the South increased 4.4 percent to an index of 99.2 and are 19.1 percent higher than June 2010. In the West the index rose 6.4 percent to 107.0 in June and is 16.4 percent above a year ago.

Weekly Initial Unemployment Claims decline to 398,000

by Calculated Risk on 7/28/2011 08:42:00 AM

The DOL reports:

In the week ending July 23, the advance figure for seasonally adjusted initial claims was 398,000, a decrease of 24,000 from the previous week's revised figure of 422,000. The 4-week moving average was 413,750, a decrease of 8,500 from the previous week's revised average of 422,250.This is the first week with initial claims below 400,000 since early April.

The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 413,750.

Wednesday, July 27, 2011

HousingTracker: Homes For Sale inventory down 11.1% Year-over-year in July

by Calculated Risk on 7/27/2011 08:29:00 PM

Last month, Tom Lawler posted on how the NAR estimates existing home inventory. The NAR does NOT aggregate data from the local boards (see Tom's post for how the NAR estimates inventory). Sometime this fall, the NAR will revise down their estimates of inventory and sales for the last few years. Also the NAR methodology for estimating sales and inventory will likely (hopefully) be changed.

While we wait for the NAR revisions, I think the HousingTracker / DeptofNumbers data that Tom mentioned might be a better estimate of changes in inventory (and always more timely). Ben at deptofnumbers.com is tracking the aggregate monthly inventory for 54 metro areas.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the NAR estimate of existing home inventory through June (left axis) and the HousingTracker data for the 54 metro areas through July. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates this fall).

Lawler wrote today:

The area covered by DON/HT does not necessarily track the nation as a whole. However, it’s listings have shown significantly larger YOY declines than has the NAR in its estimate of US existing homes for sale. Moreover, when I include areas I track that are not covered by DON/HT, I find that listings in June were down significantly more than the NAR shows. This may indicate that home sales this June were down more from a year ago than the NAR estimates suggest.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.HousingTracker reported that the July listings - for the 54 metro areas - declined 11.1% from last year.

Of course there is a large percentage of distressed inventory, and various categories of "shadow inventory" too. But the decline in listed inventory will put less downward pressure on house prices and is something to watch carefully all year.

Here are the posts this month on June Home Sales and Prices:

• New Home Sales in June at 312,000 Annual Rate

• Existing Home Sales in June: 4.77 million SAAR, 9.5 months of supply

• Home Sales: Distressing Gap

• Graph Galleries: New Home Sales and Existing Home Sales

On House Prices:

• Case Shiller: Home Prices increase in May

• Real House Prices and Price-to-Rent

• Graph Galleries: Home Prices