by Calculated Risk on 7/15/2011 07:15:00 PM

Friday, July 15, 2011

Stand-up Economist Yoram Bauman on Politics and the Federal Budget

Here is a new routine from stand-up economist Yoram Bauman on YouTube ...

Earlier:

• From the NY Fed: Empire State Manufacturing Survey indicates conditions deteriorated in July

• Consumer Sentiment declines sharply in July

• Industrial Production increased 0.2% in June, Capacity Utilization unchanged

• Eight Banks Fail European Stress Tests

• Key Measures of Inflation ease in June

Bank Failure #54: First Peoples Bank, Port Saint Lucie, FL

by Calculated Risk on 7/15/2011 06:08:00 PM

Sweating, clock staring bankers

F.D.I.C. Time!

by Soylent Green is People

From the FDIC: Premier American Bank, National Association, Miami, Florida, Assumes All of the Deposits of First Peoples Bank, Port Saint Lucie, Florida

As of March 31, 2011, First Peoples Bank had approximately $228.3 million in total assets and $209.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $7.4 million. ... First Peoples Bank is the 54th FDIC-insured institution to fail in the nation this year, and the seventh in Florida.The Friday afternoon ritual continues - three down today so far.

Earlier:

• From the NY Fed: Empire State Manufacturing Survey indicates conditions deteriorated in July

• Consumer Sentiment declines sharply in July

• Industrial Production increased 0.2% in June, Capacity Utilization unchanged

• Eight Banks Fail European Stress Tests

• Key Measures of Inflation ease in June

Bank Failure #52 & 53 in 2011: Two More in Georgia

by Calculated Risk on 7/15/2011 04:19:00 PM

Two more tumble off the tree

A bitter harvest

by Soylent Green is People

From the FDIC: Ameris Bank, Moultrie, Georgia, Acquires All the Deposits of Two Georgia Institutions: High Trust Bank, Stockbridge and One Georgia Bank, Atlanta

As of March 31, 2011, High Trust Bank had total assets of $192.5 million and total deposits of $189.5 million; and One Georgia Bank had total assets of $186.3 million and total deposits of $162.1 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for High Trust Bank will be $66.0 million and for One Georgia Bank, $44.4 million. ...The closings are the 52nd and 53rd FDIC-insured institutions to fail in the nation so far this year and the fifteenth and sixteenth in Georgia.

Key Measures of Inflation ease in June

by Calculated Risk on 7/15/2011 01:13:00 PM

This week Fed Chairman Bernanke reiterated the Fed's position that further easing (i.e. QE3) would require both persistent economic weakness and a greater risk of deflation. From Bernanke's testimony:

[T]he possibility remains that the recent economic weakness may prove more persistent than expected and that deflationary risks might reemerge, implying a need for additional policy support.One thing to watch will be the following key measures.

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.2 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. ... The gasoline index declined sharply in June, falling 6.8 percent. ... In contrast, the index for all items less food and energy increased 0.3 percent for the second consecutive month.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

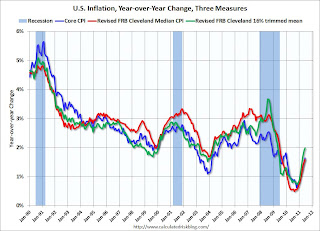

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.7% annualized rate) in June. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.7% annualized rate) during the month.Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation. You can see the median CPI details for June here.

Over the last 12 months, the median CPI rose 1.6%, the trimmed-mean CPI rose 2.0%, the CPI rose 3.6%, and the CPI less food and energy rose 1.6%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.On a year-over-year basis, these measures of inflation are increasing, but still mostly below the Fed's target. The trimmed-mean is at 2.0% year-over-year; at the Fed's target.

On a monthly basis, the median Consumer Price Index increased 1.7% at an annualized rate, down from 2.1% annualized in May. The 16% trimmed-mean Consumer Price Index also increased 1.7% annualized in June, down from 2.8% annualized in May. And core CPI increased 3.1% annualized, down from 3.5% annualized in May.

With the slack in the system, the year-over-year measures will probably stay near or be below 2% this year.

Earlier:

• From the NY Fed: Empire State Manufacturing Survey indicates conditions deteriorated in July

• Consumer Sentiment declines sharply in July

• Industrial Production increased 0.2% in June, Capacity Utilization unchanged

• Eight Banks Fail European Stress Tests

Eight Banks Fail European Stress Tests

by Calculated Risk on 7/15/2011 12:20:00 PM

Here is the page for the European Banking Authority (EBA)

EBA Press release (pdf)

Stress Test Summary report (pdf)

From the WSJ: 8 Banks Fail EU 'Stress Tests'

Eight banks flunked the European Union's "stress tests," with a combined shortfall of €2.5 billion ($3.54 billion) in capital under a simulated worst-case economic scenario, the European Banking Authority said.Only €2.5 billion in capital needed? And the banks are reported to hold an aggregate €1.1 trillion euros in government debt from Greece, Ireland, Portugal and Spain? I think investors will remain skeptical.

The EU regulator said Friday that another 16 banks narrowly passed the tests, which examined the abilities of 90 top lenders across Europe to endure a deteriorating economy and strained financial system.

By awarding a relatively clean bill of health to the vast majority of Europe's banking industry, the tests are likely to be greeted with skepticism.

Consumer Sentiment declines sharply in July

by Calculated Risk on 7/15/2011 09:55:00 AM

The preliminary July Reuters / University of Michigan consumer sentiment index declined sharply to 63.8 from 71.5 in June.

Click on graph for larger image in graphic gallery.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with lower gasoline prices, consumer sentiment declined sharply - possible because of the heavy coverage of the debt ceiling charade.

This was well below the consensus forecast of 71.0 and definitely in the recession range.

Industrial Production increased 0.2% in June, Capacity Utilization unchanged

by Calculated Risk on 7/15/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.2 percent in June after having edged down 0.1 percent in May. For the second quarter as a whole, total industrial production increased at an annual rate of 0.8 percent. Manufacturing output was unchanged in June. In the second quarter, supply chain disruptions following the earthquake in Japan curtailed the production of motor vehicles and parts and restrained output in related industries; the production index for overall manufacturing was little changed for the quarter. The output of mines rose 0.5 percent in June, while the output of utilities climbed 0.9 percent. At 93.1 percent of its 2007 average, total industrial production in June was 3.4 percent above its year-earlier level. The capacity utilization rate for total industry remained unchanged at 76.7 percent in June, a rate 2.2 percentage points above the rate from a year earlier but 3.7 percentage points below its average from 1972 to 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is still "3.7 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in June to 93.1.

Both industrial production and capacity utilization have been moving sideways recently. This was below the consensus forecast of a 0.4% increase in Industrial Production in June, and an increase to 76.9% for Capacity Utilization.

There is still significant excess capacity.

Empire State Survey indicates contraction, Core CPI increases 0.3 percent

by Calculated Risk on 7/15/2011 08:30:00 AM

• From the NY Fed: Empire State Manufacturing Survey

The July Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated for a second consecutive month. The general business conditions index remained below zero, at -3.8.The index increased from -7.8 in June, but was well below expectations of a reading of 8.0. This is the first regional survey released for July and shows that manufacturing in the NY region is still contracting.

The new orders index also remained negative, while the shipments index increased to a level slightly above zero. The indexes for both prices paid and prices received were positive but lower than last month, suggesting that price increases slowed. The index for number of employees fell to a level near zero, indicating that employment levels held steady, while the average workweek index dropped well into negative territory. Future indexes bounced up after declining steeply in June—a sign that conditions were generally expected to improve over the next six months—but the level of optimism was well below the levels observed earlier this year.

• From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.2 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. ... The gasoline index declined sharply in June, falling 6.8 percent. ... In contrast, the index for all items less food and energy increased 0.3 percent for the second consecutive month.Headline CPI declined because of the sharp decline in gasoline prices, but the core index increased 0.3 percent and is now up 1.6 percent over the last year. I'll have more on inflation later.

Thursday, July 14, 2011

European Stress Tests results at 12 PM ET

by Calculated Risk on 7/14/2011 11:15:00 PM

The 2011 EU-wide stress test reports will be released at 12 PM ET: Some country reports might be released earlier, but the summary report and the aggregate results will be published by the European Banking Authority (EBA) at 6pm CEST (5pm BST) on Friday, July 15th.

Here is the page for the European Banking Authority (EBA) (it will probably crash at 12 PM ET).

From the NY Times: Europe Looks for Hope in Bank Test Results

[T]he euro zone’s top banking supervisor will announce on Friday the results of its latest examination into the health of its financial institutions. It is an exercise that an increasingly desperate European Union hopes will quell investor fears ... Since the last stress tests a year ago, the banks have raised 67 billion euros ($94.2 billion) in new capital, according to Morgan Stanley, a relative pittance given that European banks have on their books 1.1 trillion euros in government debt from Greece, Ireland, Portugal and Spain.Also tomorrow:

8:30 AM: Consumer Price Index for June. The consensus is for a 0.2% decrease in prices. The consensus for core CPI is an increase of 0.2%.

8:30 AM ET: NY Fed Empire Manufacturing Survey for July. This is the first of regional surveys for July. The consensus is for a reading of 8.0, indicating expansion, after a reading of -7.8 in June (contraction).

9:15 AM ET: The consensus is for a 0.4% increase in Industrial Production in June, and an increase to 76.9% (from 76.7%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for July. The consensus is for a slight decrease to 71.0 from 71.5 in June.

Debt Ceiling Charade: S&P places U.S. on Credit Watch Negative, Possible Debt Deal taking shape

by Calculated Risk on 7/14/2011 08:24:00 PM

I hate to even mention this ...

From MarketWatch: S&P warns on U.S. debt, 50% chance of downgrade

Standard & Poor's Ratings Services said late Thursday it has placed U.S. sovereign credit ratings on watch for possible downgrade, saying the action "signals our view that, owing to the dynamics of the political debate on the debt ceiling, there is at least a one-in-two likelihood that we could lower the long-term rating on the U.S. within the next 90 days."Ezra Klein has some details on The debt deal that’s taking shape, and its drawbacks

I still think something will be worked out, but this interview with Stan Collender is a little scary. First on a meeting he had with some new representatives back in February:

What I took from that was, first, that the debt ceiling was going to be a lot more trouble than anyone realized. They did not want a negotiation there. There was a religious-like fervor on that point: Voting for the debt ceiling was a sin, and you can’t just sin a little.And later in the interview:

EK: What do you think the chance is we see a deal before Aug. 2?The debt ceiling is not a sin. I think there will be a deal, and I sure hope Collender is wrong.

SC: Less than 50-50.

EK: What’s the scenario for that? Is it something like the talks seem like they’re going somewhere, and then whatever the negotiators come up with unexpectedly fails on the floor after the Tea Party whips on it?

SC: Something like that. In the back of my mind I keep remembering something Peter Orszag said, which was you were going to need a combination of Democrats and Republicans in the House, and the only way that vote would be acceptable for Boehner to schedule is after negative market reaction that spooks people. It’s not unlike how TARP got through. The average member of Congress has got to be sitting there saying if I don’t vote for this, it’ll be a disaster, and if I do vote for it, it’ll be a disaster. So without the negative market effect, there’s not enough pressure. But remember Bachmann is running around saying there will be no negative effect.

EK: Which suggests to me that a market reaction could have a more significant effect on the psychology of some of these members of Congress than we give it credit for. They’re not prepared for it, and if it comes, it disproves some of the assumptions they’re working with.

SC: Right. And remember the general idea on Wall Street right now is that there will be a deal because there’s always a deal. But Wall Street works off of expectations. So if the market realizes they got this wrong, the reaction could be larger than expected