by Calculated Risk on 6/15/2011 12:43:00 PM

Wednesday, June 15, 2011

Core Measures of Inflation increased in May

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in May on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.6 percent before seasonal adjustment.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

The index for all items less food and energy rose 0.3 percent in May after increasing 0.1 percent in March and 0.2 percent in April. The shelter index rose 0.2 percent in May after increasing 0.1 percent in each of the seven previous months. Both rent and owners' equivalent rent rose 0.1 percent; the acceleration in shelter was due to the index for lodging away from home, which rose 2.9 percent in May after being unchanged in April.

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.8% annualized rate) during the month.Over the last 12 months, core CPI has increased 1.5%, median CPI has increased 1.5%, and trimmed-mean CPI increased 1.9%.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing.

Note: You can see the median CPI details for May here.

Although the year-over-year increases are below the Fed's inflation target, the annualized rates were above the target in May. However, with the slack in the system, the year-over-year core measures will probably stay near or be below 2% this year.

Earlier:

• NAHB Builder Confidence index declines in June

• Industrial Production edged up in May, Capacity Utilization unchanged

• Empire State Survey indicates contraction

• MBA: Mortgage Purchase Application activity increases

NAHB Builder Confidence index declines in June

by Calculated Risk on 6/15/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) declined to 13 in June from 16 in May. This is the lowest level since last September. Any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the June release for the HMI and the April data for starts (May housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Press release from the NAHB: Builder Confidence Declines Three Points in June

After holding at a low but steady level for the past six months, builder confidence in the market for newly built, single-family homes declined three points in June to a reading of 13 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The last time the index was this low was in September of 2010.Builders are very depressed, and the HMI has been below 25 for forty-eight consecutive months - 4 years!

...

"Builder confidence has waned even further as economic growth has stalled, foreclosures have continued to hit the market and the cost of building a home has risen," agreed NAHB Chief Economist David Crowe. "Meanwhile, potential new-home buyers are being constrained by difficulty selling their existing homes, stringent lending requirements, and general uncertainty about the economy.”

...

Every component of the HMI fell in June. The component gauging current sales conditions and the component gauging traffic of prospective buyers each fell two points, to 13 and 12, respectively. The component gauging sales expectations in the next six months fell four points to tie its record low score of 15 set in February and March of 2009.

Industrial Production edged up in May, Capacity Utilization unchanged

by Calculated Risk on 6/15/2011 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

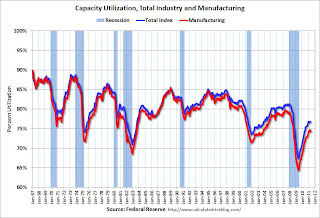

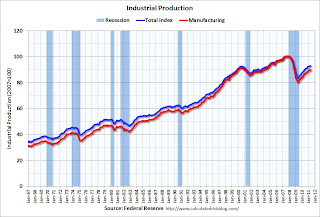

Industrial production edged up 0.1 percent in May, the second consecutive month with little or no gain. Revisions to total industrial production in months before May were small. In May, manufacturing production rose 0.4 percent after having fallen 0.5 percent in April. The output of motor vehicles and parts has been held down in the past two months because of supply chain disruptions following the earthquake in Japan. Excluding motor vehicles and parts, manufacturing output advanced 0.6 percent in May and edged down 0.1 percent in April; the decrease in April in part reflected production lost because of tornadoes in the South at the end of the month. ... At 93.0 percent of its 2007 average, total industrial production in May was 3.4 percent above its year-earlier level. Capacity utilization for total industry was flat at 76.7 percent, a rate 3.7 percentage points below its average from 1972 to 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 9.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is still "3.7 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production edged up slightly in May to 93.0.

Both industrial production and capacity utilization have stalled recently. The was below the consensus of a 0.2% increase in Industrial Production in May, and an increase to 77.0% for Capacity Utilization.

Misc: Empire State Survey indicates contraction, Inflation rate lower, French Bank Rating Reviewed

by Calculated Risk on 6/15/2011 08:30:00 AM

• From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated in June. The general business conditions index slipped below zero for the first time since November of 2010, falling twenty points to -7.8.This was well below expectations of a reading of 13.0. This is the first regional survey released for June and shows that manufacturing is contracting.

The new orders and shipments indexes also posted steep declines and fell below zero. The index for number of employees dropped fifteen points to 10.2.

• From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in May on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. ... The index for all items less food and energy increased 0.3 percent in May, its largest increase since July 2008.Even though the rate of inflation slowed, it was still higher than expected. The pickup in core inflation is bad news - I'll have more on inflation later.

• From the NY Times: Moody's to Review French Banks Over Greece Exposure

French banks were punished Wednesday for their exposure to the Greece after Moody’s Investors Service placed three of the largest on review for a possible downgrade.

Moody’s cited “concerns” about the exposure of BNP Paribas, Société Générale and Crédit Agricole to the Greek economy ...

MBA: Mortgage Purchase Application activity increases

by Calculated Risk on 6/15/2011 07:18:00 AM

The MBA reports: MMortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 16.5 percent from the previous week. The seasonally adjusted Purchase Index increased 4.5 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Mortgage rates have declined for 8 of the past 9 weeks. Coming off of the Memorial Day holiday, refinance application volume increased significantly, as borrowers jumped to lock in the lowest mortgage rates since last November," said Michael Fratantoni, MBA's Vice President of Research and Economics. "The volume of refinance applications still remains 28 percent below levels seen at that time, as borrowers with an incentive to refinance remain constrained from doing so by lack of equity in their homes."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.51 percent from 4.54 percent, with points increasing to 1.05 from 0.94 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the lowest 30-year average rate since November 19, 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of purchase activity is still at about 1997 levels. Of course there is a very high percentage of cash buyers right now, but this suggests weak existing home sales through mid-year (not counting cash buyers). Note that mortgage rates have fallen to the lowest level since last November and refinance activity has increased.

Tuesday, June 14, 2011

Residential Remodeling Index increases in April

by Calculated Risk on 6/14/2011 11:02:00 PM

The BuildFax Residential Remodeling Index was at 109.7 in April, up from 98.0 in March. This is based on the number of properties pulling residential construction permits in a given month.

From BuildFax:

The Residential BuildFax Remodeling Index rose 15% year-over-year—and for the eighteenth straight month—in April to 109.7, the highest April number in the index to date.

...

In April, all regions posted month-over-month gains, and only the Midwest posted a year-over-year loss.

...

According to Joe Masters Emison, vice president of research and development at BuildFax, “April traditionally sets a baseline for the rest of the year in residential remodeling activity, and April 2011 is the best we’ve seen since the beginning of the index in April 2004.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This is the highest level for the month of April since the index was started in 2004 - and even slightly above the levels for May in 2005 and 2006 (during the home equity and remodel boom).

Note: permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.

Since there is a strong seasonal pattern for remodeling, the second graph shows the year-over-year change from the same month of the previous year.The remodeling index is up 15% from April 2010.

As I mentioned earlier today in Key Question: Is the slowdown temporary?, Residential Investment (RI) is a leading indicator for the economy, and RI will will probably make a positive contribution to the economy this year for the first time since 2005. Even though new home construction is still moving sideways, it appears that two other components of residential investment will increase in 2011: multi-family construction and home improvement.

Data Source: BuildFax, Courtesy of Index.BuildFax.com

LA Port Traffic in May: Both Imports and Exports increased

by Calculated Risk on 6/14/2011 07:46:00 PM

The first graph shows the rolling 12 month average of loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for May. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, this graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is up 0.4% from April, and outbound traffic also up 0.4%.

The 2nd graph is the monthly data (with strong seasonal pattern).

For the month of May, loaded inbound traffic was up 5% compared to May 2010, and loaded outbound traffic was also up 5% compared to May 2010.

Exports are near the pre-recession peak in 2008, although imports in May were still below the levels of May 2006 and May 2007.

Exports are near the pre-recession peak in 2008, although imports in May were still below the levels of May 2006 and May 2007.

This suggests the trade deficit with China (and other Asians countries) probably increased seasonally in May.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/14/2011 04:11:00 PM

From economist Tom Lawler:

Based on my tracking of regional MLS that have reported data so far (not as large a sample as I would like), I estimate that existing home sales, as estimated by the National Association of Realtors, ran at a seasonally adjusted annual rate of 4.8 million in May, down about 5% from April’s pace, and down 15.5% from last May’s pace. Unadjusted sales should show a smaller YOY decline, as this May had one more business day than last May.

On the inventory front, active listings appeared to have increased modestly from April to May nationwide, but were down from a year ago in the vast majority of places – in some cases by a lot, in aggregate in the 7-8% range. What that means for the NAR’s inventory estimate, however, is not clear. Over the last several years the NAR’s existing home inventory estimate has shown MASSIVELY larger gains from March to April than have other listings sources (including realtor.com), but then showed either smaller gains or larger declines than other sources from April to May. In addition, NAR’s YOY inventory decline in April seemed materially lower than other data listing sources suggested.

Based on limited historical data I’d estimate that the NAR’s methodology will result in a reported 2.5% monthly decline in existing home inventory. That combination of sales and inventories would produce a NAR-defined “month’s supply” of 9.4 months, up from 9.2 months in April.

Shifting to pending sales, April’s seasonally adjusted 11.6% drop was surprisingly sharp and only partly explainable by “questionable” seasonal factors. Looking at the limited number of regional realtor associations/MLS/boards that report on “new” pending sales, it appears as if pending sales in aggregate showed a significant rebound from April to May. I estimate that the NAR’s Pending Home Sales Index will show a seasonally adjusted gain from April to May of around 11% -- suggesting that weather, flooding, oil prices, and “other stuff” may have had a temporarily negative impact on contract signings in April and closed sales in May, as well as a temporarily negative impact on other economic data for May.

CR Notes: The NAR reported existing home sales at a 5.05 million seasonally adjusted annual rate (SAAR) in April and inventory of 3.87 million units.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis through April. Sales in April 2011 (5.05 million SAAR) were 0.8% lower than in March, and were 12.9% lower than in April 2010.

Based on Tom Lawler's estimate, this will be the lowest level of inventory in May since 2006 and sales will decline 15.5% YoY. Of course sales in 2010 were boosted by the homebuyer tax credit.

No word yet on when the NAR will release their benchmark revision (expected this summer - and expected to show significant downward revisions to sales and inventory for the last several years).

Bernanke: "Failing to raise the debt ceiling would be self-defeating"

by Calculated Risk on 6/14/2011 02:45:00 PM

From Fed Chairman Ben Bernanke: Fiscal Sustainability

Fiscal sustainability is a long-run concept. Achieving fiscal sustainability, therefore, requires a long-run plan, one that reduces deficits over an extended period and that, to the fullest extent possible, is credible, practical, and enforceable. In current circumstances, an advantage of taking a longer-term perspective in forming concrete plans for fiscal consolidation is that policymakers can avoid a sudden fiscal contraction that might put the still-fragile recovery at risk.CR Note: The debt ceiling debate is a charade, and it helps to point out that at some point even the phony posturing will be "self-defeating".

...

Recently, negotiations over our long-run fiscal policies have become tied to the issue of raising the statutory limit for federal debt. I fully understand the desire to use the debt limit deadline to force some necessary and difficult fiscal policy adjustments, but the debt limit is the wrong tool for that important job. Failing to raise the debt ceiling in a timely way would be self-defeating if the objective is to chart a course toward a better fiscal situation for our nation.

...

In debating critical fiscal issues, we should avoid unnecessary actions or threats that risk shaking the confidence of investors in the ability and willingness of the U.S. government to pay its bills.

Key Question: Is the slowdown temporary?

by Calculated Risk on 6/14/2011 12:18:00 PM

The recent economic data indicated a slowdown in May: only 54,000 payroll jobs were added, auto sales declined significantly, retail sales were sluggish even excluding autos, growth in manufacturing slowed sharply, house prices continued to decline to new post-bubble lows (as of March), and home sales slowed.

This raises a key question: Is the recent economic slowdown temporary or is the U.S. heading into a "double dip" recession?

Some of the recent slowdown was related to the tragic events in Japan that started with the earthquake on March 11th. These events impacted the supply chain, especially for the automakers, and these disruptions negatively impacted manufacturing output in the U.S.

Also the sharp increase in oil and gasoline prices - partially attributable to events in the Middle East and North Africa - has impacted consumer sentiment and retail spending. Oil and gasoline prices have fallen in recent weeks, but are still up sharply from the end of 2010. (WTI futures averaged $85 per barrel in Q4 2010 and are now at $98 per barrel).

A third possible temporary impact has been the severe weather this year. Although there is always severe weather somewhere, the weather has been especially extreme this year from the massive snowstorms in the east, to the recent flooding along the Mississippi river.

But are these impacts temporary?

The supply chain disruptions are clearly temporary, and the good news is the supply issues are being resolved ahead of schedule. From Edmunds.com:

“Manufacturing disruptions appear to have peaked in April and May, and recent news points to steady improvements moving forward,” said Lacey Plache, chief economist at Edmunds.com. “Toyota said it expects North American production of its top-selling Camry and Corolla models to be back at 100 percent [in June], and Nissan’s key engine plant in Japan is returning to full production [in May]. Even Honda, which was the hardest hit of the big three Japanese automakers, is making optimistic statements about its recovery."Also the recent decline in oil and gasoline prices will help, although $100 oil is still a drag on the economy. The weather is unpredictable, but hopefully it will be less severe.

There are also several other ongoing drags on the economy. These include:

• Less Federal stimulus spending in 2011. The American Recovery and Reinvestment Act of 2009 (ARRA) is winding down, and will be a drag on GDP growth.

• The ongoing cuts in state and local spending.

• The festering financial crisis in Europe. Although the direct impact on U.S. trade would be minimal, there could be a significant financial impact on the U.S. if Greece (and other countries) default.

• The slowdown in China impacting U.S. exports.

• Another downturn in house prices.

Note: Since it appears that most of the impact from QE2 is due to the stock effect (as opposed to flow), the end of the buying program will probably have little impact on the economy.

And of course this is all on top of the generally fragile economy. My general outlook since mid-2009 has been for a sluggish and choppy recovery. Usually the deeper the recession, the steeper the recovery - however recoveries following a credit bubble-financial crisis tend to be sluggish.

There is still too much excess capacity in most of the economy for a large contribution from new investment (except in equipment and software). We see this excess capacity in housing, and in overall industrial production. As an example, domestic auto production is still only about 2/3 the level of 2006 - so there is no need to expand production. There is also excess capacity in office space, retail space, and other categories of commercial real estate. In addition, household debt, as a percent of income, remains very high and household deleveraging is ongoing.

Of course a sluggish recovery following a financial crisis is not unusual. From "The Aftermath of Financial Crises", Reinhart and Rogoff, 2009:

"An examination of the aftermath of severe financial crises shows deep and lasting effects on asset prices, output and employment. ... Even recessions sparked by financial crises do eventually end, albeit almost invariably accompanied by massive increases in government debt."To answer the key question we need to distinguish between the impact of these short terms issues (supply chain disruption, oil prices, weather), and the ongoing drags.

Although we can try to model the impact, it is hard to separate out the various factors. Note: Cleveland Fed economist Kenneth Beauchemin argues that "the shocks we experienced in the first quarter of 2011 have had measurable effects on both economic activity and consumer price inflation. However, as long as energy and other commodity prices do not continue to rise sharply, these effects are likely to be temporary and modest." See: Shocks and the Economic Outlook

I think the data will help us over the next month or two. If the impact was temporary, auto sales and manufacturing should rebound by July. If there are more severe issues, the weakness will persist.

We have to also remember that Residential Investment (RI) will probably make a positive contribution to the economy this year, for the first time since 2005. The five years of drag on GDP from RI (2006 through 2010) is the longest period on record, breaking the previous record of four years from 1930 to 1933. The positive contribution this year will mostly be due to a pickup in multifamily construction (apartments) and in home improvement. Of course single family housing starts will continue to struggle.

Since RI is the best leading indicator for the economy, I think a pickup in RI suggests the recovery will continue. This isn't perfect - nothing is - but RI is usually a strong leading indicator for the business cycle.

So for now I'll stick with my general forecast for 2011: growth will remain sluggish, but I expect 2011 to be better than 2010 for both employment and GDP growth.