by Calculated Risk on 5/10/2011 08:46:00 PM

Tuesday, May 10, 2011

Report: $5 Billion Mortgage Servicer Settlement being Discussed

So much for the $20 billion settlement, and it still isn't clear what would happen with the money ...

From the WSJ: Banks Float $5 Billion Deal to End Foreclosure Probe

The nation's biggest banks are willing to pay as much as $5 billion to settle claims by federal and state officials of improper mortgage-servicing practices, according to people familiar with the situation.Didn't the banks say no one was "wronged" in the foreclosure process?

Such an offer is considerably less than the amounts sought by state and federal officials, some of whom are asking for more than $20 billion in penalties.

...

The banks intend to propose that as much as $5 billion be used to compensate any borrowers previously wronged in the foreclosure process and provide transition assistance for borrowers who are ousted from their homes, according to people familiar with the matter. One idea is that foreclosed borrowers could receive several months of free rent once they find new housing, one of these people said.

Earlier:

• NFIB: Small Business Optimism Index declined in April

• CoreLogic: House Prices declined 1.5% in March, Prices now 4.6% below 2009 Lows

• Real CoreLogic House Price Index, and Price-to-Rent Ratio, back to 1999 Levels

Distressed House Sales using Sacramento data

by Calculated Risk on 5/10/2011 03:51:00 PM

The percent of distressed sales in Sacramento declined in April compared to March, because of a seasonal pickup in conventional sales, but this is the highest percentage of distressed sales for the month of April, since the Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This should be no surprise after Fannie and Freddie announced record REO sales in Q1. And we should see a high level of REO sales all year (putting pressure on house prices).

Note: I've been following the Sacramento market to see the change in mix (conventional, REOs, short sales) in a distressed area. Here are the statistics.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales increases every winter. The tax credits might have also boosted conventional sales in 2009 and early 2010.

Note: Prior to June 2009, it is unclear if short sales were included as REO or as "conventional" - or some of both.

In April 2011, 66.8% of all resales (single family homes and condos) were distressed sales. This is highest level of distressed sales for an April since Sacramento started breaking out distressed sales.

A high level of distressed sales suggests falling prices, and this data from Sacramento suggests further price declines in April.

Real CoreLogic House Price Index, and Price-to-Rent Ratio, back to 1999 Levels

by Calculated Risk on 5/10/2011 12:46:00 PM

By request, here is an update to a few graphs including the CoreLogic HPI released this morning (the March report is an average of January, February and March prices).

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 (through February release) and CoreLogic House Price Indexes (through March release) in nominal terms (as reported).

In nominal terms, the National index is back to Q1 2003 levels, the Composite 20 index is slightly above the May 2009 lows (and close to June 2003 levels), and the CoreLogic index is back to January 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to December 2000, and the CoreLogic index back to December 1999.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 (through February) and CoreLogic House Price Index (through March).

Here is a similar graph using the Case-Shiller Composite 20 (through February) and CoreLogic House Price Index (through March).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is just above the May 2009 levels (and about at November 2000 levels), and the CoreLogic index is back to December 1999.

I'll have more analysis when the March (and Q1) Case-Shiller index is released on May 31st, but the CoreLogic index suggests prices are back to 1999 levels in terms of price-to-rent and real prices.

Earlier:

• CoreLogic: House Prices declined 1.5% in March, Prices now 4.6% below 2009 Lows

CoreLogic: House Prices declined 1.5% in March, Prices now 4.6% below 2009 Lows

by Calculated Risk on 5/10/2011 10:09:00 AM

Notes: Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. CoreLogic reports the year-over-year change each month, and the headline for this post is for the change from February to March 2011. The CoreLogic HPI is a three month weighted average of January, February and March, and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Decline for 8th Straight Month

CoreLogic ... today released its March Home Price Index (HPI) which shows that home prices in the U.S. declined for the eight month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 7.5% in March 2011 compared to March 2010. ... Excluding distressed sales, year-over-year priced declined by 0.96 percent in March 2011 compared to March 2010.

Click on graph for larger image in graph gallery.

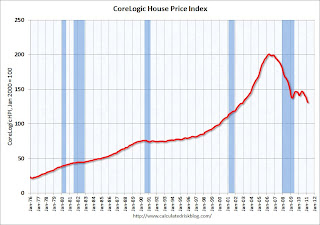

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 7.5% over the last year, and off 34.8% from the peak.

This is the eight straight month of year-over-year declines, and the ninth straight month of month-to-month declines. The index is now 4.6% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

NFIB: Small Business Optimism Index decreases in April

by Calculated Risk on 5/10/2011 07:30:00 AM

From National Federation of Independent Business (NFIB): Small-Business Optimism Index Dips for Second Consecutive Month in April

The Small Business Optimism Index fell 0.7 points in April to 91.2, not much but still a disappointing outcome following the March decline. After last month’s larger decline, this month is more akin to an “after shock”.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Thankfully, the labor market components did not decline further, although

net job creation weakened. Also, fewer reported adverse profit trends and

reports of positive sales trends were still less frequent than reports of

quarterly declines, but the best reading since December 2007, the peak of

the last expansion.

...

Twenty-five (25) percent of the owners reported that weak sales continued to be their top business problem

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The first graph shows the small business optimism index since 1986. The index decreased to 91.2 in April from 91.9 in March.

This has been trending up, although optimism has declined for two consecutive months now.

This graph shows the net hiring plans for the next three months.

This graph shows the net hiring plans for the next three months.Hiring plans were unchanged in April. According to NFIB: “The outlook for future employment growth remains unchanged from March: Only 16 percent plan to increase employment, and 6 percent plan to reduce their workforce, yielding a seasonally adjusted net 2 percent of owners planning to create new jobs in the next three months."

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in April. In good times, owners usually report taxes and regulation as their biggest problems.

Weak sales is still the top business problem with 25 percent of the owners reporting that weak sales continued to be their top business problem in April. In good times, owners usually report taxes and regulation as their biggest problems.The recovery continues to be sluggish for this index, probably partially because of the high concentration of real estate related companies. Most of the decline was due to "soft" components, especially future expectations.

Monday, May 09, 2011

Misc: Higher Margin requirements for Oil, Sheila leaving FDIC and Greece

by Calculated Risk on 5/09/2011 08:22:00 PM

• From MarketWatch: CME hikes oil, gasoline margin requirements (ht jb)

The requirement for a new position in benchmark New York Mercantile Exchange crude contracts rises to $8,438 from $6,750 previously, with margins also higher for contracts in benchmark Brent crude, gasoline and other products.• From the FDIC: FDIC Announces Chairman Bair's Official Departure Date

The Federal Deposit Insurance Corporation (FDIC) today announced Chairman Sheila C. Bair's official departure will be effective July 8th, 2011.• From the WSJ: Greek Woes Fuel Fresh Fears

• From the NY Times: Greece Pushes Plan to Raise Cash With Big Sales

No islands or beaches are up for sale, despite the persistent, usually snide suggestions from abroad that have riled many Greeks.Earlier:

• New York Fed's Q1 Report on Household Debt and Credit "Shows Signs of Healing in Consumer Credit Markets Since Last Quarter"

• AAR: Rail Traffic "mixed" in April

• Zillow on Negative Equity: 28.4% of all single-family homes with mortgages are "underwater"

Construction Employment Update

by Calculated Risk on 5/09/2011 06:02:00 PM

By request, here is an update to a graph I posted over a year ago on construction employment. Last year the outlook for construction employment was grim. This year will be a little better - but not much.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the number of construction payroll jobs (blue line), and the number of construction jobs as a percent of total non-farm payroll jobs (red line).

Construction employment is down 2.2 million jobs from the peak in April 2006, but up 26 thousand jobs so far this year.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential building employees in 1985, and residential specialty trade contractors in 2001). Usually residential investment (and residential construction) lead the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usually pickup in residential construction for previous recessions. Of course residential investment didn't lead the economy this time because of the huge overhang of existing housing units.

This table below shows the annual change in construction jobs (total, residential and non-residential).

| Annual Change in Payroll jobs (000s) | |||

|---|---|---|---|

| Year | Total Construction Jobs | Residential Construction Jobs | Non-Residential |

| 2002 | -85 | 88 | -173 |

| 2003 | 127 | 161 | -34 |

| 2004 | 290 | 230 | 60 |

| 2005 | 416 | 268 | 148 |

| 2006 | 152 | -62 | 214 |

| 2007 | -198 | -273 | 75 |

| 2008 | -787 | -510 | -277 |

| 2009 | -1053 | -431 | -622 |

| 2010 | -149 | -113 | -36 |

| Through April 2011 | 26 | 7 | 19 |

In 2011, for the first time since 2005, I expect residential construction employment to increase - mostly because of multi-family construction. I also expect residential investment to make a small positive contribution to GDP growth this year - also for the first time since 2005.

AAR: Rail Traffic "mixed" in April

by Calculated Risk on 5/09/2011 02:25:00 PM

The Association of American Railroads (AAR) reports carload traffic in April 2011 decreased 0.2 percent compared with the same month last year, and intermodal traffic (using intermodal or shipping containers) increased 9 percent compared with April 2010.

“April’s carload decline is the first year-over-year monthly decline since February 2010,” said AAR Senior Vice President John Gray. “April 2010 was a relatively strong month and therefore a difficult comparison, and coal traffic was down for the first time since July 2010. April’s carload decline was offset by continued intermodal growth. Rail traffic deserves a close watch over the next several months because it’s a useful gauge of the strength of the economy.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows U.S. average weekly rail carloads (NSA).

From AAR:

On a seasonally adjusted basis, total U.S. rail carloads fell 2.5% in April 2011 from March 2011, continuing the up-down-up-down trend of the past couple of years. As the chart shows, since the recession ended in mid-2009, the trend for seasonally adjusted U.S. carload traffic has clearly been upward, but over the past six months it’s been flat and over the past four months it’s actually been down a bit. Time will tell if the upward trend reappears.As the first graph shows, rail carload traffic collapsed in November 2008, and now, almost 2 years into the recovery, carload traffic has only recovered about half way.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):The news is much better on the intermodal side. In April 2011, U.S. railroads originated 914,518 intermodal trailers and containers, up 9.0% (75,706 units) over April 2010 and up 24.6% (180,417 units) over April 2009. April 2011’s weekly average was 228,630 units, up from 209,703 in April 2010 and the second highest average for any April in history (behind only April 2006).Intermodal traffic is close to old highs, but carload traffic is only about half way back to pre-recession levels.

Seasonally adjusted U.S. rail intermodal traffic was up 1.2% in April 2011 from March 2011, the fifth straight monthly increase.

excerpts with permission

Zillow on Negative Equity: 28.4% of all single-family homes with mortgages are "underwater"

by Calculated Risk on 5/09/2011 12:35:00 PM

Note: The most recent Negative Equity report from CoreLogic showed 11.1 million, or 23.1 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2010. With falling house prices, CoreLogic will probably show more homeowners have negative equity in Q1.

From Zillow: Negative equity reached a new high with 28.4 percent of all single-family homes with mortgages underwater

Negative equity reached a new high mark with 28.4 percent of single-family homeowners with mortgages underwater at the end of the first quarter, up from 27 percent in the fourth quarter of 2010. A homeowner is in negative equity when they owe more on their mortgage than their home is worth.The following table from Zillow shows negative equity percentages for the 25 largests MSAs. In a number of MSAs, more than half of single-family homes with mortgages have negative equity: Phoneix, Tampa, Atlanta, Riverside (CA), and Sacramento. Chicago, Minneapolis and Miami are all close. Las Vegas isn't included on this list, but according to CoreLogic, Nevada has the highest percentage of homes with negative equity.

...

With substantial home value declines, as well as increasing negative equity and foreclosures, Zillow forecasts show it is unlikely that home values will reach a bottom in 2011. First quarter data has prompted Zillow to revise its forecast, now predicting a bottom in 2012, at the earliest.

Largest 25 Metropolitan Statistical Areas Covered by Zillow | Zillow Home Value Index | ||||

Q1 2011 | QoQ Change | YoY Change | Change From Peak | Negative Equity* | |

United States | $169,600 | -3.0% | -8.2% | -29.5% | 28.4% |

New York, N.Y. | $346,600 | -1.6% | -5.3% | -24.2% | 17.1% |

Los Angeles, Calif. | $386,400 | -3.0% | -7.6% | -36.1% | 21.0% |

Chicago, Ill. | $167,900 | -4.8% | -13.8% | -38.1% | 45.7% |

Dallas, Tex. | $125,400 | -1.2% | -6.9% | -13.2% | n/a |

Philadelphia, Pa. | $187,600 | -3.2% | -10.3% | -20.5% | 22.1% |

Miami-Fort Lauderdale, Fla. | $137,300 | -1.8% | -12.8% | -55.4% | 47.7% |

Washington, D.C. | $305,900 | -1.5% | -7.0% | -30.3% | 29.5% |

Atlanta, Ga. | $121,100 | -4.4% | -17.3% | -33.7% | 55.7% |

Detroit, Mich. | $70,600 | -5.2% | -17.3% | -55.5% | 36.3% |

Boston, Mass. | $305,800 | -2.6% | -5.3% | -23.2% | 16.9% |

San Francisco, Calif. | $467,000 | -3.8% | -10.2% | -33.9% | 25.7% |

Phoenix, Ariz. | $126,100 | -2.3% | -11.2% | -55.3% | 68.4% |

Riverside, Calif. | $185,800 | -1.8% | -3.2% | -53.8% | 50.7% |

Seattle, Wash. | $259,200 | -1.7% | -11.7% | -32.1% | 34.4% |

Minneapolis-St. Paul, Minn. | $159,000 | -4.8% | -15.1% | -35.6% | 46.2% |

San Diego, Calif. | $347,500 | -2.1% | -5.5% | -35.3% | 26.0% |

St. Louis, Mo. | $127,900 | -4.0% | -9.6% | -18.7% | 31.2% |

Tampa, Fla. | $107,200 | -3.8% | -10.9% | -50.6% | 59.8% |

Baltimore, Md. | $218,300 | -2.5% | -9.8% | -27.5% | 29.6% |

Denver, Colo. | $192,300 | -2.7% | -9.6% | -17.2% | 41.0% |

Pittsburgh, Pa. | $105,800 | -0.2% | -0.1% | -5.1% | 6.8% |

Portland, Ore. | $203,300 | -3.0% | -12.1% | -30.6% | 35.9% |

Cleveland, Ohio | $108,500 | -3.9% | -9.1% | -24.7% | 41.4% |

Sacramento, Calif. | $207,400 | -4.2% | -11.0% | -50.1% | 51.2% |

Orlando, Fla. | $115,700 | -2.9% | -7.8% | -55.2% | n/a |

*Negative equity refers to the % of single-family homes with mortgages. | |||||

NY Fed Q1 Report on Household Debt and Credit

by Calculated Risk on 5/09/2011 10:00:00 AM

From the NY Fed: New York Fed's Quarterly Report on Household Debt and Credit Shows Signs of Healing in Consumer Credit Markets Since Last Quarter

The Federal Reserve Bank of New York released the Quarterly Household Debt and Credit Report for the first quarter of 2011 today, which showed signs of healing in the consumer credit markets. Evidence of improvement includes:Here is the Q1 report: Quarterly Report on Household Debt and Credit. Here are a couple of graphs:

• an increase in credit limits, by about $30 billion or 1%, for the first time since the third quarter of 2008;

• a steady number of open mortgage accounts, following a period of decline beginning in early 2008;

• continued decline of new foreclosures and new bankruptcies, down 17.7% and 13.3% respectively in the last quarter;

• a 15% decline of total delinquent balances, compared to a year ago; and

• a broad flattening of overall consumer debt balances outstanding.

Non-housing related debt, including credit cards, student loans, and auto loans, declined slightly (less than 1%), driven by a noticeable 4.6% decline in credit card balances. Credit inquiries, an indicator of consumer demand for new credit, came off their recent peak in the fourth quarter of 2010.

“We are beginning to see signs of credit markets healing gradually and evidence of greater willingness of consumers to borrow and banks to lend,” said Andrew Haughwout, vice president and New York Fed research economist.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows aggregate consumer debt increased slightly in Q1. From the NY Fed:

Aggregate consumer debt held essentially steady in the first quarter, ending a string of nine consecutive declining quarters. As of March 31, 2011, total consumer indebtedness was $11.5 trillion, a reduction of $1.03 trillion (8.2%) from its peak level at the close of 2008Q3, and $33 billion (0.3%) above its December 31, 2010 level.

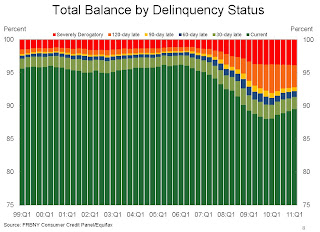

The second graph shows the percent of debt in delinquency. What stands out is that the percent of delinquent debt is declining, but the percent of severely derogatory debt is remaining the same.

The second graph shows the percent of debt in delinquency. What stands out is that the percent of delinquent debt is declining, but the percent of severely derogatory debt is remaining the same.From the NY Fed:

Total household delinquency rates declined for the fifth consecutive quarter in 2011Q1. As of March 31, 10.5% of outstanding debt was in some stage of delinquency, compared to 10.8% on December 31, 2010 and 11.9% a year ago. About $1.2 trillion of consumer debt remains delinquent and $890 billion is seriously delinquent (at least 90 days late or “severely derogatory”). Compared to a year ago, both delinquent and seriously delinquent balances have fallen 15%.There are a number of credit graphs at the NY Fed site.