by Calculated Risk on 1/31/2011 08:30:00 AM

Monday, January 31, 2011

Personal Income and Outlays Report for December

The BEA released the Personal Income and Outlays report for December this morning.

Personal income increased $54.5 billion, or 0.4 percent ... Personal consumption expenditures (PCE) increased $69.5 billion, or 0.7 percent.The following graph shows real Personal Consumption Expenditures (PCE) through December (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in December, compared with an increase of 0.2 percent in November.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter. Consumption picked up sharply in Q4.

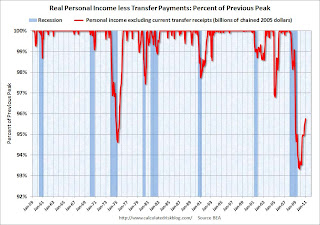

Also personal income less transfer payments increased again in December. This increased to $9,327 billion (SAAR, 2005 dollars) from $9,310 billion in November.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.3% below the previous peak - but personal income less transfer payments is growing again.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.3% below the previous peak - but personal income less transfer payments is growing again.Some of the increase in spending came from a decline in the personal saving rate that fell to 5.3% in December.

Personal saving as a percentage of disposable personal income was 5.3 percent in December, compared with 5.5 percent in November.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the December Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the December Personal Income report. When the recession began, I expected the saving rate to rise to 8% or more. With a rising saving rate, consumption growth would be below income growth. But that 8% rate was just a guess. It is possible the saving rate has peaked, or it might rise a little further, but either way most of the adjustment has already happened.

There is still a long way to go. I'd like to see personal income less transfer payments above the pre-recession peak, and I'd like to see personal consumption not growing faster than personal income.

Weekend on U.S. economy:

• Summary for Week ending January 29th

• Schedule for Week of January 30th

• BLS Employment Revisions on Feb 4th

Sunday, January 30, 2011

Inflation in China

by Calculated Risk on 1/30/2011 11:31:00 PM

On inflation in China ...

• From Keith Bradsher at the NY Times: Inflation in China May Limit U.S. Trade Deficit

Inflation is starting to slow China’s mighty export machine, as buyers from Western multinational companies balk at higher prices and have cut back their planned spring shipments across the Pacific.• And from Paul Krugman: A Cross of Rubber

While recovery in advanced nations has been sluggish, developing countries — China in particular — have come roaring back from the 2008 slump. This has created inflation pressures within many of these countries; it has also led to sharply rising global demand for raw materials.Egypt and U.S. Futures: Here is the Al Jazeera live Egypt blog for January 31st. The Asian markets are mostly off about 1% to 1.5% tonight.

... inflation in China is China’s problem, not ours. It’s true that right now China’s currency is pegged to the dollar. But that’s China’s choice; if China doesn’t like U.S. monetary policy, it’s free to let its currency rise. Neither China nor anyone else has the right to demand that America strangle its nascent economic recovery just because Chinese exporters want to keep the renminbi undervalued.

CNBC's Pre-Market Data shows the S&P 500 and Dow futures flat. Not much of a reaction.

Earlier on U.S. economy:

• Summary for Week ending January 29th

• Schedule for Week of January 30th

• BLS Employment Revisions on Feb 4th

Egypt Updates

by Calculated Risk on 1/30/2011 06:12:00 PM

Here is the Monday live Egypt blog from Al Jazeera. Other resources: The Lede at the NY Times and the Guardian

From the WSJ: Egypt Opposition Picks a Leader

The Egyptian government, with newly appointed military generals in top positions, struggled to impose order and present a show of unified strength on Sunday, but it showed no signs of bending to demands that President Hosni Mubarak resign.From the NY Times: Opposition Rallies to ElBaradei as Military Reinforces in Cairo

The Egyptian uprising, which emerged as a disparate and spontaneous grass-roots movement, began to coalesce Sunday, as the largest opposition group, the Muslim Brotherhood, threw its support behind a leading secular opposition figure, Mohamed ElBaradei, to negotiate on behalf of the forces seeking the fall of President Hosni Mubarak.

BLS Employment Revisions on Feb 4th

by Calculated Risk on 1/30/2011 02:05:00 PM

Earlier:

• Summary for Week ending January 29th

• Schedule for Week of January 30th

On Feb 4th, with the release of the January employment report, the BLS will make the following three changes / revisions:

1) Annual Benchmark revision to the Establishment Survey Data

With the release of January 2011 data on February 4, 2011, the Current Employment Statistics survey will introduce revisions to nonfarm payroll employment, hours, and earnings data to reflect the annual benchmark adjustments for March 2010 and updated seasonal adjustment factors. Not seasonally adjusted data beginning with April 2009 and seasonally adjusted data beginning with January 2006 are subject to revision.Last October the BLS released the preliminary annual benchmark revision of minus 366,000 payroll jobs. Usually the preliminary estimate is pretty close to the final benchmark estimate.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the impact of the preliminary benchmark revision on job losses in percentage terms from the start of the employment recession.

The red line on the graph is the current payroll estimate, and the dotted line shows the impact using the preliminary benchmark estimate. This means that payroll employment in March 2010 was 366,000 lower than originally estimated (using the preliminary estimate). The number is then "wedged back" to the previous revision (March 2009). This is slightly larger than a normal adjustment (see table in the post from last October).

2) Birth/death adjustment factors will be estimated on a quarterly basis

Effective with the release of January 2011 data on February 4, 2011, the establishment survey will begin estimating net business birth/death adjustment factors on a quarterly basis, replacing the current practice of estimating the factors annually. This will allow the establishment survey to incorporate information from the Quarterly Census of Employment and Wages into the birth/death adjustment factors as soon as it becomes available and thereby improve the factors. Additional information on this change is available at www.bls.gov/ces/ces_quarterly_birthdeath.pdf.This should improve the accuracy of the model at turning points.

3) Changes in Population Controls for Household Survey

Effective with the release of data for January 2011 on February 4, 2011, revisions will be introduced into the population controls for the household survey. These changes reflect the routine annual updating of intercensal population estimates by the U.S. Census Bureau.

Summary for Week ending January 29th

by Calculated Risk on 1/30/2011 09:43:00 AM

Note: here is the economic schedule for the coming week.

• The Financial Crisis Inquiry Commission report was released. Here are the conclusions.

• Protest in Egypt: Ongoing. Link for Al Jazeera English version and Live blog 30/1 - Egypt protests

Below is a summary of the previous week, mostly in graphs.

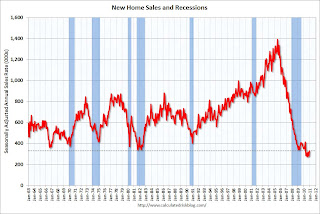

• New Home Sales increased in December

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

The Census Bureau reported New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 329 thousand. This is up from a revised 280 thousand in November.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The second graph shows existing home sales (left axis) and new home sales (right axis) through December.

The second graph shows existing home sales (left axis) and new home sales (right axis) through December.

This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

• Case-Shiller: U.S. Home Prices Keep Weakening as Eight Cities Reach New Lows in November

S&P/Case-Shiller released the monthly Home Price Indices for November (actually a 3 month average of September, October and November).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.0% from the peak, and down 0.4% in November(SA).

The Composite 20 index is off 30.9% from the peak, and down 0.5% in November (SA).

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 3 of the 20 Case-Shiller cities in November seasonally adjusted.

Prices increased (SA) in only 3 of the 20 Case-Shiller cities in November seasonally adjusted.

Prices in Las Vegas are off 57.8% from the peak, and prices in Dallas only off 8.9% from the peak.

Prices are now falling - and falling just about everywhere. As S&P noted "eight markets – Atlanta, Charlotte, Detroit, Las Vegas, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices peaked in 2006 and 2007". Both composite indices are still slightly above the post-bubble low.

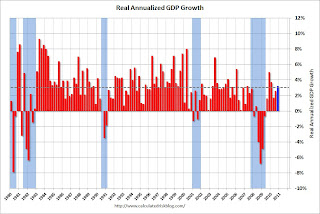

• Advance Report: Real Annualized GDP Grew at 3.2% in Q4

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the median growth rate of 3.05%. Growth in Q4 at 3.2% annualized was slightly above trend growth - weak for a recovery, especially with all the slack in the system.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the median growth rate of 3.05%. Growth in Q4 at 3.2% annualized was slightly above trend growth - weak for a recovery, especially with all the slack in the system.

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For this graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

For this graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

• Moody's: Commercial Real Estate Prices increased 0.6% in November

Moody's reported that the Moody’s/REAL All Property Type Aggregate Index increased 0.6% in November.

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are up 2.8% from a year ago and down about 42% from the peak in 2007.

• Other Economic Stories ...

• From the Telegraph: UK economy shrinks 0.5pc

• From the BLS: Regional and State Employment and Unemployment Summary

• From the Federal Reserve: No Change in policy.

• From the NAR: Pending Home Sales Continue Uptrend

• From Bloomberg: Mortgage Rates on 30-Year U.S. Loans Increase for the Second Straight Week

• From RealtyTrac: 2010 Foreclosure Activity Down in Hardest Hit Markets But Increases in 72 Percent of Major Metros

• From the Richmond Fed: Manufacturing Activity Continues to Expand in January; Expectations Remain Upbeat

• From the Kansas City Fed: Survey of Tenth District Manufacturing

• ATA Truck Tonnage Index increased in December

• The Department of Transportation (DOT) reported that vehicle miles driven in November were up 1.1% compared to November 2009

• Unofficial Problem Bank list increases to 949 Institutions

Best wishes to all!

Saturday, January 29, 2011

Some misc links: Egypt, Oil, China GDP

by Calculated Risk on 1/29/2011 10:45:00 PM

• Some analysis from Professor Hamilton at Econbrowser: Geopolitical unrest and world oil markets

• From the WSJ: Chaos, Looting Spread as Mubarak Names Key Deputies

• From the WaPo: More Egyptian protesters demand that White House condemn Mubarak

• Link for Al Jazeera English version and Live blog 30/1 - Egypt protests

And on other topics:

• From Professor Michael Pettis: How big is Chinese GDP?

• This will be a busy week for U.S. data: Schedule for Week of January 30th

Update: Revisions to Existing Home Sales

by Calculated Risk on 1/29/2011 06:56:00 PM

More clarification:

• On February 23rd, the National Association of Realtors (NAR) will release revisions for the past three years (2008 through 2010) along with the January existing home sales report. This is the ordinary annual revision, and the revisions will probably be minor.

• The NAR is working on benchmarking existing home sales for previous years with other industry data. There is no planned release date for these possible revisions - if any are announced. The process is expected to be completed sometime after mid-year, and I expect this effort will lead to significant downward revisions to previously reported sales.

Schedule for Week of January 30th

by Calculated Risk on 1/29/2011 02:18:00 PM

NOTE: The current weekly schedule is available all week in the menu bar above.

The key report for this week will be the January employment report to be released on Friday, Feb 4th.

Other key reports include the quarterly Housing Vacancies and Homeownership report to be released on Monday, the ISM manufacturing index on Tuesday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Thursday. Fed Chairman Ben Bernanke will speak on Thursday.

8:30 AM: Personal Income and Outlays for December. The consensus is for a 0.4% increase in personal income and a 0.5% increase in personal spending, and for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a decrease to a still strong 65.0 (down from 66.8 in December).

10:00 AM: Housing Vacancies and Homeownership report for Q4. This report contains an estimate for the homeownership rate, and for the homeowner and rental vacancy rates.

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.The Q3 2010 homeownership rate was at 66.9% - about the level of early 1999.

For this report, the homeowner vacancy rate was at 2.5% in Q3 2010 (down from a peak of 2.9%) and the rental vacancy rate was at 10.3% in Q3 2010, down from a peak of 11.1%. Both vacancy rates probably fell further in Q4.

10:30 AM: Dallas Fed Manufacturing Survey for January. The Texas production index showed expansion last month (at 12.8), and is expected to show expansion again in January.

12:00 PM: Atlanta Fed President Dennis Lockhart speaks at Miami Dade College

2:00 PM: The January 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve. The October survey showed banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans).

10:00 AM: ISM Manufacturing Index for January. The consensus is for an increase to 57.9 from 57.0 in December.

10:00 AM: Construction Spending for December. The consensus is for a 0.1% increase in construction spending.

All day: Light vehicle sales for January. Light vehicle sales are expected to increase to 12.6 million (Seasonally Adjusted Annual Rate), from 12.5 million in December.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate. Edmunds is forecasting:

"Edmunds.com analysts predict that January's Seasonally Adjusted Annualized Rate (SAAR) will be 12.57 million, up from 12.48 in December 2010."

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has declined over the last few weeks suggesting weak home sales through the first few months of 2011.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for +150,000 payroll jobs in January, down from the stunning +297,000 jobs reported in December.

5:30 PM: Fed Governor Elizabeth Duke speaks at the University of North Carolina "My Journey from Community Banker to Central Banker"

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims had been trending down over the last couple of months, although claims increased sharply last week to 454,000. The consensus is for a decline to 420,000.

10:00 AM: Manufacturers' Shipments, Inventories and Orders for December. The consensus is for a 1.0% increase in orders.

10:00 AM: ISM non-Manufacturing Index for December. The consensus is for a slight decrease to 57.0 from 57.1 in December.

12:30 PM: Fed Chairman Ben Bernanke will speak at the National Press Club Luncheon in Washington, D.C. "The Economic Outlook and Macroeconomic Policies"

8:00 PM: Minneapolis Fed President Narayana Kocherlakota speaks at the University of Minnesota.

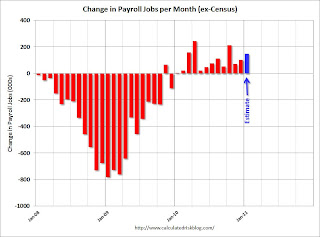

8:30 AM: Employment Report for January.

The consensus is for an increase of 150,000 non-farm payroll jobs in January, after the disappointing 103,000 jobs added in December.

The consensus is for an increase of 150,000 non-farm payroll jobs in January, after the disappointing 103,000 jobs added in December. This graph shows the net payroll jobs per month (excluding temporary Census jobs) since the beginning of the recession. The estimate for January is in blue.

The consensus is for the unemployment rate to increase to 9.5% from 9.4% in December. Note: The annual benchmark revision will be released with this report, and the preliminary estimate "indicates a downward adjustment to March 2010 total nonfarm employment of 366,000."

Unofficial Problem Bank list increases to 949 Institutions

by Calculated Risk on 1/29/2011 10:26:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 28, 2011.

Changes and comments from surferdude808:

Not the safest week in banking as the FDIC released its formal enforcement actions for December 2010 and closed four institutions including the largest bank headquartered in New Mexico. This week there were 15 additions and three removals. The changes leave the Unofficial Problem Bank list at 949 institutions with assets of $410.9 billion, up from 937 institutions with assets of $409.4 billion.

The removals include three of the four failures -- First Community Bank, Taos, NM ($2.3 billion Ticker: FSNM); Firstier Bank, Louisville, CO ($782 million); and Evergreen State Bank, Stoughton, WI ($246 million). The other failure this week -- The First State Bank, Camargo, OK was only placed under enforcement action in December 2010 (35 days before it failed) by the FDIC so it never made an appearance on the Unofficial Problem Bank List.

Among the 13 additions are First Federal Savings Bank of Elizabethtown, Elizabethtown, KY ($1.2 billion Ticker: FFKY); The Heritage Bank, Hinesville, GA ($952 million); First American International Bank, Brooklyn, NY ($604 million); Park Federal Savings Bank, Chicago, IL ($216 million Ticker: PFED); and Premier Service Bank, Riverside, CA ($157 million Ticker: PSBK).

Other changes include the issuance of Prompt Corrective Action orders by the FDIC against The Bank of Commerce, Wood Dale, Il ($174 million) and the Federal Reserve against Virginia Business Bank, Richmond, VA ($129 million). Positively, the FDIC terminated the PCA order against AmericanWest Bank, Spokane, WA ($1.5 billion Ticker: AWBCQ).

After the monthly release of actions by the FDIC, it would not be unusual for the Unofficial Problem Bank List to trend down until the middle of next month as closings tend to outpace new order issuance during this part of the month. Overall, if trends persist, the list could hit CR's anticipated [1000] mark by the end of May 2011.

ATA Truck Tonnage Index increased in December

by Calculated Risk on 1/29/2011 08:55:00 AM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 2.2 Percent in December

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.2 percent in December after falling a revised 0.6 percent in November. The latest improvement put the SA index at 111.6 (2000=100) in December, which was the highest level since September 2008. In November, the SA index equaled 109.2.

...

ATA Chief Economist Bob Costello said that December’s improvement fits well with the see-saw pattern that many carriers are reporting. “Fleets continue to tell me that freight volumes are very choppy – up one week, but down the next. That is a trend that is likely to continue this year as the economy is not growing across the board yet.” Still, Costello said it was a positive sign for the economy that SA tonnage reached the highest level in 27 months. “I continue to expect truck freight tonnage to grow modestly during the first half of 2011 and accelerate in the later half of the year into 2012.”

Click on map for graph gallery.

Click on map for graph gallery.This graph from the ATA shows the Truck Tonnage Index since Jan 2006.

This is the highest level since September 2008 - and it appears truck tonnage is increasing again after stalling out last spring and summer.