by Calculated Risk on 1/20/2011 05:15:00 PM

Thursday, January 20, 2011

Market Update

I haven't posted this graph in some time ...

From Doug Short: Current Market Snapshot: S&P 500 Closes Down But Well off the Intraday Low

The S&P 500 closed the day down 0.13%. The index is 89.2% above the March 9 2009 closing low, which puts it 18.2% below the nominal all-time high of October 2007.

Earlier on Existing Home sales:

• December Existing Home Sales: 5.28 million SAAR, 8.1 months of supply

• Existing Home Inventory increases 8.4% Year-over-Year in December

Comments on the Philly Fed Survey

by Calculated Risk on 1/20/2011 02:31:00 PM

Just getting back to this ...

From the Philly Fed: January 2011 Business Outlook Survey

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, edged down slightly from a revised reading of 20.8 in December to 19.3 in January. [anything above 0 shows expansion]That is all good news. The concern is the pickup in both prices paid and received:

...

The new orders index increased 13 points this month, the fourth consecutive monthly increase.

...

The current employment index increased 13 points [to 17.6], and for the fifth consecutive month, the percentage of firms reporting an increase in employment (25 percent) is higher than the percentage reporting a decline (7 percent).

Price increases for inputs as well as firms' own manufactured goods are more widespread this month. Fifty-four percent of the firms reported higher prices for inputs, compared with 52 percent in the previous month. ... More firms reported increases in prices (26 percent) than reported decreases (9 percent), and the prices received index increased 8 points, its second consecutive positive reading.

Click on graph for larger image in new window.

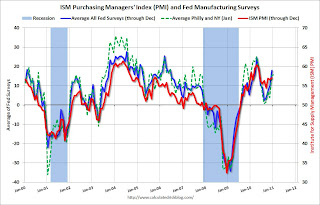

Click on graph for larger image in new window.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through January. The ISM and total Fed surveys are through December.

This early reading suggests the ISM index will be in the high 50s again this month.

Overall the Philly Fed survey was positive.

Existing Home Inventory increases 8.4% Year-over-Year in December

by Calculated Risk on 1/20/2011 11:29:00 AM

Earlier the NAR released the existing home sales data for December; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

IMPORTANT: On a seasonal basis, inventory usually bottoms in December and January, and then will start increasing again in February and March. Since the NAR "months-of-supply" metric uses Seasonally Adjusted (SA) sales, but Not Seasonally Adjusted (NSA) inventory, this seasonal decline in inventory leads to a lower "months-of-supply" in December and January.

The key is to recognize the seasonal pattern, and watch the YoY change in inventory.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Although inventory decreased from November to December, inventory increased 8.4% YoY in December.

This was one of the key metrics I used in 2005 to call the top of the housing bubble in activity. This is the largest year-over-year increase in inventory since January 2008 and this is something to watch closely over the next few months.

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

By request - the second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns are for 2010.

Sales NSA were above the level in 2007 and 2008, but below the level in 2009.

The bottom line: Sales rebounded in December to just above Tom Lawler's forecast. This was probably due to a combination of low mortgage rates, falling house prices - expecially for distressed properties, and investor buying at the low end.

Inventory remains very high, and the year-over-year increase in inventory is very concerning.

December Existing Home Sales: 5.28 million SAAR, 8.1 months of supply

by Calculated Risk on 1/20/2011 10:00:00 AM

The NAR reports: December Existing-Home Sales

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, rose 12.3 percent to a seasonally adjusted annual rate of 5.28 million in December from an upwardly revised 4.70 million in November, but remain 2.9 percent below the 5.44 million pace in December 2009.

...

Total housing inventory at the end of December fell 4.2 percent to 3.56 million existing homes available for sale, which represents an 8.1-month supply at the current sales pace, down from a 9.5-month supply in November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December 2010 (5.28 million SAAR) were 12.3% higher than last month, and were 2.9% lower than December 2009.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.56 million in December from 3.72 million in November. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall - and then really declining during the holidays. So this decline was expected.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 8.1 months in December from 9.5 months in November. The months of supply will probably increase over the next few months as sales slow a little, and inventory increases. This is still higher than normal.

These sales numbers were above the consensus of 4.9 million SAAR, and are slightly above what I expected (Lawler's forecast was 5.13 million). I'll have more later.

Weekly Initial Unemployment Claims decrease to 404,000

by Calculated Risk on 1/20/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 15, the advance figure for seasonally adjusted initial claims was 404,000, a decrease of 37,000 from the previous week's revised figure of 441,000. The 4-week moving average was 411,750, a decrease of 4,000 from the previous week's revised average of 415,750.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims for the last 10 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 4,000 to 411,750.

This was lower than consensus expectations of a decline to 420,000. The sharp decline in the four week average over the last few months is good news.

Wednesday, January 19, 2011

Europe Update

by Calculated Risk on 1/19/2011 10:27:00 PM

There was a rumor that Greece might buy back their own debt using loans from the EFSF:

• From Jack Ewing at the NY Times: For Greece, Buyback Of Bonds Is Floated

The latest speculation about a Greek restructuring was prompted by a report in the national weekly Die Zeit on Wednesday, as well as statements by two ministers of the Greek government who said Tuesday that extending debt repayments would be a good idea.And of course Greek officials denied the story:

• From Bloomberg: Greece Says No Debt Restructuring Amid `Complicated' EU Talks

“At the moment an extremely difficult and complicated discussion is taking place on how there will be a collective solution to the problem we have,” [Greek Finance Minister George] Papaconstantinou said in an interview on Mega Television in Athens. “In this discussion there are many opinions. I want to say that the government isn’t thinking along the lines of debt restructuring.”A German has a different view:

• From Bloomberg: EU's Leaders Must End Debt Restructuring `Taboo,' German CDU's Lauk Says

European leaders should drop their “taboo’ against debt restructuring, the head of the business caucus of German Chancellor Angela Merkel’s party said ... “I would recommend looking at it very closely, stop declaring it taboo and do the appropriate analysis to see where that would lead,” Kurt Lauk, president of the Christian Democratic Union’s Economic CouncilMeanwhile Spain is preparing to bail out the cajas (local banks):

• From the WSJ: Spain to Ramp Up Bailout of Banks

Spain plans to pour billions more euros into its troubled savings banks ... In a first step, Spain is preparing to issue €3 billion ($4 billion) in debt in coming days, the people familiar with the matter said. Government officials are putting plans in place to eventually raise as much as €30 billion ...Just another fun day in Europe. Here are the Ten Year yields for Spain, Portugal, Ireland and Greece (no huge changes).

DataQuick: SoCal Homes Sales increase in December

by Calculated Risk on 1/19/2011 06:15:00 PM

From DataQuick: Southern California Home Sales End 2010 Up from November, Down from ‘09

Southland December home sales shot up more than usual from November but fell well short of last year as a sluggish job market, tight credit, and record-low new-home sales undermined the market.The NAR will release Existing Home Sales for December tomorrow morning. The consensus is for sales of 4.9 million at a Seasonally Adjusted Annual Rate (SAAR) in December, up about 5% from the 4.68 million SAAR in November. Economist Tom Lawler is projecting sales of 5.13 million SAAR in December.

...

“Ultra-low mortgage rates, coupled with lower prices, gave the market a boost this fall, helping to explain the above-average gain in closings between November and December. We still see the potential for sales to perk up this spring if rates stay low and brighter economic news lifts consumer confidence. ... ” said John Walsh, DataQuick president.

“Looking back at 2010, it’s hard to ignore the ongoing slump in the Southland’s new-home market,” he continued. “Last year we saw the lowest sales by builders in two decades – less than half the annual average since 1988. 2009 wasn’t much better. What happens next will hinge largely on the pace of the economic recovery and the manner in which lenders manage their inventories of distressed properties, which are competition for new homes.”

In addition to sales, the level of inventory and months-of-supply will be very important (since months-of-supply impacts prices). The months-of-supply will probably be in the low 8 months range, down sharply from the 9.5 months reported for November. However some of the decline is seasonal, and inventory should increase again in February.

Summary on Multi-Family Theme

by Calculated Risk on 1/19/2011 03:43:00 PM

A key theme this year will be record low multi-family completions and an increase in multi-family starts.

Here are few data points:

• The Housing Starts report this morning showed a jump in multi-family permits in December to a 172,000 Seasonally Adjusted Annual Rate (SAAR) from 107,000 in November. For the first eleven months of the year, the 5+ unit permits averaged 120,000 per month. This is volatile, but a significant increase. Update: A caution via Bloomberg:

A jump in building permits, a proxy for future construction, may reflect attempts to get approval before changes in building codes took effect at the beginning of this year.• The Architecture Billings Index is at the highest level since Dec 2007 and mostly because of multi-family. From the AIA this morning: "Sector index breakdown: multi-family residential (60.1), commercial / industrial (52.7), institutional (50.6), mixed practice (47.8)"

Anything above 50 indicates expansion, and a 60.1 reading indicates a significant increase in multi-family billings.

I posted some thoughts from the NMHC Apartment Strategies Conference in Palm Springs yesterday:

• NMHC: Is the recovery real for apartments?

• Apartments: "Consensus has a high price"

It was clear from the discussions at the conference that multi-family starts will increase in 2011 and 2012.

These are the key two points: 1) there will be record low multi-family completions in 2011 (helping reduce the excess housing supply) and 2) an increase in multi-family starts in 2011 will make a positive contribution to GDP and employment growth.

Record Low Housing Completions in 2010

by Calculated Risk on 1/19/2011 12:11:00 PM

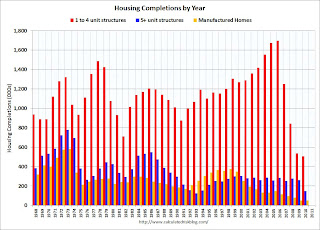

This is a key story: there were a record low number of housing completions in 2010, breaking the record set in 2009.

The total for single family, multi-family and manufactured homes (estimated) was 703 thousand units in 2010. That is about 17% below the 844 units completed in 2009 (including manufactured homes). The previous record low was 1.244 million in 1982.

As Tom Lawler noted, there will be record low number of multi-family units completed in 2011 - since it takes over a year on average to complete - and probably a record low number of total units.

Note: Multi-family completions will be at a record low this year, but starts will increase.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows annual completions for 1 to 4 units, 5+ units and manufactured homes.

In 2010, 1 to 4 unit completions were at a record low 506 thousand. This was just below the 534 thousand units completed in 2009. This is far below the previous record low of 712 thousand units in 1982.

For 5+ units, completions were at 147 thousand units. This was just above the record low of 127 thousand in 1993 - and that record will be broken in 2011.

This doesn't include demolitions that were probably in the 200 to 300 thousand unit range. This suggest the excess supply was reduced in 2010, and will probably be significantly reduced in 2011. Of course this also depends on household formation - and that means jobs.

Housing Starts Decline in December

by Calculated Risk on 1/19/2011 08:30:00 AM

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Total housing starts were at 529 thousand (SAAR) in December, down 4.3% from the revised November rate of 553 thousand, and up 11% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts decreased 9.0% to 417 thousand in December - the lowest level since early 2009.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight ups and downs due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight ups and downs due to the home buyer tax credit.

There was an increase in permits, especially for multi-family units.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was below expectations of 550 thousand starts. The low level of starts is good news for housing, and I expect Starts to stay low until more of the excess inventory of existing homes is absorbed. But I do expect starts to increase in 2011 from this low level.

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 529,000. This is 4.3 percent (±14.1%)* below the revised November estimate of 553,000 and is 8.2 percent (±14.4%)* below the December 2009 rate of 576,000.

Single-family housing starts in December were at a rate of 417,000; this is 9.0 percent (±11.7%)* below the revised November figure of 458,000.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 635,000. This is 16.7 percent (±2.1%) above the revised November rate of 544,000, but is 6.8 percent(±2.8%) below the December 2009 estimate of 681,000.

Single-family authorizations in December were at a rate of 440,000; this is 5.5 percent (±2.3%) above the revised November figure of 417,000.