by Calculated Risk on 1/09/2011 06:07:00 PM

Sunday, January 09, 2011

Europe Update: Portugal

This might be an interesting week ...

From Marcus Walker at the WSJ: Portugal's Test of Debt Market Looms This Week

Portugal hopes to raise new funds in a bond auction on Wednesday ... European Union governments including Germany and France have for weeks been urging Portugal to apply for rescue loans from the joint EU-International Monetary Fund bailout facility ...The yield on the Portugal 10-year bond is at 7.1%.

the EU's deliberations over Portugal haven't reached the intensity seen ahead of the Greek and Irish rescues ... That could change quickly, however, should Portugal's borrowing costs continue to rise. Euro-zone finance ministers are set to meet Jan. 17, by which time the market's appetite for Portuguese debt should be clear.

If the bond auction goes OK, maybe yields will fall. If not, we might see the 'intensity of deliberations' increase next weekend.

Earlier:

• Summary for Week ending January 8th

• Schedule for Week of January 9th

California Governor calls for tax extensions, spending cuts

by Calculated Risk on 1/09/2011 02:15:00 PM

From the LA Times: Gov. Jerry Brown wants to tame budget with tax extensions, deep cuts

To tame the state's chronic budget shortfalls, the Democratic governor will request cuts in a broad array of state programs and services, particularly those that lend a hand to the needy, according to those familiar with his plan.The Sacramento Bee has many of the details. And the LA Times has an interactive tool California budget balancer

He will call on lawmakers to sharply curb welfare spending by reducing eligibility and payouts and cutting the duration of benefits from five years to four. Under Brown's plan, Medi-Cal would let patients see the doctor less often and would require them to pay more when they do. Children in the state's Healthy Families insurance program would no longer receive vision coverage, and their families would pay more for medical care.

The governor will also ask voters to approve an extension of 2009 tax hikes on their incomes, purchases and vehicles in a spring special election, insiders say, and he will tie the tax extension to protecting school funding.

State and local government budgets (and debt) will be significant issue all across the country in 2011. I'm especially pessimistic about California - it would take a miracle to make any progress.

Summary for Week ending January 8th

by Calculated Risk on 1/09/2011 09:08:00 AM

Note: here is the economic Schedule for Week of January 9th.

Below is a summary of the previous week, mostly in graphs.

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

The BLS reported that payroll employment increased by 103,000 in December, and the unemployment rate declined to 9.4 percent.

Click on graph for larger image.

Click on graph for larger image.

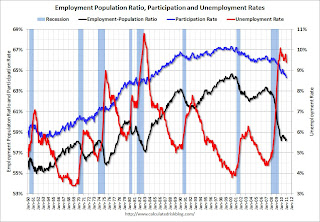

This graph shows the employment population ratio, the participation rate, and the unemployment rate. The unemployment rate decreased to 9.4% (red line).

The Labor Force Participation Rate declined to 64.3% in December (blue line). The Employment-Population ratio increased to 58.3% in December (black line).

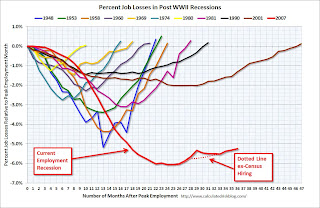

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses. The dotted line is ex-Census hiring.

The best news was the decline in the unemployment rate to 9.4% from 9.8% in November. However this was partially because the participation rate declined to 64.3% - a new cycle low, and the lowest level since the early '80s. Note: This is the percentage of the working age population in the labor force.

The 103,000 payroll jobs added was below expectations of 140,000 jobs, however payroll for October payroll was revised up 38,000 and November was revised up 32,000 for a total of 70,000.

The increase in the long term unemployed, and the high level of part time workers for economic reasons are ongoing concerns. The average workweek was steady at 34.3 hours, and average hourly earnings ticked up 3 cents.

• U.S. Light Vehicle Sales at 12.55 million SAAR in December

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.55 million SAAR in December. That is up 13.1% from December 2009, and up 2.7% from the November 2010 sales rate.

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.55 million SAAR in December. That is up 13.1% from December 2009, and up 2.7% from the November 2010 sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is still near the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was above most forecasts of around 12.3 million SAAR.

• ISM Manufacturing Index increases in December

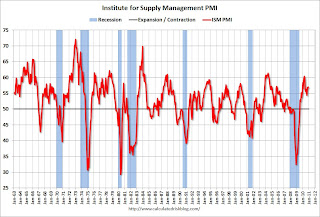

The Institute for Supply Management reported the PMI was at 57.0% in December, up slightly from 56.6% in November.

The Institute for Supply Management reported the PMI was at 57.0% in December, up slightly from 56.6% in November.

Here is a long term graph of the ISM manufacturing index.

This was slightly below expectations and in line with the regional Fed manufacturing surveys.

• ISM Non-Manufacturing Index showed expansion in December

The December ISM Non-manufacturing index was at 57.1%, up from 55.0% in November - and above expectations of 55.5%. The employment index showed slower expansion in December at 50.5%, down from 52.7% in November. Note: Above 50 indicates expansion, below 50 contraction.

The December ISM Non-manufacturing index was at 57.1%, up from 55.0% in November - and above expectations of 55.5%. The employment index showed slower expansion in December at 50.5%, down from 52.7% in November. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

• Private Construction Spending increased in November

The Census Bureau reported overall construction spending increased in November compared to October. "[C]onstruction spending during November 2010 was estimated at a seasonally adjusted annual rate of $810.2 billion, 0.4 percent (±1.6%)* above the revised October estimate of $806.7 billion."

The Census Bureau reported overall construction spending increased in November compared to October. "[C]onstruction spending during November 2010 was estimated at a seasonally adjusted annual rate of $810.2 billion, 0.4 percent (±1.6%)* above the revised October estimate of $806.7 billion."

Private construction spending also increased in November: "Spending on private construction was at a seasonally adjusted annual rate of $491.8 billion, 0.3 percent (±1.1%)* above the revised October estimate of $490.5 billion."

This graph shows private residential and nonresidential construction spending since 1993. Private residential spending increased in November; private non-residential construction spending is still declining.

Sometime this year (in 2011), residential construction spending will probably pass non-residential spending. Although I expect the recovery in residential spending to be sluggish, Residential investment will probably make a positive contribution to GDP growth in 2011 for the first time since 2005.

• Other Economic Stories ...

• From Bloomberg: Banks Lose Pivotal Massachusetts Foreclosure Case

• From Alejandro Lazo at the LA Times: Housing bust creates new kind of declining city

• Reis: Apartment Vacancy Rates decline in Q4

• Reis: Strip Mall Vacancy rates steady in Q4

• Reis: Office Vacancy Rate steady in Q4

• From the American Bankruptcy Institute: Consumer Bankruptcy Filings increase 9 percent in 2010

• ADP: Private Employment increased by 297,000 in December

• Restaurant Performance Index slips in November

• Unofficial Problem Bank list increases at 932 Institutions

Best wishes to all!

Saturday, January 08, 2011

Two stories: Europe and Foreclosures

by Calculated Risk on 1/08/2011 10:46:00 PM

The next blowup in Europe seems to be getting closer ...

• From Reuters: Germany and France want Portugal to accept aid: report

And more on the banks ...

• From David Streitfeld at the NY Times: Facing Scrutiny, Banks Slow Pace of Foreclosures

Employment posts yesterday:

• Employment: The Declining Participation Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

• Employment Graph Gallery

Commercial Real Estate Delinquencies Rising

by Calculated Risk on 1/08/2011 05:41:00 PM

CR Note: This is a very sad day for all with the shootings in Arizona ... my thoughts are with the victims and their families.

On the economy from Eric Wolff at the North County Times: REAL ESTATE: Commercial delinquencies rising as landlords struggle

The owners of Temecula Town Center, a mall at Rancho California and Ynez roads, have a problem some homeowners can relate to ---- they are behind on their loans.Even though it appears the office and mall vacancy rates have stabilized, vacancies are at a very high level - so many owners are under pressure, and commercial real estate mortgage delinquencies are still rising.

Way behind: The mall's owners owe $67 million, and they haven't made a payment in more than 90 days, according to commercial real estate analyst Trepp LLC in New York City.

...

In San Bernardino and Riverside counties, borrowers with $1.4 billion in loans are at least 30 days behind on their payments. That's 20.2 percent of the two counties' total loan balance.

In San Diego County, borrowers with loans worth $755 million are delinquent, about 7.7 percent of total commercial loan dollars. Nationally, late payers compose 9.2 percent of total loan balances. All three rates more than doubled since October 2009.

Schedule for Week of January 9th

by Calculated Risk on 1/08/2011 02:30:00 PM

The key report this week will be December retail sales on Friday.

12:40 PM ET: Atlanta Fed President Dennis Lockhart speaks on the economic outlook.

7:30 AM: NFIB Small Business Optimism Index for December. This index has been showing some small increases in optimism.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the small business optimism index since 1986. Although the index increased to 93.2 in November (highest since December 2007), it is still at recessionary levels according to NFIB Chief Economist Bill Dunkelberg.

8:30 AM ET: Philadelphia Fed President Charles Plosser speaks on the economic outlook.

9:00 AM ET: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for December (a measure of transportation).

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This report has been showing a general increase in job openings, but very little turnover in the labor market.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 1.0% increase in inventories.

2:00 PM ET: Minneapolis Fed President Narayana Kocherlakota speaks before the Wisconsin Banker's Association Annual Economic Forecast Luncheon.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been at a low level for months suggesting weak home sales early in 2011.

1:00 PM ET: Dallas Fed President Richard Fisher speaks on the "The Limits of Monetary Policy".

2:00 PM ET: The Fed Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last couple of months. The consensus is for a decrease to 402,000 from 409,000 last week.

8:30 AM: Producer Price Index for November. The consensus is for a 0.8% increase in producer prices.

8:30 AM: Trade Balance report for November from the Census Bureau. The consensus is for the U.S. trade deficit to be around $41 billion, up from $38.7 billion in October.

8:30 AM: Retail Sales for December. The consensus is for a 0.8% increase from November. (0.7% increase ex-auto).

8:30 AM: Consumer Price Index for December. The consensus is for a 0.4% increase in prices. The consensus for core CPI is an increase of 0.1%.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for December.

This graph shows industrial production since 1967. Industrial production increased in November, but production is still 6.8% below the pre-recession levels at the end of 2007.

This graph shows industrial production since 1967. Industrial production increased in November, but production is still 6.8% below the pre-recession levels at the end of 2007.The consensus is for a 0.5% increase in Industrial Production in December, and an increase to 75.6% (from 75.2%) for Capacity Utilization.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for January. The consensus is for an increase to 75.5 from 74.5 in December.

10:00 AM: Manufacturing and Trade: Inventories and Sales for November. The consensus is for a 0.7% increase in inventories.

12:00 PM: Richmond Fed President Jeffrey Lacker speaks on the economic outlook.

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Seasonal Retail Hiring: Rebound in 2010

by Calculated Risk on 1/08/2011 11:05:00 AM

According to the BLS employment report - and combining October through December - retailers hired seasonal workers at well above last year, and somewhat close to the pre-crisis levels.

Click on graph for larger in graph gallery.

Click on graph for larger in graph gallery.

Here is a graph of the historical net retail jobs added for October, November and December by year (not seasonally adjusted).

This really shows the collapse in retail hiring in 2008 and modest rebound in 2009.

Retailers hired 646 thousand workers (NSA) net during the 2010 holiday season. This is well above the 501 hired in 2009, but still below the pre-crisis average of 720 thousand for the same three months.

This suggests retailers were definitely more optimistic about the recent holiday season.

That is the good news. Here is a repeat of a depressing graph.

That is the good news. Here is a repeat of a depressing graph.

This graph is in percentage terms. In actual numbers, there are 7.24 million fewer jobs now than in December 2007.

If the economy adds 100,000 jobs per month, it will take about 72 months (6 years) to return to the December 2007 level. At 200,000 per month, it will take 36 months. At 300,000 per month(unlikely any time soon) it will take 2 years.

I'm going to need a bigger graph ...

And that doesn't include the need for about 125,000 job per month to offset population growth. It will be a long long uphill climb.

Employment posts yesterday:

• Employment: The Declining Participation Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

• Employment Graph Gallery

Unofficial Problem Bank list at 932 Institutions

by Calculated Risk on 1/08/2011 07:48:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 7, 2011.

Changes and comments from surferdude808:

The FDIC got back to work closing some banks and updating their structure database, which contributed to most of the seven removals this week. Also, there were four additions this week. The net changes leave the Unofficial Problem Bank List standing at 932 institutions with aggregate assets of $410 billion.

The removals include two failures -- First Commercial Bank of Florida, Orlando, FL ($598 million); and Legacy Bank, Scottsdale, AZ ($151 million); four unassisted mergers -- Bank of Smithtown, Smithtown, NY ($2.3 billion Ticker: PBCT); The Bank of Currituck, Moyock, NC ($173 million); Century Bank, Parma, OH ($128 million); and Texas Country Bank, Lakeway, TX ($54 million); and one action termination -- Savings Bank of Maine, Gardiner, ME ($861 million).

The additions were MetaBank, Storm Lake, IA ($1.0 billion Ticker: CASH); Tidelands Bank, Mount Pleasant, SC ($566 million Ticker: TDBK); Community First Bank, Boscobel, WI ($244 million); and Americantrust Federal Savings Bank, Peru, IN ($105 million).

The OCC may release its actions through mid-December 2010 next week, but since the 15th falls on Saturday it would not surprise if they did not release it until the 21st of January.

Friday, January 07, 2011

Oil Prices Update

by Calculated Risk on 1/07/2011 11:01:00 PM

From Ronald White at the LA Times: Gasoline prices' rise evokes 2008

"It's just ridiculous. Every day it's another big bite out of my income. I've gone from $40 for a fill-up to $60 for a fill-up in just the past several weeks," said Eric Ott, a 47-year-old Valley Glen resident.Back in early 2008 we saw clear signs of demand destruction. No obvious signs yet in 2011, but I had a similar reaction as Mr. Ott when I filled up my tank this week - ouch!

...

Oil closed Friday at $88.03 a barrel in New York futures trading.

...

"[W]e cannot expect brisk economic growth with oil at $120, $130, $140 a barrel and gasoline at $4 a gallon and higher ... Those kind of prices can spawn a tremendous amount of demand destruction." said Tom Kloza, chief oil analyst for the Oil Price Information Service

Jim Hamilton discussed this last month: Worrying about oil prices

Earlier Employment posts:

• Employment: The Declining Participation Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• December Employment Report: 103,000 Jobs, 9.4% Unemployment Rate

Bank Failure #2 for 2011: Legacy Bank, Scottsdale, Arizona

by Calculated Risk on 1/07/2011 07:28:00 PM

Assets evaporated

I am Legacy

by Soylent Green is People

From the FDIC: Enterprise Bank & Trust, St. Louis, Missouri, Assumes All of the Deposits of Legacy Bank, Scottsdale, Arizona

As of September 30, 2010, Legacy Bank had approximately $150.6 million in total assets and $125.9 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $27.9 million. ... Legacy Bank is the second FDIC-insured institution to fail in the nation this year, and the first in Arizona