by Calculated Risk on 1/03/2011 10:15:00 PM

Monday, January 03, 2011

House Prices: More Pessimistic Views

From CNBC: Home Prices Will Decline for Years: Zuckerman (ht Scott)

Mort Zuckerman ... blamed the continuing price decline on the so-called shadow inventory of foreclosed homes that's yet to come on the market.And from MarketWatch: S&P warns on ‘shadow inventory’ (ht jb)

“That’s what’s going to put downward pressure on residential prices,” Zuckerman added, “And in my judgment, that’s going to continue for several years.”

Standard & Poor’s Ratings Services said Monday that it’s taking longer for the U.S. housing market to absorb foreclosed homes, which means there may be a major drag on prices for a few more years.My view is house prices - as measured by the Case-Shiller and CoreLogic repeat sales indexes - will decline another 5% to 10%. I think it is likely that nominal house prices will bottom in 2011, but that real house prices (inflation adjusted) will decline for another two to three years. (See: Question #1 for 2011: House Prices)

Consumer Bankruptcy Filings increase 9% in 2010

by Calculated Risk on 1/03/2011 07:09:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings increase 9 percent in 2010

U.S. consumer bankruptcies increased 9 percent nationwide in 2010 from the previous year, according to the American Bankruptcy Institute (ABI) relying on data from the National Bankruptcy Research Center (NBKRC). The data showed that the overall consumer filing total for the 2010 calendar year (Jan. 1 – Dec. 31, 2010) reached 1,530,078 compared to the 1,407,788 total consumer filings recorded during 2009. Annual consumer filings have increased each year since the Bankruptcy Abuse Prevention and Consumer Prevention Act was enacted in 2005.This is slightly below ABI's forecast for 1.6 million filings last year. The following graph shows the annual consumer bankruptcy filings based on data from the U.S. Courts (and the ABI for 2010).

“The steady climb of consumer filings notwithstanding the 2005 bankruptcy law restrictions demonstrate that families continue to turn to bankruptcy as a result of high debt burdens and stagnant income growth,” said ABI Executive Director Samuel J. Gerdano. “We expect that consumer filings will continue to rise in 2011.”

Restaurant Performance Index slips in November

by Calculated Risk on 1/03/2011 03:30:00 PM

This is one of several industry specific indexes I track each month.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Performance Index Declined in November as Sales and Traffic Slipped

As a result of a downtick in same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) fell below 100 in November. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.9 in November, down 0.8 percent from October. November marked the first time in three months that the RPI stood below 100, the level above which signifies expansion in the index of key industry indicators.This is just one month of slight contraction, but something to watch.

...

For the first time in three months, restaurant operators reported a net decline in same-store sales. ... Restaurant operators also reported a net decline in customer traffic levels in November.

Question #2 for 2011: Residential Investment

by Calculated Risk on 1/03/2011 12:42:00 PM

This is the last in a series of "Ten Economic Questions for 2011". These posts included some thoughts and few predictions on these questions.

Of course no one has a crystal ball, but my general view is economic and employment growth will improve in 2011 as compared to 2010, but growth will still be sluggish relative to the slack in the system. By "sluggish" I mean I don't expect anything like the 7.2% real GDP growth we saw in 1984 coming out of the early '80s severe recession. This recession was different - caused by the bursting of the housing and credit bubbles - and recoveries from financial crisis tend to be slow.

And there are downside risks from falling house prices, Europe, and state and local government budget cuts. And unfortunately I think the unemployment rate will still be around 9% at the end of 2011.

The good news is residential investment will probably make a positive contribution to GDP growth for the first time since 2005. And residential construction employment will probably increase in 2011.

We still need to work down the excess inventory of housing units. It is good news that completions in 2011 will be at or near a record low. And with improved employment growth, we should see a pickup in household formation. The combination of a low number of new units added to the housing stock, and more household formation, should lead to a meaningful decline in the number of excess housing units this year.

That brings up the question: if there are still excess vacant housing units, why will residential investment increase in 2011? There are a few reasons: for multi-family units it takes over a year on a average to complete, and apartment owners are seeing falling vacancy rates - and some have started to plan for 2012 and will be breaking ground in 2011. We can this in reports from architects.

And for single family homes, not all areas are the same (and most housing can't be moved). Also, as the economy improves, I expect some increase in homes built for owners (not built for sale). This will probably mean something like a 15% increase in residential investment in 2011.

As I've noted before, one of the key reasons for the sluggish recovery has been the ongoing problems in housing. Usually residential investment is a major contributor to GDP growth in the early stages of a recovery, but not this time because of the huge overhang of existing vacant homes.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.This graph shows RI and investment in single family structures as a percent of GDP. Usually RI rebounds strongly at the beginning of a recovery, but this time RI has continued to decline.

RI as a percent of GDP is at a post WWII low of 2.22%, and investment in single family structures is near the all-time low.

Even though I expect a pickup this year, I think residential investment as a percent of GDP will still be very low.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Private Construction Spending increases in November

by Calculated Risk on 1/03/2011 10:59:00 AM

The Census Bureau reported overall construction spending increased in November compared to October.

[C]onstruction spending during November 2010 was estimated at a seasonally adjusted annual rate of $810.2 billion, 0.4 percent (±1.6%)* above the revised October estimate of $806.7 billion.Private construction spending also increased in November:

Spending on private construction was at a seasonally adjusted annual rate of $491.8 billion, 0.3 percent (±1.1%)* above the revised October estimate of $490.5 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending increased in November; private non-residential construction spending is still declining.

Residential spending is 65% below the peak early 2006, and non-residential spending is 38% below the peak in January 2008.

Sometime this year (in 2011), residential construction spending will probably pass non-residential spending. Although I expect the recovery in residential spending to be sluggish, Residential investment will probably make a positive contribution to GDP growth in 2011 for the first time since 2005.

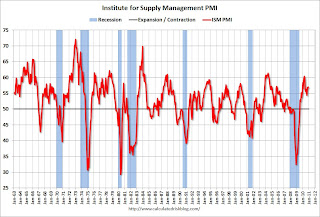

ISM Manufacturing Index increases in December

by Calculated Risk on 1/03/2011 10:00:00 AM

PMI at 57.0% in December, up slightly from 56.6% in November. The consensus was for an increase to 57.2%.

From the Institute for Supply Management: December 2010 Manufacturing ISM Report On Business®

Manufacturing continued to grow in December as the PMI registered 57 percent, an increase of 0.4 percentage point when compared to November's reading of 56.6 percent. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

...

ISM's New Orders Index registered 60.9 percent in December, which is an increase of 4.3 percentage points when compared to the 56.6 percent reported in November. This is the 18th consecutive month of growth in the New Orders Index. A New Orders Index above 50.2 percent, over time, is generally consistent with an increase in the Census Bureau's series on manufacturing orders

...

ISM's Employment Index registered 55.7 percent in December, which is 1.8 percentage points lower than the 57.5 percent reported in November. This is the 13th consecutive month of growth in manufacturing employment.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

This was slightly below expectations and in line with the regional Fed manufacturing surveys.

State and Local Government budget cuts: A 2011 Theme

by Calculated Risk on 1/03/2011 08:54:00 AM

This will be a common story this year ...

From the NY Times: Cuomo Plans One-Year Freeze on State Workers’ Pay

Gov. Andrew M. Cuomo will seek a one-year salary freeze for state workers as part of an emergency financial plan he will lay out in his State of the State address on Wednesday, senior administration officials said.This weekend:

... the immediate budget savings from the freeze would be relatively modest — between $200 million and $400 million against a projected deficit in excess of $9 billion

• Summary for Week ending January 1st

• Schedule for Week of January 2, 2011

Sunday, January 02, 2011

Krugman: Deep Hole Economics

by Calculated Risk on 1/02/2011 11:59:00 PM

From Paul Krugman in the NY Times: Deep Hole Economics

If there’s one piece of economic wisdom I hope people will grasp this year, it’s this: Even though we may finally have stopped digging, we’re still near the bottom of a very deep hole.Even though I'm more optimistic about 2011 than 2010, I still think that growth will be sluggish relative to the slack in the system - and that the unemployment rate will stay elevated for some time. There is definitely a danger of becoming too optimistic.

Why do I need to point this out? Because I’ve noticed many people overreacting to recent good economic news. ...

Jobs, not G.D.P. numbers, are what matter to American families. ... Growth at a rate above 2.5 percent will bring unemployment down over time.

Suppose that the U.S. economy were to grow at 4 percent a year, starting now and continuing for the next several years. Most people would regard this as excellent performance, even as an economic boom; it’s certainly higher than almost all the forecasts I’ve seen.

Yet the math says that even with that kind of growth the unemployment rate would be close to 9 percent at the end of this year, and still above 8 percent at the end of 2012.

WSJ: Key to Real-Estate Rebound

by Calculated Risk on 1/02/2011 06:46:00 PM

From Nick Timiraos and Anton Troinovski at the WSJ: Key to Real-Estate Rebound: Solid Economic Growth

"The No. 1 biggest risk is that, for whatever reason, the overall economy does not grow sufficiently to produce any meaningful rebound in jobs," said Thomas Lawler, a housing economist in Leesburg, Va.The key to recovery in real estate is absorbing the excess supply. Lawler makes two key points: 1) We need job growth (and that would mean household formation absorbing the excess supply) and, 2) Housing completions are at record lows (not adding to the excess supply).

...

New housing construction is stuck at its lowest levels in more than 40 years. "That will help absorb supply in ways that a lot of people underestimate," Mr. Lawler said.

Earlier:

• Summary for Week ending January 1st

• Schedule for Week of January 2, 2011

Question #3 for 2011: Delinquencies and Distressed house sales

by Calculated Risk on 1/02/2011 02:10:00 PM

Earlier:

• Summary for Week ending January 1st

• Schedule for Week of January 2, 2011

Two weeks ago I posted some questions for next year: Ten Economic Questions for 2011. These are some topics to think about this year including European debt, and state and local government issues, employment (and unemployment), house prices and more. I'm trying to add some thoughts and a few predictions for each question. Here is number 3:

3) Distressed house sales: Foreclosure activity is very high, although activity has slowed recently - probably because of "foreclosure gate" issues. The number of REOs (Real Estate Owned by lenders) is increasing again, although still below the levels of late 2008. How much will foreclosure activity pick up in 2011? Will the number of REOs peak in 2011 and start to decline?

Here are three charts on REOs. The first is just inventory for Fannie, Freddie and the FHA.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The REO inventory for the "Fs" increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

This just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs.

The 2nd chart is an estimate of Fannie, Freddie, FHA and also private-label RMBS REO inventory from economist Tom Lawler. This does not include bank and thrift REO holdings, although those probably increased in Q3 too.

|

Recall that back in 2007 and 2008 delinquencies on loans backing PL RMBS exploded upward, and the “timelines” from serious delinquency to in-foreclosure to completed foreclosure sale were much shorter. In addition, servicers of PL RMBS were initially a “little slow” in disposing of SF REO (sticker shock on prices?), and REO exploded upward in the first ten months of 2008.The third graph (via Lawler) is based on data from Barclays. They break it down differently, but this shows the same pattern as the 2nd chart.

The height of the 2nd peak depends on the number of foreclosures, and the how quickly the lenders can sell the REOs. The foreclosure-gate related moratoriums have slowed the foreclosure process, but foreclosures will probably pick up again in early 2011. My guess is the 2nd peak will happen in 2011 and be close to the same height as in 2008.

One of the key issues is the number of delinquent loans (and loans in the foreclosure process). I use the Mortgage Bankers Association (MBA) quarterly data and LPS Applied Analytics monthly data to track delinquencies.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph based on the MBA quarterly data shows the percent of loans delinquent by days past due. The MBA reported that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This was down from 14.42 percent in Q2 2010.

Most of the decline in the overall delinquency rate was in the seriously delinquent categories (90+ days or in foreclosure process). Part of the reason is lenders were being more aggressive in foreclosing in Q3 (before the foreclosure pause) - hence the surge in REO inventory in the first graphs! Some of the decline was probably related to modifications too.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages through November.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages through November.The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.02% of mortgages are delinquent (down from 9.29% in October), and another 4.08% are in the foreclosure process (up from 3.92% in October) for a total of 13.10%.

With falling house prices, the delinquency rate could start rising again since more homeowners will have negative equity. However just because a homeowner has negative equity doesn't mean they will default. It usually takes another factor such as loss of employment, divorce, or a medical emergency for the homeowner to default.

On the other hand, an improving labor market will help push down the delinquency rate. My guess is the overall delinquency rate has peaked, although I expect the delinquency rate to stay elevated for some time.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy