by Calculated Risk on 10/14/2010 11:59:00 PM

Thursday, October 14, 2010

Foreclosure-Gate: The house that started it all

From David Streitfeld at the NY Times: From This House, a Foreclosure Freeze

The house that set off the national furor over faulty foreclosures is blue-gray and weathered. The porch is piled with furniture and knickknacks awaiting the next yard sale. In the driveway is a busted pickup truck.A very interesting story.

...

Nicolle Bradbury bought this house seven years ago for $75,000, a major step up from the trailer she had been living in with her family. But she lost her job and the $474 monthly mortgage payment became difficult, then impossible.

It should have been a routine foreclosure ...

Her file was pulled, more or less at random, by Thomas A. Cox, a retired lawyer who volunteers ... Mr. Cox realized almost immediately that Mrs. Bradbury’s foreclosure file did not look right. The documents from the lender, GMAC Mortgage, were approved by an employee whose title was “limited signing officer,” an indication to the lawyer that his knowledge of the case was effectively nonexistent.

Friday Preview: Bernanke, Retail Sales, CPI, and more

by Calculated Risk on 10/14/2010 07:43:00 PM

Friday will be really busy with several key releases, many at the same time (8:30 AM ET).

I'll start off posting Fed Chairman Ben Bernanke's speech, and I'll probably wait a little while to post on retail sales (Bernanke will probably discuss QE2, but I think he might outline what the Fed will do if QE2 doesn't achieve the desired goals).

On CPI, the release tomorrow will confirm that there will be no increase in Social Security benefits in 2011 - and no increase in the maximum contribution base ($106,800 same as in 2009 and 2010). For an explanation, see: No increase to Social Security Benefits for 2011 (unofficial)

Here is the economic release schedule for tomorrow ...

8:15 AM ET: Fed Chairman Ben S. Bernanke will speak at the Federal Reserve Bank of Boston Conference "Monetary Policy Objectives and Tools in a Low-Inflation Environment"

8:30 AM: Consumer Price Index for September. The consensus is for a 0.2% increase in prices. This is being closely watched for further disinflation, and also because Q3 is the quarter the annual annual cost-of-living adjustment (COLA) is calculated for Social Security (this will make it official that there will be no change in 2011).

8:30 AM: Retail Sales for September. The consensus is for a 0.4% increase from August.

8:30 AM: Empire Manufacturing Survey for October. The consensus is for a reading of 8.0, up from 4.1 in September. These regional surveys have been showing a slowdown in manufacturing and are being closely watched right now.

9:15 AM: Atlanta Fed President Dennis Lockhart participates in a question-and-answer session on the economy in Atlanta.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for October. The consensus is for a slight increase to 69.0 from 68.2 in September.

10:00 AM: Manufacturing and Trade: Inventories and Sales for August. Consensus is for a 0.4% increase in inventories in August.

Early Third Quarter GDP Forecast

by Calculated Risk on 10/14/2010 04:44:00 PM

From Catherine Rampell at the NY Times Economix: Third-Quarter G.D.P. Forecast Revised Down

Macroeconomic Advisers ... has just downgraded its estimate for third-quarter annual output growth to a measly 1.2 percent.My early guess is real PCE growth will come in around 2.0% in Q3. Since PCE is about 70% of GDP, that gives a contribution to GDP of 1.4 percentage points at an annual rate.

Residential investment (RI) will probably subtract close to 0.6 or more percentage points. Equipment and software will be positive and mostly offset the decline in RI. Government spending will also probably make a negative contribution. All of that puts us close to 1.0% annualized real GDP growth in Q3 before ..

Still unknown are the contributions from the trade balance and changes in inventories. With the higher than expected trade deficit in August, the contribution from trade could be close to zero. I expect a small positive contribution from inventories - so I think the 1.2% estimate is probably close (I'd guess closer to 1.5%).

It sure seems like the 2nd half slowdown is intact. And I expect PCE growth to slow in Q4 - but I think that will be offset with residential investment probably being somewhat flat (as opposed to the negative contribution in Q3).

The advance Q3 GDP report will be released on Oct 29th, and that is probably the last economic release standing between the Fed and QE2. Based on this early forecast, QE2 will arrive on Nov 3rd ...

Freddie Mac: 30 year Mortgage Rates fall to 4.19 percent, lowest since 1951

by Calculated Risk on 10/14/2010 03:10:00 PM

From Freddie Mac: 30-Year FRM Under 5 Percent for 23 Consecutive Weeks

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), which found that the 30-year fixed-rate mortgage rate fell again to break the survey’s all-time low; the 30-year FRM has been under 5 percent for 23 weeks in a row. The last time 30-year FRM rates were this low was April 1951 (based on a data series of FHA rates going back to 1948). The 5-year ARM tied the all-time survey low set last week.

...

30-year fixed-rate mortgage (FRM) averaged 4.19 percent with an average 0.8 point for the week ending October 14, 2010, down from last week when it averaged 4.27 percent. Last year at this time, the 30-year FRM averaged 4.92 percent.

Hotel Performance: RevPAR up 8.8% compared to same week in 2009

by Calculated Risk on 10/14/2010 12:43:00 PM

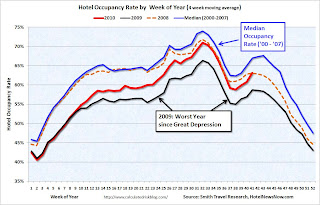

Hotel occupancy is one of several industry specific indicators I follow ...

Important: Even though the occupancy rate is close to 2008 levels, 2010 is a much more difficult year for the hotel industry than 2008. RevPAR (revenue per available room) is up 8.8% compared to 2009, but still down 4.1% compared to 2008 - and 2008 was a very difficult year for the hotel industry.

From HotelNewsNow.com: STR: Economy ADR performance falls short

Overall, the industry’s occupancy increased 6.5% to 63.6%, ADR was up 2.2% to US$101.58, and revenue per available room ended the week up 8.8% to US$64.62.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.4% compared to last year (the worst year since the Great Depression) and 5.8% below the median for 2000 through 2007.

The occupancy rate is about at the levels of 2008, but RevPAR is still down 4.1%.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Trade Deficit increases sharply in August

by Calculated Risk on 10/14/2010 09:10:00 AM

The Census Bureau reports:

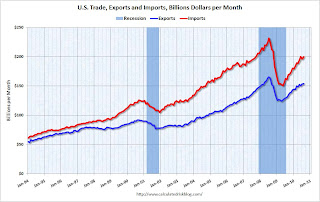

[T]otal August exports of $153.9 billion and imports of $200.2 billion resulted in a goods and services deficit of $46.3 billion, up from $42.6 billion in July, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through August 2010.

After trade bottomed in the first half of 2009, both imports and exports increased significantly. However in 2010 export growth has slowed, and imports have been increasing much faster than exports.

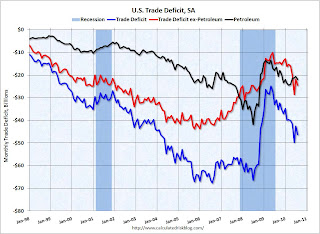

The second graph shows the U.S. trade deficit, with and without petroleum, through August.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The increase in the deficit in August was due to both oil and China, although the bulk of the increase was because of trade with China. The trade deficit with China increased to $28.0 billion in August from $25.9 billion in July (NSA).

The imbalances have returned ...

Weekly Initial Unemployment Claims increase to 462,000

by Calculated Risk on 10/14/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Oct. 9, the advance figure for seasonally adjusted initial claims was 462,000, an increase of 13,000 from the previous week's revised figure of 449,000 [up from 445,000]. The 4-week moving average was 459,000, an increase of 2,250 from the previous week's revised average of 456,750.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 2,250 to 459,000.

The 4-week moving average has been moving sideways at an elevated level since last December - and that suggests a weak job market.

Note: most revisions have been slightly up over the last year or so. The average revision has been just over 2,000. But if you follow the 4 week moving average (as I do), this would only impact the last data point - and only by about 500. I couldn't see that on the graph! Not a big deal.

Wednesday, October 13, 2010

RealtyTrac: Record Repossessions reported in September

by Calculated Risk on 10/13/2010 11:59:00 PM

From RealtyTrac: Foreclosure Activity Increases 4 Percent in Third Quarter

Foreclosure filings were reported on 347,420 U.S. properties in September, an increase of nearly 3 percent from the previous month and an increase of 1 percent from September 2009. A record total of 102,134 bank repossessions were reported in September, the first time bank repossessions have surpassed the 100,000 mark in a single month.This will slow down in Q4, but will pick up again soon.

“Lenders foreclosed on a record number of properties in September and in the third quarter, taking a bite out of the backlog of distressed properties where the foreclosure process was delayed by foreclosure prevention efforts over the past 20 months,” said James J. Saccacio, chief executive officer of RealtyTrac. “We expect to see a dip in those bank repossessions — and possibly earlier stages of the foreclosure process — in the fourth quarter as several major lenders have halted foreclosure sales in some states while they review irregularities in foreclosure-processing documentation that has been called into question in recent weeks.”

Fed's Lacker: Inflation "now on Target"

by Calculated Risk on 10/13/2010 09:42:00 PM

Here is a different view ...

From Richmond Fed President Jeffrey Lacker: Economic Outlook, October 2010

[I]nflation is now on target, as far as I'm concerned. Over the last 12 months the price index for personal consumption expenditure has risen 1.5 percent, which is exactly what I've been recommending for the last six years. We also track a core price index that omits volatile food and energy prices, and it is sending the same message, having risen by 1.4 percent over the last 12 months. I believe that the Fed's best contribution to our nation's economic prosperity over time would be to keep inflation stable near the current 1.5 percent rate. But inflation has been lower this year, with overall inflation increasing at only a 0.7 percent annual rate, which is too low for me. I would point out that these inflation numbers often run hot or cold for several months at a time, which is why economists focus on the 12-month number I cited a moment ago. I am not yet convinced that inflation is likely to remain undesirably low. Moreover, the public's expectation of future inflation is not at such a low level; indeed, the latest survey from the University of Michigan puts the public's short-run inflation expectation at 2.2 percent. So I do not see a material risk of deflation — that is, an outright decline in the price level.Lacker speech is a little strange because he mentions three possible reasons for the high unemployment rate - skills mismatch, extended benefits, uncertainty regarding government policies - and leaves out the most widely accepted reason: lack of aggregate demand. Weird.

And on inflation, core CPI (from the BLS) is up 1.0% over the last 12 months and median CPI from the Cleveland Fed (an alternative measure of inflation) is up only 0.5% over the last year - so I'd argue inflation is below Lacker's target.

Lacker is not currently on the FOMC.

U.S. outlines process for "orderly and expeditious resolution of foreclosure process issues"

by Calculated Risk on 10/13/2010 05:39:00 PM

From the FHFA: Statement By FHFA Acting Director Edward J. DeMarco On

Servicer Financial Affidavit Issues

“On October 1, FHFA announced that Fannie Mae and Freddie Mac are working with their respective servicers to identify foreclosure process deficiencies and that where deficiencies are identified, will work together with FHFA to develop a consistent approach to address the problems. Since then, additional mortgage servicers have disclosed shortcomings in their processes and public concern has increased.This is a four-point plan:

Today, I am directing the Enterprises to implement a four-point policy framework detailing FHFA’s plan, including guidance for consistent remediation of identified foreclosure process deficiencies. This framework envisions an orderly and expeditious resolution of foreclosure process issues that will provide greater certainty to homeowners, lenders, investors, and communities alike. ..."

1) Verify Process -- Mortgage servicers must review their processes and procedures and verify that all documents, including affidavits and verifications, are completed in compliance with legal requirements. ...

2) Remediate Actual Problems -- When a servicer identifies a foreclosure process deficiency, it must be remediated in an appropriate and timely way and be sustainable.

Note: this includes actions for a) Pre-judgment foreclosure actions, b) Post-judgment foreclosure actions (prior to foreclosure sale), c) Post-foreclosure sale (Enterprise owns the property), and d) Bankruptcy Cases. This includes actions to clear title.

3) Refer Suspicion of Fraudulent Activity

4) Avoid Delay -- In the absence of identified process problems, foreclosures on mortgages for which the borrower has stopped payment, and for which foreclosure alternatives have been unsuccessful, should proceed without delay.