by Calculated Risk on 5/18/2010 08:30:00 AM

Tuesday, May 18, 2010

Housing Starts increase in April

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 672 thousand (SAAR) in April, up 5.8% from the revised March rate, and up 41% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 593 thousand (SAAR) in April, up 10.2% from the revised February rate, and 65% above the record low in January 2009 (360 thousand).  The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts are still very low.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts are still very low.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:Note that permits fell sharply, suggesting a significant decline in housing starts next month.

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 672,000. This is 5.8 percent (±13.0%)* above the revised March estimate of 635,000 and is 40.9 percent (±19 8%) above the revised April 2009 rate of 477,000.

Single-family housing starts in April were at a rate of 593,000; this is 10.2 percent (±10.7%)* above the revised March figure of 538,000.

Housing Completions:

Privately-owned housing completions in April were at a seasonally adjusted annual rate of 769,000. This is 19.2 percent (±13.8%) above the revised March estimate of 645,000, but is 8.7 percent (±12.8%)* below the revised April 2009 rate of 842,000.

Single-family housing completions in April were at a rate of 564,000; this is 14.6 percent (±13.1%) above the revised March figure of 492,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 606,000. This is 11.5 percent (±1.1%) below the revised March rate of 685,000, but is 15.9 percent (±1.3%) above the revised April 2009 estimate of 523,000.

Single-family authorizations in April were at a rate of 484,000; this is 10.7 percent (±1.1%) below the revised March figure of 542,000.

Monday, May 17, 2010

FHA will Reduce Allowable Seller Concessions this Summer

by Calculated Risk on 5/17/2010 09:27:00 PM

These changes have been under discussion for some time ...

From Jon Prior at HousingWire: FHA Set to Reduce Closing Cost Assistance This Summer

The FHA will reduce allowable seller concessions — the percentage sellers can take from the sales price of a home to fund closing costs — from 6% to 3%. According to an announcement in January, the current level of 6% exposes the FHA to excess risk by creating incentives for appraisers to increase the value of these homes. The change will take place in “early summer,” according to the FHA, but a spokesperson said no specific date has been set.In early April, the FHA increased the upfront insurance premiums on FHA-backed loans from 1.75% to 2.25% of the loan amount. Borrowers also have to pay an annual premium based on the LTV and type of loan.

The FHA is also trying to crack down on poor performing mortgage brokers and lenders, from Nick Timiraos at the WSJ: Mortgage Insurer Turns to Lenders to Police Brokers

Under changes set to take effect May 20, the FHA will stop certifying mortgage brokers or tracking the individual performance of loans that they originate. Instead, it will require lenders to sponsor brokers and to assume responsibility for those loans, including losses from fraud or poorly underwritten loans ...These are all small changes, but they add up.

The FHA is also asking Congress for greater authority to recoup losses from lenders on defaulted loans that were improperly underwritten. Currently, the FHA has that indemnification authority for loans from some 600 lenders that account for 71% of all FHA-backed loans. The new rules would apply to the remaining 1,400 lenders that account for the remaining 29% of FHA originations.

More on HAMP

by Calculated Risk on 5/17/2010 05:40:00 PM

From Diana Olick at CNBC: Mortgage Mods Doomed by Back End Debt. On the absurdly high back end debt-to-income ratio:

"A 64.3% DTI is so far out of scope with the pre-bubble years safe and sound 36% total DTI — and even typical bubble-years full-doc DTI's of 50% — it is absolutely irresponsible," says mortgage analyst Mark Hanson. "Servicers are pushing the envelope with respect to getting people to qualify," he adds.Olick adds:

I have to wonder if any mortgage originator today would even offer a new loan to anyone with those kinds of stats. My guess is no.I hope not!

And from David Streitfeld at the NY Times: U.S. Mortgage Program Stalling, Data Shows

David Stevens, assistant secretary for housing at HUD ... said the program should be considered in light of the government’s extensive efforts over the last year to shore up the housing market. These efforts included keeping a lid on home mortgage rates, a tax credit and refinancing programs for those who owed more than their house was worth.Stevens is referring to all the government programs aimed at supporting house prices (the assumed overall strategy). HAMP was very successful at delaying foreclosures and keeping the level of distressed inventory down. Other programs, such as the housing tax credit and Fed MBS purchase program, were aimed at boosting demand.

Lower supply and higher demand kept house prices from falling further. I guess if house prices don't fall too far from here, it is possible that the overall strategy could be considered a success even though some of the tactics, like HAMP and the housing tax credit, were clear failures when analyzed separately.

HAMP April data shows program slowing down

by Calculated Risk on 5/17/2010 02:54:00 PM

From Treasury: HAMP Servicer Performance Report Through April 2010

About 299,000 modifications are now "permanent", and 277,000 trial modification cancelled. There is still a huge number of borrowers in limbo. According to HAMP, there are 637,353 "active trials".

As of April, there were 1,214,085 trials started, and as of last September there were 553,568. That gives 660,000 trials started over the last 7 months - about the same number as "active trials". Ouch. That suggests that the HAMP trial period is about 7 months!

Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to around 47,160 in April 2010. This is slowest pace since the program started, probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers. The program is dying ...

On page 6 is some new data. Not surprisingly the servicers who verified income before starting a trial modification have a much higher conversion rate than servicers that allowed borrowers to state their income.

Debt-to-income ratios worsen

If we look at the HAMP program stats (see page 5), the median front end DTI (debt to income) before modification was 44.9% - up slightly from 44.8% last month. And the back end DTI was an astounding 80.2% (up from 77.5% last month).

Think about that for a second: over 80% of the borrowers income went to servicing debt. And it is over 64% after the modification. Do they have a life?

Just imagine the characteristics of the borrowers who can't be converted!

In summary: 1) the program is dying, 2) the borrowers DTI characteristics are poor - and getting worse, and 3) there are a large number of borrowers in modification limbo.

NAHB Builder Confidence Increases in May

by Calculated Risk on 5/17/2010 01:00:00 PM

Note: any number under 50 indicates that more builders view sales conditions as poor than good. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) was at 22 in May. This is an increase from 19 in April. This is the highest level since August 2007 - and builders were seen as depressed then!

The record low was 8 set in January 2009. This is still very low ... This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the May release for the HMI and the March data for starts (April starts will be released tomorrow).

This second graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the May release for the HMI and the March data for starts (April starts will be released tomorrow).

This shows that the HMI and single family starts mostly move generally in the same direction - although there is plenty of noise month-to-month.

Press release from the NAHB: Builder Confidence Continues to Strengthen in May

Builder confidence in the market for newly built, single-family homes rose for a second consecutive month in May to its highest level in more than two years, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI gained three points to 22 in May, its highest point since August of 2007.

“Builders surveyed for the HMI at the beginning of May were undoubtedly reacting to the heightened consumer interest they had just witnessed as the deadline for home buyer tax credits arrived at the end of April,” said Bob Jones, Chairman of the National Association of Home Builders (NAHB) and a home builder from Bloomfield Hills, Mich. “Builders are also hopeful that the solid momentum that the tax credits initiated will continue even now that those incentives are gone.”

“The really encouraging part of today’s HMI is that sales expectations for the next six months continued to gain, despite the expiration of the home buyer tax credits at the end of April,” said NAHB Chief Economist David Crowe. “This means builders are more comfortable that the market is truly beginning to recover, and that positive factors for buying a new home – low interest rates, great selection, stabilizing prices, and a recovering job market – are taking the place of tax incentives to generate buyer demand.”

Crowe was quick to point out, however, that while builder confidence has improved from the depths of the housing downturn, it is still quite low by historic standards. “Obviously we still have a long way to go ..."

Each of the HMI’s three component indexes posted three-point gains in May. The component gauging current sales conditions climbed to 23, its highest level since July of 2007. The component gauging sales expectations in the next six months rose to 28, its highest point since November 2009, and the component gauging traffic of prospective buyers improved to 16, its best showing since September 2009.

Europe's Woes impacting China

by Calculated Risk on 5/17/2010 09:50:00 AM

From Keith Bradsher at the NY Times: Europe’s Debt Crisis Is Casting a Shadow Over China

The steep rise of the renminbi prompted a Commerce Ministry official in Beijing to warn Monday that China’s exports could be threatened. ...

“The yuan has risen about 14.5 percent against the euro during the past four months, which will increase cost pressure for Chinese exporters and also have a negative impact on China’s exports to European countries,” Yao Jian, the ministry’s spokesman, said at a news conference in Beijing, according to news services.

...

Because American companies in particular compete in the Chinese market with European companies in many industries, the euro’s weakness against the renminbi is putting American companies at a disadvantage ...

As I noted a few weeks ago ... keep an eye on the Shanghai index (in red).

As I noted a few weeks ago ... keep an eye on the Shanghai index (in red). Click on graph for larger image in new window.

This graph shows the Shanghai SSE Composite Index and the S&P 500 (in blue).

The SSE Composite Index is at 2,559.93 - down 5% last night and off almost 20% since early April. This is the lowest level in over a year.

Should we be more concerned about the slowdown in Europe, or the slowdown in China?

NY Fed: Manufacturing Conditions Improve, but at Slower Pace

by Calculated Risk on 5/17/2010 08:32:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to improve for a tenth consecutive month in May, albeit at a slower pace than in April. The general business conditions index fell 13 points, to 19.1. Similarly, the new orders and shipments indexes also moved lower but remained at positive levels. The inventories index dropped back to a level near zero after rising into positive territory in March and April. .... Future indexes suggest that activity is expected to expand further in the months ahead, but the level of optimism was noticeably lower in May than in recent months.This came in below expectations. New orders are softer and the inventory adjustment is over. Manufacturing continued to improve, although at a slower pace in May. This is an early indicator for the national ISM survey that will be released June 1st.

...

The new orders index was also lower, falling 15 points to 14.3. ... The index for number of employees climbed to 22.4, with nearly a third of respondents increasing employment levels in May. The average workweek index fell to zero, following four months of positive readings. .... The future inventories index fell below zero for the first time since October of last year, suggesting that inventory levels were not expected to rise in the coming months.

Sunday, May 16, 2010

Sunday Night Futures

by Calculated Risk on 5/16/2010 10:15:00 PM

The U.S. futures are off tonight:

From CNBC: Pre-Market Data shows the S&P 500 off about 11 points or 1%. Dow futures are off about 100 points.

CBOT mini-sized Dow

And the Asian markets are in the red with most indexes off about 2%.

And a graph of the Asian markets.

The Euro is at 1.23 dollars. Update: more currency exchange rates and from NetDania.

It will be a busy week ...

Best to all.

Libor Increases, Euro Falls

by Calculated Risk on 5/16/2010 04:33:00 PM

Note: here is the Weekly Summary and a Look Ahead (busy week)!

On the Libor and the Euro ...

From the Financial Times: Banks’ debt exposure fuels risk aversion

Concern about the exposure of European banks to the debts of weaker countries in the eurozone is ... increasing the amounts banks charge to lend to each other.The Libor has risen recently, but it is still very low (here is a graph from Bloomberg). The Libor is at 0.45%; the Libor peaked at 4.81875% on Oct 10, 2008.

The London inter-bank offer rate, or Libor, has risen in recent weeks to its highest level since last August ... which is significant because the rate has served as a leading gauge of stress during the financial crisis.

excerpt with permission

The TED spread has increased too, but it is still very low at 30. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps - so this is still below normal.

And from The Times: Euro heads for parity with dollar

THE euro is set to slide further and could be heading for parity with the dollar, analysts say. ... The euro fell to a 19-month low against the dollar of $1.23 on Friday night ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.Update: Oops. Chart was labeled backwards. There are 1.23 dollars per Euro.

The Euro has only been around since Jan 1999. The graph shows the number of dollars per euro since Jan 1, 1999.

There is nothing magical about "parity" except it makes a good headline - and would be a significant decline.

Weekly Summary and a Look Ahead

by Calculated Risk on 5/16/2010 11:59:00 AM

Three housing related reports will be released early this week: the NAHB builder confidence survey on Monday, housing starts on Tuesday, and the MBA Q1 delinquency report on Wednesday. Of course Europe will still be in the spotlight too.

On Monday, the May Empire State manufacturing survey will be released at 8:30 AM. The consensus is for a slight decline from the strong reading in April. Also on Monday, the May NAHB homebuilder survey will be released at 1 PM. The consensus is for a slight increase to 20 from 19 in April.

On Tuesday, Housing Starts for April will be released at 8:30 AM. The consensus is for an increase to 650K (SAAR) in April from 626K in March. Also at 8:30 AM, the BLS will release the Producer Price Index (PPI) for April. The consensus is for an increase of 0.1%. The Census Bureau will also release the Q1 Quarterly Starts and Completions report.

Also on Tuesday, Cleveland Fed President Sandra Pianalto speaks at the Economic Club of Pittsburgh at 12:20 PM , and former Fed Chairman Paul Volcker speaks at Stanford University at 9:45 PM. It was five years ago – at Stanford – that Volcker remarked that “circumstances seem as dangerous and intractable as I can remember" and "homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security". That speech is still worth reading.

On Wednesday, the Q1 MBA delinquency report will be released at 10 AM. The big news last quarter was the decline in 30 day delinquencies, and expectations are for further declines – although long term delinquencies will still be a problem. I’ll be on the conference call at 10:30 AM.

Also on Wednesday, the April Consumer Price Index (CPI) will be released at 8:30 AM. The consensus is for a 0.1% increase in prices. Also the AIA's Architecture Billings Index for April will be released (a leading indicator for commercial real estate). The FOMC minutes for the April meeting will be released at 2 PM.

On Thursday, the closely watched initial weekly unemployment claims will be released. Consensus is for a decline to 440K from 444K last week. Also on Thursday, the Philly Fed survey and the Conference Board's index of leading indicators will both be released at 10 AM.

And on Friday, the BLS will release the Regional and State Employment and Unemployment report for April at 10 AM. And of course the FDIC will probably have another busy Friday afternoon ...

Note: Other reports that will probably be released this week include the Moodys/REAL Commercial Property Price Index (for March), the HAMP April report, DOTs Vehicle Miles Driven for March, and the First American Corelogic distressed sales report for February.

And a summary of last week:

The EU announced a total bailout package of €750 billion (if needed). This story is ongoing ...

1) The EU created a €60 billion fund based on article 122 (special circumstances). The IMF will add €30 billion. Press conference archive here (40 minutes)

2) The EU will create a Special Purpose Vehicle (SPV) for 3 years based on inter government agreements. These are potential loan guarantees backed by all Euro Zone countries. This is in addition to €60 billion and will be up to €440 billion - plus a contribution from the IMF up to half of European Union contribution (up to €220 billion).

3) Both Portugal and Spain announced steps to reduce their deficits.

4) The European Central Bank (ECB) intervened "in the euro area public and private debt securities markets (Securities Markets Programme) to ensure depth and liquidity in those market segments which are dysfunctional."

5) The Federal Reserve reopened swap lines to provide dollar liquidity.

6) Deutsche Bank CEO expressed doubts about Greece

7) ECB's Trichet called this the "most difficult situation" since the World War.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the REO inventory for Fannie, Freddie and FHA through Q1 2010.

Even with all the delays in foreclosure, the REO inventory has increased sharply over the last three quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, 172,357 at the end of Q4 2009 and now 209,500 at the end of Q4 2010.

These are new records for all three agencies.

Remember this is just a portion of the total REO inventory. Private label securities and banks and thrifts hold an even larger number of REOs.

On a monthly basis, retail sales increased 0.4% from March to April (seasonally adjusted, after revisions), and sales were up 8.8% from April 2009 (easy comparison).

On a monthly basis, retail sales increased 0.4% from March to April (seasonally adjusted, after revisions), and sales were up 8.8% from April 2009 (easy comparison).This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish.

Retail sales are up 9.2% from the bottom, but still off 3.6% from the pre-recession peak.

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization This graph shows industrial production since 1967.

This is the highest level for industrial production since Dec 2008, but production is still 9.0% below the pre-recession levels at the end of 2007.

First American CoreLogic released the Q1 2010 negative equity report this week.

This graph shows the negative equity and near negative equity by state.

This graph shows the negative equity and near negative equity by state. Ten percent or more of homeowners have negative equity in 33 states and the D.C., and over 20% have negative equity or near negative equity in 23 states and D.C. This is a widespread problem.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA on the graph above.

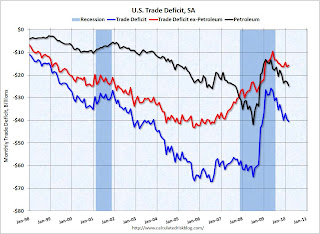

This graph shows the U.S. trade deficit, with and without petroleum, through March.

This graph shows the U.S. trade deficit, with and without petroleum, through March.The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Both imports and exports have been increasing sharply, but are still below the pre-financial crisis levels. Once again China and oil are the major contributors to the trade deficit.

Best wishes to all.