by Calculated Risk on 9/11/2009 02:00:00 PM

Friday, September 11, 2009

Bandos at the Beach and other Foreclosure Stories

Bando: Someone who lives in an abandoned home.

Here are photos of the property.

From the LA Times: Wells Fargo exec used Malibu Colony home lost by Madoff-duped couple, neighbors say

Bernard L. Madoff's massive fraud stunned some of the wealthy denizens of Malibu Colony, especially when a couple devastated by the scheme surrendered their oceanfront home to Wells Fargo Bank.Contrast this to the following Reuters story: Eviction patrol heats up on U.S. foreclosures (ht Ken)

But some neighbors say the real shocker came when they saw one of the bank's top executives spending weekends in the $12-million beach house and hosting eye-catching parties there. What's more, Wells Fargo spurned offers to show the property to prospective buyers, a real estate agent said.

[D]eputies enforcing home evictions in Anaheim find mold, backed-up plumbing, marijuana crops, abandoned grandparents and the occasional suicide.

...

One common task these days is serving eviction notices to people who have done nothing wrong -- who rent properties that have fallen into foreclosure, or are repossessed to recover unpaid debts.

"They are shocked and surprised," [Orange County Sheriff's Deputy Ramona Figueroa] said as she went on her rounds. "And here I am giving them a five-day notice and they explain that just five days earlier the homeowner was at the home collecting rent."

With 17,000 homes going into foreclosure in this Southern California county in the first half of 2009, Figueroa has found her caseload in the last year getting heavier and harder to bear.

Hotel RevPAR off 9.9 Percent

by Calculated Risk on 9/11/2009 12:25:00 PM

Note: Last year Labor Day was a week earlier (Sept 1st in 2008, Sept 7th this year) and that made the comparison last week more difficult, and the comparison easier this week.

From HotelNewsNow.com: STR weekly numbers show improvement in easy comp week

With the Labor Day holiday weekend falling a week later than 2008, the year-over-year comparisons for the week ending 5 September 2009 were not as harsh as usual,according to Smith Travel Research.

Overall the U.S. hotel industry’s occupancy fell 1.4 percent to end the week at 53.4 percent, ADR dropped 8.6 percent to US$92.20, and RevPAR decreased 9.9 percent to finish at US$49.28.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 7.1% from the same period in 2008.

The average daily rate is down 8.6%, and RevPAR is off 9.9% from the same week last year.

Earlier this year business travel was off much more than leisure travel. So it was expected that the summer months would not be as weak as earlier in the year. The next few weeks will be the real test for business travel, and for the hotel industry.

University of Michigan Consumer Sentiment

by Calculated Risk on 9/11/2009 10:01:00 AM

From MarketWatch: Consumer sentiment improves in early Sept, UMich

Consumer sentiment improved sharply in early September, according to media reports on Friday of the Reuters/University of Michigan index. The consumer sentiment index rose to 70.2 from 65.7 in August.Although this is being reported as a "sharp increase" and above expectations, sentiment is still low - and this is just a rebound to the June levels.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - it tells you what you pretty much already know.

This graph shows consumer sentiment and the unemployment rate. There are other factors impacting sentiment too - like gasoline prices - but until the unemployment rate starts to decline, consumer sentiment will probably stay fairly low.

FedEx: "Difficult to predict timing of any economic recovery"

by Calculated Risk on 9/11/2009 09:08:00 AM

Press Release: FedEx Corp. First Quarter Earnings to Exceed Guidance

FedEx expects ... a continued modest recovery in the global economy. ...UPS and FedEx are usually good indicators for the economy. The increase in earnings (compared to guidance) was due to international volumes and cost cutting, not domestic volumes.

“Despite some encouraging signs in the global economy, it is difficult to predict the timing and pace of any economic recovery. Revenue per shipment declined year over year in each of our transportation segments, as fuel surcharges declined significantly and we continue to face a very competitive pricing environment combined with significant overcapacity in the LTL freight market.” ... said Alan B. Graf, Jr., FedEx Corp. chief financial officer.

emphasis added

Still no signs of green shoots in the U.S.

Thursday, September 10, 2009

Corus Bank Watch

by Calculated Risk on 9/10/2009 10:15:00 PM

From the WSJ: Ross Gets Nod for a Bank Charter

Real-estate mogul Stephen M. Ross and the two other partners in his company, Related Cos., have been granted preliminary approval by regulators to charter a new bank, a move that would allow them to bid on failed institutions seized by the government.Although the FDIC was apparently soliciting bids for both the bank and the condo projects separately, the WSJ suggests the FDIC might prefer to sell to one bidder. According to published reports, bids for the assets of Corus were due last Thursday, so the bank will probably be seized some Friday this month.

The approval comes at a time that Related, a national real-estate developer known for such high-profile projects as Time Warner Center in New York, vies with a stable of private-equity and real-estate firms to buy the assets of condo lender Corus Bankshares Inc.

I'll take tomorrow.

Fed Vice Chairman Kohn on Monetary Policy

by Calculated Risk on 9/10/2009 06:36:00 PM

This speech is a review of an academic paper (and a bit wonkish) ... here are some excerpts on two key topics: 1) how well the Fed followed the precepts of Walter Bagehot, and 2) if the Fed should target a higher inflation rate in a liquidity trap.

From Federal Reserve Vice Chairman Donald Kohn: Comments on "Interpreting the Unconventional U.S. Monetary Policy of 2007-2009"

... In designing our liquidity facilities we were guided by the time-tested precepts derived from the work of Walter Bagehot. Those precepts hold that central banks can and should ameliorate financial crises by providing ample credit to a wide set of borrowers, as long as the borrowers are solvent, the loans are provided against good collateral, and a penalty rate is charged.Clearly the Fed believes - except in a few special circumstances - that they did not take on significant credit risk.

..

The liquidity measures we took during the financial crisis, although unprecedented in their details, were generally consistent with Bagehot's principles and aimed at short-circuiting these feedback loops. The Federal Reserve lends only against collateral that meets specific quality requirements, and it applies haircuts where appropriate. Beyond the collateral, in many cases we also have recourse to the borrowing institution for repayment. In the case of the TALF, we are backstopped by the Treasury. In addition, the terms and conditions of most of our facilities are designed to be unattractive under normal market conditions, thus preserving borrowers' incentives to obtain funds in the market when markets are operating normally. Apart from a very small number of exceptions involving systemically important institutions, such features have limited the extent to which the Federal Reserve has taken on credit risk, and the overall credit risk involved in our lending during the crisis has been small.

In Ricardo's view, if the collateral had really been good, private institutions would have lent against it. However, as has been recognized since Bagehot, private lenders, acting to protect themselves, typically severely curtail lending during a financial crisis, irrespective of the quality of the available collateral. The central bank--because it is not liquidity constrained and has the infrastructure in place to make loans against a variety of collateral--is well positioned to make those loans in the interest of financial stability, and can make them without taking on significant credit risk, as long as its lending is secured by sound collateral. A key function of the central bank is to lend in such circumstances to contain the crisis and mitigate its effects on the economy.

emphasis added

And on monetary policy in a liquidity trap:

Ricardo notes that the theoretical literature on monetary policy in a liquidity trap commonly prescribes targeting higher-than-normal inflation rates even beyond the point of economic recovery, so that real interest rates decline by more and thus provide greater stimulus for the economy. The arguments in favor of such a policy hinge on a clear understanding on the part of the public that the central bank will tolerate increased inflation only temporarily--say, for a few years once the economy has recovered--before returning to the original inflation target in the long term. Notably, although many central banks have put their policy rates near zero, none have adopted this prescription. In the theoretical environment considered by the paper, long-run inflation expectations are perfectly anchored. In reality, however, the anchoring of inflation expectations has been a hard-won achievement of monetary policy over the past few decades, and we should not take this stability for granted. Models are by their nature only a stylized representation of reality, and a policy of achieving "temporarily" higher inflation over the medium term would run the risk of altering inflation expectations beyond the horizon that is desirable. Were that to happen, the costs of bringing expectations back to their current anchored state might be quite high. But while the Federal Reserve has not attempted to raise medium-term inflation expectations as prescribed by the theories discussed in the paper, it has taken numerous steps to lower real interest rates for private borrowers and keep inflation expectations from slipping to undesirably low levels in order to prevent unwanted disinflation. These steps include the credit policies I discussed earlier, the provision of forward guidance that the level of short-term interest rates is expected to remain quite low "for an extended period" conditional on the outlook for the economy and inflation, and the publication of the longer-run inflation objectives of FOMC members.There are both interesting topics. If the collateral is mostly solid (or the haircuts appropriate), then the Fed will be in decent shape when they start to unwind current policy positions. However Reis (no link) apparently argues that the Fed will suffer significant losses, and the borrowing from the Treasury will make the Fed's monetary policy less independent.

MEW and the Wealth Effect

by Calculated Risk on 9/10/2009 02:50:00 PM

Professors Atif Mian and Amir Sufi (both University of Chicago Booth School of Business and NBER) published a new paper: The Household Leverage-Driven Recession of 2007 to 2009 This is related to their paper earlier this year: House Prices, Home Equity-Based Borrowing, and the U.S. Household Leverage Crisis, See: MEW, Consumption and Personal Saving Rate

A cross-sectional analysis of U.S. counties shows that areas with modest increases in leverage from 2002 to 2006 have experienced only a minor economic downturn, whereas counties with large increases in household leverage from 2002 to 2006 have experienced a severe recession. Our findings suggest that the process of household de-leveraging is likely to be the major headwind facing the economy going forward.The authors have written a brief discussion of the paper at NPR Money: Lessons From The Fall: Household Debt Got Us Into This Mess

The Economist has a recent review of the paper: Withdrawal symptoms

More than a third of new defaults in 2006-08 were because of home-equity-based borrowing. Default rates for low credit-quality homeowners rose by more than 12 percentage points in places where housing was scarcest and prices had risen most. In “elastic” cities, by contrast, the increase was less than four percentage points. This suggests huge over-borrowing. Prospects for a sustained recovery look dim if households that are most inclined to spend are mired in negative equity.Here are three graphs from the paper (posted with permission from the author):

Click on graph for larger image.

Click on graph for larger image.The first graph is figure 5B from the paper. Looking at the left panel, note that the x-axis is the change in debt to income, by County, from 2002 to 2006. And the y-axis is for the period 2006 - 2008. This shows that the change in the debt to income ratio was a good predictor of default rates.

From the authors:

Correlation across Counties of Default Rates and House Prices during Recession with Leverage Growth from 2002 t0 2006

The left panel presents the correlation across U.S. counties of the increase in the household debt to income ratio from 2002 to 2006 and the increase in the default rate from 2006 to 2008. The right panel presents the correlation across U.S. counties of the increase in the household debt to income ratio from 2002 to 2006 and the decline in house prices from 2006 to 2008. The sample includes 450 counties with at least 50,000 households as of 2000.

The second graph is figure 6A from the paper. From the authors:

The second graph is figure 6A from the paper. From the authors: Auto Sales and Unemployment Rates in High and Low Leverage Growth Counties

High leverage growth counties are defined to be the top 10% of counties by the increase in the debt to income ratio from 2002 to 2006. Low leverage growth counties are in the bottom 10% on the same measure. The left panel plots the growth in auto sales for high and low leverage growth counties since 2005, and the right panel plots the change in the unemployment rate in high and low leverage growth counties since 2005. Auto sales decline and unemployment increases by significantly more in counties that experience the sharpest increase in debt to income ratios from 2002 to 2006.

The third graph is figure 6B from the paper. From the authors:

The third graph is figure 6B from the paper. From the authors: Correlation across Counties of Auto Sales and Unemployment during Recession with Leverage Growth from 2002 to 2006This analysis, comparing high and low leverage counties, is very revealing and shows that the high leverage areas are also the hardest hit (not surprising to those of us who felt mortgage equity extraction was a significant driver of consumption growth). The authors conclude:

The left panel presents the correlation across U.S. counties of the increase in the household debt to income ratio from 2002 to 2006 and the decline in auto sales from 2006 to 2008. The right panel presents the correlation across U.S. counties of the increase in the household debt to income ratio from 2002 to 2006 and the increase in unemployment rates from 2006 to 2008. The sample includes 450 counties with at least 50,000 households as of 2000.

[T]he initial economic slowdown was a direct result of an over-leveraged household sector unable to keep pace with its debt obligations.

Census Bureau: Real Median Household Income Fell 3.6%

by Calculated Risk on 9/10/2009 11:39:00 AM

From the Census Bureau:

The U.S. Census Bureau announced today that real median household income in the United States fell 3.6 percent between 2007 and 2008, from$52,163 to $50,303. This breaks a string of three years of annual income increases and coincides with the recession that started in December 2007.Here are some interesting stats on income: Annual Social and Economic (ASEC) Supplement

The nation’s official poverty rate in 2008 was 13.2 percent, up from 12.5 percent in 2007. There were 39.8 million people in poverty in 2008, up from 37.3 million in 2007.

Meanwhile, the number of people without health insurance coverage rose from 45.7 million in 2007 to 46.3 million in 2008, while the percentage remained unchanged at15.4 percent.

...

•Income inequality was statistically unchanged between 2007 and 2008, as measured by shares of aggregate household income by quintiles and the Gini index. The Gini index was 0.466 in 2008.

Note: for the house price to household income chart I graph every quarter, I assumed a "2% increase in household [nominal] median income for 2008 and flat for 2009". That was too optimistic.

Report: Treasury to Announce Short Sale Incentives this Month

by Calculated Risk on 9/10/2009 11:02:00 AM

From Diana Golobay at Housing Wire: Federal Incentives Coming for Short Sales, Deeds-in-Lieu

US Treasury Department sources confirmed to HousingWire the Treasury expects to issue details on the short sale and deed-in-lieu program later this month.This program is aimed at borrowers who would be "generally eligible for a MHA modification", but are probably too far underwater ... or owe too much.

...

[Federal Housing Administration (FHA) commissioner David Stevens said, in prepared remarks, at a House Financial Services subcommittee hearing yesterday:] “Because we know that the MHA program will not reach every at-risk homeowner or prevent all foreclosures, on May 14th the Administration announced the Foreclosure Alternatives program that will provide incentives for, and encourage, servicers and borrowers to pursue short sales and deeds-in-lieu (DIL) of foreclosure in cases where the borrower is generally eligible for a MHA modification but does not qualify or is unable to complete the process.”

He said the program will simplify the process of pursuing short sales and deeds-in-lieu, which will encourage more servicers and borrowers to participate in the program. The program will standardize the process, documentation and short performance timeframes.

“These options eliminate the need for potentially lengthy and expensive foreclosure proceedings, preserve the physical condition and value of the property by reducing the time a property is vacant, and allows the homeowners to transition with dignity to more affordable housing,” Stevens added.

emphasis added

Trade Deficit Increases in July

by Calculated Risk on 9/10/2009 08:46:00 AM

The Census Bureau reports:

The ... total July exports of $127.6 billion and imports of $159.6 billion resulted in a goods and services deficit of $32.0 billion, up from $27.5 billion in June, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through July 2009.

Imports were up again in July, and exports also increased. On a year-over-year basis, exports are off 22% and imports are off 30%.

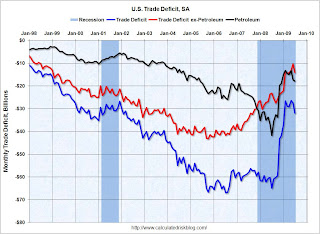

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $62.48 in July - up about 50% from the prices in February (at $39.22) - and the fifth monthly increase in a row. Import oil prices will probably rise further in August.

It appears the cliff diving for U.S. trade might be over, although recent port data shows some weakness in traffic.