by Calculated Risk on 9/01/2009 12:08:00 PM

Tuesday, September 01, 2009

Autos: Ford U.S. August sales rise 17%

From MarketWatch: Ford U.S. August sales rise 17%

Ford Motor Co. said Tuesday that total U.S. sales in August rose 17% to 182,149 vehicles from 155,690 last year.From MarketWatch: Volkswagen U.S. August sales rise 11.4%

From MarketWatch: Daimler U.S. August sales fall 10.5%

Update: MarketWatch: Chrysler U.S. August sales decline 15%

Toyota, GM and more to come.

Once all the reports are released, I'll post a graph of the estimated total August sales (SAAR: seasonally adjusted annual rate). The range of estimates for August have been very wide because of the Clunker program - from a low of 13 million SAAR to a high of about 16 million SAAR.

Construction Spending in July

by Calculated Risk on 9/01/2009 10:29:00 AM

Two of the key stories in 2009 are the probable bottom for residential construction spending, and the collapse in private non-residential construction. Both stories are still developing ... but this report shows further evidence of both stories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased in July, and nonresidential spending continued to decline.

Private residential construction spending is now 63.7% below the peak of early 2006.

Private non-residential construction spending is still only 9.7% below the peak of last September. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 8.3% on a year-over-year basis, and will turn strongly negative as projects are completed. Residential construction spending is still declining YoY, although the negative YoY change will get smaller going forward.

From the Census Bureau: July 2009 Construction at $958 Billion Annual Rate

Pending Home Sales Increase in July

by Calculated Risk on 9/01/2009 10:00:00 AM

From the NAR: Pending Home Sales on a Record Roll

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in July, increased 3.2 percent to 97.6 from a reading of 94.6 in June, and is 12.0 percent higher than July 2008 when it was 87.1. The index is at the highest level since June 2007 when it was 100.7.The increase in pending sales has been mostly from lower priced homes with demand from first time home buyers (taking advantage of the tax credit) and investors.

...

NAR estimates that about 1.8 to 2.0 million first-time buyers will take advantage of the $8,000 tax credit this year, with approximately 350,000 additional sales that would not have taken place without the credit.

emphasis added

And look at the cost of the tax credit! If NAR is close to being correct, 2 million buyers will claim the tax credt - times $8,000 - is $16 billion. But this only resulted in "approximately 350,000 additional sales".

So this tax credit cost taxpayers about $45,000 per each additional home sold. Not very effective ... especially considering most of these are lower priced homes.

Hotels: "A False Bottom in RevPAR?"

by Calculated Risk on 9/01/2009 08:50:00 AM

In my weekly posts on hotel occupancy and RevPAR (Revenue per available room), I've been noting:

Earlier this year business travel was off much more than leisure travel. So it was expected that the summer months would not be as weak as earlier in the year. September - after Labor Day (Sept 7th) - will be the real test for business travel, and for the hotel industry.Here is an excerpt from some Morgan Stanley research released last week on hotels making the same point: A False Bottom in RevPAR? (no link).

"[W]e are in an operating environment in which a) group demand is significantly worse than transient demand, and b) leisure demand is holding up better than the other segments. Due to the seasonality of the lodging demand mix, we believe that July and August RevPAR improvement is partially a mirage created by a shift in the demand mix away from groups and toward leisure. As the demand mix shifts back away from leisure and toward group in September and October, we expect RevPAR trends to deteriorate from this false bottom. ... we expect ... RevPAR declines to be close to 20% for [September and October].Last week, from HotelNewsNow.com: STR reports US performance for week ending 22 August 2009

emphasis added

Revenue per available room for the week decreased 16.7 percent to finish at US$57.84.With the expected seasonal decline in leisure travel, I wouldn't be surprised to see RevPAR off 20% in September and October - and that will put additional pressure on hotels.

Monday, August 31, 2009

Hope Now Mortgage Loss Mitigation Statistics

by Calculated Risk on 8/31/2009 10:48:00 PM

Hope Now released the July Mortgage Loss Mitigation Statistics.

Most of the data concerns modifications - and those are not encouraging - but here are couple of graphs on delinquencies and foreclosures. Click on graph for larger image in new window.

Click on graph for larger image in new window.

There are now more than 3 million mortgage loans 60+ delinquent based on the Hope Now statistics.

The Hope Now program covers approximately 73% of the total industry, so the total delinquent is probably over 4 million now. The second graph shows delinquent loans, and foreclosure starts and completions.

The second graph shows delinquent loans, and foreclosure starts and completions.

Foreclosure starts were above 283 thousand in July, and completions only 89 thousand. There is a lag between start and completion, and a number of loans cure or are modified.

But foreclosures are dwarfed by 60+ day delinquencies. Although there will probably be a surge in foreclosure sales later this year (based on the increase in foreclosure starts), the real question is how many of those delinquent loans will become foreclosures?

Clunkers and August Auto Sales

by Calculated Risk on 8/31/2009 08:23:00 PM

There is no question auto sales will decline sharply in September, but there is a pretty amazing range of estimates for August ... a couple of excerpts:

From the WSJ: Next for Auto Sector, Post-Clunker Hangover

Auto sales for August, due out by Tuesday afternoon, are expected to come in between 13 million SAAR, or the seasonally adjusted annual rate of car sales, and 16 million.And from Bloomberg: U.S. Auto-Sales Rate May Be Highest Since April 2008

U.S. auto sales in August probably will run at the highest rate since April 2008 after the federal government’s “cash for clunkers” rebates fueled demand.There probably were 550 thousand clunker related sales in August, but the question is the number of non-clunker sales. If there was little cannibalization of regular sales, non-clunker sales would probably be close to 800 thousand. August is usually a strong sales month, and adjusting for seasonal factors, this would suggest a sales rate close to 16 million SAAR.

The so-called seasonally adjusted annual rate for this month will be 14.3 million, the average estimate of 10 analysts surveyed by Bloomberg.

...

August sales results, released tomorrow, will reflect more than three weeks of transactions under the clunkers program, which ran from July 27 through Aug. 24.

From Dow Jones: Edmunds.com Sees Aug US Auto Sales Up 18%; Wary On Sept

Edmunds.com is projecting August U.S. new-vehicle sales of about 1.17 million and a seasonally adjusted annualized rate of slightly more than 13 million.A sales rate of 13 million SAAR - although the highest rate since last August - would have to be considered very disappointing.

CNBC: What Banks are doing with Foreclosures

by Calculated Risk on 8/31/2009 05:01:00 PM

Diana Olick at CNBC has some BofA info: What Banks Are Really Doing With Foreclosures

Bank of America:According to BofA, they are not sitting on REOs (Real Estate Owned) for longer than normal, but they are holding off foreclosing - pending modification attempts. That is basically what the data says too.Foreclosure sales have been abnormally low since we learned of the pending implementation of the administration’s Making Home Affordable program. From that point, we delayed the initiation of foreclosure proceedings and sales for customers that may eligible for a loan modification under MHA. As a result of this policy, our foreclosure sales in recent months have been as little as half the normal pace we experienced before.

...Now that Making Home Affordable programs are operational, we do project an increase in foreclosures as we exhaust every available option to qualify customers for modifications and other solutions.

...We do not hold foreclosed properties off the market.

The Q2 FDIC Quarterly Banking Profile showed the banks held $11.5 billion in 1-4 family residential REO at the end of Q2. That is the same level as the last several quarters.

But what has really changed is the surge in delinquencies - combined with the banks holding off foreclosing. As BofA notes, this will lead to a wave of foreclosures later this year and into 2010, however the size of the wave depends on the success of the modification programs (not looking great so far).

August Economic Summary in Graphs

by Calculated Risk on 8/31/2009 04:00:00 PM

Here is a collection of real estate and economic graphs for data released in August ...

Note: Click on graphs for larger image in new window. For more info, click on link below graph to original post.

New Home Sales in July (NSA)

New Home Sales in July (NSA)The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the 3rd lowest sales for July since the Census Bureau started tracking sales in 1963.

In July 2009, 39 thousand new homes were sold (NSA); the record low was 31 thousand in July 1982; the record high for July was 117 thousand in 2005.

From: New Home Sales Increase in July

New Home Sales in July

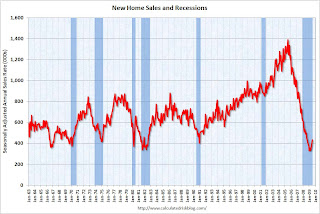

New Home Sales in JulyThis graph shows shows New Home Sales vs. recessions for the last 45 years.

"Sales of new one-family houses in July 2009 were at a seasonally adjusted annual rate of 433,000 ...

This is 9.6 percent (±13.4%) above the revised June rate of 395,000, but is 13.4 percent (±12.9%) below the July 2008 estimate of 500,000."

From: New Home Sales Increase in July

New Home Months of Supply in July

New Home Months of Supply in JulyThere were 7.5 months of supply in July - significantly below the all time record of 12.4 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of July was 271,000. This represents a supply of 7.5 months at the current sales rate."

From: New Home Sales Increase in July

Existing Home Sales in July

Existing Home Sales in July This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2009 (5.24 million SAAR) were 7.2% higher than last month, and were 5.0% lower than July 2008 (4.99 million SAAR).

From: Existing Home Sales increase in July

Existing Home Inventory July

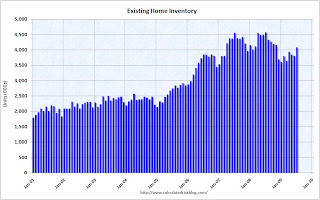

Existing Home Inventory JulyThis graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 4.09 million in July. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Also, many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs and other shadow inventory - so this inventory number is probably low.

From: Existing Home Sales increase in July

Existing Home Inventory July, Year-over-Year Change

Existing Home Inventory July, Year-over-Year ChangeThis graph shows the year-over-year change in existing home inventory.

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 9.4 months), and that will take some time. Plus remember the shadow inventory!

From: More on Existing Home Inventory

Case Shiller House Prices for June

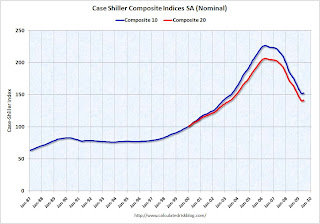

Case Shiller House Prices for JuneThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.6% from the peak, and up about 9% (annualized) in June.

The Composite 20 index is off 31.4% from the peak, and up in June.

From: Case-Shiller House Price Index Increases in June

NAHB Builder Confidence Index in August

NAHB Builder Confidence Index in AugustThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 18 in August from 17 in July. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

From: NAHB: Builder Confidence Slightly Higher in August

Architecture Billings Index for July

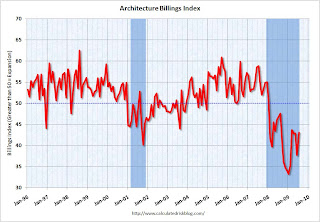

Architecture Billings Index for July"The Architecture Billings Index rebounded more than 5 points last month to a reading of 43.1, reversing a similar decline in June, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008 ..."

From: AIA: Architecture Billings Index shows Contraction in July

Housing Starts in July

Housing Starts in JulyTotal housing starts were at 581 thousand (SAAR) in July, off slightly from June, but up sharply over the last three months from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 490 thousand (SAAR) in July, up slightly from June; 37 percent above the record low in January and February (357 thousand).

From: Housing Starts Flat in July

Construction Spending in June

Construction Spending in JuneThe first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased slightly in June, and nonresidential spending declined a little. From other data (new housing starts), it appears that residential spending has stabilized and might increase in Q3 - however private nonresidential construction will be falling off a cliff.

From: Construction Spending Increases Slightly in June

July Employment Report

July Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 247,000 in July. The economy has lost almost 5.7 million jobs over the last year, and 6.66 million jobs during the 19 consecutive months of job losses.

The unemployment rate declined slightly to 9.4 percent.

Year over year employment is strongly negative.

From: Employment Report: 247K Jobs Lost, 9.4% Unemployment Rate

July Employment Comparing Recessions

July Employment Comparing RecessionsThis graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last year, and the current recession is now the 2nd worst recession since WWII in percentage terms (and the 1948 recession recovered very quickly) - and also in terms of the unemployment rate (only early '80s recession was worse).

From: Employment Report: 247K Jobs Lost, 9.4% Unemployment Rate

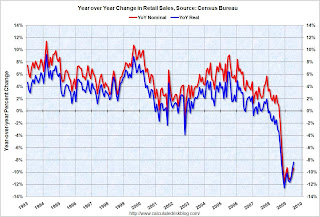

July Retail Sales

July Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

The Census Bureau reported retail sales decreased 0.1% from June to July (seasonally adjusted), and sales are off 8.3% from July 2008 (retail ex food services decreased 9.3%).

From: Retail Sales Decline Slightly in July

LA Port Traffic in July

LA Port Traffic in JulyThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 22.0% below July 2008.

Outbound traffic was 22.7% below July 2008.

There had been some recovery in U.S. exports earlier this year (the year-over-year comparison was off 30% from December through February). And this showed up in the in the Q1 and Q2 GDP reports as net exports of goods and services added 2.64% and 1.38% to GDP in Q1 and Q2, respectively.

From: LA Area Ports: Export Traffic Declines in July

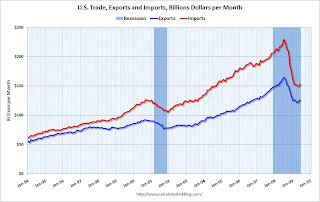

U.S. Imports and Exports Through June

U.S. Imports and Exports Through JuneThis graph shows the monthly U.S. exports and imports in dollars through June 2009.

Imports were up in June, mostly because of a spike in oil prices. Exports also increased in June. On a year-over-year basis, exports are off 22% and imports are off 31%.

From: Trade Deficit Increases in June

Capacity Utilization in July

Capacity Utilization in July This graph shows Capacity Utilization. This series is slightly above the record low (the series starts in 1967).

"Industrial production increased 0.5 percent in July. Aside from a hurricane-related rebound in October 2008, the gain in July marked the first monthly increase since December 2007. ... At 96.0 percent of its 2002 average, total industrial production was 13.1 percent below its level of a year earlier. In July, the capacity utilization rate for total industry edged up to 68.5 percent, a level 12.4 percentage points below its 1972-2008 average."

From: Industrial Production, Capacity Utilization Increase in July

Restaurant Performance Index for July

Restaurant Performance Index for July"The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 98.1 in July, up 0.3 percent from its June level. However, the RPI still remained below 100 for the 21st consecutive month, which signifies contraction in the index of key industry indicators.

...

In addition to sales declines, restaurant operators reported negative customer traffic levels for the 23rd consecutive month in July."

From: Restaurants in July: 23rd Consecutive Month of Declining Traffic

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty seven states are showing declining three month activity.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 35 states in June, and was unchanged in 8 states.

From: Philly Fed State Coincident Indicators: Still a Widespread Recession in July

Light vehicle sales in July

Light vehicle sales in JulyThis graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for July (red, light vehicle sales of 11.24 million SAAR from AutoData Corp).

This is the highest vehicle sales since September 2008 (12.5 million SAAR).

From: Light Vehicle Sales Over 11 Million (SAAR) in July

Q2: Office, Mall and Lodging Investment

Q2: Office, Mall and Lodging Investment This graph shows investment in offices, lodging and malls as a percent of GDP.

The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has started to decline (0.27% in Q2 2009). There was a small increase in Q2 2009 that is probably related to projects being completed. I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen sharply.

Office investment as a percent of GDP peaked at 0.46% in Q3 2008 and has started to decline sharply. With the office vacancy rate rising sharply, office investment will also probably decline through at least 2010.

From: Q2: Office, Mall and Lodging Investment

NMHC Quarterly Apartment Survey

NMHC Quarterly Apartment SurveyThis graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

From: Q2 NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

U.S. Consumer Bankruptcy Filings in July

U.S. Consumer Bankruptcy Filings in JulyThis graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, 2009 based on monthly data from the American Bankruptcy Institute.

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Reach Highest Monthly Total Since 2005 Bankruptcy Law Overhaul

U.S. consumer bankruptcy filings reached 126,434 in July, the highest monthly total since the Bankruptcy Abuse Prevention and Consumer Protection Act was implemented in October 2005, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC).From: ABI: Personal Bankruptcy Filings up 34.3 Percent compared to July 2008

Delinquency Rates in Q2 2009

Delinquency Rates in Q2 2009 This graph shows the delinquency rates at the commercial banks for residential real estate, commercial real estate and consumer credit cards.

Commercial real estate delinquencies (7.91%) are rising rapidly, and are at the highest rate since the early '90s (as delinquency rates declined following the S&L crisis).

Residential real estate (8.84%) and consumer credit card (6.7%) delinquencies are at the highest levels since the Fed started tracking the data (since Q1 '91).

Although there is credit deterioration everywhere, the rise in these three categories is especially significant. There was also a significant increase in C&I delinquencies (commerical & industrial) and Agricultural loans.

From: Fed: Delinquency Rates Surged in Q2 2009

Fitch: Credit Card Default Chargeoffs decline Slightly in July

by Calculated Risk on 8/31/2009 01:35:00 PM

From Fitch: Consumer 'Signs of Life' Improve U.S. Credit Card Chargeoffs

U.S. consumer credit quality showed signs of life as credit card ABS chargeoffs declined last month, snapping a string of five consecutive record highs, according to the latest Credit Card Index results from Fitch Ratings.As a reminder, the bank stress tests assumed a cumulative two year credit card loss rate of 18% to 20% for the more adverse scenario (only 12% to 17% for the baseline scenario). Right now losses are worse than the more adverse scenario.

...

'We still need to see some measurable improvement in the delinquency and personal bankruptcy figures and the employment situation overall before chargeoffs revert to more historical norms,' said Managing Director Michael Dean. 'For now, we expect chargeoffs to moderate at these elevated levels in the coming months.'

Chargeoffs had risen 45% from February through July and they still remain 63% above year earlier levels. Late stage delinquencies, or receivables more than 60 days past due, have held relatively stable albeit near record highs during the same period following a rapid increase over the prior six months that forewarned the chargeoff run-up.

Fitch's Prime Credit Card Chargeoff Index declined 24 basis points (bps) to 10.55% for the July collection period. ...

Also credit card loss rates tend to the track unemployment - so, as the unemployment rate rises into 2010, the credit card chargeoffs might increase some more.

Restaurants in July: 23rd Consecutive Month of Declining Traffic

by Calculated Risk on 8/31/2009 10:03:00 AM

Note: Any reading below 100 shows contraction for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain In June as Restaurant Performance Index Declined for Second Consecutive Month

The outlook for the restaurant industry improved somewhat in July, as the National Restaurant Association’s comprehensive index of restaurant activity registered its first gain in three months. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 98.1 in July, up 0.3 percent from its June level. However, the RPI still remained below 100 for the 21st consecutive month, which signifies contraction in the index of key industry indicators.

“Although restaurant operators continue to report soft same-store sales and customer traffic levels, they are more optimistic about improving conditions in the months ahead,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Restaurant operators reported a positive six-month economic outlook, and the proportion expecting higher sales rose to its highest level in three months.”

...

In addition to sales declines, restaurant operators reported negative customer traffic levels for the 23rd consecutive month in July.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The restaurant business is still contracting, although not contracting as fast as late last year.

The cook must have put the green shoots in the soup.