by Calculated Risk on 8/19/2009 05:03:00 PM

Wednesday, August 19, 2009

Report: BBVA Submits Winning Bid for Guaranty Bank (Texas)

From Bloomberg: BBVA Said to Win FDIC Bidding for Guaranty Financial of Texas

Banco Bilbao Vizcaya Argentaria SA ... was selected to take over the assets of Guaranty Financial Group Inc. in a government-assisted transaction ...Guaranty might be seized tomorrow - or even today (like what happened with BankUnited after the deal was leaked).

Guaranty will be the second largest failure of the year.

Ouch. Colonial Left a Mark! (on Loans)

by Calculated Risk on 8/19/2009 04:06:00 PM

From Peter Eavis at the WSJ: Colonial Bank Marks a New Low for Loans

In doing the deal, BB&T is marking down Colonial loans and real-estate collateral by 37%, a number that reflects a large amount of estimated losses. The biggest mark is on construction loans; BB&T is cutting their value by 67%.And here is the BB&T presentation.

Click on slide for larger image in new window.

Click on slide for larger image in new window.Yes, Colonial had some really bad loans. Peter Eavis quoted Daryl Bible, BB&T's chief financial officer: "When we looked at Colonial's portfolio versus ours, we saw a lot of borrowers we turned away."

Still it appears the BB&T / Colonial marks are the lowest yet.

Moody’s: CRE Prices Off 36 Percent from Peak, Off 1% in June

by Calculated Risk on 8/19/2009 01:25:00 PM

From Bloomberg: U.S. Commercial Property Values Fall as Rent Declines Forecast

The Moody’s/REAL Commercial Property Price Indices fell 1 percent in June and are down 36 percent from their October 2007 peak, Moody’s Investors Service said in a report today.I think the office prices increase was an anomaly. Other CRE prices fell much faster.

...

“It’s too soon to call the bottom,” said Connie Petruzziello, a Moody’s analyst and co-author of the commercial property price report.

The Moody’s survey found a 4 percent increase in office prices in the second quarter compared with the previous three months ... Industrial properties ... fell 20 percent in the quarter, while apartments fell 16 percent and retail properties 8 percent.

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

Failed Bank List, Including Percent Losses

by Calculated Risk on 8/19/2009 11:20:00 AM

As a companion to the Problem Bank List (unofficial), here is a list of failed banks since Jan 2007. Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Financial Reform: Don't hold your breath

by Calculated Risk on 8/19/2009 10:00:00 AM

From Bloomberg: Scholes, Merton Says Banks Should Value Assets Better (ht Brian)

Financial institutions should use mark-to-market accounting or list the hard-to-value securities on public exchanges whenever possible, Scholes said in a Bloomberg Radio interview yesterday. ...Don't hold your breath.

“I’d like to see us encourage many more securities held on the books of the banks be migrated to exchanges if possible,” he said. Doing so would “allow for market discovery and market pricing as much as possible,” Scholes added.

...

“This is not the way forward,” [Merton, Robert Kaplan and Scott Richard] wrote. “While regulators and legislators are keen to find simple solutions to complex problems, allowing financial institutions to ignore market transactions is a bad idea.”

And from the SEC: Sample Letter Sent to Public Companies on MD&A Disclosure Regarding Provisions and Allowances for Loan Losses (ht LDM)

Clear and transparent disclosure about how you account for your provision and allowance for loan losses has always been critically important to an investor’s understanding of your financial statements. ... Finally, although determining your allowance for loan losses requires you to exercise judgment, it would be inconsistent with generally accepted accounting principles if you were to delay recognizing credit losses that you can estimate based on current information and events. Where we believe a financial institution’s financial statements are inconsistent with GAAP, we will take appropriate action.Don't hold your breath.

emphasis added

And from the Jackson Hole conference in 1987: Restructuring the Financial System. Concluding remarks from Gerald Corrigan:

Clearly there is a broad-based consensus that something has to be done about restructuring our financial system. There is even a broadbased consensus as to why it has to be done. I certainly would count myself among those who put considerable urgency behind the task of getting it done.Nothing was done. Hopefully no one held their breath.

AIA: Architecture Billings Index shows Contraction in July

by Calculated Risk on 8/19/2009 07:43:00 AM

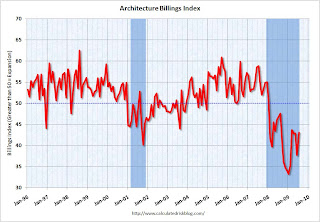

From Reuters: U.S. architecture billings index up in July: AIA

... The Architecture Billings Index rebounded more than 5 points last month to a reading of 43.1, reversing a similar decline in June, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008 ...

Credit remains tight and government stimulus funds have had little visible impact on project activity, AIA Chief Economist Kermit Baker said.

"There has been too much contraction in recent months to get overly optimistic about business conditions," Baker said.

...

Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions. The AIA's Billings Index, which began in 1995, is considered a measure of construction spending nine to 12 months in the future.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index is still below 50 indicating falling demand.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment later this year and next.

New Appraisal Process Shifts Power

by Calculated Risk on 8/19/2009 12:02:00 AM

From David Streitfeld at the NY Times: In Appraisal Shift, Lenders Gain Power and Critics

Mike Kennedy, a real estate appraiser in Monroe, N.Y., was examining a suburban house a few years ago when he discovered five feet of water in the basement. The mortgage broker arranging the owner’s refinancing asked him to pretend it was not there.Streitfeld discusses the origins of the HVCC and the current situation (only the appraisal management companies and lenders are happy). Interesting story.

Brokers, real estate agents and banks asked appraisers to do a lot of pretending during the housing boom, pumping up values while ignoring defects. While Mr. Kennedy says he never complied, many appraisers did, some of them thinking they had no choice if they wanted work. A profession that should have been a brake on the spiral in home prices instead became a big contributor.

On May 1, a sweeping change took effect that was meant to reduce the conflicts of interest in home appraisals while safeguarding the independence of the people who do them.

Brokers and real estate agents can no longer order appraisals. Lenders now control the entire process.

The Home Valuation Code of Conduct is setting off a bitter battle. Mortgage brokers, lenders, real estate agents, regulators and appraisers are all arguing over whether an effort to fix one problem has created many new ones.

Tuesday, August 18, 2009

Update on Bank Bids: Guaranty (Texas) and Corus

by Calculated Risk on 8/18/2009 09:32:00 PM

From Reuters: Guaranty Financial draws bid -- sources

A consortium that is led by financial services executive Gerald Ford and includes several private equity firms submitted a bid for troubled bank Guaranty Financial, despite uncertainty over U.S. regulation guidelines, sources familiar with the matter said on Tuesday.Today was the deadine for bids for the assets of Guaranty ($14.4 billion in assets as of Q1). My guess is the bank will be seized this week.

It was unclear how many offers were submitted in total by Tuesday's deadline for bids, but sources said that there were also expected to be bids from other parties.

From Nick Timiraos at the WSJ: Corus Bids Enter the Final Stretch

New York developer the Related Cos. and Lubert-Adler Partners LP, a Philadelphia real-estate investment firm, have teamed up to bid on the assets of condo lender Corus Bank, joining a rival offer from Los Angeles private-equity fund Colony Capital LLC and iStar Financial Inc., the New York commercial-mortgage real-estate investment trust.From other reports, it appears the bidding on the assets of Corus will be open until Sept 3rd (Corus had $7.6 billion in assets as of Q1).

Several real-estate professionals see the Related-Lubert team as having the inside track to the bank's assets in a sale brokered by the Federal Deposit Insurance Corp., though other private-equity firms remain in the mix ...

These will be the 2nd and 4th largest failures of the year. Colonial had $25 billion in assets, and BankUnited had $12.8 billion in assets when they failed.

Judge: Banker "Culture of Corruption" was "Pernicious and pervasive"

by Calculated Risk on 8/18/2009 06:54:00 PM

The following article is about one of the ex-Credit Suisse brokers being found guilty of securities fraud. The judge's comments about the culture in financial services industry are on point ...

From Bloomberg: Ex-Credit Suisse Broker Eric Butler Guilty of Securities Fraud

U.S. District Judge Jack Weinstein ... asked lawyers for both Butler and the government, when they file sentencing papers, to put Butler’s acts in the context of “how pernicious and pervasive was the culture of corruption, lack of regulation” and “serious negligence in the financial services industry in supervising people like this.”Some of these operations made J.T. Marlin look legit (OK, another movie reference).

Market, Autos and Misc

by Calculated Risk on 8/18/2009 04:00:00 PM

Note: Google / Blogger is under a DDoS-style attack again - sorry for any inconvenience. Click on graph for larger image in new window.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From Edmunds.com: “Cash for Clunkers” Sales on the Rapid Decline (ht Bob_in_MA)

The rush of automotive sales activity brought on by the "Cash for Clunkers" program is fading fast, according to Edmunds.com, whose latest study of car buyer behavior indicates that automotive purchase intent is down 31 percent from its peak in late July.And from a Guaranty Bank (Texas) NT 10-Q SEC filing:

“Now that there is plenty of money in the program and the most eager shoppers have already participated, the sense of urgency is gone, and the pace of intent decline is accelerating,” observed Edmunds.com CEO Jeremy Anwyl. "Inventories are getting lean and prices are climbing, giving consumers reasons to sit back."

Last week, activity was down 15 percent from the late July peak, and Edmunds.com analysts predict that in the coming days, purchase intent will return to levels seen before the launch of Cash for Clunkers. Purchase intent has proven to be a reliable leading indicator of sales to come in the following 90 days.

“Our research indicates that Cash for Clunkers buyers have come in three waves: the first was the informed, pent-up buyers who anxiously waited for the program to launch, while the second was the mass market who responded to advertising and other promotional coverage of the program,” recalls Edmunds.com Senior Analyst Jessica Caldwell. “Now the industry is largely servicing the third wave, which is generally made up of people who had to chase down copies of lost titles and other paperwork and are now able to finally participate. It is unclear where the customers will come from after this wave crests and breaks.”

As described in the July 23 8-K, the Company does not believe it is possible to raise sufficient capital to comply with the Orders to Cease and Desist described in the Company’s Current Report on Form 8-K filed on April 8, 2009. Accordingly, the Company no longer believes that it will be able to continue as a going concern.Bids for Guaranty's assets were due today, and it is very likely that Guaranty will be seized this week by the FDIC. Guaranty keeps repeating the warning - and still the stock is trading above zero ...

The Company continues to cooperate with the Office of Thrift Supervision (the “OTS”) and the Federal Deposit Insurance Corporation (“FDIC”) as they pursue alternatives for the business of the Bank. Any such transaction would not be expected to result in the receipt of any proceeds by the stockholders of the Company.