by Calculated Risk on 7/27/2009 11:57:00 PM

Monday, July 27, 2009

WaPo: Foreclosures Frequently Best Alternative for Lenders

Note: I covered this research a few weeks ago: Researchers: "Few Preventable Foreclosures", but this is worth repeating ...

From the WaPo: Foreclosures Are Often In Lenders' Best Interest

Government initiatives to stem the country's mounting foreclosures are hampered because banks and other lenders in many cases have more financial incentive to let borrowers lose their homes than to work out settlements, some economists have concluded.If the option is foreclosure or modification - and the modification will work, then the economics favor foreclosure.

Policymakers often say it's a good deal for lenders to cut borrowers a break on mortgage payments to keep them in their homes. But, according to researchers and industry experts, foreclosing can be more profitable.

The problem is it is hard to tell if the borrowers will self-cure or redefault.

Nearly a third of the borrowers who miss two payments are able to self-cure without help from their lender, according to the Boston Fed study. Separately, Moody's Economy.com, a research firm, estimated that about a fifth of those who miss three payments will self-cure.And on redefault:

Lenders also worry that borrowers may re-default even after receiving a loan modification. This only delays foreclosure, which can be costly to the lender because housing prices are falling throughout the country and the home's condition may deteriorate if the owner isn't maintaining it. In some cases, lenders lose twice as much foreclosing on a home as they did two years ago, said Laurie Goodman, senior managing director at Amherst Securities.When you compare the losses from foreclosure to the losses from modifications - and include self-cure risk and redefault risk - the researchers argue there are very few preventable foreclosures.

Just something to remember, meanwhile from the WSJ: U.S. Effort to Modify Mortgages Falters

An Obama administration effort to reduce home foreclosures by lowering the mortgage payments of struggling borrowers before they fall behind is failing to help as many people as expected.Should be an interesting discussion.

Among the problems: Some homeowners are being told they must be behind on their payments to receive help, which runs counter to the aim of the program. In other cases, delays are so long that borrowers who are current on their payments when they ask for a loan modification are delinquent by the time they receive one. There is also confusion about who qualifies.

Administration officials have summoned executives of 25 mortgage-servicing companies to Washington on Tuesday to discuss efforts to help borrowers, both delinquent and at risk.

Truck Tonnage Index Declined 2.4 Percent in June

by Calculated Risk on 7/27/2009 08:22:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Fell 2.4 Percent in June Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 2.4 percent in June. In May, SA tonnage jumped 3.2 percent. June’s decrease, which lowered the SA index to 99.8 (2000=100), wasn’t large enough to completely offset the robust gain in the previous month. ...Some interesting comments from Costello. Maybe the cliff diving is over, but the sideways motion is "choppy". Not exactly little green shoots ...

Compared with June 2008, tonnage fell 13.6 percent, which surpassed May’s 11 percent year-over-year drop. June’s contraction was the largest year-over-year decrease of the current cycle, exceeding the 13.2 percent drop in April.

ATA Chief Economist Bob Costello said truck tonnage is likely to be choppy in the months ahead. “While I am hopeful that the worst is behind us, I just don’t see anything on the economic horizon that suggests freight tonnage is about to rise significantly or consistently,” Costello said. “The consumer is still facing too many headwinds, including employment losses, tight credit, and falling home values, to name a few, that will make it very difficult for household spending to jump in the near term.” He also noted that inventories, relative to sales, are still too high in much of the supply chain, especially in the manufacturing and wholesale industries. “As a result, this is likely to be the first time in memory that truck tonnage doesn’t lead the macro economy out of a recession. Today, many new product orders can be fulfilled with current inventories, not new production, thus suppressing truck tonnage.”

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.2 billion tons of freight in 2008. Motor carriers collected $660.3 billion, or 83.1 percent of total revenue earned by all transport modes.

"Precipitous" House Price Declines at the High End

by Calculated Risk on 7/27/2009 05:58:00 PM

From the Chicago Tribune: Luxury prices keep falling (ht Ann)

Real estate agents say they have never seen prices drop so precipitously when dealing with opulent, often empty high-end homes along the North Shore ... "It is a phenomenon we've never seen in our lifetime," said real estate agent Jason Hartong with Rubloff Residential Properties, who has seen some multimillion-dollar price tags cut nearly in half.The problems are movin' on up the value chain.

...

Developers, many now in bankruptcy, were caught by surprise, as well. Vacant and unfinished homes dot the Chicago suburbs, with for sale signs that tout the "New Price."

For instance, a custom-built stone home at 750 Sheridan Rd. in Winnetka priced at $5.5 million in November 2007 is going for $3.3 million.

Option ARMs: Good News, Bad News

by Calculated Risk on 7/27/2009 04:04:00 PM

The good news, according to a Barclays Capital report, is not as many Option ARMs will recast in 2011 as forecast earlier by Credit Suisse.

The bad news is borrowers are defaulting en masse before the recast.

From Bloomberg: Option ARM Defaults Shrink Size of Recast Wave, Barclays Says (ht Brian)

The wave of “option” adjustable- rate mortgages recasting to higher payments, projected by some economists to represent a looming source of foreclosures that will hurt housing markets over the next few years, will be smaller “than feared” because many borrowers will default before their bills change, Barclays Capital analysts said.Also some of the loans (mostly Wells Fargo) will probably recast later than the Credit Suisse chart.

...

About 40 percent of borrowers with option ARMs are already delinquent, and “many” of the others will start missing payments before their obligations change, the Barclays mortgage- bond analysts wrote in a July 24 report. ...

“The additional risk really will only be for borrowers who manage to stay current over the next couple of years and might default due to a payment shock,” the New York-based analysts including Sandeep Bordian and Jasraj Vaidya wrote.

...

More than $750 billion of option ARMs were originated between 2004 and 2008 ...

Also on Option ARMs from the WSJ a couple weeks ago: Pick-a-Pay Loans: Worse Than Subprime

This suggests the recast related problems will happen sooner than the Credit Suisse chart suggests. That is good news in that the problems might not linger as long, and also suggests further price pressure in the short term for the mid-to-high end areas with significant Option ARM activity.

UPDATE on Wells Fargo Option ARM portfolio, from Q2 recorded comments (ht HealdsburgBubble):

The Pick-a-Pay portfolio also performed as expected as we continued to de-risk the portfolio. I want to highlight some key points that are important for every investor to understand about this portfolio:

First, not all option ARM portfolios are alike and we believe we have the best portfolio in the industry. While recently reported industry data, as of April 2009, indicates 37 percent of all industry option ARM loans are at least 60 days past due, our portfolio is performing significantly better with only 18 percent 60 days or more past due as of June 30. Not surprisingly, our non-impaired portfolio is performing significantly better than our impaired portfolio with only 4.7 percent 60 days or more past due. In fact, 92 percent of the non-impaired portfolio is current, compared with 62 percent of the impaired portfolio. In addition, while many other option ARM loans have recast periods as short as five years, our Pick-a-Pay loans generally have ten-year contractual recasts. As a result, we have virtually no loans where the terms recast over the next three years, allowing us more time to work with borrowers as they weather the current economic downturn.

emphasis added

Housing: Remember the Two Bottoms!

by Calculated Risk on 7/27/2009 02:30:00 PM

With my post yesterday, Economy: A Little Sunshine and the New Home sales report this morning - it is worth repeating: There will probably be two bottoms for Residential Real Estate.

The first will be for new home sales, housing starts and residential investment. The second bottom will be for prices. Sometimes these bottoms can happen years apart. I think it is likely that we've seen the bottom for new home sales and single family starts, but not for prices.

It is way too early to try to call the bottom in prices. House prices will probably fall for another year or more. My original prediction (a few years ago) was that real house prices would fall for 5 to 7 years (after 2005), and we could start looking for a bottom in the 2010 to 2012 time frame for the bubble areas. That still seems reasonable to me.

However it is important to note that some lower priced areas - with heavy distressed sales activity - might be at or near the bottom.

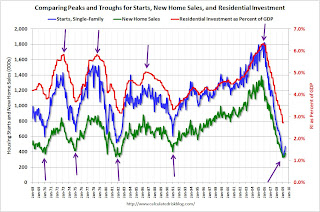

For the first bottom, we have several possible measure - the following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. But this says nothing about prices.  The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

The second graph compares RI as a percent of GDP with the real Case-Shiller National house price index.

Although the Case-Shiller data only goes back to 1987, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 - more than 5 years later!

Something similar will most likely happen again. Indicators like new home sales, housing starts and residential investment will bottom long before house prices.

Economists and analysts care about these housing indicators (starts, sales, RI) because they impact GDP and employment. However most people (homeowners, potential homebuyers) think 'house prices' when we talk about a housing bottom - so we have to be aware that there will be two different housing bottoms. And a bottom in starts and new home sales doesn't imply a bottom in prices.

Report: 5000+ CRE NODs in March

by Calculated Risk on 7/27/2009 01:36:00 PM

CRE: Commercial Real Estate. NOD: Notice of Default.

From Bloomberg: Almost $165 Billion in Commercial Mortgages to Come Due in ’09

Almost $165 billion in U.S. commercial real estate [shops, offices, hotels, apartment buildings and land] loans will mature this year and need to be sold or refinanced as rents and occupancies fall, according to First American CoreLogic.These defaults will push down CRE prices and also hit many regional and local banks that had excessive loan concentrations in Construction & Development (C&D) and CRE loans. The FDIC will be very busy ...

...

More than 5,000 properties in the 10 biggest U.S. metropolitan areas got at least one default notice in March, marking the first time that’s happened in First American records going back to January 2003.

...

“As long as prices contract, we expect loan performance will worsen and that will make financing difficult,” Sam Khater, senior economist for First American, said in an interview. “Delinquencies and notices of default are rising, and we expect that to continue.”

Distressing Gap: Ratio of Existing to New Home Sales

by Calculated Risk on 7/27/2009 11:38:00 AM

For graphs based on the new home sales report this morning, please see: New Home Sales increase in June, Highest since November 2008

Last week the National Association of Realtors (NAR) reported that distressed properties accounted 31 percent of sales in June. Distressed sales include REO sales (foreclosure resales) and short sales, and based on the 4.89 million existing home sales (SAAR) that puts distressed sales at about a 1.5 million annual rate in June.

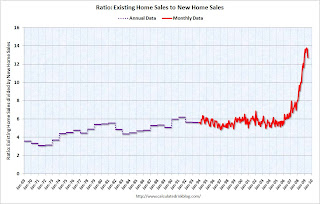

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including June new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through June.

As I've noted before, I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.  The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio. The small decline in June ratio was because of the increase in new home sales.

The ratio could decline because of increase in new home sales, or a decrease in existing home sales - or a combination of both.  The third graph shows the ratio back to 1969 (annual data before 1994).

The third graph shows the ratio back to 1969 (annual data before 1994).

Note: the NAR has changed their data collection over time and the older data does not include condos: Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began.

New Home Sales increase in June, Highest since November 2008

by Calculated Risk on 7/27/2009 10:00:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 384 thousand. This is an increase from the revised rate of 345 thousand in May. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the 2nd lowest sales for June since the Census Bureau started tracking sales in 1963.

In June 2009, 36 thousand new homes were sold (NSA); the record low was 34 thousand in June 1982; the record high for June was 115 thousand in 2005. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in June 2009 were at a seasonally adjusted annual rate of 384,000 ...And another long term graph - this one for New Home Months of Supply.

This is 11.0 percent (±13.2%)* above the revised May rate of 346,000, but is 21.3 percent (±11.4%) below the June 2008 estimate of 488,000.

There were 8.8 months of supply in June - significantly below the all time record of 12.4 months of supply set in January.

There were 8.8 months of supply in June - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of June was 281,000. This represents a supply of 8.8 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply for inventory has peaked, and there is some chance that sales of new homes has bottomed for this cycle - but we won't know for many months. However any recovery in sales will likely be modest because of the huge overhang of existing homes for sale.

I'll have more later ...

San Diego: High-Rise Condos Sit Vacant

by Calculated Risk on 7/27/2009 08:37:00 AM

From Peter Hong at the LA Times: San Diego high-rise condo market goes from frenzy to fizzle

Drive through California's sprawling inland suburbs and you'll spot the familiar mileposts of a real estate bust: foreclosure signs, brown lawns and abandoned subdivisions.Many of these new high-rise condos are part of the shadow inventory since they are not included in the new home sales report. High-rise condos were overbuilt in a number of cities like Miami, Las Vegas, San Diego, Chicago - and it will take several years to absorb all the inventory (or the units will be converted to rentals). Just another fine mess ... and of course a number of banks (like "Condo King" Corus Bank) will fail because of these projects.

To see the damage in downtown San Diego, walk a few blocks. Then look straight up.

There you'll see hundreds of unsold luxury condominiums stacked in vacant high-rises. ... Downtown San Diego, a 2.2-square-mile area, is now awash in condos. ... An additional 1,000 units that were under construction when the market soured are slated to be completed this year, adding to the glut and putting further downward pressure on prices.

Merle Hazard Video: Bailout

by Calculated Risk on 7/27/2009 12:06:00 AM

Some of Merle's other videos:

Merle Hazard Meets Arthur Laffer

H-E-D-G-E

Mark to Market.

Merle chats with Stanford economist John Taylor

And that inspires Merle: Inflation or Deflation