by Calculated Risk on 7/14/2009 05:06:00 PM

Tuesday, July 14, 2009

Manhattan Office Vacancy Rate Increases, Effective Rents off 44%

From Reuters: Manhattan office vacancies spike to 4-1/2 yr high (ht Brian)

The overall vacancy rate -- which includes space that will become available over the next six months -- rose 0.9 percentage point from the first quarter to 10.5 percent, the highest rate since the fourth quarter 2004, when it touched 11 percent. ...Sharply lower rents, reduced leverage and much higher cap rates - Brian calls this the "neutron bomb for RE equity"; destroys CRE investors, but leaves the buildings still standing.

Asking rent in the second quarter fell to $60.23 per square foot, down 15.9 percent from a year ago, Cushman said.

Factoring in months of free rent and work space improvements, effective rent in Manhattan already is off 44 percent from the peak in the first quarter 2008.

As Foreclosure Activity Surges, Obama Considers Rental Option

by Calculated Risk on 7/14/2009 03:38:00 PM

From Reuters: Obama mulls rental option for some homeowners-sources

Under one idea being discussed, delinquent homeowners would surrender ownership of their homes but would continue to live in the property for several years ... Officials are also considering whether the government should make mortgage payments on behalf of borrowers who cannot keep up with their home loansAnd another surge in foreclosure activity is reported today by ForeclosureRadar:

For the third consecutive month, foreclosure sales jumped significantly as lenders come off the moratorium. Foreclosure sales increased by 24.7 percent following a 31.9 percent increase in May, and a 35 percent April increase. Notices of Trustee Sale dropped by an unexpected 28.7 percent, with the timing of the drop indicating that it was in response to the California Foreclosure Prevention Act. This law was widely believed to have little or no impact on foreclosure filings, as it exempted the majority of large lenders that operate in the state.

...

After a 4.2 percent drop the prior month, Notices of Default, the initial step in the foreclosure process, rose by 11.8 percent to the second highest level on record at 45,691 filings. Year-overyear filings increased by 10.0 percent from June of 2008.

...

A total of 22,291 foreclosures were taken to sale at auction, representing loan value of $9.57 Billion dollars; a 24.7 percent increase from the prior month, though 8.2 percent lower than the prior year. The opening bids set by lenders were an average 39.3 percent lower than the loan balance, with 46.0 percent of sales discounted by 50.0 percent or more.

...

A new statistic we are watching closely is the number of properties actively scheduled for sale – meaning that a Notice of Trustee Sale has been filed to set the auction date and time, but the foreclosure has not yet been sold or cancelled. Under California’s foreclosure code, a foreclosure sale can be postponed repeatedly for one year before a new Notice of Trustee Sale has to be filed. While postponements are quite common, they have reached record levels in recent months, swelling the number of scheduled foreclosures 90.1 percent year-over-year to 113,141.

emphasis added

S&P Cuts Ratings on CMBS

by Calculated Risk on 7/14/2009 02:34:00 PM

Here come some Commercial Mortgage Backed Security (CMBS) rating cuts ...

UPDATE: From Dow Jones: Commercial Mtge-Backed Securities Index Hit By S&P Downgrades-Source

From S&P: S&P Lowers 23 Credit Suisse Comm Mortgage 2007-C3 Rtgs; 3 Afmd

NEW YORK (Standard & Poor's) July 14, 2009--Standard & Poor's Ratings Services today lowered its ratings on 23 classes of commercial mortgage-backed securities (CMBS) from Credit Suisse Commercial Mortgage Trust Series 2007-C3 and removed them from CreditWatch with negative implications...Here is an example: GSMS 2007-GG10 A4's (super senior with 30% credit support) were taken from AAA to BBB-. That is a significant cut, and below the street expectations.

The lowered ratings follow our analysis of the transaction using our recently released U.S. conduit and fusion CMBS criteria, which was the primary driver of the rating actions....

This is the beginning of the rating cuts associated with the S&P June 4th release of The Potential Rating Impact Of Proposed Methodology Changes On U.S. CMBS

Obama: Unemployment Rate will "tick up for several months"

by Calculated Risk on 7/14/2009 12:50:00 PM

From the WSJ: Obama Says Jobless Rate Likely to Tick Up for Several Months

"[How employment numbers are going to respond is not yet clear.]* My expectation is that we will probably continue to see unemployment tick up for several months," Mr. Obama told reporters ...*Added quote from AP.

Mr. Obama, who has said he believes joblessness will soon hit 10%, will visit Michigan later Tuesday, a state already dealing with double-digit unemployment.

While he said he doesn't have a "crystal ball," Mr. Obama said he anticipates unemployment will follow historical trends and lag "for some time" even after an economic recovery begins.

On the positive side, he said the U.S. has "seen some stabilization in the financial markets, and that's good because that means companies can borrow and banks are starting to lend again."

This is probably way too optimistic. Professor Roubini wrote today:

In the U.S., the unemployment rate, currently at 9.5%, is poised to rise above 10% by the fall. It should peak at 11% some time in 2010 and remain well above 10% for a long time.Although no one has a crystal ball, it does appear the unemployment rate will rise well into 2010 - and then stay elevated for some time as the U.S. suffers with another jobless recovery.

...

But these raw figures on job losses, bad as they are, actually understate the weakness in world labor markets. If you include partially employed workers and discouraged workers who left the U.S. labor force, for example, the unemployment rate is already 16.5%; even temporary employment is sharply down.

...

Moreover, many employers, seeking to “share the pain” of the recession and slow down the rate of layoffs, are now asking workers to accept cuts in both hours and hourly wages. Thus, the total effect of the recession on labor income of jobs, hours and wage reductions is much larger.

More Inventory Correction

by Calculated Risk on 7/14/2009 10:10:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed more evidence of declining inventories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Census Bureau reported:

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,368.1 billion, down 1.0 percent (±0.1%) from April 2009 and down 8.0 percent (±0.4%) from May 2008.The above graph shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in this recession, but inventories are now declining sharply.

However, even with the sharp decline in inventories, the inventory to sales ratio has only declined to 1.42 in May - since sales have fallen sharply too.

However, even with the sharp decline in inventories, the inventory to sales ratio has only declined to 1.42 in May - since sales have fallen sharply too.There has been a race between declining sales and declining inventory. Even as sales start to stabilize (appears to be happening), inventory levels are still too high compared to the lower sales levels, and further inventory reductions are probably coming.

Retail Sales in June

by Calculated Risk on 7/14/2009 08:30:00 AM

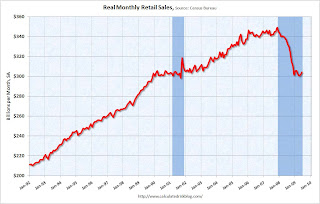

On a monthly basis, retail sales increased 0.6% from May to June (seasonally adjusted), and sales are off 9.6% from June 2008 (retail ex food services decreased 10.3%). Excluding autos and gas, retail sales fell again in June.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (June PCE prices were estimated as the average increase over the previous 3 months).

The Census Bureau reported that nominal retail sales decreased 10.3% year-over-year (retail and food services decreased 9.6%), and real retail sales declined by 9.7% on a YoY basis. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and may have bottomed - but at a much lower level.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $342.1 billion, an increase of 0.6 percent (±0.5%) from the previous month, but 9.0 percent (±0.7%) below June 2008. Total sales for the April through June 2009 period were down 9.6 percent (±0.5%) from the same period a year ago. The April to May 2009 percent change was unrevised from 0.5 percent (±0.3%).Maybe the cliff diving is over, but retail sales are still at the bottom of the cliff ...

Retail trade sales were up 0.8 percent (±0.7%) from May 2009, but 10.0 percent (±0.7%) below last year. Gasoline stations sales were down 31.6 percent (±1.5%) from June 2008 and motor vehicle and parts dealers sales were down 14.1 percent (±2.5%) from last year.

Monday, July 13, 2009

Report: Private-Equity Firms Bidding for Corus Assets

by Calculated Risk on 7/13/2009 10:54:00 PM

Just a reminder, with BankUnited the stories of private-equity bidders appeared on Tuesday May 19th and BankUnited was seized by the FDIC two days later.

From the WSJ: Starwood Enters Bidding for Corus Assets

Barry Sternlicht's Starwood Capital Group, a private-equity firm specializing in real-estate investments, is bidding on assets of Corus Bankshares Inc ...Corus faced a June 18th deadline to boost its capital levels ... that wasn't met.

"We're bidding on a bank," Mr. Sternlicht said during a conference call with investors in Starwood funds on Monday. Without naming the bank, he said it is heavily concentrated in real-estate lending and has more than 110 construction loans. People with knowledge of the matter identified the bank as Corus.

... Investors don't appear to be interested in buying the entire bank, but instead are looking at buying the bank's assets out of receivership if regulators take over.

As with BankUnited, the line "buying the bank's assets out of receivership" says it all. Say goodnight, Gracie.

Appraisal Update

by Calculated Risk on 7/13/2009 08:00:00 PM

There have been quite a few complaints about the new appraisal rules from real estate agents, homebuilders and mortgage brokers.

Last Friday Freddie Mac updated their appraisal guidelines and clarified that the appraiser is not required to use distressed sales (REOs, short sales):

The appraiser’s selection of comparable sales is crucial to providing an accurate opinion of value based on market data. With respect to comparable sales, the appraiser must choose appropriate comparable sales, and certify that the comparable sales chosen are those most similar to the subject property. In underwriting the appraisal, the underwriter must consider whether any adjustments are supported and are reasonable. The amount and number of any adjustments must also be considered. Typically, the higher the amount of the adjustments or the number of adjustments the more likely the comparable sales might not be representative of the subject property. Freddie Mac does not have requirements about what comparable sales the appraiser is to use. For example, we do not require appraisers to use Real Estate Owned (REO), foreclosure or short sales. However, if the appraiser determines that these are representative of the properties available to typical purchasers for the market in which the property is located, appraisers must consider their use.My favorite paragraph in the bulletin is:

To determine that a Mortgage is eligible for sale to Freddie Mac, a Seller/Servicer must conclude that the Borrower is creditworthy (acceptable credit reputation and capacity) and the Mortgaged Premises (collateral) are adequate for the transaction. Credit reputation, capacity and collateral are often called the “three Cs” of underwriting; if one of these components is not acceptable or if there is excessive layering of risk across components, the Mortgage is not eligible for sale to Freddie Mac. Sellers must accurately evaluate and determine a Borrower’s ability to repay the Mortgage.Imagine that.

NY Magazine: The Billyburg Bust

by Calculated Risk on 7/13/2009 05:55:00 PM

From David Amsden at New York Magazine: The Billyburg Bust (ht Jennifer). A few excerpts:

With sales across Brooklyn down a staggering 57 percent from a year ago, Williamsburg, with its high density of new construction, has taken on an ominous disposition. Walk down virtually any block and you’ll come across an amenity-laden building that sits nearly empty: relics of a moment in history that seems, increasingly, like a fever dream. Some developers with iffy financing have quietly been forced to go rental, others have lowered prices to the point where losses are inevitable, and a handful of projects, including two buildings Maundrell had been selling, have gone into foreclosure.Amsden takes us on a tour and gives several examples like this one:

Most unsettling are the cases of the developers who seem to have vanished, leaving behind so many vacant lots and half-completed buildings—eighteen, to be precise, more than can be found in all of the Bronx—that large swaths of the neighborhood have come to resemble a city after an air raid.

Later that afternoon, I made my way to a building called Warehouse 11, on the corner of Roebling and North 11th Streets. Marketed by David Maundrell, the building has 120 total units (plus the requisite yoga center, playroom, parking garage, 24-hour concierge, gym, and communal sundeck). While the model apartment seemed an appealing enough place to live, there was something generally off about the building as a whole: Despite having been on the market since early 2008, only 30 percent of the units were in contract, and it was clear that construction wasn’t complete. The list prices, too, were significantly higher than comparable products, as if the developer had not been informed about the current state of the economy. A few weeks later, I noticed the front doors of the lobby had been padlocked shut. The process of foreclosure had begun.According to Amsden the developer borrowed $50 million from Capital One, and another $12 million from private equity. Apparently bids are coming in close to $30 million ... another half off sale!

Market and Credit Indicators

by Calculated Risk on 7/13/2009 03:20:00 PM

Investors seem bipolar, with the S&P 500 up about 2.5% today ... Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The British Bankers' Association reported that the three-month dollar Libor rates were fixed at 0.509%. This is up slightly from Friday's record low of 0.505%. The LIBOR peaked at 4.81875% on Oct 10, 2008.  There has been improvement in the A2P2 spread. This has declined to 0.31. This is far below the record (for this cycle) of 5.86 after Thanksgiving, and still above the normal spread of around 20 bps.

There has been improvement in the A2P2 spread. This has declined to 0.31. This is far below the record (for this cycle) of 5.86 after Thanksgiving, and still above the normal spread of around 20 bps.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

Meanwhile the TED spread has decreased further and is now at 33.9. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. This graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

This graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The spread has decreased sharply over the last few months. The spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.Meanwhile from Bloomberg: ‘Fallen Angels’ Jump to Third-Highest Monthly Total, S&P Says

Fifteen companies lost their investment-grade ratings in June, the third-highest monthly tally since 1987, according to Standard & Poor’s.Even though credit indicators have improved, there are plenty of companies in deep trouble.

With rankings for two additional issuers cut to junk status, the number of “fallen angels” climbed to 60 this year with a combined debt of $209.2 billion, S&P analysts led by Diane Vazza in New York said in a report today.

...

The largest fallen angel this year is CIT Group Inc. ...