by Calculated Risk on 6/08/2009 08:48:00 PM

Monday, June 08, 2009

More New Vacant Condos

In some cities there are a substantial number of uncounted new condos for sale or just sitting vacant. These units are not included in the Census Bureau new home sales inventory report.

Here is a short video from Jim the Realtor of a few more units in Encinitas (north county San Diego). Hey ... where are the gas meters?

Supreme Court temporarily blocks Chrysler deal

by Calculated Risk on 6/08/2009 06:14:00 PM

From the SCOTUS Blog: Ginsburg temporarily blocks Chrysler deal

Supreme Court Justice Ruth Bader Ginsburg put a temporary hold Monday on the deal to sell Chrysler to save it from collapse. Her order, however, simply gives her or the full Court more time to ponder whether to postpone the sale further, or allow it to go forward. The order can be found here.There is more ...

...

The deal remains in legal limbo until Ginsburg, as the Circuit Justice, or the full Court takes some definitive action. There is now no timetable for further action at the Supreme Court, although the terms of the deal allow Chrysler’s new business spouse — Fiat, the Italian automaker — to back out as of next Monday if the deal has not closed. Moreover, the papers filed in the Supreme Court have suggested that Chrysler is losing money at the rate of $100 million a day, pending the sale. That gives the Justices some incentive not to let much time pass before acting.

Fed: Big Bank Capital Plans are Sufficient

by Calculated Risk on 6/08/2009 05:46:00 PM

The 10 banking organizations required by the Supervisory Capital Assessment Program to bolster their capital buffers have all submitted capital plans that, if implemented, would provide sufficient capital to meet the required buffer under the assessment's more-adverse scenario. As supervisors, we will be working with the institutions to ensure their plans are implemented quickly and effectively.

Supervisors also continue to work with all regulated financial institutions to review the quality of their corporate-governance, risk-management and capital-planning processes.

Krugman: Recession May End this Summer

by Calculated Risk on 6/08/2009 03:58:00 PM

Paul Krugman is delivering a three part lecture at the London School of Economics starting today.

Bloomberg has some quotes: Nobel Laureate Krugman Says Recession May End ‘This Summer’

“I would not be surprised if the official end of the U.S. recession ends up being, in retrospect, dated sometime this summer,” he said in a lecture today at the London School of Economics. “Things seem to be getting worse more slowly. There’s some reason to think that we’re stabilizing.”The next two lectures will be Tuesday ("The eschatology of lost decades") and Wednesday ("The night they reread Minsky") at 6:30 PM London Time.

...

Even with a recovery, “almost surely unemployment will keep rising for a long time and there’s a lot of reason to think that the world economy is going to stay depressed for an extended period,” Krugman said.

The live webcasts are here.

Fed Letter: "Jobless Recovery Redux?"

by Calculated Risk on 6/08/2009 02:42:00 PM

Economic letter from the San Francisco Fed: Jobless Recovery Redux?

Although the pace of layoffs appears to be subsiding and the overall economy is showing hints of stabilization, most forecasters expect unemployment to continue to increase in coming months and to recede only gradually as recovery takes hold. In this Economic Letter, we evaluate this projection using data on three labor market indicators: worker flows into and out of unemployment; involuntary part-time employment; and temporary layoffs. We pay particular attention to how these indicators compare with data from previous episodes of recession and recovery. Our analysis generally supports projections that labor market weakness will persist, but our findings offer a basis for even greater pessimism about the outlook for the labor market. Specifically, we suggest that the relatively low level of temporary layoffs and high level of involuntary part-time workers make a jobless recovery similar to the one experienced in 1992 a plausible scenario.

emphasis aded

| Click on graph for larger image in new window. |

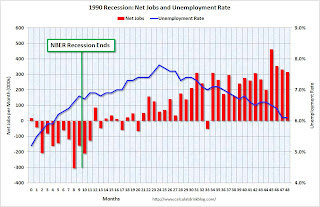

What does all this mean for the course of the labor market? We combine data on involuntary part-time workers with the standard unemployment rate to arrive at an alternative measure of labor underutilization. We plot this measure in Figure 3, which shows that the labor market has considerably more slack than the official unemployment rate indicates. The figure extends this labor underutilization measure using the Blue Chip consensus forecast for the unemployment rate as a benchmark and then adding a share of involuntary part-time workers based on the proportion of workers in that category to the unemployed during the current recession. This projection indicates that the level of labor market slack would be higher by the end of 2009 than experienced at any other time in the post-World War II period, implying a longer and slower recovery path for the unemployment rate. This suggests that, more than in previous recessions, when the economy rebounds, employers will tap into their existing workforces rather than hire new workers. This could substantially slow the recovery of the outflow rate and put upward pressure on future unemployment rates.This weekend I plotted some graphs of jobs and the unemployment rate for four recessions and recoveries (1981, 1990, 2001, and the current recession). See: Jobs and the Unemployment Rate. Here is the graph for the 1990 recession and the jobless recovery that followed:

The unemployment rate continued to rise for 15 months after the recession ended.

The unemployment rate continued to rise for 15 months after the recession ended.The researchers argue that the labor recovery following the current recession may be similar or worse than the jobless recovery following the 1991 recession:

[S]hould labor market conditions ... proceed along the path taken in the 1992 recovery, the unemployment rate could peak close to 11% in mid-2010 and remain above 9% through the end of 2011.

Hotel Recession Reaches 19 months

by Calculated Risk on 6/08/2009 01:00:00 PM

From HotelNewsNow: U.S. hotel industry enters 19th month of recession

economic research firm e-forecasting.com, in conjunction with STR, announced that following a decline of 1.1 percent in April, HIP declined 1.3 percent in May. HIP, the Hotel Industry Pulse index, is composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decrease brought the index to a reading of 83.1. The index was set to equal 100 in 2000.

...

The U.S. hotel industry is still in its recession, having officially entered the 19th month of decline, said Evangelos Simos, chief economist of e-forecasting.com.

| Click on graph for larger image in new window. |

And from the Chicago Tribune: Chicago hotels racked by glut of rooms (ht dum luk)

Hotel occupancy and average daily room rates have posted double-digit percentage drops over the first four months of this year compared with the same time last year. ... Despite demand being down, the city's supply of hotel rooms is on the way up.The decline in revenue per available room (RevPAR) in Chicago is only slightly worse than the national average decline of 18.9% compared to last year, see: Hotel Occupancy Rate Falls to 51.6%.

The opening of four new hotels, plus rooms that will join the inventory at Trump International Hotel & Tower, will add 989 rooms to the downtown Chicago market this year.

...

In April alone, the average room rate in downtown Chicago hotels was about $162 a night, 23 percent less than the roughly $210 per night guests paid during April 2008, according to data from Smith Travel Research Inc.

As a result, total revenue for the 35,000-plus rooms in downtown Chicago has plunged 25 percent year to date.

Chicago's Magnificent Mile Vacancy Rate Highest Since 1992

by Calculated Risk on 6/08/2009 12:28:00 PM

From Crain's Chicago Business: Mag Mile facing a glitz gap

The vacancy rate in the Mag Mile corridor rose to 7.2% in the year ended April 30 from 6.3% the year before, according to an annual survey by real estate brokerage CB Richard Ellis Inc. provided exclusively to Crain's.

Empty storefronts large and small dot the avenue, a big departure from seven years ago, when the rate dropped to as low as 1%. Based on historical demand and announcements by stores of possible closures next year, the vacancy rate could approach its 1992 level of 9%.

...

"In this recession, high-end merchants have been negatively impacted, and that's reflected in the vacancy numbers on the street," [Bruce Kaplan, a senior vice-president in Chicago at CB Richard Ellis] says.

Large Banks: TARP Repayment, Capital Raising, Management Review

by Calculated Risk on 6/08/2009 09:15:00 AM

The Obama administration will announce this week that several large banks will be approved to repay TARP funds. Some of the rumored banks are J.P. Morgan Chase ($25 billion), Goldman Sachs ($10 billion), Morgan Stanley ($10 billion), American Express ($3.4 billion), Bank of New York Mellon ($3 billion), State Street ($2 billion), US Bancorp ($6.6 billion) and BB&T Corp. ($3.1 billion).

Also today is also the deadline for regulators to approve capital-raising plans and for banks to complete a management review. From the WSJ: Bank Chiefs Await Report Cards

Monday is the deadline for federal bank regulators to approve capital-raising plans at nine of the country's largest banks, a culmination of the stress-test process. But the moment could be overshadowed by a less publicized deadline: banks' equally in-depth review of their management.

Several top banks, including Bank of America Corp. and Citigroup Inc., have had to assess top executives and directors "to assure that the leadership of the firm has sufficient expertise and ability to manage the risks presented by the current economic environment" ...

Sunday, June 07, 2009

Report: Administration to Propose More Oversight of Compensation

by Calculated Risk on 6/07/2009 10:12:00 PM

From the NY Times: U.S. to Propose Wider Oversight of Compensation

The Obama administration plans to require banks and corporations that have received two rounds of federal bailouts to submit any major executive pay changes for approval by a new federal official who will monitor pay, according to two government officials.

The proposal is part of a broad set of regulations on executive compensation expected to be announced by the administration as early as this week. Some of the rules are required by legislation enacted in the wake of the worst financial crisis since the Great Depression, and would apply only to taxpayer money.

Others, which are being described as broad principles, would set standards that the government would like the entire financial industry to observe as they compensate their highest-paid executives, though it is not clear how regulators will enforce them.

Hotel Owner "Walking Away"

by Calculated Risk on 6/07/2009 06:23:00 PM

"At some point, you just stop the bleeding and hand the keys back."From the WSJ: Sunstone Hotel Investors to Turn Over W San Diego to Mortgage Holders

John Arabia, an analyst with real estate research company Green Street Advisors

Sunstone Hotel Investors Inc. intends to forfeit the 258-room W San Diego to its lenders after its efforts to reach a compromise on the luxury hotel's $65 million securitized mortgage failed.Much less than $65 million? That means the price has probably fallen 50% or more since 2006.

Sunstone ... bought the W for $96 million in 2006 ... Sunstone estimates the W San Diego is worth much less than the $65 million balance on its mortgage. At the end of last year, the hotel posted an occupancy of 69% and generated revenue per available room of nearly $153.