by Calculated Risk on 5/21/2009 10:28:00 PM

Thursday, May 21, 2009

WaPo: Auto Bankruptcies Next Week: GM in, Chrysler out

From the WaPo: U.S. to Steer GM Toward Bankruptcy

The Obama administration is preparing to send General Motors into bankruptcy next week under a plan that would give the automaker tens of billions of dollars more in public financing ...That is fast!

The move comes as the administration prepares to lift the nation's other faltering car company, Chrysler, from bankruptcy as soon as next week ...

CRE Bust: UK Style

by Calculated Risk on 5/21/2009 08:52:00 PM

From Bloomberg: British Land Has $6.1 Billion Loss on Property Slump (ht Adam)

British Land’s real estate was valued at 5.8 billion pounds on March 31, about 28 percent less than a year earlier, [British Land said in a statement today]. More than half of the properties are retail warehouses and malls, and the rest are office buildings.Rents back to 1991. Property values off 28%. Ouch.

...

Most of British Land’s office buildings are in the City of London, where rents are expected to fall back to 1991 levels by the end of this year ... as job losses and a mistimed building boom depress prices.

...

The City of London now has enough empty space to hold two- thirds of Canary Wharf, its rival financial district 1 1/2 miles to the east. About 9 million square feet (855,000 square meters) are available in the City and that may climb to 12 million by the end of 2009, according to CB Richard Ellis Group Inc. Rents that reached a high of 65 pounds per square foot in mid-2007 are forecast to fall to 40 pounds by the end of this year ...

San Diego House Sales: Divergent Markets

by Calculated Risk on 5/21/2009 07:35:00 PM

From Zach Fox at the NC Times: REAL ESTATE: Foreclosures, booming sales make predictions difficult

The case for a bottoming or recovering housing market is strongest along Highway 78 (Escondido, San Marcos, Vista, Oceanside) and Southwest Riverside County, where housing inventory ---- the length of time to sell all active listings ---- has dipped below three months. Six months is considered healthy; three months is screaming hot.

...

However, the numbers flip-flop in high-end areas such as Del Mar and Rancho Santa Fe. Inventory has breached a new stratosphere at anywhere from 25 to 50 months to sell all listings.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graphic from Zach shows both the Notice of Default rate (NOD) and months of inventory by zip code (posted with permission).

In general the lower priced areas are seeing more foreclosure activity than the high prices areas, but the months of inventory is lower.

In a dynamic that is reflected in the divergent inventory numbers, buyers are avoiding the higher end and finding the purchase process on the lower end surprisingly frustrating; real estate agents have reported up to 25 offers on a single house.Just some more data showing the divergent markets.

...

[S]ome analysts think those red-hot inventory numbers in Escondido, Oceanside and pretty much all of Southwest Riverside County aren't that telling, because it's hard to determine how many foreclosures are actually up for sale.

Lenders and government agencies have embraced foreclosure moratoriums, delaying the process of actually seizing the property and putting it back on the market. Once those foreclosures are put on the market, the inventory number could shoot up in a hurry.

Bank Failure #34: BankUnited, Coral Gables, Florida

by Calculated Risk on 5/21/2009 05:56:00 PM

Swarm the shoguns failed bank

Almost seppuku

by Soylent Green is People

From the FDIC: BankUnited Acquires the Banking Operations of BankUnited, FSB, Coral Gables, Florida

BankUnited, a newly chartered federal savings bank, acquired the banking operations, including all of the nonbrokered deposits, of BankUnited, FSB, Coral Gables, Florida, in a transaction facilitated by the Federal Deposit Insurance Corporation (FDIC). As a result of this transaction, BankUnited, FSB, offices and branches will be operated as BankUnited offices and branches.

...

Bank United, FSB had assets of $12.80 billion and deposits of $8.6 billion as of May 2, 2009. The new BankUnited will assume $12.7 billion in assets and $8.3 billion in nonbrokered deposits. ...

The FDIC facilitated the transaction with John Kanas and a consortium of investors after BankUnited, FSB, was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver. The FDIC estimates that the cost to its Deposit Insurance Fund will be $4.9 billion. BankUnited's acquisition of all the deposits and assets of BankUnited, FSB was the "least costly" resolution for the DIF compared to alternatives.

...

BankUnited, FSB is the 34th FDIC-insured institution to fail in the nation this year, and the third in Florida. The last bank to be closed in the state was Riverside Bank of the Gulf Coast, Cape Coral on February 13, 2009.

Market and CAMELS

by Calculated Risk on 5/21/2009 04:00:00 PM

Here are a couple of market graphs from Doug (the 2nd one is new - the mega bear quartet in real prices), and an excerpt from CFO Magazine How Healthy Is Your Bank?

There was a significant bond sell-off today - probably because of concerns about the UK (and US) credit ratings.

| Click on graph for larger image in new window. The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

| The second graph compares four significant bear markets: the Dow during the Great Depression, the NASDAQ, the Nikkei, and the current S&P 500. This is inflation adjusted. See Doug's: "The Mega-Bear Quartet 2000" for a dicussion. |

Excerpt from CFO Magazine How Healthy Is Your Bank? (ht jb)

Evaluating a bank's health falls into two parts, says Mark J. Flannery, a finance professor at the University of Florida's Warrington College of Business Administration. One, how well capitalized is the bank — how much loss can it stand without failing? Two, what is the quality of its assets — how much loss risk is the bank exposed to?It is all about asset quality right now.

In the FDIC's eyes, a well-capitalized bank has a ratio of Tier 1 capital to total risk-weighted assets of at least 6% (analysts prefer to see 8%); a ratio of total capital to total risk-weighted assets of at least 10%; and a Tier 1 leverage ratio of at least 5%. ...

The trouble is, the risk-based capital ratios "don't work very well," says Frederick Cannon, chief equity strategist at Keefe Bruyette Woods, specialists in financial services. That's because the risk weightings that the government uses are out of date. For example, a mortgage-backed security is weighted at 20%, meaning that it requires one-fifth the capital of whole loans. "But some of those securities have declined in value a lot more than the values of whole loans," says Cannon. The option ARM, which "proved to be an absolutely horrible product in terms of performance," is weighted at 50%; "in hindsight it probably should have been weighted at 200%," he says. As for the leverage ratio, "it doesn't pay any attention to the composition of assets and their risk," says Flannery.

Many investors no longer trust the regulatory ratios. ... An officially well-capitalized bank may have a dangerously thin TCE ratio. Take Citigroup. At the end of December, the $1.9 trillion (in assets) bank holding company had a Tier 1 ratio of 11.9%, a total capital ratio of 15.7%, and a leverage ratio of 6.1%. ... But its TCE ratio was just 1.5%. ...

But the TCE ratio is not infallible. Right before Washington Mutual failed, its TCE ratio was 7.8%. For regulators and analysts, TCE is one more metric in the tool kit. That tool kit is typically based on CAMELS, the supervisory rating system that looks at a bank's capital, asset quality, management, earnings, liquidity, and sensitivity to market risk (hence the acronym). Earnings are always important, but "these days it's more about the 'C' and the 'A,'" says Valentin.

The "A" is a growing source of discomfort as the recession drags on. With growth slowing and unemployment rising, a broad swath of consumer and business loans is beginning to sour. "Most of the banks that have failed to date have had significant early credit-cycle exposure — subprime, option-ARM, residential construction loans," says Cannon. "We're starting to see significant deterioration in midcycle credit: prime mortgages, home-equity loans, some nonresidential construction. And there's increasing concern about late-cycle credit instruments such as commercial real-estate mortgages and commercial loans."

California Bay Area Home Sales: "Robust" and "Anemic"

by Calculated Risk on 5/21/2009 02:12:00 PM

The tale of two cities continues ...

From DataQuick: Bay Area home sales rise again; median price up slightly over March

Bay Area home sales posted a year-over-year gain for the eighth consecutive month in April, with robust sales in lower-cost inland areas once again compensating for anemic sales on the coast. ...Key points (worth repeating):

A total of 7,139 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was up 12.9 percent from 6,325 in March and up 13.1 percent from 6,310 in April 2008, according to MDA DataQuick of San Diego.

Last month’s sales were the second-lowest for an April since 1995 and were 23.2 percent below the average April sales total back to 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in April that had been foreclosed on in the prior 12 months – accounted for 47.4 percent of Bay Area resales. That was down from 50.2 percent in March and 52.0 percent in February. Last month’s figure was the lowest since foreclosure resales were 46.8 percent of existing home sales last November.

A lower concentration of discounted foreclosure resales in the statistics is one reason the median sale price has recently begun to more or less flatten, or at least erode more slowly, in many markets.

...

Home sales in many high-end areas, especially on the coast, remain at record or near-record-low levels.

In lower-cost communities, first-time buyers have turned to government-insured FHA mortgages, which represented a record 26 percent of all Bay Area home purchase loans in April, up from 3.2 percent a year ago. The combination of FHA financing, steep home price declines and low mortgage rates have fueled record or near-record-high sales this spring in many of the Bay Area’s most affordable, foreclosure-heavy communities.

...

Foreclosure activity remains at historically high levels ...

emphasis added

Hotel RevPAR Off 21.4% Year-over-year

by Calculated Risk on 5/21/2009 11:38:00 AM

Note: HotelNewsNow has a free hotel related newsletter available here. This week they have an update on the Yellowstone Club vs. Credit Suisse case.

And on occupancy and RevPAR from HotelNewsNow.com: STR reports U.S. data for week ending 16 May

In year-over-year measurements, the industry’s occupancy fell 12.6 percent to end the week at 57.8 percent. Average daily rate dropped 10.0 percent to finish the week at US$98.33. Revenue per available room for the week decreased 21.4 percent to finish at US$56.84.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.3% from the same period in 2008.

The average daily rate is down 10.0%, so RevPAR is off 21.4% from the same week last year.

Philly Fed: Continued Manufacturing Weakness in May

by Calculated Risk on 5/21/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector continued to show weakness in May ... Although the indexes for general activity, shipments, and employment improved, the index for new orders declined slightly. ... Most of the survey's broad indicators of future activity improved notably again this month, suggesting that the region's manufacturing executives are more optimistic that a recovery will occur over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -24.4 in April to -22.6 this month. Although an indication of continued overall decline, this reading is the index's highest since last September; it has now edged higher for three consecutive months. Still, the index has been negative for 17 of the past 18 months, a span that corresponds to the current recession.

...

Broad indicators of future activity showed improvement again this month. The future general activity index remained positive for the fifth consecutive month and increased 11 points, from 36.2 in April to 47.5. The index has now increased 33 points in the past two months (see Chart).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 17 of the past 18 months, a span that corresponds to the current recession."

Unemployment Claims: Continued Claims at Record 6.66 Million

by Calculated Risk on 5/21/2009 08:34:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 16, the advance figure for seasonally adjusted initial claims was 631,000, a decrease of 12,000 from the previous week's revised figure of 643,000. The 4-week moving average was 628,500, a decrease of 3,500 from the previous week's revised average of 632,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 9 was 6,662,000, an increase of 75,000 from the preceding week's revised level of 6,587,000.

Click on graph for larger image in new window.

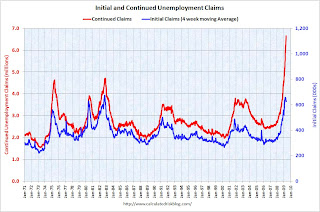

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four-week moving average is at 628,500, off 30,250 from the peak 6 weeks ago.

Continued claims are now at 6.66 million - an all time record.

Typically the four-week average peaks near the end of a recession. There is a reasonable chance that claims have peaked for this cycle, but it is still too early to be sure, and if so, continued claims should peak soon.

The level of initial claims (631 thousand) is still very high, indicating significant weakness in the job market.

Wednesday, May 20, 2009

Report: BofA Wants to Repay TARP in 2009

by Calculated Risk on 5/20/2009 11:46:00 PM

From the Financial Times: BofA seeks to repay $45bn by end of year

Bank of America wants to pay back $45bn in bail-out funds by the end of the year, in a faster-than-expected move made possible by an accelerated programme to raise capital.Stop laughing!

BofA is on track to raise more than $35bn in capital by the end of September...

People familiar with the bank’s plans say negotiations to sell some of BofA’s non-core assets are under way and, if the asset sales occur in the next few months, the bank will be able to fulfil its stress-test obligations and pay back Tarp funds from its $173bn cash reserves.

Plenty of info today:

best to all.