by Calculated Risk on 5/11/2009 08:58:00 AM

Monday, May 11, 2009

Krugman Warns of Lost Decade

A few quotes from Paul Krugman in China ...

From Reuters: Krugman fears lost decade for US due to half-steps

"We're doing half-measures that help the economy limp along without fully recovering, and we're having measures that help the banks survive without really thriving," Krugman said.

"We're doing what the Japanese did in the nineties," he told a small group of reporters during a visit to Beijing.

...

"I'm mostly worried that the U.S. and the euro zone will have Japanese-type lost decades," he said.

...

"It's clear the administration won't take radical action to strengthen the banks any time soon," he said.

Sunday, May 10, 2009

Sunday Night Futures

by Calculated Risk on 5/10/2009 11:25:00 PM

Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

The S&P 500 is up 37.4% from the bottom, but still off 40.6% from the peak.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph is the Shanghai SSE composite index. I used to post this graph with the subtitle "Cliff Diving"!

The second graph is the Shanghai SSE composite index. I used to post this graph with the subtitle "Cliff Diving"!

The Shanghai composite is up again tonight, and this index is now up 54% from the bottom, but still off 55% from the peak.

Both these markets show how the denominator impacts percentages. Imagine a market that peaked at 100 and dropped to 30. Then rallied back to 50. The market would the be up 67% from the bottom: 50 minus 30 = 20, divided by 30, but still off 50% from the peak. That is why it helps to report both numbers!

The S&P 500 is up 37.4% from the bottom, but that just puts it near the level following the early October crash.

The U.S. futures are off tonight:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the Asian markets. The Asian markets are mixed.

And a graph of the Asian markets.

Best to all.

A Return to Trend Growth in 2010?

by Calculated Risk on 5/10/2009 06:44:00 PM

From the NY Times: White House Forecasts No Job Growth Until 2010

Speaking on C-SPAN, Christina Romer, chairwoman of the White House Council of Economic Advisers, said that she expected the G.D.P. to begin growing in the fourth quarter of this year. ... Ms. Romer also said that she expected unemployment to rise even after the economy turns, saying that the G.D.P. has to grow at a rate of about 2.5 percent before unemployment will fall. Before that happens, she said, it is “unfortunately pretty realistic” that the unemployment rate could reach 9.5 percent. A reasonable estimate for the G.D.P.’s growth rate in 2010, she said, is three percent.Three percent is pretty close to trend growth. Although three percent is possible, I think a more sluggish recovery is likely. Note: Romer isn't forecasting a "V-shaped" recovery with strong growth coming out of the recession.

The usual engines of recovery - personal consumption expenditures (PCE) and residential investment (RI) - will both be under pressure. With nearly stagnant wages and a rising saving rate (my forecast based on households repairing balance sheets and an aging population), PCE growth will probably be below trend. And for RI, there is far too much inventory for any significant rebound in new home construction. Where will growth come from? Not investment - there is too much capacity.

Meanwhile the banking system is still very fragile, with the Obama administration gambling that the banks will earn their way out of the mess.

I'm still amazed by the bipolar outlooks of forecasters: just a few months ago, many forecasters were openly talking about a 2nd Great Depression (while I was writing about seeing a bottom in a few key leading indicators), and now some forecasters are talking about an immaculate recovery. Amazing.

NY Times: Falling Apartment Rents in Manhattan

by Calculated Risk on 5/10/2009 03:19:00 PM

From the NY Times: Manhattan Calling

... Great Recession prices are drawing even the most loyal outer-borough dwellers back to Manhattan. ...This is mostly anecdotal data, but it does appear apartment rents are falling in much of the country.

Among the lures: $1,600 one-bedrooms on the Lower East Side. Lenient landlords who no longer require security deposits. And an overriding sense that an obscenely overpriced borough is now, well, slightly more reasonably overpriced.

... "[T]his was a unique moment in real estate history where renters have the upper hand, which seemed unbelievable a couple of years ago." [said] Keith O’Brien, a 30-year-old in marketing and public relations ...

In the first three months of the year, one-bedroom rents in Manhattan fell 6.7 percent compared with the previous year, while Brooklyn one-bedrooms dropped just 3.2 percent, according to data from Citi Habitats and Ideal Properties Group ... Other reports show some Manhattan rents down by 10 percent from a year ago.

... prices at upscale rental buildings like 45 Wall Street have come down significantly, discounted by 15 to 20 percent in recent weeks.

SNL: Geithner Cold Open

by Calculated Risk on 5/10/2009 11:48:00 AM

From Saturday Night Live sorry about the ad.

(For serious posts on banking scroll down)

Report: Banks Can Reduce Capital Needs if Profits Higher

by Calculated Risk on 5/10/2009 10:50:00 AM

From the Financial Times: US banks claim line softened on $74bn (ht Bo)

US banks have been given government assurances they will be allowed to raise less than the $74.6bn in equity mandated by stress tests if earnings over the next six months outstrip regulators’ forecasts, bankers said.The banks have a real incentive to book profits during Q2 and Q3 - something to remember.

The agreement, which was not mentioned when the government revealed the results on Thursday, means some banks may not have to raise as much equity through share issues and asset sales as the market is expecting. It could also increase the incentive for banks to book profits in the next two quarters.

The banks have 28 days to announce their capital-raising plans and until November 9 to implement them. Wells Fargo and other banks that will have to raise capital told the Financial Times that if operating profits were greater than the government’s stress-case forecast for the second and third quarter, they would receive credit for the difference. That, in turn, would reduce the need to raise fresh equity from other sources.

For more, see the comments of Nouriel Roubini and Jan Hatzius (Goldman's chief economist) that I posted yesterday: The Race: Future Earnings vs. Writedowns

Saturday, May 09, 2009

More Foreclosure Auction Video

by Calculated Risk on 5/09/2009 10:31:00 PM

Here is another video from Jillayne Schlicke at a foreclosure auction on April 24, 2009 in Bellevue, WA.

Did he say "Calculated Risk"? (1 min 14 sec)

The Race: Future Earnings vs. Writedowns

by Calculated Risk on 5/09/2009 06:07:00 PM

The results of the stress test showed that the bulk of future bank losses will come from accrual loan portfolios, as opposed to exotic securities (most of the writedowns to date have come from these securities). Here is the quote from the stress test results:

"The bulk of the estimated losses – approximately $455 billion – come from losses on the BHCs’ accrual loan portfolios, particularly from residential mortgages and other consumer‐related loans. ... Estimated possible losses from trading‐related exposures and securities held in investment portfolios totaled $135 billion."Here is Professor Roubini's comment (from Ten Reasons Why the Stress Tests Are “Schmess” Tests and Why the Current Muddle-Through Approach to the Banking Crisis May Not Succeed):

Federal Reserve, The Supervisory Capital Assessment Program: Overview of Results, May 7, 2009

Second, the capital/needs of these banks depend on a race between retained earnings before writedowns/provisioning that will be positive given a high net interest rate margin and the losses deriving from further writedowns. It appears that regulators have overestimated the amount of such retained earnings for 2009-2010. The IMF recently estimated that retained earnings (after taxes and dividends) for all US banks – not just these 19 ones – would be only $300 bn total over the 2009-2010 period. The stress tests – instead – assumed much higher retained earnings - $362 bn - for these 19 banks alone for the 2009-2010 period in the more adverse scenario. Since these 19 banks account for about half of US banks assets if one were to use the IMF estimate of net retained earnings for these 19 banks their net retained earnings for 2009-2010 would be $150 bn rather than the $362 bn assumed by the regulators. While the IMF may have been too conservative in its estimates of net retained earnings it appears that regulators may have been too generous to these 19 banks in forecasting their earnings in an adverse scenario. Thus, ex-post capital needs will be significantly higher if net retained earnings turn out to be lower than assumed in the stress tests.And a more optimistic view from Jan Hatzius:

"The enormous volume of securities writedowns in 2008 basically overwhelmed the pre-provision earnings power of the banking industry. ... We think that most of the loss recognitions in securities has now occurred. U.S. banks will still need to recognize substantial losses, but this will be mainly the provisions for whole loans that are spread out over a somewhat longer period of time, and somewhat more predictable, and therefore won't be as violent as the securities write-downs, and as a result these remaining losses can be offset via pre-provision earnings to a much greater degree."This brings up a key concept:

Jan Hatzius, Chief Economist, Goldman Sachs, Conference Call, May 8, 2009 (no link)

Imagine a bank holds a RMBS (Residential Mortgage Back Security). Forget about tranches - just imagine the security is based on 100 mortgage loans. All of the loans are current, but the security is actively traded, and the price falls to 50 cents on the dollar because investors believe that there are many default (and losses) coming. The bank has lost 50% immediately. The bank holds the security, not the loans - so it is the change in the value of the security that hits their income statement.

Perhaps the bank believes the most profitable thing to do is just keep the loans in its own portfolio (fair value accounting principle called "highest and best use"). Now the bank also has a portfolio of 100 loans with exactly the same characteristics as the RMBS. The Fair Value estimate for income producing loans for which there is no available market or counterparty will be based on the Income approach (discounted future cash flows). As before all of the loans are current, so the bank takes writedowns based on estimates of discounted future cash flows (they are being held to maturity). As the losses, both current and future, become estimable, the bank takes the writedown.

A large portion of Alt-A (like Option ARMs) is held on bank balance sheets. So the building Alt-A crisis will be written down as the losses are estimable. Tanta mentioned this last year in: Subprime and Alt-A: The End of One Crisis and the Beginning of Another

If the "subprime crisis" was about "exotic securities," the "Alt-A crisis" is going to be about bank balance sheets.And this brings up a second key point:

The Fed estimated both future losses and future earnings. As Dr. Roubini noted, there will be a race between losses and earnings - and if the Fed overestimated earnings or underestimated losses, the banks will need additional capital. If Hatzius is correct, the banks will win (or draw) the race - if Roubini is correct, the banks will lose.

But whether the banks win or lose the race, the rapidly rising defaults for Alt-A (and HELOCs and Jumbo Prime) loans will impact house prices in neighborhoods where the loans are concentrated (mostly mid-to-high end areas).

NY Times on Saving Rate

by Calculated Risk on 5/09/2009 04:27:00 PM

From the NY Times: Shift to Saving May Be Downturn’s Lasting Impact

The economic downturn is forcing a return to a culture of thrift that many economists say could last well beyond the inevitable recovery.The NY Times article notes the need to repair household balance sheets, but there is a second factor that will push up the saving rate too: changing demographics. Here is what I wrote a week ago:

This is not because Americans have suddenly become more financially virtuous or have learned the error of their free-spending ways. Instead, these experts say, Americans may have no choice but to continue pinching pennies.

This shift back to thrift may seem to be a healthy change for a consumer class known for spending more than it earns, but there is a downside: American businesses have become so dependent on consumer spending that any pullback sends ripples through the economy.

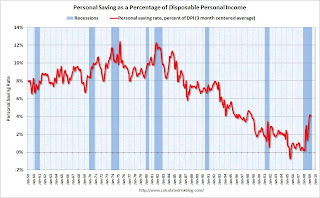

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the March Personal Income report. The saving rate was 4.1% in March.I expect the saving rate to continue to rise to 8% or so, although the future increases will probably not be as rapid as the last few months.

This suggest households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but ... this will also keep pressure on personal consumption.

Saturday Morning Summary

by Calculated Risk on 5/09/2009 10:17:00 AM

Jon Lansner at the O.C Register has some quotes on housing: When will housing bottom? Depends on who is talking! I'll add my two cents later ...

And for those that missed them, here are some reset / recast charts.

And a graph comparing job losses with previous recessions.

And a video of a mothballed condo project in Irvine, CA

Best to all