by Calculated Risk on 5/08/2009 09:25:00 AM

Friday, May 08, 2009

Employment: Comparing Recessions and Diffusion Index

Note: earlier Employment post: Employment Report: 539K Jobs Lost, 8.9% Unemployment Rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

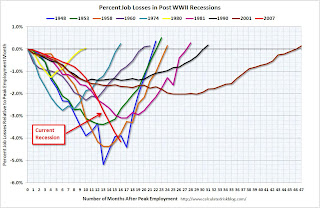

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last 6 months (4 million jobs lost, red line cliff diving on the graph), and the current recession is now the worst recession since WWII in percentage terms after 16 months - although not in terms of the unemployment rate.

In the early post-war recessions (1948, 1953, 1958), there were huge swings in manufacturing employment and that lead to large percentage losses. For the current recession, the job losses are more widespread.

In April, job losses were large and widespread across nearly all major private-sector industries.Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

BLS, April Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.So it is possible for the diffusion index to increase (like manufacturing increased from 12.7 to 26.5) not because industries are hiring, but because fewer industries are losing jobs.

Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In December, the index hit 20.5, suggesting job losses were very widespread. The index has recovered since then (28.5 in April), although job losses are still widespread.

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index recovered slightly to 26.5 in April.