by Calculated Risk on 4/16/2009 08:13:00 AM

Thursday, April 16, 2009

General Growth Properties Files Bankruptcy

From the WSJ: Mall Titan Enters Chapter 11

Mall owner General Growth Properties Inc. sought bankruptcy protection early Thursday in one of the largest real-estate failures in U.S. history ...The Mall is Flattened ...

The bankruptcy will have far-reaching implications for the mall industry, including putting pressure on already declining property values of U.S. malls ...

China GDP increases 6.1% from Q1 2008

by Calculated Risk on 4/16/2009 12:58:00 AM

From MarketWatch: China's economy expands 6.1% in first quarter

Gross domestic product expanded 6.1% in the first quarter from a year earlier, after expanding 6.8% in the fourth quarter, government data showed Thursday.China reports GDP growth on a year-over-year basis, so this is the growth from Q1 2008 (as opposed to quarterly growth annualized like in the U.S.). Since growth was fairly robust early last year, this suggest GDP is probably slightly positive in the most recent quarter.

...

The Chinese government said Thursday that recent economic data showed "positive changes with better performance than expected."

A spokesman for the National Bureau of Statistics in a statement Thursday cited improvement in agriculture and a steady increase in industrial production, despite falling profits.

However, the bureau also warned that problems remain, including a fall in demand for Chinese exports, reduced government revenue and increased difficulties on employment.

"The national economy is confronted with the pressure of slowdown," the spokesman said.

Wednesday, April 15, 2009

Six Banks to Receive up to $9.9 Billion for Mortgage Modifications

by Calculated Risk on 4/15/2009 09:43:00 PM

From CNNMoney: Obama launches mortgage rescue plan

The Treasury Department announced Wednesday the first six participants to sign up for President Obama's plan. They include three of the nation's largest banks: JPMorgan Chase (JPM, Fortune 500), which will get up to $3.6 billion in subsidy and incentive payments; Wells Fargo (WFC, Fortune 500), $2.9 billion; and Citigroup (C, Fortune 500), $2 billion. The others are GMAC Mortgage, $633 million; Saxon Mortgage Services, $407 million; and Select Portfolio Servicing, $376 million.This is the Making Home Affordable plan.

...

The modification plan calls for the servicer to reduce interest rates so that the monthly obligation is no more than 38% of a borrower's pre-tax income, and then the government would kick in money to bring payments down to 31% of income. Servicers can also reduce the loan balance to achieve these affordability levels. The government will share in the cost, up to the amount the servicer would have received if it had reduced the interest rates.

Only loans where the cost of the foreclosure would be higher than the cost of modification would qualify. Also, Treasury will not provide subsidies to reduce rates to levels below 2%.

Mortgage Defaults Spreading to Higher Priced Areas

by Calculated Risk on 4/15/2009 05:46:00 PM

From Zach Fox at the North County Times: Mortgage defaults hit new high, spread to upscale neighborhoods

Mortgage delinquencies hit a new high in March ... according to a report released Tuesday.Defaults: Movin' on up!

The report also showed that notices of default, the first step in the foreclosure process, have spiked in the region's tonier neighborhoods ---- places that, until now, have avoided the mass foreclosures elsewhere ---- while appearing to have reached a plateau in lower-end regions, which have already been hammered.

In fact, areas such as Valley Center and Rancho Bernardo shot up to be among the leaders in North County for most foreclosure notices per 1,000 houses.

...

Default notices shot to new highs in areas of Carlsbad, Rancho Bernardo and Rancho Penasquitos. On the other hand, notices in foreclosure-prone neighborhoods such as Oceanside and Escondido were below peaks reached earlier.

In fact, one region of Rancho Bernardo saw more default notices in March per 1,000 homes than Oceanside's 92057 ZIP code ---- the most foreclosure-prone neighborhood in North County over the last two years.

Capital One Credit Card Charge-Offs Increase Sharply in March

by Calculated Risk on 4/15/2009 04:01:00 PM

From Zero Hedge blog:

Some very ugly credit card charge-off data just out from Capital One. The February annualized rate of 8.06% has spiked by over 1% month-over-month to the current 9.33%, a very troubling deterioration ...Allow me to add a graph ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the COF annualized credit card charge-off rate since January 2005.

Notice the spike in 2005 associated with a surge in bankruptcy filings ahead of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA).

Credit card charge-offs in March (annualized) were almost as high as the peak in 2005 (9.33% in March compared to 9.75% in October 2005)

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

White House: US to release bank stress data in May

by Calculated Risk on 4/15/2009 02:56:00 PM

From Reuters: US to release bank stress data in May-White House

... "Early in May, you will see in a systematic and coordinated way the transparency of determining and showing to all involved some of the results of these stress tests," White House spokesman Robert Gibbs said."[T]he transparency of determining and showing"? What does that mean? "Some of the results"?

The tests will assess how much of a "capital cushion" the banks are likely to need to stay healthy, given the current economic environment, he said.

"Our hope is that banks that are not healthy, or need help, will first and foremost seek that help privately, and then we'll take steps from there to assist them," Gibbs said.

...

U.S. regulators are preparing a guide to explain to the public the bank stress tests and how to interpret the results, sources have told Reuters.

And a guide on how to interpret the results? We don't need no stinkin' guide! Just show us the data.

Update: The orginal "any stinkin' badges" from The Treasure of the Sierra Madre (ht Eli)

Fed's Beige Book: "economic activity contracted further or remained weak"

by Calculated Risk on 4/15/2009 02:04:00 PM

From the Fed: Beige Book

Reports from the Federal Reserve Banks indicate that overall economic activity contracted further or remained weak. However, five of the twelve Districts noted a moderation in the pace of decline, and several saw signs that activity in some sectors was stabilizing at a low level.On Real Estate and construction:

emphasis added

Housing markets remained depressed overall, but there were some signs that conditions may be stabilizing. Many Districts said factors such as homebuyer tax credits, low mortgage rates, and more affordable prices led to a rising number of potential buyers. The Richmond, Atlanta, Minneapolis, Kansas City, and San Francisco Districts noted a modest improvement in sales in some areas.It appears residential real estate is at or near a bottom in activity (but not in prices). However commercial real estate (CRE) is following residential off the cliff (this is the typical pattern - CRE follows residential). CRE will be crushed this year and into 2010.

New home construction activity fell further, however, as inventories remained elevated. Nonetheless, several Districts, including Atlanta and Kansas City, said that inventories of unsold homes had turned down slightly.

Home prices continued to decline in most Districts, although a few reports noted that prices were unchanged or that the pace of decline had eased. Low mortgage rates were fueling refinancing activity. Outlooks for the housing sector were generally more optimistic than in earlier surveys, with respondents hopeful that increased buyer interest would lead to better sales.

Nonresidential real estate conditions continued to deteriorate over the past six weeks. Demand for office, industrial and retail space continued to fall, and there were reports of increases in sublease space. Rental concessions were rising. Property values moved lower as reality "set in." Construction activity continues to slow, and several Districts noted increased postponement of both private and public projects. Nonresidential construction is expected to decline through year-end, although there were some hopeful reports that the stimulus package may lead to some improvement.

Commercial real estate investment activity weakened further. Contacts said a decline in credit availability and markdowns on commercial property were keeping buyers and sellers on the sidelines.

DataQuick: SoCal Home Sales Increase

by Calculated Risk on 4/15/2009 01:26:00 PM

From DataQuick: Southland home sales up; median levels off

Home sales in Southern California increased again last month, led by strong foreclosure resale activity in the Inland Empire. ...Sales are being driven by foreclosure resales (55.4% of all sales) in the less expensive areas. There are two problems for the mid-to-high end: limited financing with jumbo loans, and prices haven't fallen enough (but foreclosure activity is now increasing in the higher priced areas and that will push down prices).

A total of 19,486 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 27.9 percent from 15,231 for the prior month, and up 52.1 percent from 12,808 for March 2008, according to MDA DataQuick of San Diego.

An increase from February to March is normal for the season. Last month was the ninth in a row with a year-over-year sales increase. March last year was the slowest March in DataQuick's statistics, which go back to 1988. The March average is 25,138.

"We're still waiting for the upper half of the mortgage market to open up. We know that sales of lower-cost housing, especially foreclosure resales in Riverside and San Bernardino counties, are driving today's market. What we don't know is how the recession has affected the more expensive neighborhoods," said John Walsh, MDA DataQuick president.

... a common form of financing used by first-time home buyers in more affordable neighborhoods is near record levels. Government- insured, FHA mortgages made up 37.8 percent of all purchase loans in March, up slightly from a revised 37.5% in February and up from 10.1% in March last year.

Regionwide, foreclosure resales accounted for 55.4 percent of March's resales activity, down from a revised 56.7 percent in February and up from 35.7 percent in March 2008.

...

Indicators of market distress continue to move in different directions. Foreclosure activity is nearing its 2008 peak ...

emphasis added

As always, ignore the median price. Note that foreclosure activity is picking up again (after the moratorium).

NAHB: Builder Confidence Increases in April

by Calculated Risk on 4/15/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

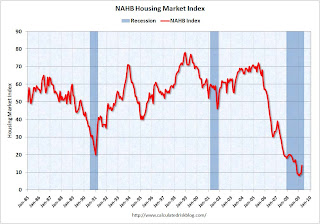

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 14 in April from 9 in March. The record low was 8 set in January.

The increase in April follows five consecutive months at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added): April Data Suggests Market At or Near Bottom

Builder confidence in the market for newly built, single-family homes rose five points in April to the highest level since October 2008, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This gain was the largest one-month increase recorded since May of 2003, and brings the HMI out of single-digit territory for the first time in six months – to 14. Every component of the HMI reflected the boost, with the biggest gain recorded for sales expectations in the next six months.

...

“This is a very encouraging sign that we are at or near the bottom of the current housing depression,” said NAHB Chief Economist David Crowe. “With the prime home buying season now underway, builders report that more buyers are responding to the pull of much-improved affordability measures, including low home prices, extremely favorable mortgage rates and the introduction of the $8,000 first-time home buyer tax credit.”

...

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations in the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Each of the HMI’s component indexes recorded substantial gains in April. The largest of these gains was a 10-point surge in the component gauging builder sales expectations for the next six months, which brought that index to 25. The component gauging current sales conditions and the component gauging traffic of prospective buyers each rose five points, to 13 and 14, respectively.

The HMI also rose in every region in April, with an eight-point gain to 16 in the Northeast, a six-point gain to 14 in the Midwest, a five-point gain to 17 in the South and a 4-point gain to 9 in the West.

Industrial Production Declines Sharply in March

by Calculated Risk on 4/15/2009 09:16:00 AM

How about this headline from Rex Nutting at MarketWatch: Biggest drop in industrial output since VE Day

Industrial production is down 13.3% since the recession began in December 2007, the largest percentage decline since the end of World War II. ... Factory output has fallen 15.7% during the recession, also the largest decline since 1945-1946.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is some serious cliff diving. Also - since capacity utilization is at a record low (the series starts in 1967), there is little reason for investment in new production facitilies.

The Federal Reserve reported:

Industrial production fell 1.5 percent in March after a similar decrease in February. For the first quarter as a whole, output dropped at an annual rate of 20.0 percent, the largest quarterly decrease of the current contraction. At 97.4 percent of its 2002 average, output in March fell to its lowest level since December 1998 and was nearly 13 percent below its year-earlier level. Production in manufacturing moved down 1.7 percent in March and has registered five consecutive quarterly decreases. Broad-based declines in production continued; one exception was the output of motor vehicles and parts, which advanced slightly in March but remained well below its year-earlier level. Outside of manufacturing, the output of mines fell 3.2 percent in March, as oil and gas well drilling continued to drop. After a relatively mild February, a return to more seasonal temperatures pushed up the output of utilities. The capacity utilization rate for total industry fell further to 69.3 percent, a historical low for this series, which begins in 1967.

emphasis added