by Calculated Risk on 3/24/2009 09:07:00 PM

Tuesday, March 24, 2009

Equity Extraction Data

Earlier today I graphed the mortgage equity extraction data for Q4 2008 from Dr. James Kennedy at the Fed.

Thanks again to Dr. Kennedy for all the data!

For those interested, here is the equity extraction data from the Fed (excel file) Enjoy!

IMPORTANT NOTE: If you use this data, please read this note from the Fed:

Attached are the estimates of home equity extraction and related data through the fourth quarter of 2008, courtesy of Jim Kennedy. Please note that there will be no further updates to this data series.Here is a repeat of the total MEW graph:

These data are the product of a research project undertaken by Jim and Alan Greenspan. The data are not an official publication or product of the Federal Reserve Board. If you cite these data, please reference one of the two papers that Jim wrote with Alan Greenspan. For example, a reference might read something like this:

"Updated estimates provided by Jim Kennedy of the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41."

Since the fall of 2005, when the first paper Jim wrote with Alan Greenspan was released, Jim has updated the data periodically, usually quarterly, a few days after publication of the Flow of Funds data.

Click on graph for larger image in new window.

Click on graph for larger image in new window.For Q4 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $77 billion, or negative 2.9% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Obama Press Conference on the Economy at 8 PM ET

by Calculated Risk on 3/24/2009 07:50:00 PM

UPDATE: Form the WSJ: Obama Says 'Signs of Progress' Emerging in Economy

Here is the CNBC feed.

Here is the FOX feed.

Volcker on Inflation, the Dollar and China

by Calculated Risk on 3/24/2009 04:55:00 PM

On inflation (from Dow Jones):

“One historic way of getting yourself out of this situation — or trying to — is to inflate. Either you do it deliberately or you allow it to happen,” [Vlocker] said. “And if we permit that to happen then I think all these dollars will come tumbling down on us.” ...And on China:

“I get a little nervous when I see the Federal Reserve announcements that they want have the amount of inflation that’s conducive to recovery,” Volcker said. “I don’t know what ‘the amount of inflation that’s conducive to recovery’ would be appropriate. I’d much rather they say that they want to maintain stability in the currency, which is conducive to confidence and recovery.”

“I think the Chinese are a little disingenuous to say, ‘Now isn’t it so bad that we hold all these dollars.’ They hold all these dollars because they chose to buy the dollars, and they didn’t want to sell the dollars because they didn’t want to depreciate their currency. It was a very simple calculation on their part, so they shouldn’t come around blaming it all on us.”

Fed to Start Buying Longer Term Treasury Securities on Wednesday

by Calculated Risk on 3/24/2009 03:00:00 PM

From the New York Fed: New York Fed Issues Tentative Operation Schedule, FAQs for Treasury Purchases, Updated FAQs for Agency Debt and Agency MBS Purchases

The first outright Treasury coupon purchase will be conducted on Wednesday, March 25, 2009, and will settle Thursday, March 26, 2009. Results will be posted on the New York Fed’s website following the operation.According to the current schedule, the Fed will be buying 7 to 10 year securities tomorrow. On Friday they will be buying 2 to 3 year securities. And on Monday they will buying in the 17 to 30 year range.

Starting on Wednesday, April 1, 2009, and continuing every two weeks, the New York Fed will issue a tentative operation schedule for its purchases of longer-dated Treasury securities, including the maturity sector or sectors to be targeted.

What is the backup plan?

by Calculated Risk on 3/24/2009 01:40:00 PM

From TPM: We Don't Need No Stinkin' Contingencies

Rep. Gresham Barrett: What is the backup plan?

Secretary Geithner: This plan will work.

Q4 Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 3/24/2009 11:37:00 AM

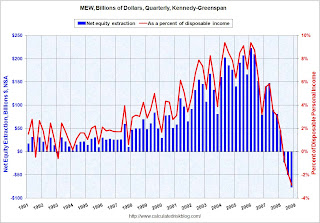

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q4 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $77 billion, or negative 2.9% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income. Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

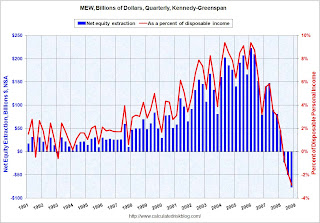

Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This measure is near zero ($7.2 billion for the quarter) and is probably a better estimate of the impact of MEW on consumption. When people refinance with cash out or draw down HELOCs, they usually spend the money.

The Fed's Flow of Funds report shows the amount of mortgages outstanding is declining, and this is partially because of debt cancellation per foreclosure sales, and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

Clearly the Home ATM has now been closed for a few quarters.

Note: This will be the last update of MEW from Dr. Kennedy. My thanks to Jim Kennedy and the other contributors to the MEW updates.

MBA: Refinance Boom will Boost Mortgage Originations to $2.7 Trillion in 2009

by Calculated Risk on 3/24/2009 10:20:00 AM

From Paul Jackson at Housing Wire: MBA: Originations Could Top $2.7 Trillion in 2009

[T]he Mortgage Bankers Association, which said that it had increased its forecast of mortgage originations in 2009 by over $800 billion, due to a refinancing boom ... The MBA said it now expects originations to total $2.78 trillion, which would make 2009 the fourth highest originations year on record, behind only 2002, 2003, 2005.It sounds like the mortgage brokers will be busy this year!

...

“This boost is due entirely to the expected increase in mortgage refinancing activity motivated by the drop in interest rates following last week’s Federal Reserve’s announcement on the Treasury bond and mortgage-backed securities purchases programs and the Fannie Mae and Freddie Mac refinance programs,” the mortgage lobbying and trade group said in a press statement.

...

This origination boom, however, will differ from recent years past — while previous record origination years of 2002, 2003 and 2005 had large amounts of subprime loans and jumbo loans, the MBA said it expects 2009 originations to consist almost entirely of conforming and/or FHA-eligible mortgages.

...

The MBA projected that total existing home sales for 2009 will drop 2.5 percent from 2008 to 4.8 million units, while new home sales will decline a far sharper 39 percent in 2009 to 293,000 units.

This refinance boom will lower the payments for homeowners with conforming loans, but that doesn't help much in the higher priced areas.

Geithner: New Powers Needed to Seize Non-bank Financial Companies

by Calculated Risk on 3/24/2009 09:07:00 AM

Geithner and Bernanke are scheduled to testify at 10AM ET.

From Bloomberg: Geithner to Call for New Powers to Avoid AIG Repeat

U.S. Treasury Secretary Timothy Geithner will call for expanded government powers to deal with failing non-bank financial institutions such as American International Group Inc., an administration official said.

Geithner, who testifies today before the House Financial Services Committee on AIG’s rescue, is expected to focus on the need for new tools for financial institutions other than banks, similar to those that the Federal Deposit Insurance Corp. has for winding down failed lenders and insuring consumer bank deposits, the official said.

The authority would allow the Treasury, in collaboration with the Federal Reserve, regulators and the president, to step in and more easily combat problems at systemically important institutions on the verge of failure ...

Monday, March 23, 2009

Krugman Discusses Geithner's Toxic Plan on News Hour

by Calculated Risk on 3/23/2009 11:57:00 PM

On existing home sales, here are a few posts:

Existing Home Sales Increase Slightly in February

More on Existing Home Sales

Existing Home Sales: Turnover Rate

News Hour - Paul Krugman & Donald Marron discuss Geithner's plan Part I

Part II:

Goolsbee Responds to Krugman

by Calculated Risk on 3/23/2009 10:19:00 PM

Austan Goolsbee, of the White House Council of Economic Advisers responds to Paul Krugman on Hardball. (ht David)

A couple of comments: Goolsbee claims "if the private guy makes money, the government makes money. If the private guy loses money, the government loses money." Goolsbee is correct on an individual pool, but investors can buy multiple pools and Nemo has an excellent example of how the investors can make money, and the government lose money.

Goolsbee should read that example.

At 4:40 Goolsbee essentially agrees with Krugman's column:

[T]he Geithner scheme would offer a one-way bet: if asset values go up, the investors profit, but if they go down, the investors can walk away from their debt. So this isn’t really about letting markets work. It’s just an indirect, disguised way to subsidize purchases of bad assets.It's not a complete one-way bet on any individual pool because the investors do put a small amount of money down - and that small amount is at risk. But Krugman was referring to the non-recourse debt and he is correct.

BTW, Tanta once ripped Goolsbee - very funny: Dr. Goolsbee: I’ll Stop Impersonating an Economist If You Quit Underwriting Mortgage Loans