by Calculated Risk on 2/19/2009 01:23:00 PM

Thursday, February 19, 2009

Fed's Lockhart sees "catalysts for the start of modest recovery"

Excerpts from a speech by Altanta Fed President Dennis (edit) Lockhart today:

[T]he economic outlook is not indefinitely bad. Most forecasts, my own included, see catalysts for the start of modest recovery in the second half of the year.I think almost everyone agrees with the "not indefinitely bad" comment. But I'm interested in what Lockhart sees as "catalysts for recovery":

With production falling—and expected to decline significantly more this quarter—I expect some reduction of excess business inventories, putting producers in a position to expand output as spending returns.Right now it appears inventory levels are too high. In the Philly Fed economic outlook report today, they asked a special question about inventory levels:

In special questions this month, firms were asked about their current inventory situation. Nearly 44 percent of the firms indicated that their inventories were too high and were expected to decrease during the first quarter; 67 percent said their customers' inventory plans had also decreased.So Lockhart might be correct, but it is too early to tell if producers will reduce inventory enough in the first half of 2009 to expand output in the second half of the year.

There are signs lower mortgage interest rates are helping housing markets on the margin. The January pending sales number was up, and there has been a spurt in refinancing activity. If historically low mortgage rates can be sustained over the coming months, I expect more buyers will be drawn into the market.Actually the most recent pending home sales number was for December and the reason it showed an increase was because of more activity in areas with significant foreclosures.

Several factors should lift consumer spending as the year progresses. These factors include the dramatic fall in energy prices, greater stability in the housing market, and improving consumer confidence.This is very possible, but I don't see evidence of this yet.

I should mention that last week the U.S. Census Bureau reported an unexpected increase in retail sales during January. I would like to see further confirmation of the underlying strength hinted at in this report, but on its face, the pickup in consumer spending is encouraging.This is just one month of data and could be related to gift cards, so I wouldn't read much into that small increase.

Also contributing to the upturn seen in the consensus outlook are the large and targeted fiscal, credit, and monetary policies of the government and the Federal Reserve ... The intent of these aggressive and unprecedented policy actions is to support spending and fix the dysfunction in credit markets that has so severely constrained the economy’s natural forces of growth.I think we can start looking for some rays of sunshine, but I don't see anything yet.

Indeed, we have seen modest, but hopeful, signs that financial markets are improving. A key element in the improved economic environment expected in the latter half of the year is that financial institutions will find more stable footing and begin to provide greater support to business expansion and consumer spending.

Rick Santelli: "Chicago Tea Party in July"

by Calculated Risk on 2/19/2009 12:29:00 PM

Some say this is the "rant of the year" ...

Homebuilder Survives Depression, Files Bankruptcy

by Calculated Risk on 2/19/2009 11:36:00 AM

From Bloomberg: WL Homes, Homebuilder, Seeks Bankruptcy, Cites Market Collapse

WL Homes LLC [also does business as John Laing Homes], the 161-year-old homebuilder, filed for bankruptcy protection from creditors with plans to focus on developments in Southern California.Jon Lansner at the O.C. Register had been following WL Homes, from one week ago: Laing Homes lays off 72 O.C. workers

The company blamed its filing on the collapse of the real estate market, saying its 2007 sales had fallen by about half ...

More evidence surfaced this week that all is not well with Newport Beach-based homebuilder John Laing Homes, which apparently has been all-but mothballed by its Dubai-based owner.Not a very good $1 billion investment.

Laing reported that it laid off 72 employees in Orange County on Jan. 15, according to a state Employment Development Department notice published Monday.

...

Rumors have been circulating that the company — sold for $1 billion to Emaar Properties of the United Arab Emirates in June 2006 — has halted work on projects from here to Colorado.

U.S. Vehicle Miles Driven Off 3.6% in 2008

by Calculated Risk on 2/19/2009 11:20:00 AM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by -1.6% (-3.8 billion vehicle miles) for December 2008 as compared with December 2007. Travel for the month is estimated to be 237.2 billion vehicle miles.

Cumulative Travel for 2008 changed by -3.6% (-107.9 billion vehicle miles). The Cumulative estimate for the year is 2,921.9 billion vehicle miles of travel.

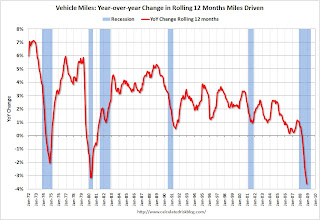

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in December 2008 were 1.6% less than December 2007, so the YoY change in the rolling average may start to increase.

The second graph shows the change from the same month in the previous year. This is a noisy graph. Although miles driven was 1.6% less in December 2008 as compared to December 2007, the decline from the previous year was much less than the previous months.

The second graph shows the change from the same month in the previous year. This is a noisy graph. Although miles driven was 1.6% less in December 2008 as compared to December 2007, the decline from the previous year was much less than the previous months.For miles driven in December, the sharp decline in gasoline prices offset the impact from the slowing economy.

Philly Fed Survey: Employment index at Record Low

by Calculated Risk on 2/19/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Conditions in the region's manufacturing sector continued to deteriorate this month, according to firms polled for the February Business Outlook Survey. All of the survey's broad indicators for current activity remained negative and fell from their already low levels in January. Employment losses were more substantial this month, and nearly half of the surveyed firms reported declines in both employment and average hours worked. Firms continued to report declines in input prices and prices for their own manufactured goods. Most of the survey's indicators of future activity improved, continuing to suggest that the region's manufacturing executives expect declines to bottom out over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, declined from a reading of -24.3 in January to -41.3 this month, its lowest reading since October 1990. The index has been negative for 14 of the past 15 months ...

In special questions this month, firms were asked about their current inventory situation. Nearly 44 percent of the firms indicated that their inventories were too high and were expected to decrease during the first quarter; 67 percent said their customers' inventory plans had also decreased.

The current employment index fell for the fifth consecutive month, dropping seven points, to -45.8, its lowest reading in the history of the survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index vs. recessions for the last 40 years.

"The index has been negative for 14 of the past 15 months, a period that corresponds to the current recession."

Unemployment Claims: Continued Claims Almost 5 Million

by Calculated Risk on 2/19/2009 09:18:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 14, the advance figure for seasonally adjusted initial claims was 627,000, unchanged from the previous week's revised figure of 627,000. The 4-week moving average was 619,000, an increase of 10,500 from the previous week's revised average of 608,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 7 was 4,987,000, an increase of 170,000 from the preceding week's revised level of 4,817,000. The 4-week moving average was 4,839,500, an increase of 92,500 from the preceding week's revised average of 4,747,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 619,000, the highest since 1982.

Continued claims are now at 4.99 million - another new record - above the previous all time peak of 4.71 million in 1982.

Note: I'll normalize by covered employment next week.

Another weak unemployment claims report ...

Roubini: Housing, Stimulus and Nationalization

by Calculated Risk on 2/19/2009 01:11:00 AM

Another upbeat interview with Professor Roubini ...

Wednesday, February 18, 2009

Corus Bankshares Announces Consent Order

by Calculated Risk on 2/18/2009 10:16:00 PM

Press Release: Corus Bankshares Announces Written Agreement With the Federal Reserve Bank of Chicago and a Consent Order With the Office of the Comptroller of the Currency (ht Anthony)

Corus Bankshares ... today announced that, in coordination with, and at the request of, both the Federal Reserve Bank of Chicago (the "FRB") and the Office of the Comptroller of the Currency (the "OCC"), the Company and its subsidiary bank, Corus Bank, N.A. (the "Bank"), respectively, have entered into a Written Agreement (the "Agreement") with the FRB and a Consent Order (the "Order") with the OCC.Here is the written agreement with the Federal Reserve Bank of Chicago, and the Consent Order.

The Agreement and the Order (collectively, the "Regulatory Agreements") contain a list of strict requirements ranging from a capital directive, which requires Corus and the Bank to achieve and maintain minimum regulatory capital levels (in the Bank's case, in excess of the statutory minimums to be classified as well-capitalized) to developing a liquidity risk management and contingency funding plan, in connection with which the Bank will be subject to limitations on the maximum interest rates the Bank can pay on deposit accounts. The Regulatory Agreements also include several requirements related to loan administration as well as procedures for managing the Bank's growing portfolio of foreclosed real estate assets. Corus is also restricted from paying any dividends or making any capital distributions, including distributions related to its trust preferred debt without advance regulatory approval. ...

Meanwhile, for those who missed it, the WSJ reported last week on BankUnited: U.S. Won't Help Deal for Florida Bank

The future of the largest Florida-based bank is in jeopardy because the U.S. government has declined to prop up a private bid for BankUnited Financial Corp. ... the government isn't supporting an assisted transaction ... because it has determined that a potential collapse of BankUnited does not constitute a risk to the larger financial system.A couple of candidates for Friday afternoon blogging.

Key Economic News

by Calculated Risk on 2/18/2009 08:05:00 PM

Mark Thoma at Economist's View has a summary of reactions to Obama's Housing Plan. My main objection is that part 2 of the plan bails out some homebuyers who gambled and lost by using exotic mortgages as affordability products.

The focus on subprime is misleading; the subprime crisis has peaked. Part 2 is really about Option ARMs and Alt-A mortgages in mid-priced neighborhoods. Update: There is a limit: Only owner-occupied homes qualify; no home mortgages larger than the Freddie/Fannie conforming limits will be eligible. Oh well, we're all subprime now! (Tanta Vive)

In other news, "record low" was the phrase of the day ...

Housing starts hit another record low.

The Architecture Billings Index hit another record low.

And Capacity Utilization and Industrial Production continued off the cliff, including another record low in the factory sector for capacity utilization:

Capacity utilization in the factory sector alone fell to 68% in January, a record low for the index that goes back to 1948.

Housing Starts: The Pain in Spain

by Calculated Risk on 2/18/2009 06:40:00 PM

If you thought U.S. housing starts have fallen off a cliff, here is an article on Spain: Biggest developers in Spain start just 135 properties in last quarter of 2008 (hat tip carlomagno)

Just 135 new housing starts in the last quarter of 2008, and not a single one in December: That was the combined output in terms of housing starts for the G-14 group of Spain’s biggest developers ...I don't know if these numbers are accurate, but it sounds like they could stop building for at least a couple of years.

Pedro Pérez, President of the G-14, estimates the new build housing inventory at 700,000 properties, though other sources claim that there are more than 1 million new homes on the market ... Pérez also claims that there is demand in Spain for between 400,000 and 450,000 new properties a year, thanks to new household formation and demand for holiday homes from both Spaniards and other nationalities.