by Calculated Risk on 2/11/2009 08:24:00 PM

Wednesday, February 11, 2009

Viewing Problems Today and Congressional Video

I know a number of readers couldn't access the blog today. Please accept my apology for the inconvenience. This happened for anyone who was using the old blogspot address as a bookmark or an older link from another site.

Google is supposed to redirect that address to the new URL www.calculatedriskblog.com. The RSS feed also wasn't updating. That should all be fixed now too.

We had another display of pettifogging Congressmen today, but at least they provided some entertainment! Here is Congressman Mike Capuano venting (hat tip Nemo):

Stimulus: Homebuilder Tax Break "Sharply Curtailed"

by Calculated Risk on 2/11/2009 07:04:00 PM

More good news on the stimulus bill.

From the WSJ: Big Business Loses Out on Tax Break Under Stimulus Deal

A tax break sought by businesses that would allow unprofitable firms to recoup taxes paid in the past five years has been sharply curtailed ...I lobbied hard against both the homebuyer tax credit and the homebuilder tax break, and it looks like both provisions were scaled back sharply.

Sen. Baucus (D., Mont.) said House and Senate negotiators have agreed to limit the tax break to small businesses only. That means large manufacturers, retailers and homebuilders that lobbied for the provision would be shut out under a deal reached earlier today.

...

Congressional tax estimators said it would have delivered as much as $67.5 billion in tax benefits to businesses this year and next. The provision would have allowed firms to convert 2009 and 2010 losses into tax refunds by carrying those losses back for five years to offset tax liability.

Housing Tax Credit: "Largely Dropped"

by Calculated Risk on 2/11/2009 04:50:00 PM

From Bloomberg: U.S. Lawmakers Agree on $789 Billion Stimulus Plan

Asked what a proposed $15,000 tax credit for homebuyers looks like in the compromise plan, Baucus laughed and said, “not much.” He said that proposal has largely been dropped, though he didn’t provide details.We still need the details on what "not much" means, but this is a little bit of good news.

Note: I'm still working on some Google technical issues. This includes the feed not working. Sorry for the inconvenience.

Martin Wolf: The New TARP Will Fail

by Calculated Risk on 2/11/2009 03:55:00 PM

Excerpts from Martin Wolf: Why Obama’s new Tarp will fail to rescue the banks

All along two contrasting views have been held on what ails the financial system. The first is that this is essentially a panic. The second is that this is a problem of insolvency.It is very important that the bank stress tests be completed quickly (within 30 days), and the results made public. This will help remove some of the uncertainty, and might make it clear whether or not the U.S. needs to preprivatize (a kinder term for nationalize) the banks.

Under the first view, the prices of a defined set of “toxic assets” have been driven below their long-run value ... The solution, many suggest, is for governments to make a market, buy assets or insure banks against losses. ...

Under the second view, a sizeable proportion of financial institutions are insolvent: their assets are, under plausible assumptions, worth less than their liabilities.

...

Personally, I have little doubt that the second view is correct and, as the world economy deteriorates, will become ever more so. But this is not the heart of the matter. That is whether, in the presence of such uncertainty, it can be right to base policy on hoping for the best. The answer is clear: rational policymakers must assume the worst. If this proved pessimistic, they would end up with an over-capitalised financial system. If the optimistic choice turned out to be wrong, they would have zombie banks and a discredited government. ...

Why then is the administration making what appears to be a blunder? It may be that it is hoping for the best. But it also seems it has set itself the wrong question. It has not asked what needs to be done to be sure of a solution. It has asked itself, instead, what is the best it can do given three arbitrary, self-imposed constraints: no nationalisation; no losses for bondholders; and no more money from Congress. Yet why does a new administration, confronting a huge crisis, not try to change the terms of debate? This timidity is depressing.

...

The correct advice remains the one the US gave the Japanese and others during the 1990s: admit reality, restructure banks and, above all, slay zombie institutions at once. ...

By asking the wrong question, Mr Obama is taking a huge gamble. ... He needs to rethink, if it is not already too late.

U.S. Budget Deficit: Heading for $1.6 Trillion

by Calculated Risk on 2/11/2009 02:06:00 PM

From MarketWatch: U.S. Jan. budget deficit $84.0 bln vs $17.8 surplus yr-ago

The government reported a deficit of $84.0 billion in January ... [compared to] a surplus of $17.84 billion in the same month one year ago. Lower corporate taxes are dragging receipts lower, while spending has jumped ... Experts are forecasting a deficit above $1.6 trillion in the fiscal year ending Sept. 30The CBO was projecting a deficit of $1.2 trillion before the Obama stimulus plan:

As for the startling [$1.2 trillion] estimate from the nonpartisan Congressional Budget Office, if it proves accurate, the budget deficit will be nearly two and a half times bigger than the previous record shortfall of $455 billion reached in 2008.And it is important to note that this is the unified budget deficit that includes the significant Social Security Insurance surplus. The General Fund deficit will be even worse.

The estimate was far higher than most other analysts have predicted. If combined with the gigantic stimulus package of tax cuts and new spending that Mr. Obama is preparing, which could amount to nearly $800 billion over two years, the shortfall this year could hit $1.6 trillion.

Report: Stimulus Agreement Reached

by Calculated Risk on 2/11/2009 11:20:00 AM

Update: CNBC: Tentative Accord Reached On Smaller Stimulus Plan

The White House and key congressional negotiators have tentatively settled on a $790 billion price tag for President Barack Obama's economic recovery plan, Democratic aides on Capitol Hill said.Update: WSJ: Deal Nears on Stimulus Plan

The aides said one way negotiators are trimming the measure's cost below the $838 billion plan that passed the Senate Tuesday is to pare back Obama's signature "Making Work Pay" tax credit for 95 percent of workers.

This should be cut to $400 a year instead of $500. A married couple would get $800 instead of the $1,000 initially proposed by Obama.

Under the framework coming together, lawmakers would trim the cost of Senate-approved tax cuts intended to spur auto and home sales, but would preserve a measure intended to shield millions of middle-income Americans from the alternative minimum tax, a levy originally designed to hit the wealthy.One headlines says "reach", the other "near" ... It sounds like a deal is close, and the stimulus package will likely be smaller than either the House or Senate versions.

Among other things, a signature Obama tax cut—the payroll tax holiday for workers –would be scaled back, under the framework being negotiated.

Commercial Mortgage Applications Off 80 Percent in Q4

by Calculated Risk on 2/11/2009 09:30:00 AM

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Mortgage Bankers Association Commercial/Multifamily Mortgage Originations index since 2001.

From the Mortgage Bankers Association (MBA): Commercial/Multifamily Mortgage Originations Down 80% from Q4 2007 in MBA Survey (hat tip Robert)

Commercial and multifamily mortgage loan originations dropped in the fourth quarter, according to the Mortgage Bankers Association's (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. Fourth quarter originations were 80 percent lower than during the same period last year. The year-over-year decrease was seen across all property types and investor groups.For more details, here is the quarterly report.

"Commercial and multifamily mortgage lending slowed to a trickle in the fourth quarter," said Jamie Woodwell, Vice President of Commercial Real Estate Research at the Mortgage Bankers Association. "Origination levels in the fourth quarter were 80 percent below last year's fourth quarter, and originations for all of 2008 were down approximately 60 percent from 2007 levels. Between the worsening economy and the continued credit crunch, lenders are extremely cautious about lending and borrowers are likely to hold onto the assets and the loans they already have."

Decreases in total commercial/multifamily mortgage originations continued to be led by a drop in commercial mortgage-backed security (CMBS) conduit loans and loans for commercial bank portfolios. ...

The decrease in commercial/multifamily lending activity during the fourth quarter was driven by decreases in originations for all property types. When compared to the fourth quarter of 2007, the overall 80 percent decrease included a 99 percent decrease in loans for hotel properties, an 82 percent decrease in loans for retail properties, a 76 percent decrease in loans for industrial properties, a 72 percent decrease in loans for office properties, a 62 percent decrease in multifamily property loans, and a 47 percent decrease in health care property loans.

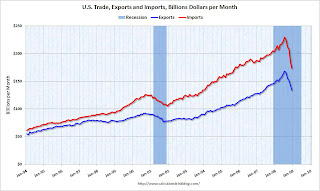

U.S. Trade: Exports and Imports Decline Sharply

by Calculated Risk on 2/11/2009 08:36:00 AM

The big trade story is the continuing sharp decline in both imports and exports.

The Census Bureau reports:

[T]otal December exports of $133.8 billion and imports of $173.7 billion resulted in a goods and services deficit of $39.9 billion, down from $41.6 billion in November, revised. December exports were $8.5 billion less than November exports of $142.3 billion. December imports were $10.2 billion less than November imports of $183.9 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2008. The recent rapid decline in foreign trade continued in December. Note that a large portion of the decline in imports is related to the fall in oil prices - but not all.

The second graph shows the U.S. trade deficit, both with and without petroleum through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices fell to $49.93 in December, although import quantities increased in December - so the petroleum deficit only declined slightly. Import oil prices will probably fall further in January.

Excluding petroleum, the trade deficit has been falling since early 2006. The rebalancing of trade continues, although the sharp declines in both imports and exports is very concerning.

Credit Suisse: $5.2 billion Loss

by Calculated Risk on 2/11/2009 02:12:00 AM

From Bloomberg: Credit Suisse Reports SF6.02 Billion Loss on Trading

Credit Suisse Group AG, Switzerland’s second-biggest bank, reported a 6.02 billion Swiss-franc ($5.2 billion) fourth-quarter loss on wrong-way trading bets and costs tied to cutting jobs and selling part of its fund unit.Another visit to the confessional.

...

“We have had a strong start to 2009 and were profitable across all divisions year to date,” [Chief Executive Officer Brady] Dougan said in a statement. “We have positioned our businesses to be less susceptible to negative market trends if they persist in the coming months.”

Tuesday, February 10, 2009

Stimulus Package: The Negotiations Begin

by Calculated Risk on 2/10/2009 09:10:00 PM

The House and Senate stimulus bills are significantly different, and finding a compromise will probably be difficult.

From the WSJ: Obama Seeks to Restore Spending to Stimulus Plan

The White House is seeking to restore funding cut by the Senate for schools, health insurance and computerizing health records as the economic-stimulus plan heads for a final round of negotiations in Congress this week.The $35 billion tax credit is probably the least useful provision in the Senate stimulus bill.

...

To make room for added spending, the White House, joined by House Democratic leaders, is pressing to scale back certain Senate-passed tax breaks, including ... an $11.5 billion proposal to give car buyers a tax deduction covering local sales taxes and interest on auto loans, and a $35 billion proposal to create a new tax credit for home purchases.

Here is one of my posts on this provision: The Homebuyer Tax Credit

And here is Professor Kash Mansori on the impact of the tax credit on house prices: Will a Home Purchase Tax Credit Help Boost House Prices?

This tax credit will not stabilize house prices, has very limited stimulative impact, and it will mostly go to home buyers who would buy anyway. Hopefully it will be removed in conference.