by Calculated Risk on 5/23/2008 04:31:00 PM

Friday, May 23, 2008

DOT: Vehicle Miles Fell 4.3% in March

Graph of 12 month rolling total U.S. vehicle miles added: Click on graph for larger image.

Click on graph for larger image.

From the Department of Transportation: Eleven Billion Fewer Vehicle Miles Traveled in March 2008 Over Previous March

Americans drove less in March 2008, continuing a trend that began last November, according to estimates released today from the Federal Highway Administration.It appears that prices are finally impacting demand in the U.S.

...

The FHWA’s “Traffic Volume Trends” report, produced monthly since 1942, shows that estimated vehicle miles traveled (VMT) on all U.S. public roads for March 2008 fell 4.3 percent as compared with March 2007 travel. This is the first time estimated March travel on public roads fell since 1979. At 11 billion miles less in March 2008 than in the previous March, this is the sharpest yearly drop for any month in FHWA history.

Vallejo files for bankruptcy

by Calculated Risk on 5/23/2008 02:21:00 PM

From the AP: Vallejo files for bankruptcy to deal with budget shortfall

This was expected. The question is: Is Vallejo unique, or will a number of other cities file bankruptcy?

Historical Housing Graphs: Months of Supply, Sales and Inventory

by Calculated Risk on 5/23/2008 01:31:00 PM

The first graph shows the year end months of supply since 1982 (and April 2008). Click on graph for larger image.

Click on graph for larger image.

The months of supply has risen to 11.2 months, and will probably be over 12 months sometime this summer. I don't have monthly data back to the early '80s, but the months of supply will probably be close to an all time record by July.

The second graph shows annual existing home sales and year end inventory. As the NAR recently noted 2007 was the fifth highest sales year on record. Note: for 2008 I used the April sales and inventory numbers. All other numbers are annual sales, and year-end inventory.

Note: for 2008 I used the April sales and inventory numbers. All other numbers are annual sales, and year-end inventory.

If the red columns (inventory) rises above the blue column (sales) - something that will probably happen this summer - then the "months of supply" number will be over 12.

The third graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This graph shows that inventory is at an all time record level by this key measure.  This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - April sales were at a 4.89 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - April sales were at a 4.89 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests that sales of existing homes could fall further in 2008.

More on April Existing Home Sales and Inventory

by Calculated Risk on 5/23/2008 11:39:00 AM

For more, see my earlier post: April Existing Home Sales Click on graph for larger image.

Click on graph for larger image.

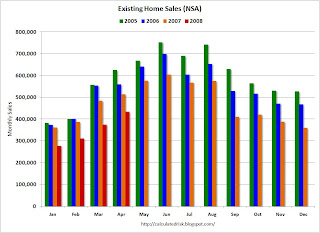

The first graph is Not Seasonally Adjusted sales by month for the last few years. This shows that sales have plunged in April 2008 compared to the previous three years.

April is an important month for existing home sales, and is part of the spring selling season. The next four months - May through August - are typically the strongest selling months of the year. Existing home sales are recorded at the close of escrow, and most homebuyers want to move during the summer months.

For forecasting, probably the most important number in the existing home sales report is inventory; houses listed for sale. For April, the NAR reported inventory at 4.552 million units, an all time record high for April.

This tells us nothing about the number of distressed homes for sale (REOs, short sales). It also says nothing about homeowners waiting for a 'better market'. But the NAR inventory report does provide a general idea of the supply side of the 'supply and demand' equation.

See the earlier post for a graph of inventory. The second graph shows the seasonal pattern for inventory for the last few years (based on year end inventory from the previous year).

The second graph shows the seasonal pattern for inventory for the last few years (based on year end inventory from the previous year).

Note: the NAR doesn't seasonally adjust inventory.

This suggests that the inventory build so far this year has been about normal, and it is reasonable to expect inventory levels to continue to increase into the summer.

My guess is existing home inventory will peak in mid-summer at around 5 million units. This will probably put the months of supply over 12 months.

BTW, the all time record high for inventory, for any month, was July 2007 at 4.561 million units. That will probably be broken in May.

April Existing Home Sales

by Calculated Risk on 5/23/2008 10:07:00 AM

Update: Graphs added.

Update2: Here is the NAR press release.

From MarketWatch: Unsold houses rise to 23-year high in April

The U.S. housing market weakened further in April, with a flood of homes coming on the market even as sales and prices declined, the National Association of Realtors reported Friday.

Resales of U.S. houses and condos dropped 1% to a seasonally adjusted annualized rate of 4.89 million from 4.94 million in March.

...

Resales have sunk 17.5% in the past year and are down 33% from the peak in 2005.

...

The inventory of unsold homes jumped 10.5% to 4.55 million, an "uncomfortably high" level, said Lawrence Yun, chief economist for the real estate trade group.

Inventories represented an 11.2 month supply at the April sales pace ...

Click on graph for larger image.

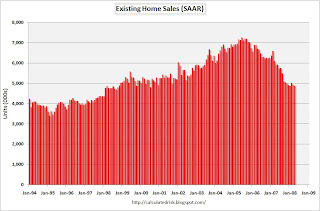

Click on graph for larger image. The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in April 2008 (4.89 million SAAR) were the weakest April since 1998 (4.77 million SAAR).

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to 4.55 million homes for sale in April.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to 4.55 million homes for sale in April. The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase in the Spring.

I'll have more on inventory later today.

The third graph shows the 'months of supply' metric for the last six years.

Months of supply increased sharply to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Inventory is the story in this report.

More later (the NAR website has problems this morning).

Thursday, May 22, 2008

Comptroller Dugan on "Unprecedented Home Equity Loan Losses"

by Calculated Risk on 5/22/2008 05:21:00 PM

From the Comptroller of the Currency: Comptroller Dugan Tells Lenders that Unprecedented Home Equity Loan Losses Show Need for Higher Reserves and Return to Stronger Underwriting Practices (hat tip Steven)

Comptroller of the Currency John C. Dugan said today that accelerating losses in the home equity business show the need to build reserves and to return to the stronger underwriting standards of past years.It appears HELOC losses are accelerating rapidly in Q2, and will definitely impact earnings. Dugan's comment that HELOC losses are "not likely large enough to impair capital" might be a tad optimistic.

Home equity loans and lines of credit grew dramatically in recent years, more than doubling, to $1.1 trillion, since 2002. In part, that’s because of the rapid appreciation in house prices, the tax deductibility feature of home equity loans, and low interest rates.

“But another contributing factor was perhaps not so obvious: liberalized underwriting standards,” Mr. Dugan said, in a speech to the Financial Services Roundtable’s Housing Policy Council. “These relaxed standards helped more people to qualify for loans, and more people to qualify for significantly larger loans.”

These relaxed standards included limited verification of a borrower’s assets, employment, or income; higher debt to equity ratios; and the use of home equity loans as “piggyback” loans that helped borrowers qualify for first mortgages with low down payments and without mortgage insurance, resulting in ever-higher cumulative loan-to-value ratios.

Consequently, once house prices began to decline in 2007, home equity lenders began to experience unprecedented losses. While losses have traditionally run at about 20 basis points, or two tenths of a percent of loans, they shot up to nearly 1 percent in the fourth quarter of 2007 and to 1.73 percent in the first three months of 2008.

Looked at in dollar terms, losses on all home equity loans, including HELOCs and junior home equity liens, rose from $273 million in the first quarter of 2007 to almost $2.4 billion in the first three months of 2008 – a nine-fold increase. And the largest home equity lenders are now saying that they expect losses to continue to escalate in 2008 and beyond, Mr. Dugan said.

The Comptroller said these loss numbers need to be viewed in perspective. Though accelerating quickly, they are still much lower than the loss rates for other types of retail credit, such as credit card loans.

“It’s true that home equity credit was priced with lower margins than these other types of credit, and it’s true that the product has become a significant on-balance sheet asset for a number of our largest banks,” he said. “Nevertheless, the higher level of losses and projected losses – even under stress scenarios – are what we at the OCC would describe generally as an earnings issue, not a capital issue. That is, while these elevated losses, depending on their magnitude, could have a significant effect on earnings over time, with few exceptions they are not in and of themselves likely to be large enough to impair capital.”

For the near term, Mr. Dugan said, the OCC expects national banks to continue to build reserves.

emphasis added

S&P Cuts Ratings of Prime-Jumbo Mortgage Bonds

by Calculated Risk on 5/22/2008 04:48:00 PM

From Bloomberg: S&P Cuts, Reviews $6 Billion of Prime-Jumbo Mortgage Bonds (no link yet)

Standard & Poor's cut or threatened to cut the ratings on almost $6 billion of securities backed by prime ``jumbo'' mortgages ...This is more evidence that the credit problems have moved up the chain. See: Fed: Delinquency Rates Rose Sharply in Q1. Also the Q1 Mortgage Bankers Association (MBA) delinquency report will be released soon - and I expect that report to show accelerating delinquencies in Alt-A and prime loans.

Ratings on 125 classes of [prime-jumbo] bonds created in the first half of 2007 ... were downgraded ... Ratings on 156 classes were put under review. ... Ninety percent of the securities put under review are AAA rated ...

Late payments of at least 90 days and defaults among prime-jumbo loans underlying bonds issued last year rose to 1.16 percent as of April bond reports, up 180 percent since December, S&P said.

National House Price Indices: OFHEO vs. Case-Shiller Graphs

by Calculated Risk on 5/22/2008 01:23:00 PM

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the OFHEO Purchase Only Index (through Q1 2008) vs. the Case-Shiller National Index (through Q4 2007). (Q1 2000 = 100 for both indices).

Note that the Case-Shiller National Index showed a larger price increase during the boom, and is now showing a faster price decline. The second graph shows the year-over-year change in the price indices. The Case-Shiller index showed larger annual percentage increases than OFHEO during the boom, and is now showing larger annual percentage declines.

The second graph shows the year-over-year change in the price indices. The Case-Shiller index showed larger annual percentage increases than OFHEO during the boom, and is now showing larger annual percentage declines.

The Case-Shiller index for Q1 2008 will be released next Tuesday at 9 AM ET, and the index will probably be at about the same level as the OFHEO index on the first graph, and will probably show a year-over-year price decline close to 15%.

S&P: Subprime and Alt-A Delinquencies Rising

by Calculated Risk on 5/22/2008 11:50:00 AM

From Reuters: Subprime, Alt-A mortgage delinquencies rising: S&P

Delinquencies for Alt-A mortgages rated between 2005 and 2007 are climbing, with total delinquencies rising as high as 17 percent in some cases, more than 6 percentage points higher than previous estimates, the ratings agency said in a report.Yesterday, the Fed released the commercial bank delinquency report and it appears that prime delinquencies are rising rapidly too.

Lower-quality subprime mortgage delinquencies soared as high as 37 percent for mortgages originated in 2006, 4 percentage points higher than previous estimates, S&P said.

Subprime mortgages originated in 2007 saw delinquencies climb to almost 26 percent, 6 percentage points higher.

OFHEO: Decline in House Prices Accelerates

by Calculated Risk on 5/22/2008 10:34:00 AM

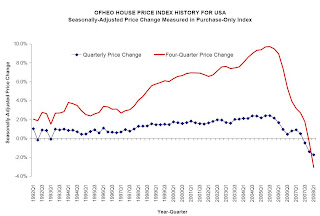

From OFHEO: Decline in House Prices Accelerates in First Quarter

U.S. home prices fell in the first quarter of 2008 according to OFHEO’s seasonally-adjusted purchase-only house price index. The index, which is based on data from home sales, was 1.7 percent lower on a seasonally-adjusted basis in the first quarter than in the fourth quarter of 2007. This decline exceeded the 1.4 percent price decline between the third and fourth quarters of 2007 and is the largest quarterly price decline on record. Over the past year, prices fell 3.1 percent between the first quarter of 2007 and the first quarter of 2008. This is the largest decline in the purchase only index’s 17-year history.

Click on graph for larger image.

Click on graph for larger image.This graph, from OFHEO, shows the four quarter and quarterly price changes for the Purchase Only Index.

There are significant differences between the OFHEO index and the Case-Shiller index (see House Prices: Comparing OFHEO vs. Case-Shiller), but it's important to note that the Fed uses the OFHEO index to calculate changes in household assets - and this means the Flow of Funds report in Q1 will show a significant decline in the value of household real estate (no surprise, but the number will be large).