by Calculated Risk on 3/20/2008 09:24:00 PM

Thursday, March 20, 2008

Delinquencies Rise for Small Home Builders

Michael Corkery at the WSJ writes: Mortgage Mess Hits Home For Nation's Small Builders

This article discusses how small builders all across the country are falling behind on their Construction and Development loans (C&D) and some are filing bankruptcy. This is impacting local small banks too:

Builders' problems are now threatening losses for small and medium-size regional banks. Muscled out of the mortgage business by large national lenders, many of these banks flocked to construction lending as the housing market boomed ... they are the front-line casualties when builders and developers can't make their payments.

Click on image for WSJ graphic.

This graphic (at the WSJ) shows the stunning increase in 30 day past due rates on C&D loans between Q1 2007 and Q4 2007.

Also check out the graphic (see WSJ article) of the overall C&D 30 day past due rates over time. In mid-2006, only 1% of C&D loans were 30 days past due. In Q4, 2007, it was close to 8% (and rising rapidly).

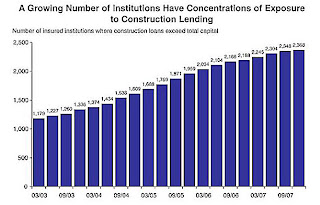

Many small and mid-size institutions have a high concentration of C&D loans. The following graph is from the FDIC's quarterly banking profile released in February:

"A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"

"A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"This graph shows the number of institutions, by quarter, where the construction loans exceed total capital.

These are the higher risk institutions. There are 2,368 institutions that met this criteria in Q4 2007, out of 8500 insured institutions.

And there is also the problem with Commercial Real Estate (CRE) loan concentrations ...

Mortgage Rates and the Ten Year Treasury

by Calculated Risk on 3/20/2008 04:44:00 PM

Thirty year mortgage rates fell sharply in the last week. Housing Wire reports the Bankrate.com numbers: Mortgage Rates Swoon Amid Market Uncertainty

Fixed mortgage rates fell sharply in the past week, with the average conforming 30-year fixed mortgage rate now 5.98 percent — a 41 basis-point drop from last week. According to Bankrate.com’s weekly national survey of large lenders, the average 30-year fixed mortgage has an average of 0.38 discount and origination points.And from Freddie Mac: Long-term mortgage rates plummet

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.87 percent with an average 0.5 point for the week ending March 20, 2008, down from last week when it averaged 6.13 percent.Freddie Mac reported mortgage rates were this low in the middle of February (about one month ago).

The following graph compares the weekly 30 year mortgage rate (as reported by Freddie Mac) with the weekly ten year treasury yield. The black line is the spread between the two rates.

Click on graph for larger image.

Click on graph for larger image.The spread between the ten year treasury and the 30 year mortgage tends to rise when the ten year yield is falling sharply. This is probably because investors believe homeowners will hold their mortgages longer. This can be seen in 2002 and again last year.

However the recent increase in the spread is probably due more to liquidity issues, as opposed to an increase in holding period. Last week 30 year mortgage rates declined both because the ten year yield declined, and because the spread declined somewhat. Still, the spread of 2.5% for GSE loans above the ten year yield, is still 0.5% or more above the normal spread. The spread will probably decline further if the liquidity crisis eases.

Dow Jones Reports Home Builder Cancellation Rate Now 43%

by Calculated Risk on 3/20/2008 02:33:00 PM

Dow Jones reported today that the average home builder cancellation rate is currently 43%.

From Dow Jones: For Home Builders, Cancellations Create Expensive Problem (no link yet)

Many contracted buyers, spooked by falling home prices or suddenly unsure of their financial state, are fleeing before closing. The average cancellation rate now tops 43% - leaving builders saddled with even more unplanned, unsold and unwanted homes.Unfortunately the article doesn't provide the cancellation rate for previous periods, other than to state "the average cancellation rate dipped slightly in the fourth quarter".

The data I compile (probably a subset of the Dow Jones data) shows the cancellation rate dipped slightly to just below 40% in Q4, from a peak of 42.5% in Q3 2007.

Cancellations rates are important when following the reported new home sales and inventory from the Census Bureau. The Census Bureau doesn't include cancellations in their report.

The actual sales could be calculated as total houses sold minus cancellations in the month. The total houses sold would include new sales, plus sales of houses cancelled in previous periods.

We could write this as:

Total Sales = Sales(new) + Sales(Previous cancellations) - Cancellations

But the Census Bureau reports sales as Sales(new) only, and they ignore both factors of cancellations (if a house was sold previously, then cancelled, then resold, it isn't included in the sales numbers). This works fine as long as cancellation rates are fairly steady.

However, with rising cancellation rates, the Census Bureau overstates sales, and understates the increase in inventory (or overstates a decrease in inventory). For cancellation adjusted inventory, see my post: Housing Starts, New Home Sales and Cancellations

The opposite is also true: during periods of declining cancellations, the Census Bureau under reports sales, and overstates inventory. This will be very important in the coming year, since cancellation rates will likely decline as builders require larger deposits and take other steps to avoid cancellations.

ECRI: U.S. "unambiguously" in a recession

by Calculated Risk on 3/20/2008 12:43:00 PM

ECRI has finally called the recession.

From Reuters: Leading index shows US economy in recession, ECRI says

The United States is "unambiguously" in a recession ... citing a nine-month decline in its weekly measure of the economy.ECRI may have called the 2001 recession, but they are late to the party on this one.

The Economic Cycle Research Institute, which correctly predicted the 2001 recession at a time when many on Wall Street still maintained a rosy outlook, said their numbers indicate the economic contraction is already under way.

Extending its weakening trend, the firm's Weekly Leading Index fell to 130.8 in the week of March 14 from 132.1 in the prior week, revised down from 132.2.

"It is exhibiting a pronounced, pervasive and persistent decline that is unambiguously recessionary," said Lakshman Achuthan, managing director at ECRI.

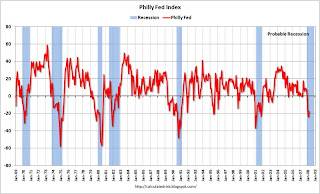

Philly Fed Index

by Calculated Risk on 3/20/2008 10:02:00 AM

My apology, I Initially used data for the wrong month.

The Philadelphia Fed Index was released today: Business Outlook Survey.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Philly index vs. recessions for the last 40 years. There are a number of times the index was below zero without a recession - so the reading today doesn't mean the economy is in recession. However it is very likely that the economy is already in recession.

From the release, weaker conditions and higher prices:

Indexes Suggest Continued Weakness

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, improved from -24.0 in February to -17.4 in March (see Chart). The index has remained negative for four consecutive months.

...

Firms Report Higher Prices

A notable share of the firms reported higher prices for inputs this month. Sixty-one percent of the manufacturers surveyed reported higher input prices. The prices paid index jumped from 46.6 in February to 54.4 and has increased 18 points since December.

...

Six-Month Outlook Improves But Remains Cautious

The future general activity index rebounded from a reading of -16.9 in February (its lowest since 1990) to -0.5 this month (see Chart). The percentage of firms expecting growth in activity over the next six months (28 percent) was offset by the percentage expecting decreases (29 percent).

NYT: Journalistic Malpractice, Again

by Anonymous on 3/20/2008 09:07:00 AM

I suspect this thing in the NYT is going to get a lot of discussion.

They took out adjustable-rate mortgages at the peak of the housing bubble to buy homes they would otherwise not be able to afford. Or they refinanced existing mortgages to take cash out. And now, two or three years later, the day of reckoning is here.It gets worse from there. A lot worse.

These are not lower- and middle-income borrowers, but more affluent consumers with annual incomes of $100,000 or more who are increasingly being ensnared in the home mortgage crisis.

The first step for distressed homeowners, said Rhonda Porter, a certified mortgage planning specialist and broker in Seattle, is to pull out their loan documents and see what they say.First of all, I really want to know what a "certified mortgage planning specialist" is. As a certified mortgage nonsense detector, I call BS. Second, that's the entire paragraph. Besides not noticing the rather savage irony of all these rich folks who are only now getting around to seeing what the loan documents say--so it's not just those dumb poor folk who do that?--there's no indication of what is supposed to happen next. Is it just me, or is there a hint here that the first thing people should do is check to see if there's some way to sue? At the end of the article is a little story that's likely to piss off plenty of readers:

Mr. Geller said he had heard of just one loan balance reduction won by a borrower.A "real estate consultant." (Isn't anyone just a broker anymore?) But what "understanding" of what "state law" did this dude use to get this deal done? Why is the dude "afraid of angering his lender"? He already got his deal . . . ?

That borrower, a real estate consultant in California who did not want to be identified because he feared angering his lender, said he used his understanding of state law to negotiate the refinancing. He bought a condominium two years ago for $450,000 and invested another $50,000 for improvements. His ARM had a 5.5 percent initial rate that was soon resetting to 7.25 percent. But his condo is now worth only about $350,000.

His lender agreed to give him a 6 percent fixed-rate mortgage and, he said, to knock $135,000 off the principal.

The agreement came only after he stopped paying his mortgage for two months. “I am very happy and grateful to the lender because what I owe on my condo now is in line with its worth,” he said. “I’m ecstatic.”

Then there is this:

Borrowers should determine if they live in a state with nonrecourse laws. In general, lenders in those states cannot pursue borrowers for money owed. But these laws are complex and change often, so consulting with a lawyer may be necessary, Mr. Geller said. He has compiled a list of nonrecourse states at www.mortgagerelief formula.com/recourse.I'll go for state foreclosure laws being complex, but changing often? Really? Like, how often? My impression has been that some of our recent troubles stem from the fact that foreclosure laws haven't changed in a lot of places since the Depression. Anyway, I was interested in that list because I have been asked for one several times. The link in the NYT piece is not formatted properly; try this. What you will get is simply a list of states with non-judicial foreclosure processes. Labelled "non-recourse mortgage walkaway states." Is this Geller simply incompetent, not understanding the difference between non-judicial foreclosure and antideficiency statutes? Or is he just trying to jump on the same bandwagon of youwalkaway.com? And how did he get to be a source for an article in the NYT, giving him "credibility" and free publicity?

I suggest spending a few minutes with Mr. Geller's website:

If you can get the lender to approve your short sale, you can walk away pretty much unscathed. You can have good credit. You can even fix any negative reports they may have made about you, reports that say you were late. And you won't face any more of those huge loan payments. You'll be free and clear, baby!Of course you don't get the "details" of how this works unless you "download the report," and I am not sure my PC is well-enough protected to do that. But after the short sale, we get to Mr. Geller's advice for what to do now that you no longer own a home:

But first you gotta get there. The way to make sure that the lender says yes is to give the lender *exactly* what they need to see . . .

The way to sell your house quickly is to follow the formula I call the Sell Your House in Nine Days system. It is also called the round robin. . . .

The key here is convincing them [the lender] that the short sale price is right. They rely a lot on a broker's price opinion, or BPO. And there is a whole system of ethically and honestly convincing the broker that the selling price is a fair one. If the broker reports that your short sale price is fair, the lender will probably say "yes."

The shocking secret of how to buy without qualifying and without getting on the hook for a loan . . .Yes, this is the bucket of scum that the reporter has given credibility to on the pages of the Grey Lady. Is there left an editor who, to paraphrase Jackson Browne, still knows how to cry?

Here's the deal you are looking for. If you are in an area with $150,000 houses, find a house where the motivated seller has a $150,000 mortgage. And then buy the property "subject to" the existing mortgage.

It really is that simple. The seller moves out. You settle at the lawyer's office. Nobody tells the lender anything. You start making the payments.

The loan is still in Mr. Seller's name. Is that a problem? No. You are the owner. You have a grant deed on file at the county courthouse in your name. No problem at all.

Anyone can sell their house to someone else as long as they are still the owner, and title will transfer. Even if there are loans still on the house. Doesn't matter.

So in this situation, Mr. Seller signed a deed over to you. You checked the loan balance (punching in Mr. Sellers' loan number into the mortgage company's automated robot phone system) and now you have the keys and you have every right and privilege as the owner that Mr. Seller did.

But look what you did. You have the mortgage interest deduction which lowers your taxes. You own the house, lock stock and barrel. But you never had to get your own loan.

Many sellers will want you to pay off the loan. Of course they will. But they are motivated, remember? So you tell them that you aren't going to do that just yet. When will you? Maybe in a year or three. Maybe in five years. A motivated seller can be convinced to sell to you because they are relieved that someone else is stepping into their shoes. It's human nature to breathe a sigh of relief and let someone else (you) deal with the mortgage.

And it's as simple as that. There are wrinkles to this and things you should know, but it really isn't that hard.

Please do go back and take note that the anecdote of the borrower who scored the $135,000 principal reduction turns out to be a story "Mr. Geller heard of."

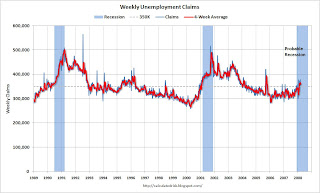

Weekly Unemployment Claims

by Calculated Risk on 3/20/2008 08:49:00 AM

The 4-week moving average of weekly unemployment insurance claims reached 365,250 this week.

From the Department of Labor:

In the week ending March 15, the advance figure for seasonally adjusted initial claims was 378,000, an increase of 22,000 from the previous week's revised figure of 356,000. The 4-week moving average was 365,250, an increase of 6,000 from the previous week's revised average of 359,250.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy might be in recession. Notice that following the previous two recessions, weekly unemployment claims stayed high for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable).

Note: There is nothing magical about the 350K level. We don't need to adjust for population growth because this indicator is just suggestive and not precise.

FedEX Warns

by Calculated Risk on 3/20/2008 08:28:00 AM

From the WSJ: FedEx Sees 'Limited' Growth Ahead

[T]the shipper projected fourth-quarter earnings below analysts' estimates, sees "limited earnings growth" in the upcoming fiscal year and will cut planned capital spending in the current year by another $100 million.UPS warned last week. UPS and FedEx are usually pretty decent coincident indicators of economic activity, and these warnings indicate the economy is probably in recession.

"Our fourth-quarter earnings outlook has been impacted by higher-than-anticipated fuel prices and a weak U.S. economy," said Chief Financial Officer Alan B. Graf Jr. "Looking ahead to our fiscal 2009, we are expecting a continuation of fourth-quarter trends, which would result in limited earnings growth next year. We are scrutinizing all expenses and investments to realign them with the current environment."

Also important is the planned cuts in capital spending. A number of companies have now announced less business investment in 2008, also impacting the economy.

Credit Suisse Warns

by Calculated Risk on 3/20/2008 08:22:00 AM

From the WSJ: Credit Suisse Expects Quarterly Loss; Revises Down Fourth-Quarter Profit

Credit Suisse Group Thursday poured cold water on hopes that the banking industry was on the mend as it warned that difficult market conditions in March will lead to a first-quarter net loss, erasing gains made in the first two months of the year.The credit crisis continues.