by Calculated Risk on 3/20/2008 09:24:00 PM

Thursday, March 20, 2008

Delinquencies Rise for Small Home Builders

Michael Corkery at the WSJ writes: Mortgage Mess Hits Home For Nation's Small Builders

This article discusses how small builders all across the country are falling behind on their Construction and Development loans (C&D) and some are filing bankruptcy. This is impacting local small banks too:

Builders' problems are now threatening losses for small and medium-size regional banks. Muscled out of the mortgage business by large national lenders, many of these banks flocked to construction lending as the housing market boomed ... they are the front-line casualties when builders and developers can't make their payments.

Click on image for WSJ graphic.

This graphic (at the WSJ) shows the stunning increase in 30 day past due rates on C&D loans between Q1 2007 and Q4 2007.

Also check out the graphic (see WSJ article) of the overall C&D 30 day past due rates over time. In mid-2006, only 1% of C&D loans were 30 days past due. In Q4, 2007, it was close to 8% (and rising rapidly).

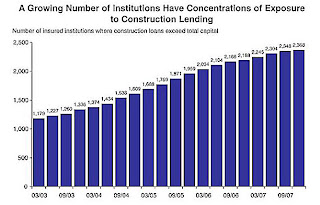

Many small and mid-size institutions have a high concentration of C&D loans. The following graph is from the FDIC's quarterly banking profile released in February:

"A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"

"A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"This graph shows the number of institutions, by quarter, where the construction loans exceed total capital.

These are the higher risk institutions. There are 2,368 institutions that met this criteria in Q4 2007, out of 8500 insured institutions.

And there is also the problem with Commercial Real Estate (CRE) loan concentrations ...