by Calculated Risk on 3/20/2008 10:02:00 AM

Thursday, March 20, 2008

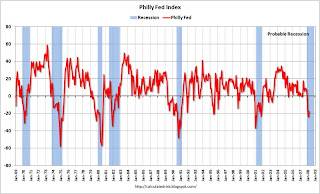

Philly Fed Index

My apology, I Initially used data for the wrong month.

The Philadelphia Fed Index was released today: Business Outlook Survey.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Philly index vs. recessions for the last 40 years. There are a number of times the index was below zero without a recession - so the reading today doesn't mean the economy is in recession. However it is very likely that the economy is already in recession.

From the release, weaker conditions and higher prices:

Indexes Suggest Continued Weakness

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, improved from -24.0 in February to -17.4 in March (see Chart). The index has remained negative for four consecutive months.

...

Firms Report Higher Prices

A notable share of the firms reported higher prices for inputs this month. Sixty-one percent of the manufacturers surveyed reported higher input prices. The prices paid index jumped from 46.6 in February to 54.4 and has increased 18 points since December.

...

Six-Month Outlook Improves But Remains Cautious

The future general activity index rebounded from a reading of -16.9 in February (its lowest since 1990) to -0.5 this month (see Chart). The percentage of firms expecting growth in activity over the next six months (28 percent) was offset by the percentage expecting decreases (29 percent).