by Calculated Risk on 3/15/2015 11:08:00 AM

Sunday, March 15, 2015

FOMC Preview: Remove "Patient"

The FOMC will meet on Tuesday and Wednesday. The FOMC statement will be released Wednesday at 2:00 PM ET. Fed Chair Janet Yellen will hold a press conference at 2:30 PM. Here is what I expect on Wednesday:

• The initial focus will be on the word "patient" in the FOMC statement. From the January statement:

"Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy."It seems very likely "patient" will be removed on Wednesday.

• How the FOMC discusses inflation will also be important since inflation has declined sharply and is well below the FOMC 2% target. My guess is these sentences will remain about the same, but the FOMC could express more concern about low inflation:

"Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation have declined substantially in recent months; survey-based measures of longer-term inflation expectations have remained stable.• The key focus will be on Fed Chair Janet Yellen's press conference and the FOMC projections.

...

Inflation is anticipated to decline further in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate. The Committee continues to monitor inflation developments closely."

• The following paragraph from Fed Chair Janet Yellen's testimony on February 24th seemed to suggest "patient" would be dropped from the FOMC statement at the meeting this week. Sentence by sentence from her testimony:

The FOMC's assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings.That just repeated the previous understanding. If the FOMC wants to have the option to raise rates in June, they would most likely drop "patient" from the statement in March (June is the second meeting after March).

If economic conditions continue to improve, as the Committee anticipates, the Committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis. Before then, the Committee will change its forward guidance.Yes, the FOMC needs to drop "patient" before they move to a meeting-by-meeting basis.

However, it is important to emphasize that a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings.This was an important clarification.

My guess is Yellen will reiterate that dropping "patient" does not mean a rate hike is guaranteed two meetings later - just that a hike may be considered based on incoming data (employment and inflation). She will also state that the first rate hike will be data dependent.

• It will also be interesting to see the changes to the FOMC projections. For review, here are the previous projections. GDP is looking weak in Q1, and it is possible GDP projections for 2015 will be decreased slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 2.6 to 3.0 | 2.5 to 3.0 | 2.3 to 2.5 | |

| Sept 2014 Meeting Projections | 2.6 to 3.0 | 2.6 to 2.9 | 2.3 to 2.5 | |

The unemployment rate was at 5.5% in February, so the unemployment rate projection for Q4 2015 might be lowered slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 5.2 to 5.3 | 5.0 to 5.2 | 4.9 to 5.3 | |

| Sept 2014 Meeting Projections | 5.4 to 5.6 | 5.1 to 5.4 | 4.9 to 5.3 | |

As of January, PCE inflation was up only 0.2% from January 2014, and core inflation was up 1.3%. PCE inflation will probably be revised down for 2014, and will be well below the FOMC's 2% target. A key will be projections for 2016 and 2017.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 1.0 to 1.6 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Sept 2014 Meeting Projections | 1.6 to 1.9 | 1.7 to 2.0 | 1.9 to 2.0 | |

PCE core inflation was up only 1.3% in January. A key will be if PCE core inflation is revised down for 2014 in the projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 1.5 to 1.8 | 1.7 to 2.0 | 1.8 to 2.0 | |

| Sept 2014 Meeting Projections | 1.6 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 | |

Saturday, March 14, 2015

Schedule for Week of March 15, 2015

by Calculated Risk on 3/14/2015 10:00:00 AM

The key economic report this week is February housing starts on Tuesday.

For manufacturing, the February Industrial Production and Capacity Utilization report, and the March NY Fed (Empire State), and Philly Fed surveys, will be released this week.

The FOMC meets on Tuesday and Wednesday.

8:30 AM: NY Fed Empire State Manufacturing Survey for March. The consensus is for a reading of 7.0, down from 7.8 last month (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.5%.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

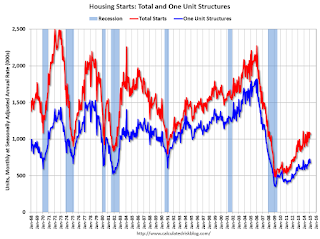

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. Total housing starts were at 1.065 million (SAAR) in January. Single family starts were at 678 thousand SAAR in January.

The consensus is for total housing starts to decrease to 1.040 million (SAAR) in February.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for January

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to make no change to policy, however the word "patient" will probably be removed from the statement opening the possibility of a rate hike as early as June.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 289 thousand.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 7.0, up from 5.2 last month (above zero indicates expansion).

No economic releases scheduled.

Friday, March 13, 2015

Year 4: It Never Rains in California

by Calculated Risk on 3/13/2015 07:51:00 PM

Another heat wave in California this weekend (the high was 90 where I live). This is the fourth year in a row with little rain or snow in the mountains (the statewide snowpack is about 17% of normal for this date). California is the largest agricultural state, and an ongoing drought could have an impact on food prices - and on the economy.

An Op-Ed in the LA Times: California has about one year of water left. Will you ration now?

January was the driest in California since record-keeping began in 1895. Groundwater and snowpack levels are at all-time lows. We're not just up a creek without a paddle in California, we're losing the creek too.Maybe it is time to revisit the Alaska-California Undersea Aqueduct proposal.

Data from NASA satellites show that the total amount of water stored in the Sacramento and San Joaquin river basins — that is, all of the snow, river and reservoir water, water in soils and groundwater combined — was 34 million acre-feet below normal in 2014. That loss is nearly 1.5 times the capacity of Lake Mead, America's largest reservoir.

Statewide, we've been dropping more than 12 million acre-feet of total water yearly since 2011. Roughly two-thirds of these losses are attributable to groundwater pumping for agricultural irrigation in the Central Valley. ... Wells are running dry. In some areas of the Central Valley, the land is sinking by one foot or more per year.

As difficult as it may be to face, the simple fact is that California is running out of water.

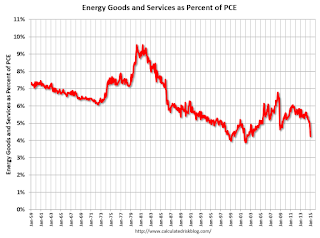

Energy expenditures as a percentage of consumer spending

by Calculated Risk on 3/13/2015 04:06:00 PM

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through January 2015.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

With some further declines - WTI oil futures fell 4% today to $45.09 per barrel - we might see energy expenditures as a percent of PCE at new lows and resume the long term down trend.

CoStar: Commercial Real Estate prices increased in January

by Calculated Risk on 3/13/2015 11:18:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: CRE Price Indices Start 2015 on a Strong Note with Solid Gains in January

COMPOSITE PRICE INDICES POST SOLID GAINS IN JANUARY 2015. Following a strong 2014, prices for commercial real estate (CRE) continued to climb in January 2015, supported by an expanding economy, strengthening market fundamentals and continued low interest rates. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—each increased by 1.2% in January 2015, contributing to annual gains of more than 12% in each index.

VALUE-WEIGHTED COMPOSITE INDEX REACHES NEW HIGH. Thanks to steady gains in recent months, the value-weighted U.S. Composite Index reached a record high in January 2015, and now stands 7.5% above its prerecession peak in 2007, reflecting strong competition among investors for large, high-quality commercial properties.

EQUAL-WEIGHTED COMPOSITE INDEX RISES TO WITHIN 13.4% OF PRERECESSION HIGH. After beginning its recovery later in the current cycle, the equal-weighted U.S. Composite Index has continued to grow steadily in the 12 months since January 2014, although it remains 13.4% below its 2007 prerecession peak. The increase in the equal-weighted U.S. Composite Index, which is influenced by smaller deals, reflects the general movement of capital into secondary markets and property types, as investors search for higher yields after property pricing has escalated in core U.S. coastal markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is at a record high, but the equal weighted is still 13.4% below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak, but still a little elevated.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

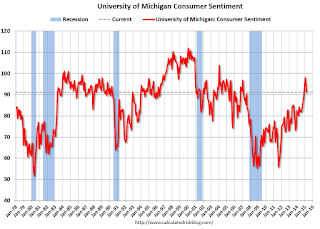

Preliminary March Consumer Sentiment decreases to 91.2

by Calculated Risk on 3/13/2015 10:02:00 AM

Thursday, March 12, 2015

Friday: PPI, Consumer Sentiment

by Calculated Risk on 3/12/2015 07:51:00 PM

On mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Steady Near March Lows

Mortgage rates were mixed today depending on the lender, but moved just slightly lower on average. This wasn't the case this morning as essentially all lenders came out with noticeably lower rates following the weaker-than-expected Retail Sales report. As the day progressed, early gains in bond markets faded, especially after the afternoon's 30yr Bond auction. While that refers to 30yr Treasuries, the goings-on in the Treasury market always have some effect on the mortgage-backed-securities that dictate mortgage rates. Today was no exception, and as prices fell into the afternoon, most lenders 'repriced' to higher rates. ...CR Note: The Ten Year yield decreased slightly to 2.10% today from 2.11% on Wednesday.

That puts us very close to the lowest levels in March, seen on the first two days of the month. Most lenders are quoting conventional 30yr fixed rates of 3.875% to top tier borrowers. A few of the stronger lenders are at 3.75% and fewer still remain at 4.0%.

Friday:

• 8:30 AM ET, the Producer Price Index for February from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (preliminary for March). The consensus is for a reading of 95.5, up from 95.4 in February.

Hotels: Solid Start for 2015

by Calculated Risk on 3/12/2015 04:35:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 7 March

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 1-7 March 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 0.5 percent to 64.5 percent. Average daily rate increased 2.0 percent to finish the week at US$116.74. Revenue per available room for the week was up 2.5 percent to finish at US$75.27.

emphasis added

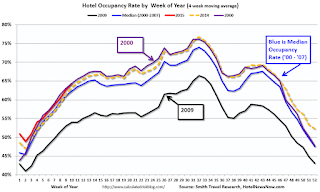

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the Spring travel period and business travel will increase over the next couple of months.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at about the same level as 2000 (best year for hotels) - and 2015 will probably be the best year ever for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed's Q4 Flow of Funds: Household Net Worth at Record High

by Calculated Risk on 3/12/2015 12:00:00 PM

The Federal Reserve released the Q4 2014 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3:

The net worth of households and nonprofits rose to $82.9 trillion during the fourth quarter of 2014. The value of directly and indirectly held corporate equities increased $742 billion and the value of real estate rose $356 billion.Prior to the recession, net worth peaked at $67.9 trillion in Q2 2007, and then net worth fell to $54.9 trillion in Q1 2009 (a loss of $13.0 trillion). Household net worth was at $82.9 trillion in Q4 2014 (up $28.0 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.6 trillion in Q4 2014. The value of household real estate is still $1.9 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is close to the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up but has moved sideways over the last year.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2014, household percent equity (of household real estate) was at 54.5% - up from Q3, and the highest since Q1 2007. This was because of an increase in house prices in Q4 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 54.5% equity - and millions still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $5 billion in Q4.

Mortgage debt has declined by $1.26 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up slightly in Q4, and somewhat above the average of the last 30 years (excluding bubble).

Weekly Initial Unemployment Claims decreased to 289,000

by Calculated Risk on 3/12/2015 09:25:00 AM

Catching up: The DOL reported:

In the week ending March 7, the advance figure for seasonally adjusted initial claims was 289,000, a decrease of 36,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 320,000 to 325,000. The 4-week moving average was 302,250, a decrease of 3,750 from the previous week's revised average. The previous week's average was revised up by 1,250 from 304,750 to 306,000.The previous week was revised up to 325,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 302,250.

This was below the consensus forecast of 300,000, and the low level of the 4-week average suggests few layoffs.