by Calculated Risk on 1/25/2010 05:38:00 PM

Monday, January 25, 2010

Fed MBS Purchase Program 92% Complete

From the Atlanta Fed weekly Financial Highlights:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

[T]the agency MBS purchase program nears its goal of $1.25 trillion.The Fed purchased an additional $12 billion net in MBS over the last week, bringing the total to over $1.15 trillion or just over 92% complete.The Fed purchased a net total of $14 billion of agency-backed MBS through the week of January 13. This brings its total purchases up to $1.14 trillion, and by the end of the first quarter 2010 the Fed will purchase $1.25 trillion (thus, it is 91% complete).

And on the concerns about the Fed ending the MBS purchase program from David Cho, Neil Irwin and Dina ElBoghdady at the WaPo: Stakes are high as government plans exit from mortgage markets

The wind-down of federal support for mortgage rates, set to end in two months, is a momentous test of whether the Obama administration and the Federal Reserve have succeeded in jump-starting the housing market and ensuring it can hold its own. ...The Fed has already slowed the MBS purchases, and 30 year mortgage rates are still hovering around 5%. I expect no change to the FOMC statement on Wednesday concerning the MBS purchase program.

Keeping the mortgage rates at historic lows ... was viewed within the administration as a central plank of the economic strategy last year, senior officials said. ... the policy ... helped revitalize home buying in some parts of the country and put money in the pockets of millions of homeowners who were able to refinance into lower monthly payments, the officials added.

"We did what we thought was necessary to stabilize the market, but we don't think the government should continue special efforts forever," said Michael S. Barr, an assistant secretary at the Treasury Department. "As you bring stability, private participants come back in. We do expect this now that the market has stabilized. I'm not going to say there will be no effect on rates, but we do think you are seeing market signs and market signals that there should be an orderly transition."

...

Administration and Fed officials expressed confidence that rates will rise only modestly -- perhaps a quarter of a percentage point. They attribute their optimism to the lengthy notice they have given the market.

Sunday, January 10, 2010

Fed's Rosengren Expects Mortgage Rates to Rise up to 75bps

by Calculated Risk on 1/10/2010 08:39:00 AM

From Kenneth Gosselin and Dan Harr at The Hartford Courant: Boston Fed Chief Expects Mortgage Rates To Rise This Spring (ht MrM)

Eric S. Rosengren, president and chief executive of the Boston Fed, said in an interview at The Courant that he expects [mortgage] rates to rise when the [Fed MBS purchase] program ends — or before, as the end approaches.So Rosengren is expecting a 50 to 75 bps increase when the Fed MBS purchase program ends. That is slightly higher than my forecast of 35 to 50 bps.

"Actually, I've been surprised that we haven't seen more of a backing up already," Rosengren said. "You maybe would have thought you would have seen rates move up more quickly than they have, but nonetheless that is a concern."

...

The mortgage rate increase of one-half to three-fourths of a percentage point from the end of the Fed program would happen regardless of any Fed action in interest rates, Rosengren said.

...

Rosengren said the Fed could choose to extend the mortgage buying program if the economy deteriorated dramatically.

"That's not in our forecast," Rosengren said. "That's not what we're expecting."

Wednesday, January 06, 2010

MBA: Mortgage Purchase Applications Lowest in 12 Years

by Calculated Risk on 1/06/2010 08:56:00 AM

The MBA reports: Mortgage Applications Drop the Week of Christmas and Remain Flat the Week After

The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the weeks ending December 25, 2009 and January 1, 2010. For the week ending December 25, 2009, the Market Composite Index, a measure of mortgage loan application volume, decreased 22.8 percent on a seasonally adjusted basis from the prior week. For the week ending January 1, 2010, this index increased 0.5 percent on a seasonally adjusted basis. ...

For the week ending December 25, 2009, the Refinance Index decreased 30.5 percent from the previous week and the seasonally adjusted Purchase Index decreased 4.0 percent from one week earlier. The following week, the Refinance Index decreased 1.6 percent and the seasonally adjusted Purchase Index increased 3.6 percent.

...

For the week ending January 1, 2010, the average contract interest rate for 30-year fixed-rate mortgages increased to 5.18 percent with points decreasing to 1.28.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Note: In the past the MBA index was somewhat predictive of future sales - and was a favorite indicator of Alan Greenspan, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining. Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase.

Despite the problems, it is hard to ignore the sharp decline in purchase applications since mid-October. The four week moving average is now at the lowest level since November 1997.

Tuesday, January 05, 2010

Pimco's Gross on Fed MBS Purchases

by Calculated Risk on 1/05/2010 06:49:00 PM

From an interview in Time: Pimco's Bill Gross Sees 2010 as Year of Reckoning. Excerpts on MBS:

Gross: I think the Fed's statements suggest that they really want to exit in some fashion from the buying program. The first step in that direction, logically, would be to stop buying and our sense is that they're at least going to try that. But based on our forecasts for the second half of the year they may have to re-initiate it, and that will be difficult to do once they stop because it then becomes a political hot potato.So Bill Gross is thinking we will see about a 50 bps increase in mortgage rates when the Fed stops buying MBS, but admits he really doesn't know. He also thinks the Fed will stop buying - probably on the current schedule - but he thinks they may want to re-initiate the program in the 2nd half of 2010.

All that said, I think they'll stop buying mortgage agency securities, and the trillion-and-a-half dollar check that's been written over the past 9 to 12 months basically disappears. ...

TIME: Because they might have to restart the buying program later?

Yes, I think the Fed wonders about this as well. ... They won't sell — it's a near impossibility to unload what they've purchased over past 12 months. But they'll at least stop buying.

TIME: Won't that put upward pressure on interest rates?

I think it will. I mean the mortgage market would be your first place to look in terms of something that's overvalued that would become normalized. Nobody knows what the Fed's buying is worth — we think about half a percentage point on rates, but we don't know.

But secondly, there's a ripple affect. ... They're buying a trillion dollars of them, or have over the past 9-12 months, and so we sold them a lot of ours. Now, what did we do with the money? We bought Treasuries, we bought corporate bonds, and so the bond markets in general have benefited, as have stocks because this available money effectively flows through the capital markets. ... How that affects the markets, I just don't know. I'm not eagerly anticipating the answer, but I think it holds some surprises in 2010, not just in mortgage securities but stocks as well. We could miss the money, put it that way.

emphasis added

Saturday, December 26, 2009

Freddie Mac economist: 6% Mortgage rates by end of 2010

by Calculated Risk on 12/26/2009 11:30:00 AM

From Dina ElBoghdady at the WaPo: Freddie sees mortgage rates hitting 6% in 2010

[T]he average rate on a 30-year, fixed-rate mortgage rose to 5.05 percent this week and could climb to 6 percent by the end of 2010, if not sooner, according to giant mortgage financier Freddie Mac.This is similar to the comments made by Mark Zandi of economy.com earlier in the week:

...

The key catalyst for interest rates going forward will be the end of a Federal Reserve program that buys a sizable chunk of mortgage-backed securities issued by firms such as Fannie Mae and Freddie Mac. ... the Fed has committed to winding down the program by March.

...

Amy Crews Cutts, deputy chief economist at Freddie Mac, said interest rates are bound to rise to 6 percent by the end of 2010 because private buyers will demand a higher rate of return on the securities than the Fed did.

"If you told me by the end of 2010 a 30-year rate was at 6 percent, that sounds about right," says Mark Zandi, chief economist at Moody's. "I don't think there's any question rates are headed up."Rates are definitely moving up, and they will move higher as the Fed winds down the MBS purchase program. Although 6% is possible, I'll take the under in 2010. The reason is I think the recovery will be sluggish and choppy - and that will keep rates down.

Note: Some people think 30 year mortgage rates will increase 100 bps or even 200 bps when the Fed stops buying MBS - so they expect 6% to 7% mortgage rates by April - but I think that estimate is too high.

Tuesday, December 22, 2009

Mortgage Rates Move Higher

by Calculated Risk on 12/22/2009 04:34:00 PM

From CNBC: After Record Lows, Mortgage Rates Headed Up in 2010

"If you told me by the end of 2010 a 30-year rate was at 6 percent, that sounds about right," says Mark Zandi, chief economist at Moody's. "I don't think there's any question rates are headed up."Rates are definitely headed up right now, and with the Fed MBS purchase program scheduled to end in about three months, mortgage rates will probably increase some more. But I think the following estimate is way too high:

"The ending of the Fed program will definitely effect rates," says Mark Goldman, professor of real estate at San Diego State University. "So far, the Fed has not expressed interest in keeping the program going. That could raise rates by some 150-200 basis points."As I've noted before, I think the increase in rates will be in the 35-50 bps range relative to the 10 year Treasury yield when the Fed MBS purchase program ends. But here is an estimate much higher than mine!

Zandi also suggests there might be some Fed tightening next year due to inflation concerns and that could push up mortgage rates (I think this is unlikely), and also that the bond vigilantes might return next year because of concerns about the U.S. fiscal deficit and push up long rates (also unlikely in my view). Although not impossible, I don't think mortgage rates will rise to 6% next year - mostly because I think the recovery will be sluggish and choppy in 2010, and inflation will be benign (too much slack).

But the fear of higher rates is probably another reason for the surge in existing home sales, although I think the primary driver was the expected expiration of the first time home buyer tax credit.

Saturday, December 19, 2009

Bernanke ARM OK, Head "Explodes"?

by Calculated Risk on 12/19/2009 12:49:00 PM

Bernanke misspoke in the recent TIME magazine interview:

TIME: Do you have a mortgage?Bernanke did have an adjustable rate mortgage, but it did not "explode".

Bernanke: Oh, yes, we refinanced.

TIME: Oh, perfect. When?

Bernanke: About 5%. A couple of months ago.

TIME: Good time.

Bernanke: Yes. We had to do it because we had an adjustable rate mortgage and it exploded, so we had to.

TIME: So, did you get a fixed rate at 5%? I think this might be the most valuable piece of information. (Laughter.)

Bernanke: Thirty years fixed rate at a little over 5%.

First, Dr. Bernanke is the Fed Chairman and "exploding" ARMs are a very important mortgage issue. So I think this topic is relevant and newsworthy (and Bernanke mentioned it).

Second, "explode" has a very clear meaning when discussing mortgages; it means that the borrower's mortgage payment has increased sharply. An ARM can "explode" for two reasons:

1) The interest rate can reset to a much higher level. This isn't much of a concern right now because the most common indexes like LIBOR are at very low levels and most loans are resetting lower.

2) The loan can recast. From Tanta on resets and recasts:

"Reset" refers to a rate change. "Recast" refers to a payment change. ... "Recast" is really just a shorter word for "reamortize": you take the new interest rate, the current balance, and the remaining term of the loan, and recalculate a new payment that will fully amortize the loan over the remaining term.Neither applied to Bernanke. From the WSJ: Looking a Little Deeper at Bernanke’s Floating Rate Mortgage

The Fed chairman was in an adjustable rate mortgage with a rate that started at 4.125% in 2004 and adjusted after five years to a rate that would be 2.25 percentage points above one-year Libor, which as of the first reset date in June was a little more than one and a half percent. That suggest his costs wouldn’t be exploding now, as the interview suggested. In fact, they’d be going down.So Bernanke refinanced into a loan with a higher interest rate and with a larger mortgage payment for the security of a fixed rate. This suggests he thinks fixed mortgage rates have bottomed (otherwise he could have paid less on his mortgage, at a 3.75% interest rate, and then refinanced next year). He did not "have to do it".

Monday, December 14, 2009

Refinance Activity and Interest Rates

by Calculated Risk on 12/14/2009 10:35:00 AM

The Mortgage Bankers Association's (MBA) current forecast for refinance activity in 2010 is $693 billion, and falling further in 2011 to $591 billion. The MBA is currently estimating 2009 refinance originations will be $1,246 billion - so they expect activity to fall almost in half.

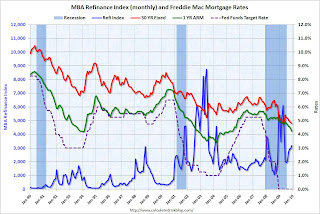

This gives me an excuse for a graph or two (as if I need one). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Refinance activity picks up when mortgage rates fall (for obvious reasons), and this graph shows the monthly refinance activity (MBA refinance index) and the Freddie Mac 30 year fixed mortgage rate and one year adjustable mortgage rate - and the Fed Funds target rate since Jan 1990.

Mortgage rates would have to fall further in 2010 to get another increase in refinance activity, and with the Fed MBS purchase program scheduled to end by the end of Q1, it seems unlike that rates will fall - unless the program is extended or the economy weakens significantly.

Notice that following the '90/'91 and '01 recessions, the Fed kept lowering the Fed Funds rate because of high unemployment rates. This spurred refinance activity. The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates. The same thing will happen in 2010 and 2011 - there will only be a surge in refinance activity if rates fall below the rates of 2009.

Wednesday, December 09, 2009

Expected Mortgage Rates

by Calculated Risk on 12/09/2009 03:02:00 PM

With the Ten Year Treasury yield at 3.42%, I was wondering what that would mean for mortgage rates. Click on graph for larger image.

Click on graph for larger image.

This graph is from Political Calculations: Predicting Mortgage Rates and Treasury Yields (based on one of my posts).

Using their calculator and a Ten Year Yield of 3.42%, we would expect the 30 year Freddie Mac fixed mortgage rate to be around 5.38%. Of course it is lower than expected - as it has been from most of the year - and some of the difference from the expected rate is probably due to the Fed's MBS purchases (also prepayment speed is a factor - and also just randomness).

The following table shows the difference between the expected and actual rate for the last 6 months. This suggests that mortgage rates will rise about 30 to 50 bps relative to the Ten Year Treasury yield when the Fed stops buying MBS.

| Ten Year Treasury Yield | Expected Mortgage Rate | Freddie Mac Mortgage Rate | Spread | |

|---|---|---|---|---|

| May | 3.28% | 5.28% | 4.86% | 0.42% |

| June | 3.71% | 5.59% | 5.42% | 0.17% |

| July | 3.54% | 5.46% | 5.22% | 0.24% |

| Aug | 3.58% | 5.49% | 5.19% | 0.30% |

| Sep | 3.39% | 5.36% | 5.06% | 0.30% |

| Oct | 3.37% | 5.34% | 4.95% | 0.39% |

| Nov | 3.40% | 5.36% | 4.88% | 0.48% |

| Average | 0.33% |

Saturday, November 21, 2009

The Fed and Mortgage Rates

by Calculated Risk on 11/21/2009 03:20:00 PM

Meredith Whitney expressed concern about what will happen when the Fed stops buying GSE MBS by the end of the first quarter 2010. From Bloomberg: Meredith Whitney Says Bank Stocks Are ‘Grossly’ Overvalued

The Federal Reserve has begun slowing purchases in the $5 trillion market for so-called agency mortgage-backed securities after announcing in September that it would extend the timeline for its $1.25 trillion program to March 31 from year-end. Whitney said that banks are only originating home loans that they can sell to Fannie Mae and Freddie Mac.This raises an interesting question: What is the impact from Fed MBS buying on mortgage rates? I looked at this a couple of months ago: The Impact on Mortgage Rates of the Fed buying MBS and here is an update:

“If Fannie and Freddie can’t sell to an end buyer, i.e. the U.S. government steps back, the mortgage market at minimum contracts, rates go higher, and banks are poised with more writedowns,” said Whitney, founder of Meredith Whitney Advisory Group. “This is probably the issue that scares me most across the board.”

Earlier this year, Political Calculations introduced a tool to estimate mortgage rates based on the Ten Year Treasury yield (based on an earlier post of mine): Predicting Mortgage Rates and Treasury Yields. Using their tool, with the Ten Year yield at 3.356%, this suggests a 30 year mortgage rates of 5.33% based on the historical relationship between the Ten Year yield and mortgage rates.

Freddie Mac released their weekly survey Thursday:

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.83 percent with an average 0.7 point for the week ending November 19, 2009, down from last week when it averaged 4.91 percent. Last year at this time, the 30-year FRM averaged 6.04 percent.This suggests morgage rates are about 50 bps below the expect level ...

Here is an update to the previous graph. Sure enough mortgage rates have been below expectations for about seven months (recent months in yellow with blue outline at lower left).

Here is an update to the previous graph. Sure enough mortgage rates have been below expectations for about seven months (recent months in yellow with blue outline at lower left).Although this is a limited amount of data - and the yellow triangles are within the normal spread - this suggests the Fed's buying of MBS is reducing mortgage rates by about 35 to 50 bps relative to the Ten Year treasury.

It isn't that Fannie and Freddie "can’t sell to an end buyer", it is that the GSEs will be selling for a lower price (higher yield) when the Fed completes the MBS purchase program. At that time mortgage rates will probably rise by about 35 bps to 50 bps (relative to the Ten Year) in order to attract other buyers. Alone that isn't all that "scary".

But combined with the growing problems at the FHA, the distortions in the housing market caused by the first-time home buyer tax credit, rising delinquencies, the uncertainty of the modification programs, and likely further house price declines in many bubble states - there are serious problems ahead for the housing market.

Wednesday, October 21, 2009

MBA: Mortgage Applications Decrease, Rates Rise

by Calculated Risk on 10/21/2009 08:56:00 AM

The MBA reports: Mortgage Applications Decrease

The Market Composite Index, a measure of mortgage loan application volume, decreased 13.7 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index, also adjusted for the holiday, decreased 16.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 7.6 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.07 percent from 5.02 percent, with points increasing to 1.13 from 1.11 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

The Purchase index declined to 268.8, and the 4-week moving average declined to 284.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Wednesday, September 30, 2009

MBA: 30 Year Mortgage Rate Falls to 4.94 Percent

by Calculated Risk on 9/30/2009 08:42:00 AM

The MBA reports: Mortgage Applications Decrease

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.8 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 0.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 6.2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.94 percent from 4.97 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

The Purchase index declined to 270.4, and the 4-week moving average declined to 283.9.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Thursday, September 17, 2009

The Impact on Mortgage Rates of the Fed buying MBS

by Calculated Risk on 9/17/2009 06:20:00 PM

The Federal Reserve released the Factors Affecting Reserve Balances today. Total assets were basically flat at $2.14 trillion. This graph from the Atlanta Fed shows the breakdown in the assets (from earlier this month): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This raises an interesting question: What is the impact from Fed MBS buying on mortgage rates?

Earlier this year, Political Calculations introduced a tool to estimate mortgage rates based on the Ten Year Treasury yield (based on an earlier post of mine): Predicting Mortgage Rates and Treasury Yields. Using their tool, with the Ten Year yield at 3.39%, this suggests a 30 year mortgage rates of 5.36% based on the historical relationship between the Ten Year yield and mortgage rates.

Freddie Mac released their weekly survey today:

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.04 percent with an average 0.7 point for the week ending September 17, 2009, down from last week when it averaged 5.07 percent.This made me wonder if mortgage rates have been running below projections while the Fed has buying MBS ...

So I updated the previous graph. Sure enough mortgage rates have been below expectations for a number of months (the last 5 months in blue triangles).

So I updated the previous graph. Sure enough mortgage rates have been below expectations for a number of months (the last 5 months in blue triangles).Although this is a limited amount of data - and the blue triangles are within the normal spread - this suggests the Fed's buying of MBS is reducing mortgage rates by about 35 bps.

Of course the Fed is also buying Treasuries - reducing the yield on the Ten Year Treasury - and that is another factor reducing mortgage rates (although Treasury buying is a much smaller amount and for different durations).

The third graph shows a breakdown of Fed Treasury purchases by maturity. From the Atlanta Fed:

The third graph shows a breakdown of Fed Treasury purchases by maturity. From the Atlanta Fed: Decomposing the Fed’s purchases of Treasury securities by maturity shows a heavy focus in the four-to-seven-year and seven-to-10-year sectors, together making up half of all purchases so far.I think the impact on mortgage rates from the Treasury purchases is minor. This suggests to me that mortgage rates will rise by about 35 bps, relative to the Ten Year yield, when the Fed stops buying MBS.

But the last four Treasury purchases have been focused elsewhere, with the biggest purchases in the shorter end of the yield curve.

Wednesday, June 24, 2009

MBA: Mortgage Rates Decrease Slightly

by Calculated Risk on 6/24/2009 08:25:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 548.2, an increase of 6.6 percent on a seasonally adjusted basis from 514.4 one week earlier.

...

The Refinance Index increased 5.9 percent to 2116.3 from 1998.1 the previous week and the seasonally adjusted Purchase Index increased 7.3 percent to 280.3 from 261.2 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.44 percent from 5.50 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index. Since the MBA surveyed mostly the major lenders, when lenders like New Century went under - this pushed more borrowers to lenders included in the survey. As smaller lenders went out of business, the remaining lenders saw more applications. Plus a number of borrowers started submitting multiple applications. Both factors distorted the index. That increase in 2007 fooled many people, like Alan Greenspan. See, from Bloomberg: Greenspan Says `Worst' May Be Past in U.S. Housing (Oct 6, 2006)

Although we can't compare directly to earlier periods because of the changes in the index, this shows no significant pick up in overall sales activity.

Wednesday, June 17, 2009

MBA: Mortgage Applications Decrease

by Calculated Risk on 6/17/2009 07:47:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 514.4, a decrease of 15.8 percent on a seasonally adjusted basis from 611.0 one week earlier.The Purchase Index is now at the level of the late '90s.

...

The Refinance Index decreased 23.3 percent to 1998.1 from 2605.7 the previous week and the seasonally adjusted Purchase Index decreased 3.5 percent to 261.2 from 270.7 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.50 percent from 5.57 percent ...

With the 10 year yield moving down (3.67% yesterday from 3.99% a week ago), 30-year fixed mortgage rates decreased slightly this week. But mortgage rates are still significantly higher than three weeks ago (4.81%), and that increase in mortgage rates has led to significantly fewer refinance applications.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Although we can't compare directly to earlier periods because of the changes in the index, this shows no pick up in overall sales activity.

Wednesday, June 10, 2009

Mortgage Rates and the Ten Year Yield

by Calculated Risk on 6/10/2009 01:08:00 PM

Here is a new tool from Political Calculations: Predicting Mortgage Rates and Treasury Yields

This is based off the chart I posted last Friday and is very timely with the Ten Year Yield pushing 4%.

Using their tool, with the Ten Year yield at 3.99%, this suggests that 30 year mortgage rates will rise to 5.8% based on the historical relationship between the Ten Year yield and mortgage rates.

According to the MBA the "average contract interest rate for 30-year fixed-rate mortgages increased to 5.57 percent" last week. So rates will probably be higher this week.

BTW, I first used the term "Bernanke's conundrum" in 2005 to describe what I thought would happen when the Fed rate was low following the housing bust - and the long rate started to rise.

MBA: Mortgage Rates Increase, Refinance Applications Decline

by Calculated Risk on 6/10/2009 08:37:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 611.0, a decrease of 7.2 percent on a seasonally adjusted basis from 658.7 one week earlier.The Purchase Index is now at the level of the late '90s.

...

The Refinance Index decreased 11.8 percent to 2605.7 from 2953.6 the previous week and the seasonally adjusted Purchase Index increased 1.1 percent to 270.7 from 267.7 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.57 percent from 5.25 percent ...

emphasis added

30-year fixed mortgage rates were at 4.81% two weeks ago, and are now at 5.57%. With the 10 year yielding 3.9%, mortgage rates will probably rise again this week.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Although we can't compare directly to earlier periods because of the changes in the index, this shows no pick up in overall sales activity.

Friday, June 05, 2009

Rising Rates: The Next Fed Meeting Will be Interesting

by Calculated Risk on 6/05/2009 12:04:00 PM

First from Reuters: Fed's Lockhart: Can't wait too long to tighten (ht Alan)

The Federal Reserve needs to be "anticipatory" and not wait too long to tighten monetary policy, Atlanta Fed President Dennis Lockhart said in an interview published on Friday. ... Lockhart is a voter on the Fed's policy-setting Federal Open Market Committee, which meets June 23-24.This is similar to the comments of Kansas Fed President Thomas Hoenig on Wednesday.

Yields are rising across the board, with the Ten Year yield at 3.84%.

This will push mortgage rates higher ... here is a scatter graph I posted last month showing the relationship between the Ten Year yield and 30 year mortgage rates.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the relationship between the Ten Year yield (x-axis) and the 30 year mortgage rate (y-axis, monthly from Freddie Mac) since 1971. The relationship isn't perfect, but the correlation is very high.

Based on this historical data, a Ten Year yield at 3.84% suggests a 30 year mortgage rate of around 5.75%.

Freddie Mac reported that 30 year mortgage rates were at 5.29% for the week ending June 4th, and the MBA reported rates at 5.25% for the week ending May 29th. These rates should jump again next week putting pressure on the Fed.

Wednesday, May 27, 2009

Mortgage Rates: Moving Higher

by Calculated Risk on 5/27/2009 02:30:00 PM

With the Ten Year Treasury yield hitting 3.7% today, mortgage rates will be increasing. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the relationship between the Ten Year yield (x-axis) and the 30 year mortgage rate (y-axis, monthly from Freddie Mac) since 1971. The relationship isn't perfect, but the correlation is very high.

Based on this historical data, a Ten Year yield at 3.7% suggests a 30 year mortgage rate of around 5.6%. The second graph compares the weekly 30 year fixed rate conforming rate from Freddie Mac, and the 10 year treasury yield. The black line is the spread between the two rates.

The second graph compares the weekly 30 year fixed rate conforming rate from Freddie Mac, and the 10 year treasury yield. The black line is the spread between the two rates.

As the Ten Year yield increased earlier this year, the spread decreased, and mortgage rates only moved up slightly.

However the spread has reached the lower end of the range, and the recent increase in the Ten Year yield will push up mortgage rates.

Thursday, May 07, 2009

Mortgage Rates and the Ten Year Treasury Yield

by Calculated Risk on 5/07/2009 09:29:00 PM

With the recent increase in treasury yields, reader shortcourage asked for a graph comparing the 30 year fixed mortgage rate and the ten year treasury yield. Sometimes we do requests ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the weekly 30 year fixed rate conforming rate from Freddie Mac, and the 10 year treasury yield. The black line is the spread between the two rates.

The spread is back down near the lower end of the range - and this suggests any further increase in the ten year yield will push up morgage rates.

Freddie Mac reported today:

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.84 percent with an average 0.7 point for the week ending May 7, 2009, up from last week when it averaged 4.78 percent. Last year at this time, the 30-year FRM averaged 6.05 percent.