by Calculated Risk on 3/22/2009 12:10:00 PM

Sunday, March 22, 2009

More Jumbo Financing Coming

From Kenneth Harney at the LA Times: New supply of 'jumbo' financing in pipeline

Bank of America, the country's largest mortgage lender, is rolling out a large program to finance loans between about $730,000 and $1.5 million, with fixed 30-year rates starting in the upper 5% range.The lenders are paying attention to the "Three C's": creditworthiness, capacity, and collateral, and requiring a serious downpayment that will keep the homeowners committed.

...

The minimum down payment for an ING Direct jumbo is 25%; Bank of America quotes a minimum of 20%.

...

Bank of America's new program requires hefty liquid resources -- six months of principal, interest, property tax and insurance payments in reserve -- plus fully documented income, solid credit scores and a full appraisal.

Currently jumbo rates are in the 6.5% range, and rates for these new programs are in the "upper 5% range" - still way above rates on conforming loans, but this will probably help in some markets. Here is an excerpt from DataQuick's report on the California Bay Area:

[U]se of so-called jumbo loans to finance high-end property remained at abnormally low levels. Before the credit crunch hit in August 2007, jumbo loans, then defined as over $417,000, represented 62 percent of Bay Area purchase loans, compared with just 17.5 percent last month.I'm not sure this will "open the spigot", but it will probably help a little.

The difficulties potential high-end buyers have had in obtaining jumbo loans helps explain why sales of existing single-family houses fell to record-low or near-record-low levels for a February in some higher-end communities. They included Orinda, Walnut Creek, San Rafael, San Francisco, Burlingame, San Mateo, Los Gatos, and Los Altos.

“A lot of Bay Area activity is basically on hold, waiting for the jumbo mortgage spigot to reopen.” said John Walsh, MDA DataQuick president.

Thursday, March 19, 2009

How far will mortgage rates fall?

by Calculated Risk on 3/19/2009 02:45:00 PM

With the Fed buying longer term Treasury securities, how far will 30 year mortgage rates fall?

On CNBC yesterday, PIMCO's Bill Gross suggested mortgage rates might fall to 4%. I think this is unlikely. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the relationship between the Ten Year yield (x-axis) and the 30 year mortgage rate (y-axis, monthly from Freddie Mac) since 1971. The relationship isn't perfect, but the correlation is very high.

Based on this historical data, the Fed would have to push the Ten Year yield down to around 2.3% for the 30 year conforming mortgage rate to fall to 4.5%.

Currently the Ten Year yield is 2.58% (typo corrected) suggesting a 30 year mortgage rate around 4.7%.

If the Fed buys Ten Year treasuries with the goal of 4.0% mortgage rates, they might have to push Ten Year yields down under 2.0%, maybe close to 1.5%.

Monday, February 09, 2009

30 Year Mortgage Rates vs. Ten Year Treasury Yield

by Calculated Risk on 2/09/2009 12:36:00 PM

On CNBC this morning, PIMCO's Bill Gross said:

"I think at some point we're going to see a 4.5 percent mortgage rate and the 10-year Treasury rate capped at some level."How far would the Ten Year yield have to fall for mortgage rates to decline to 4.5%? The ten year yield is currently at 3.045%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the relationship between the Ten Year yield (x-axis) and the 30 year mortgage rate (y-axis, monthly from Freddie Mac) since 1971. The relationship isn't perfect, but the correlation is very high.

Based on this historical data, the Fed would have to push the Ten Year yield down to around 2.3% for the 30 year conforming mortgage rate to fall to 4.5%.

The Fed could also buy more agency MBS to push down mortgage rates, but if they buy Ten Year treasuries with the goal of 4.5% mortgage rates, they might have to push Ten Year yields down significantly.

Bill Gross: Fed to Cap Ten Year Yield

by Calculated Risk on 2/09/2009 11:20:00 AM

From CNBC: Mortgage Rates Likely Headed to 4.5%: Pimco's Gross

"I think at some point we're going to see a 4.5 percent mortgage rate and the 10-year Treasury rate capped at some level," he said. "When the Fed comes in to buy Treasurys that will be a big day."CNBC has a video of the interview with Gross.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The 10-year yield is at 3.04% today, well above the record low of 2.07% set on Dec 18th.

This graph shows the 10 year yield since 1962. The smaller graph shows the ten year yield since the start of 2008. In the bigger scheme, this has been a fairly small rebound in yield.

To move the 30 year mortgage rate to 4.5%, the Fed would probably have to cap the Ten Year yield near 3.0%.

Tuesday, January 06, 2009

Obama Stimulus Plan to Increase Conforming Jumbo Limit?

by Calculated Risk on 1/06/2009 12:37:00 PM

From the Boston Globe: Jumbo mortgage loan rates put damper on refinancing (hat tip Soylent Green Is People). The article notes the difference between conforming loans (below $417K), "conforming jumbo loans" (by MSA), and jumbo loans:

Last year, Congress raised jumbo limits when it allowed Fannie Mae and Freddie Mac to buy or guarantee higher-balance loans. In Massachusetts, the limit increased to $523,750, from $417,000, with jumbo loans being above the higher amount, and conforming jumbos between the two figures.Apparently Barney Frank wants to increase the conforming jumbo limit:

The Federal Housing Finance Agency recently recalculated the loan limits for 2009, as required by law, based on recent home sales.

That resulted in the jumbo limit for the Boston area being lowered to $465,750, meaning some borrowers who would have qualified for lower rates in December are now back in the jumbo category.

...

On Friday ... one lender was offering a 5.25 interest rate for conventional loans, 5.75 percent for conforming jumbos, and 8 percent for jumbos.

US Representative Barney Frank, Democrat of Massachusetts, said Friday that he wants jumbo limits to be raised again - to the previous level, if not higher.

Frank, chairman of the House Committee on Financial Services, pledged to include a provision for this in the economic stimulus bill Congress is expected to take up with President-elect Barack Obama. He also wants to change the way the loan limits are calculated to reflect real market conditions.

"Even if you accept the principal we shouldn't be financing luxury housing; what's a luxury house in Nebraska is an average house in Quincy," Frank said. "I'm lobbying hard to get at least last year's level to be put back where it was."

emphasis added

Friday, December 26, 2008

Low Mortgage Rates, Few Qualify

by Calculated Risk on 12/26/2008 11:33:00 AM

From the Miami Herald: Refinance rates low; few qualify

Recent drops in interest rates have homeowners rushing to call local banks and mortgage lenders about refinancing. Loan applications are pouring in.This is a key point - these lower rates don't help underwater homeowners. Also, I think the 45% debt-to-gross income ratio is a little higher than most lenders will allow now.

Yet, South Florida homeowners are mostly getting a big fat ''No!'' from the bank when they ask to refinance. The chief reason: Falling home values mean they owe more than their homes are worth.

...

In South Florida, four in 10 homeowners who bought or refinanced over the past five years owe more on their home than it is worth, according to sales and mortgage data analyzed by Zillow.com ... Many of them chose adjustable-rate loans and other expensive mortgages because that was the only way they could afford the payments.

...

''This is only putting people who are in a good position in a better position,'' [Justin Miller, a broker with Resource Mortgage Group in Plantation] said.

...

Before LaPenta begins processing an application, he said he makes sure customers are aware of the essential criteria needed to refinance: 20 percent equity in the property, a homestead exemption, a credit score of 700 or higher, a mortgage debt-to-income ratio of no more than 45 percent and the ability to fully document income and assets.

Wednesday, December 24, 2008

Conforming Mortgage Rates Fall, Jumbo Spread at Record

by Calculated Risk on 12/24/2008 01:01:00 PM

Freddie Mac reported Long-Term Rates Fall for Eight Consecutive Week Setting Another New Low

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.14 percent with an average 0.8 point for the week ending December 24, 2008, down from last week when it averaged 5.19 percent. Last year at this time, the 30-year FRM averaged 6.17 percent. The 30-year FRM has not been lower since Freddie Mac started the Primary Mortgage Market Survey in 1971.The MBA reported: Near Record Low Mortgage Rates Boost Mortgage Applications in Latest MBA Weekly Survey

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.04 percent from 5.18 percent, with points increasing to 1.17 from 1.13 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The contract rate for 30-year fixed-rate mortgages is the lowest recorded in the survey since the record low of 4.99 percent for the week ending June 13, 2003.Note the surge in refinance applications too!

However, Bloomberg reports: Jumbo Mortgage Shoppers Get Little Relief From Rates

Jumbo mortgage shoppers in the most expensive U.S. housing markets such as New York and San Francisco aren’t getting much relief from lower borrowing costs.It's jumbos rates that matter for most of California and other higher priced markets.

The average 30-year fixed rate for home loans of more than $729,750 remains almost 2 percentage points above conforming rates and the spread between them may set a record this month, according to financial data firm BanxQuote.

...

The difference between the two averaged 2.13 percentage points in December, 10 times the spread from 2000 to 2006 and above last month’s 1.95 percentage points that was the highest on record.

Thursday, December 18, 2008

Freddie Mac: 30 Year Mortgage Rates Lowest Since Survey Started

by Calculated Risk on 12/18/2008 11:47:00 AM

From MarketWatch: 30-year fixed-rate mortgage at 37-year low

The benchmark 30-year fixed-rate mortgage tumbled to a national average 5.17% this week, the lowest level since Freddie Mac began its weekly rate survey in 1971.Yeah, but what about jumbo rates?

...

"Interest rates for 30-year fixed-rate mortgage rates fell for the seventh consecutive week, moving these rates to the lowest since the survey began in April 1971," said Frank Nothaft, Freddie Mac chief economist. "The decline was supported by the Federal Reserve announcement on Dec. 16, when it cut the federal funds target to a record low and stated it stood ready to expand its purchases of mortgage-related assets as conditions warrant."

As an example Wells Fargo is offering a 30 year fixed at 4.75% (up to $417K), but their rates are 7.375% for loans above that limit.

Thursday, December 11, 2008

30 Year Mortgage Rate Lowest Since 2004

by Calculated Risk on 12/11/2008 10:28:00 AM

From MarketWatch: Freddie Mac: 30-year mortgage average at 4-1/2 year low

The 30-year fixed-rate average was 5.47% with an average 0.7 point for the week ending Dec. 11, down from 5.53% a week ago. Last year the average was 6.11%. The 30-year average has not been lower since March 25, 2004, when it averaged 5.4%, Freddie Mac said.Wells Fargo is offering a 5.125% 30 year fixed rate mortgage (conforming limit) with 1 point. I'm sure others are offering similar rates.

Wednesday, December 03, 2008

House Prices and Interest Rates

by Calculated Risk on 12/03/2008 09:18:00 PM

There were two stories published today concerning house prices and interest rates.

The first story came out this morning, and quoted a report from Global Insight suggesting "the housing market is now slightly undervalued". Please stop laughing ...

And later today, the WSJ reported that the Treasury would "purchase securities underpinning [GSE mortgage] loans at a price equivalent to the 4.5% rate". The purpose, according to the WSJ:

Treasury views this plan as potentially halting the slide in home prices by enabling borrowers to afford bigger mortgages, thus increasing demand for homes and pushing up home values.The Treasury plan is only for purchase loans, not refis.

If we look at the Global Insight methodology for evaluating home prices, we see:

For example, a conventional 30-year mortgage of $200,000 carries a monthly cost of $1,468 with mortgage interest rates of 8 percent. At 6 percent, however, a homebuyer could service a far higher $245,000 mortgage with the same monthly expense.Clearly both stories draw a strong connection between house prices and interest rates. But what is the relationship?

It is true that the rent vs. buy decision moves in the "buy" direction with lower interest rates.

Say someone is paying $1000 per month in rent, and they are interested in buying a $240,000 house with $24,000 down (10%). With a 6% mortgage rate the principle & interest (P&I) payment alone would be $1295 per month. Add in insurance, maintenance, mortgage insurance, property taxes and other costs and fees (like HOA) and subtract the income tax break, and it probably doesn't work.

We need a spreadsheet and more details to work it out exactly.

But at a lower mortgage rate - say 4.5% - the P&I would be $1,095 and depending on the other costs, and with all else being equal, buying might make sense.

But why would this push up prices as suggested by the Global Insight analysis? Prices would increase because of higher demand - not directly because of lower interest rates. A rational buyer wouldn't pay more just because the interest rate is lower - although they might have to pay more because the demand is greater. But the current buyer wouldn't pay much more, because the rational buyer would realize interest rates will probably not be artificially low when they try to sell, and their future buyer would have a higher interest rate and a lower price.

This suggests the Global Insight analysis is flawed, as is the "affordability index" from the NAR, or any other measure of house prices based on interest rates. In fact house prices are still too high as suggested by the price-to-income ratio and real prices.

The WSJ article correctly noted that lower interest rates "increas[e] demand for homes", but do they push up home values? The answer in the current environment is probably no.

This may be a little surprising since lower interest rates will likely increase demand.

In a perfect market, an increase in demand would push up prices. And an increase in supply with steady demand would lower the price enough to clear the market.

However, housing is an imperfect market - house prices are sticky downwards and typically take several years to adjust (what we are seeing!) - so even though there is currently far too much supply, prices still have not fallen far enough to balance supply and demand.

An increase in demand from current renters deciding to buy, would probably only make a small dent in the huge excess supply. And house prices would continue to fall - so the goal of supporting house prices would not be met.

In fact, it could be worse. Landlords, already struggling with high vacancy rates and falling rents, would probably lower their rents further and make the rent vs. buy decision more difficult again. So lower interest rates might not boost demand very much, it might just lead to lower rents.

This is a bad idea from the Treasury. And leaking this story is a terrible idea, since some potential homebuyers might potentially wait for lower interest rates.

This is very different than the Fed program to buy agency MBS. That program makes sense since the GSEs have effectively been nationalized (in Conservatorship) and also helps current homeowners refinance, although I don't understand why the government just doesn't announce the GSE debt is backed by the U.S. Government.

WSJ: Treasury Considers Plan to Lower Mortage Rates to 4.5%

by Calculated Risk on 12/03/2008 04:32:00 PM

From the WSJ: Treasury Considers Plan to Stem Home-Prices Decline

The Treasury Department is considering a plan to revitalize the U.S. housing market by reducing mortgage rates for new home loans ... The plan, which is in the development stages, would use mortgage giants Fannie Mae and Freddie Mac to bring loan rates down as low as 4.5%, a full percentage point lower than the prevailing rates for 30-year fixed mortgages.Oh my ...

...

Under the plan, Treasury would buy securities underpinning loans guaranteed by the two mortgage giants...

Tuesday, November 25, 2008

Mortgage Rates Fall: 30 Year Fixed at 5.5%

by Calculated Risk on 11/25/2008 08:38:00 PM

From Bloomberg: U.S. Mortgage Rates Fall on $600 Billion Fed Plan

U.S. mortgage rates fell more than three-quarters of a percentage point today ... The average U.S. rate for a 30-year fixed mortgage ended the day at about 5.5 percent after falling to as low as 5.25 percent, according to Bankrate Inc. It was 6.38 percent this morning ...And refinance activity has picked up immediately, from the WSJ: Fed Aid Sets Off a Rush to Refinance

The Federal Reserve's attempt to stabilize the housing market set off a chain reaction across the U.S. on Tuesday, dropping interest rates and quickly spurring a burst of refinancing activity by borrowers eager to lower their mortgage costs.

Some brokers said it was the most activity they've seen in at least one year, although there was no way to determine to volume of refinancing.

Friday, November 21, 2008

Kedrosky: The Option ARM Non-Bomb?

by Calculated Risk on 11/21/2008 12:14:00 PM

Paul Kedrosky writes: The Option ARM Non-Bomb? (hat tip Brett)

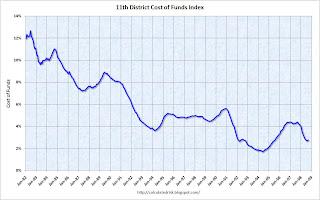

I just had someone email me something interesting today about their adjustable-rate mortgage resetting –- but to considerably lower levels. How widespread is this phenomenon? Or, asked differently, what percentage of ARMs are tied to Treasuries, as opposed to Libor, etc.?The answer from American CoreLogic, via Sue McAllister at the Mercury News, is 60% of ARMs are tied to a LIBOR index, about 25% to various treasuries, and the remaining 15% to the 11th District Cost of Funds Index (COFI -popular in California).

Click on graph for larger image.

Click on graph for larger image.This graph shows the 11th District Cost of Funds Index.

It appears ARMs tied to the COFI and treasuries will be non-bombs. The other 60% of loans tied to LIBOR might reset at a higher rate, although with the 3-month LIBOR down to 2.16% (it was 5.02% one year ago), even these 60% aren't bombs.

But we have to remember a higher interest rate is only one problem. Many of these borrowers had Option ARMs and were choosing the negatively amortizing or interest only options. When these loans recast, the borrowers will be required to pay the amortizing payment - and that could have a much larger impact on the monthly payment than the change in interest rates.

Remember "Reset" refers to a rate change. "Recast" refers to a payment change. See Tanta's Reset Vs. Recast, Or Why Charts Don't Match

Tuesday, November 04, 2008

Fannie Mortgage Bond Spreads Decline

by Calculated Risk on 11/04/2008 04:46:00 PM

From Bloomberg: Fannie Mortgage-Bond Spreads Fall to Lowest in Almost Two Weeks (no link yet)

Yields on Fannie Mae, Freddie Mac and Ginnie Mae mortgage bonds tumbled to the lowest in almost two weeks relative to U.S. government notes, potentially lowering home-loan rates.A little more progress.

The difference between yields on Washington-based Fannie's current-coupon 30-year fixed-rate mortgage securities and 10-year Treasuries fell about 23 basis points to about 183 basis points ...

Tuesday, September 23, 2008

Wells Fargo 30 Year Jumbo Mortgage Rates at 9.2% APR

by Calculated Risk on 9/23/2008 04:37:00 PM

Wells Fargo Jumbo 30 year fixed mortgage rates are now at 9.0% (9.176% APR). (hat tip patrick.net) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This will really hurt the markets with house prices above the conforming loan limit. Here are the conforming loan limits by County from Fannie Mae (excel file).

Thursday, September 18, 2008

Freddie Mac: 30 Year Fixed Mortgage Rate Drops to 5.78%

by Calculated Risk on 9/18/2008 10:16:00 AM

This is quite a decline in mortgage rates over the last few weeks.

From MarketWatch: Freddie Mac: 30-year fixed-rate mortgage average drops

Freddie Mac said Thursday the 30-year fixed-rate mortgage average ... was 5.78% with an average 0.6 point for the week ending Sept. 18, compared with 5.93% last week. Last year at this time, the average rate was 6.34%.

Thursday, September 11, 2008

Lower Mortgage Rates, But More Lenders Require 15% Down Payment

by Calculated Risk on 9/11/2008 01:12:00 PM

Update: Here are the new guidelines from Fannie Mae (hat tip MaxedOutMama)

NOTE THAT THE 85% LTV applies to cash out refis. Purchase Money Mortgage (new purchase) is still 95% LTV (or 5% down payment).

From Peter Viles at L.A. Land: 10% down? Forget it, it's now 15%

Good news from the government takeover of Fannie and Freddie: Mortgage rates are falling. Bad news for borrowers short on cash: You need more cash to get a mortgage.Peter excerpts from an L.A. Times story by Scott Reckard: Mortgage rates are plunging -- for those who qualify

[L]enders spooked by free-falling home prices and surging foreclosures have imposed tougher lending standards. ... most banks this week immediately adopted new guidelines that Fannie Mae said it would implement next year.Here is the current mortgage product info from Fannie Mae. Does someone have a link to the guidelines for next year?

Among them: Home purchasers must put down at least 15% of the purchase price, up from 10%.

Thursday, August 28, 2008

Mortgage Rates Decrease Slightly

by Calculated Risk on 8/28/2008 11:31:00 AM

From Housing Wire: Mortgage Rates Drift Lower as Economic Concerns Linger

Economic concerns continued to help mortgage rates in the past week, according to data released Thursday by Freddie Mac. The GSE said that its weekly mortgage market survey found 30-year fixed-rate mortgages averaged 6.40 percent with an average 0.6 point for the week ending Aug. 21, down 7 basis points from last week. Last year at this time, the 30-year FRM averaged 6.67 percent.Personal Note: I'll be hiking the John Muir Trail from Yosemite Valley to Mt Whitney (and to Whitney Portal) starting on Sunday morning. While I'm gone, Paul Jackson from Housing Wire will be helping Tanta.

When I return I'll have more time for analysis (all the hours working out has really cut into my analysis time over the last couple of months)! In a couple of weeks I'll post my forecasts for housing and the economy. Also - I apologize for not responding to all emails recently. Best to all.

Monday, August 25, 2008

NYT: The GSEs Invent the Risk Premium

by Tanta on 8/25/2008 09:59:00 AM

Either I've finally lost what passes for my mind, or business press's increased fixation on blaming every problem in the mortgage market on Fannie Mae and Freddie Mac has just about jumped the shark. I don't know how else to explain this, from the NYT:

MORTGAGE rates are typically driven by the financial market’s outlook for long-term interest rates, but not always. Policy changes at Fannie Mae and Freddie Mac, the two government-sponsored companies that buy most mortgages issued by United States lenders, recently helped drive that point home.Um, what kind of profound mental confusion could make someone write those first two sentences? Mortgage rates have always been driven by the market "outlook for long-term interest rates," they still are, and they always will be. So have Treasury rates and the yield the local bank offers you on your certificate of deposit. That yield curve thingy. You've heard of it, maybe.

This month, Fannie and Freddie increased the fees they charge lenders for many loans, effectively bumping up interest rates for many borrowers who have marginal credit. The companies also tightened their policies on refinance loans that enable an owner to take cash out of a home.

But mortgage rates have never been "purely" about the bond market's outlook for benchmark yields, since the benchmarks, like U.S. Treasuries, are credit risk-free investments. Treasuries are backed by the full faith and credit of the U.S. Government, which has financial resources that Joe Blow the homebuyer doesn't have. Mortgage loans, like corporate bonds, have credit risk: the borrower might default and you might not get all your money back.

This is why interest rates on home mortgages are always higher than the rate on risk-free bonds of equivalent duration, like Treasury notes. If they weren't, nobody would invest in mortgages, they'd just buy the risk-free bonds. Are you still with me, everyone?

So there are always two main ingredients of mortgage rates, comparable-duration bond yields and the credit risk premium. And the credit risk premium, theoretically as well as practically, can fluctuate pretty widely, depending on, well, one's "outlook" for credit risk.

Fannie and Freddie have always guaranteed the credit risk of the mortgage-backed securities they issue. That is what they do and why they're here. In the "required yields" they establish for the loans they securitize, there has always been this little extra bit that they do not pass through to investors; it's the part they keep for themselves to cover credit losses, because they do not pass credit losses on to investors. You can call it a guarantee fee or a loan-level pricing adjustment or a post-settlement fee, if you want to be technical, or you can just call it a "credit risk premium."

One possibility here is that the GSEs are increasing their credit risk premium--which, in the absence of marked changes in required net yield to the end investor, will appear to make mortgage rates rise "independently" of other long-term interest rates--because, well, current conditions in the housing and mortgage market suggest that mortgages are pretty risky right now, credit-wise. One thing that indicates the extent of this risk, of course, is that by and large nobody but the GSEs are buying mortgage loans right now. Perhaps this is what is confusing the Times reporter: if Fannie and Freddie had any competition right now--if there were anyone else out there buying loans--it might be more obvious that everyone increases risk premiums when perceived credit risk rises. But really, you know. When nobody else but the government-chartered investors are in the market, that can be understood to mean that risk is so high that nobody else is even feeling strong enough to be willing put a price on it. The absence of competitors in a market often suggests that risk has risen in that market. If you've ever tried to get flood insurance, you may have noticed this phenomenon.

Of course, there's another way to look at this, which is that in the last five to seven years it did not "appear" that there was much of a risk premium in mortgage rates because, well, there wasn't much of one. Since we cannot actually open a newspaper or get on the internet without another story of horrible losses taken by investors in mortgages whose "cushion" for defaults--their credit risk premium--was ludicrously low given the riskiness of the mortgages they were investing in, we might have concluded by now that things like the increased risk premiums that the GSEs are now charging are something along the lines of a return to "normal" interest rates. Normal rates being ones that have a realistic risk premium in them.

These two issues do, actually, converge: if the GSEs are the only ones buying loans right now, then they are likely to be buying more of the kinds of loans that private investors used to buy before they quit buying anything. Unless they want to go the same way their private competitors have gone, they have to either tighten standards or raise risk premiums or a combination of both, since it's pretty obvious that the private investor loans of the last few years--mostly subprime, Alt-A, and jumbo--were pretty seriously underpriced. Mortgage markets really aren't that weirder than any other market: you can't make up a negative margin on volume.

This Times piece strikes me as just a somewhat subtler version of the "GSEs Refuse to Save the Day" rhetoric we've seen expressed somewhat more stridently before. What else can we make of this:

Those buying homes will have little choice but to absorb the cost. But the new policies will be felt more by those thinking of refinancing mortgages.Ohhh-kaaay. If you have to buy--apparently people do "have to" buy--you just have to pay a higher interest rate than buyers did until recently. But if you already have a mortgage and refinancing doesn't look promising right now because the rate you have is lower than the rate on a new loan--you're really suffering? Well, OK, what we seem to mean is that if you "have to" refinance--to get cash or to get out of some crazy high-risk ARM--then you will feel some pain. Because apparently Fannie and Freddie aren't willing to take borrowers who "have to" supplement their income with cash-outs or bail out of loans that let them buy too much house without charging extra for it.

Strangely enough, the Times piece makes pretty clear that this "charging extra" doesn't really amount to all that much, relatively speaking. Another eighth of a percent on the annual interest rate isn't exactly going to hit the usury ceiling any time soon. It also provides a nifty little chart showing that one-year ARM rates are still out there with a pretty decent discount. If you don't like paying 6.93% (in New York) for a 30-year fixed, you can always get an ARM for 6.01%. What? You don't want an ARM because you're afraid rates will rise in the future? And we thought rates no longer had anything to do with such expectations . . .

Thursday, July 24, 2008

Freddie Mac: Mortgage Rates Rise Sharply

by Calculated Risk on 7/24/2008 11:26:00 AM

From MarketWatch: Freddie Mac: 30-yr fixed-rate mortgage up on inflation woes The 30-year fixed-rate mortgage average was up to 6.63% from 6.26% last week.

"Market concerns about rising inflation, further weakness in the housing market and greater probability that the Federal Reserve will raise short-term rates this year all combined to push mortgage rates higher this week."The ten year treasury yield has been rising, plus investors are concerned about MBS.

Frank Nothaft, Freddie Mac's chief economist

BTW, the housing bill now goes to the Senate and will probably be signed into law pretty quickly: House Approves Sweeping Effort to Help Housing

The White House, citing an urgent need to restore market confidence in the two mortgage giants, Fannie Mae and Freddie Mac, said President Bush would sign the measure despite his opposition to the inclusion of nearly $4 billion in grants for local governments to buy and refurbish foreclosed properties.It will be interesting to see if the spread between the 30 year fixed rate mortgage and the ten year treasury declines after passage of the housing bill.

Mr. Bush’s support assures that the bill will become law after final passage by the Senate, possibly on Saturday.