by Calculated Risk on 10/22/2009 12:08:00 AM

Thursday, October 22, 2009

Apartment Rents "Plunge" in the West

From the Mercury News: Santa Clara County apartment rents plunge

Apartment rents plunged 10 percent in Santa Clara County in the third quarter compared with a year earlier, the biggest decline in any metro area in the Western United States ...From the Las Vegas Sun: LV apartment rental rates decline in third quarter

RealFacts ... said the average asking price for apartments in the Las Vegas area in the quarter was $837, down 2.1 percent from $855 in the second quarter and down 5.7 percent from $887 one year ago.From Bloomberg: Apartment Rents Decline in U.S. West as Unemployment Increases

Apartment rents declined throughout the U.S. West and South in the third quarter as rising unemployment made it harder for landlords to raise their rates.Falling rents is great for renters, but it means falling apartment values, more losses for lenders and CMBS investors, more pressure on home prices, and possibly a declining CPI (rent is the largest component).

The average asking rent fell to $965 from $1,002 a year earlier, said Novato, California-based RealFacts, which surveyed owners of more than 12,600 complexes. The occupancy rate dipped below 92 percent from almost 93 percent a year earlier.

...

In California’s Oxnard-Thousand Oaks-Ventura region, rents fell 7.4 percent to $1,429, and in the Seattle area they dropped 7.3 percent to $1,036.

Monday, September 14, 2009

More Accidental Landlords

by Calculated Risk on 9/14/2009 01:36:00 PM

From Shahien Nasiripour at the HuffPost: Unable To Sell Their Houses, Millions Of Homeowners Are Turning Into Landlordsmaybe

Since 2007 about 2.5 million homes have been converted into rentals, according to an analysis performed for The Huffington Post by Foresight Analytics, a real estate market research firm based in Oakland, Calif. The conversions account for about 85 percent of the increase in rental homes.The numbers are probably higher. As I noted in The Surge in Rental Units

Since Q2 2004, there have been over 4.3 million units added to the rental inventory.Note: I've been writing (and joking) about accidental landlords for several years.

...

Where did these approximately 4.3 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.2 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

From Nasiripour on a prominent accidental landlord:

[A] growing number of homeowners ... have become landlords, often reluctantly, as they struggle to sell during one of the worst housing markets in recent memory. The most prominent example may be U.S. Treasury Secretary Timothy Geithner, who after failing to sell his $1.6 million home in a New York City suburb found tenants instead.I guess Geithner is holding on for a better market!

Monday, August 31, 2009

Chicago: A Renters' Market

by Calculated Risk on 8/31/2009 09:05:00 AM

From the Chicago Tribune: Chicago's a renters' market, but vacancies, delinquencies on rise

More apartments are available in Chicago, and at prices that have slipped since the beginning of the year, creating a renter's market and allowing some consumers to trade up to better housing. ... according to a study scheduled to be released Monday by DePaul University's Institute for Housing Studies.

...

"If anything, I think [DePaul] is reporting less than what I see," said Jack Markowski, president of Community Investment Corp., a non-profit mortgage lender to multifamily buildings that started seeing increases in multifamily mortgage delinquencies 18 months ago. Multifamily buildings, he said, "are vulnerable right now."

...

Landlords, seeking to cover their costs, are lowering rents to attract tenants, and the study found that rents declined in all sizes of buildings and in all city neighborhoods except for the North Side.

...

The level of multifamily mortgages foreclosed on in Chicago during the year's second quarter, at 0.8 percent of the total supply, was twice as high as it was in the comparable year-ago period, said James Shilling, a DePaul professor and director of the institute.

"It only gets worse," Shilling said of the predicament the rental market finds itself in. "There's downward pressure on rents and upward pressure on vacancy rates. I think for the rest of 2009 and 2010 we'll see more defaults."

Monday, August 17, 2009

Recession Roommates

by Calculated Risk on 8/17/2009 08:51:00 PM

From Carolyn Said at the San Francisco Chronicle: More share space to shave costs in recession

Facing layoffs, pay cuts and furloughs, more people have turned to shared housing to help make ends meet. Craigslist ... says that its roommate-wanted postings over the past 12 months are up 60 percent for the Bay Area, and up 85 percent within San Francisco.It is common in a recession for households to double up by moving in with a friend or family member. However I'm not sure if taking in boarders is common in a recession ... although from the stories I've heard, it was very common during the Depression.

While young singles sharing digs to save money is nothing new, this new brand of "recession roommates" includes more families and couples who are sacrificing their privacy as a way to cope with the economic downturn.

...

The Census Bureau's American Community Survey showed a jump in cohabiting in 2007, the most recent survey year. In California, the number of "family households" with a roommate stood at 228,500 in 2007, up 9.6 percent from 2006. In "nonfamily households," 674,000 reported having roommates in 2007, a 9.4 percent increase from the previous year.

...

During the Great Depression, plenty of people rented out spare rooms to cope with hard times, said Los Altos resident Don McDonald, 91, whose family in Ohio took in boarders regularly. ... "(Boarders) always ate with us and were, in effect, part of the family. The old family photo album shows several of them over those years."

Sunday, August 16, 2009

The Rentership Society

by Calculated Risk on 8/16/2009 10:11:00 AM

From the Boston Globe: President shifts focus to renting, not owning

The Obama administration, in a major shift on housing policy, is abandoning George W. Bush’s vision of creating an “ownership society’’ and instead plans to pump $4.25 billion of economic stimulus money into creating tens of thousands of federally subsidized rental units in American cities.This conversion of housing stock from ownership to rental units is already happening. Based on data from the Census Bureau, there have been over 4.3 million units added to the rental inventory since Q4 2004, far more than the 1.1 million new units completed as 'built for rent' since 2004. (see The Surge in Rental Units)

The idea is to pay for the construction of low-rise rental apartment buildings and town houses, as well as the purchase of foreclosed homes that can be refurbished and rented to low- and moderate-income families at affordable rates.

...

“People who were owners are going to be renting for a while,’’ said Margery Turner, vice president for research for The Urban Institute, a Washington think tank that studies social and economic policy.

“There is a housing stock that is sitting vacant. There is a real opportunity here’’ to use those homes as rental property and solve both problems, she said.

And this conversion is ongoing. According to the Campbell Survey, 29 percent of all existing home properties in Q2 were purchased by investors - probably mostly for use as rentals.

In addition, many of the modification programs are really turning homeowners into renters (or "debtowners"). Most mods just capitalize missed payments and fees, and reduce interest rates for a few years. Many of these "homeowners" will still have negative equity when the interest rate increases again, and this could be viewed as Single Family Public Housing.

The Rentership Society.

Wednesday, August 05, 2009

BRE Properties: Rents to Decline well into 2010

by Calculated Risk on 8/05/2009 01:14:00 PM

"I think it is shaping up there is another leg down in terms of market rents and effective rents and that will be somewhere late this year or early [next] year where I think all the operators will move their rents down to basically handle the late stage of this recession."BRE is an apartment REIT in the West. Here are some comments from their conference call (hat tip Brian):

BRE CEO, Aug 5, 2009

“In our market footprint non farm jobs have decreased almost 800,000 or 5% year-over-year. We feel we are at the midpoint of the market cycle. Operating fundamentals will continue to be challenged until jobs stabilize. Past recession patterns and current forecast [suggest this will be] 15 to 18 months after GDP stabilizes, currently expected in the third or fourth quarter this year.This matches the data from the NMHC apartment market tightness survey released yesterday.

... our current views have not changed from the start of the year, specifically the rent curve should continue to decline well into 2010. Cumulative rent loss may be double digits and pricing power will not return until jobs turn positive which may be late 2010.

On the disposition front, we were successful in selling the two Sacramento assets that were classified as held for sale. One community sale occurred in June and the second in July generating growth proceeds of 65 million. The cap rate was 8.5%. ...

This environment calls to mind the Churchhill comment,”if you are going through hell, keep going.”

... we believe we are halfway through a tough two-year period for rents and operations.

Occupancy at the end of the second quarter was 95%, we are slightly north of that today. We have two positive variables available to us, higher traffic and favorable renewal rates.

... market rent in our communities is down 4% year-over-year and down 6% since September. Essentially all the market decline was realized during the end of the year in the first quarter. Rents have been flat since the end of March. Effective rents are down almost 9% from peak levels in '08.

..

Concessions and/or discount pricing are prevalent in all operating markets, available from private and public operators. Whether you call it a concession or effective rent, discounts are available. In this environment the customer is focused on the check writing experience so the concession is taking the form of the recurring discount off the monthly rent. ...

Historically we haven't used concessions. In most of our markets, they weren't necessary. They are proving useful [today] on two fronts. One, we needed to recover the occupancy line [in Q2] and wanted some immediate velocity. This proved successful. The concessions are also helping where we go from here. There is another leg down from people with job losses. Our view is to pick the appropriate time in each market to adjust rents and at that time begin to reduce concessions. The objective is to reduce concessions and discount at some point by the second half in 2010.

...

Renewals are running 55%. We don't lose many tenants to other properties, about 3%. Move outs to home purchases are running 8.5% down from 16% a year ago. Jobs are the drivers for move outs. If we combine job transfer, job loss, relocation, personal reasons and financial problems, these five factors total 30% of move out activity. Unscheduled move outs, evictions and skips are another 9%.

There remains a fairly healthy rent to own gap in our Orange County, Seattle and San Diego markets, in LA where there is virtually no and the Inland Empire is negative 15 to 20%. Phoenix is negative 5% and Denver has a positive rent to own gap.

...

Analyst: I'm trying to specifically narrow down what is going to cause another 5% [decline in rents] in an environment where job losses are decreasing?

BRE: We expect there to be continued sequential declines in job growth in all of our markets through at least the midpoint of 2010. Right now the economy.com forecast is showing that you go from negative sequential declines to a point of stabilization to a beginning of modest job growth through 2010 and into ' 11. We are using that forecast and erring on the side of conservatism. We are still [expecting] another leg down in rents. In February when we gave our comments we said we thought '09-'10 would be a two-year decline in a range of 10 to 15%. I think that's still where we are today. If it is not there, we will be thrilled and happy not to cut the rents all the way down. Right now I think it is shaping up there is another leg down in terms of market rents and effective rents and that will be somewhere late this year or early [next] year where I think all the operators will move their rents down to basically handle the late stage of this recession.

emphasis added

Tuesday, August 04, 2009

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 8/04/2009 10:49:00 AM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 20 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous month.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Stabilizing, But Not Improving, According to NMHC Quarterly Survey

The apartment market continues to struggle, but shows early signs of possibly stabilizing, according to the National Multi Housing Council’s latest Quarterly Survey of Apartment Market Conditions.

All four of the survey's market indexes covering occupancy, sales volume, equity finance and debt finance remained below 50 (indicating conditions were worse than three months ago), but three of the four increased from the last quarter, with only the debt index recording a decline.

“Apartment demand remains tethered to an economy that continues to shed jobs at a fairly rapid pace,” noted NMHC Chief Economist Mark Obrinsky. “Financing is beginning to stabilize, but the market is still a long way from ‘normal’.”

“The survey also suggests that transaction activity is mainly being restrained by uncertainty in apartment property values—whether they have ‘bottomed out’—and not financing constraints. Only when this uncertainty fades are we likely to see a significant upturn in apartment transactions.”

Fears of future property value declines are behind the difficulty apartment firms are having in obtaining equity financing. In a special survey question, 67 percent of respondents said potentially falling property values best explained the lack of equity availability.

...

The Market Tightness Index rose from 16 to 20. This was the eighth straight quarter in which the index has been below 50, but it also the third straight quarter in which the index measure has been rising, as greater shares of respondents are reporting that vacancies are unchanged from the previous quarter rather than even looser.

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

Friday, July 24, 2009

The Surge in Rental Units

by Calculated Risk on 7/24/2009 11:36:00 AM

Please see this earlier post for graphs of the homeownership rate, and homeowner and rental vacancy rates.

The supply of rental units has been surging: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.3 million units added to the rental inventory.

Note: please see caution on using this data - this number might be a little too high, but the concepts are the same even with a lower increase.

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at a record 10.6%.

Where did these approximately 4.3 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.2 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

This huge surge in rental supply has pushed down rents, and pushed the rental vacancy rate to record levels.

Yes, people are doubling up with friends and family during the recession, and some renters are now buying again, but the main reason for the record vacancy rate is the surge in supply.

Wednesday, July 08, 2009

Apartment Vacancy Rate at 22 Year High

by Calculated Risk on 7/08/2009 12:56:00 AM

From Reuters: U.S. apartment vacancies near historic high: report

The vacancy rate for U.S. apartments reached its highest level in more than 20 years...Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at 10.1% in Q1 2009. This fits with the NMHC apartment market survey.

The national vacancy rate rose to 7.5 percent ... The record high was 7.8 percent in 1986.

"We are reaching that historic high very quickly," said Victor Calanog, Reis director of research.

... effective rent was down 1.9 percent from the prior year and 0.9 percent from the first quarter to $975, Reis said.

... "With general expectations of an economic recovery pushed back to early 2010 at the earliest, it seems likely that apartments will have to endure a few more quarters of distress, lower rents and higher vacancies," Calanog said.

Rising vacancies. Falling Rents. This time for apartments ...

Sunday, July 05, 2009

Apartment Rents Decline in Los Angeles

by Calculated Risk on 7/05/2009 09:43:00 AM

From Lauren Beale at the Los Angeles Times: Vacancies give renters room to negotiate

The first quarter saw the largest rent decline in a decade for Los Angeles County, Reis' [Victor Calanog, director of research] said. Effective rents, those that take concessions into account, fell 1.7% in the first quarter of this year from the fourth quarter of 2008, while asking rents dropped 1%.And vacancy rates are rising:

The rate climbed to 5.3% in the first quarter from 3.8% in the first quarter of 2008, said [Reis' Calanog] ... In contrast, vacancies had been hovering between 2% and 3% for the last decade.Declining rents puts more pressure on house prices ... and rents could continue to fall through 2010.

...

The last time vacancy rates were this high in Los Angeles County was in the early 1990s, when they hit 5%.

Here are some comments from BRE (a REIT) in February:

We believe we are looking at a negative rent curve for the next two years.

We believe on a composite basis, market rents in 2009 could fall between 3 and 6% from peak levels in 2008. And the rent cuts in 2010 could be deeper ...

Sunday, June 28, 2009

How many Homeowners Sold to Rent at the Peak?

by Calculated Risk on 6/28/2009 07:26:00 PM

TJ & The Bear asks: "ocrenter had an interesting question over at JtR's BubbleInfo. Specifically, what percentage of homeowners that sold during the height of the bubble (04 to 06) went to cash and rented?" ocrenter is obviously curious about "cash on the housing sidelines".

We don't have the data to answer that question, but using the Census Bureau Residential Vacancies and Homeownership report, we can see that the number of occupied rental units bottomed in Q2 2004. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The number of occupied rental units bottomed in Q2 2004, and has increased by 3.8 millions units since then.

The homeownership rate also peaked in 2004, although it didn't start declining sharply until 2007.  Note: graph starts at 60% to better show the change.

Note: graph starts at 60% to better show the change.

There are probably several reasons why the number of renters started increasing in the 2nd half of 2004 (even though the housing bubble didn't peak in activity until the summer of 2005, and in prices until the summer of 2006.) More and more renters probably thought housing prices were too high by 2004 and put off buying, and some homeowners probably sold and became renters ...

To answer ocrenters question (somewhat), the number of renters increased by about 1.6million in the 2004 to 2006 period. A large number of those renters could have been homeowners who decided to sell and rent. We just don't have the data ...

Wednesday, June 17, 2009

Owners' Equivalent Rent

by Calculated Risk on 6/17/2009 10:23:00 AM

Owners' equivalent rent (OER) is a major component of CPI (23.8% of CPI, see Cleveland Fed), and even though rents are falling in most areas, OER is still increasing (up 2.1% Year-over-year and up 1.8% annualized in May).

For a discussion from the BLS of rent measures see: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and Rent of primary residence (Rent)

The expenditure weight in the CPI market basket for Owners’ equivalent rent of primary residence (OER) is based on the following question that the Consumer Expenditure Survey asks of consumers who own their primary residence:UPDATE: I misread the BLS document.“If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?”

The survey question above is for weighting. The price relative for OER is calculated by sampling non rent-controlled renters every six months. These average rents are divided by the sample six months earlier - and converted to a monthly change (by taking to the 1/6th power).

From the BLS document above: "The first step is standardizing the collected (market) rents, putting them on a monthly basis, and adjusting them for a number of circumstances that should not affect the CPI."

I apologize for any confusion.

END UPDATE.

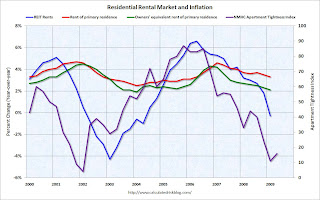

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman Sachs), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.

Wednesday, May 20, 2009

Residential Rental Market and Inflation

by Calculated Risk on 5/20/2009 08:15:00 PM

Goldman Sachs tracks the rents at a large number of apartment REITs - and rents are now falling (excerpted from research report with permission):

REITs tend to adjust more rapidly to changing market conditions than the typical landlord, so changes in their behavior are useful signals of turns in the market ... Public REITs typically report the rent increases they have achieved on a year-over-year, comparable-unit basis with each quarterly filing. ... [the tracked] REITS managed 300,000 units that were comparable to the year-before period in the first quarter of 2009 ... In the first quarter of 2009, the major REITs collectively reported an outright decline in rents for the first time since 2004.Goldman notes that declining rents for REITS typically lead declines in the CPI measures of rent: Owners' equivalent rent of primary residence (OER) and Rent of primary residence.

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.

This is important for house prices too. With falling rents, house prices need to fall further to bring the house price-to-rent ratio back to historical levels.

Tuesday, May 12, 2009

Can't Sell? Try Renting

by Calculated Risk on 5/12/2009 04:24:00 PM

From CNBC: Homeowners Turn to Renting, Waiting for Market to Recover

Still having trouble selling your house? More homeowners are deciding to rent out their homes while they wait for the market to recover.And here is a video I took this morning in Newport Beach (note: this also fits with the Home Sales: One and Done post too. Who will buy in these more expensive beach communities when there are no move up buyers?

"I had my condo on the market for three months and I didn't have any bites," says Molly Smith, a public relations executive in Newburyport, Massachusetts. "I realized if I was going to sell it, I'd take a big loss."

So the 29-year-old Smith, who wanted a shorter commute to her job, decided to rent out her house and move into a rental herself.

Please be patient with me - I'm still working on this video stuff!

The construction noise at the beginning of the video is a new Senior Center being built (still demolishing the old structure and grading the property).

Although rentals are common in Newport Beach, the market is usually very tight. Not right now.

Sunday, May 10, 2009

NY Times: Falling Apartment Rents in Manhattan

by Calculated Risk on 5/10/2009 03:19:00 PM

From the NY Times: Manhattan Calling

... Great Recession prices are drawing even the most loyal outer-borough dwellers back to Manhattan. ...This is mostly anecdotal data, but it does appear apartment rents are falling in much of the country.

Among the lures: $1,600 one-bedrooms on the Lower East Side. Lenient landlords who no longer require security deposits. And an overriding sense that an obscenely overpriced borough is now, well, slightly more reasonably overpriced.

... "[T]his was a unique moment in real estate history where renters have the upper hand, which seemed unbelievable a couple of years ago." [said] Keith O’Brien, a 30-year-old in marketing and public relations ...

In the first three months of the year, one-bedroom rents in Manhattan fell 6.7 percent compared with the previous year, while Brooklyn one-bedrooms dropped just 3.2 percent, according to data from Citi Habitats and Ideal Properties Group ... Other reports show some Manhattan rents down by 10 percent from a year ago.

... prices at upscale rental buildings like 45 Wall Street have come down significantly, discounted by 15 to 20 percent in recent weeks.

Friday, May 01, 2009

NMHC: Apartment Market Conditions Continue to Worsen

by Calculated Risk on 5/01/2009 09:23:00 AM

Note: Any reading below 50 indicates conditions are worsening; above 50 improving. So the increase in the index to 16 means the apartment conditions are worsening, but at a slower pace.

"Worse conditions" implies higher vacancy rates and lower rents - so it is good for renters.

From the National Multi Housing Council (NMHC): Apartment Market Still Suffering Downturn, Though Pace Is Decelerating, According To National Multi Housing Council Survey

Apartment market conditions continue to worsen, though the pace is decelerating, according to the National Multi Housing Council's (NMHC) latest Quarterly Survey of Apartment Market Conditions.

While all four market indexes remained below 50 (index numbers below 50 indicate conditions are worsening; numbers above 50 indicate conditions are improving), they all rose from three months ago. In particular, about half of respondents thought conditions were unchanged in the sales volume, equity finance, and debt finance markets.

“This global downturn has led to the most challenging economic conditions in at least five decades, and the apartment industry is suffering like other industries," noted Mark Obrinsky, NMHC's Chief Economist. "Capital remains difficult to obtain, and the sharp and continuing drop in employment, in particular, is sapping demand for apartments in markets throughout the country."

“Interestingly,” he continued, “despite considerable media focus on the “shadow rental” market, only a slim majority of respondents noted greater competition from condos and single-family rentals than in previous years.”

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose to 16 from 11 last quarter. Nevertheless, 73 percent of respondents said markets were looser (meaning higher vacancy and/or lower rents). While this was the seventh straight quarter in which the index has been below 50, the low reading may partially represent normal seasonal weakness.

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

It is common in a recession for apartment vacancies to rise, as households double up by moving in with a friend or family member. However an added factor in this recession is all the single family homes being offered as rentals. This is possible additional competition for apartments:

In a special fifth question to NMHC’s Quarterly Survey, one-third (33 percent) said such competition [from condos and single-family rentals] was unchanged. Another four percent thought there was less competition, and 11 percent don’t consider condos and single-family rentals to be significant competition for apartments in their markets. A slightly majority, 52 percent, did report more competition from condos and single-family rentals than in previous years.Competition from condos and single-family rentals probably depends on location.

Monday, April 13, 2009

Another Story of Falling Apartment Rents

by Calculated Risk on 4/13/2009 03:00:00 PM

From Bloomberg: Manhattan Apartment Rents Fall as Unemployment Rises

Manhattan apartment rents fell as much as 5.9 percent in March from a year earlier as rising unemployment damped demand, Citi-Habitats Inc. said.Some asking prices are falling even faster. From Amanda Fung at Crain's on New York: Big landlord takes hit on falling apt. rents

...

Rents for studios dropped 2.1 percent to an average of $1,812, while those for one-bedroom apartment fell 5.9 percent to $2,595. The cost of renting two-bedroom homes declined 2.2 percent to $3,631 and three-bedrooms fell 1.6 percent to an average of $4,670.

The average declines for March don’t reflect concessions offered by landlords, such as a free month’s rent, that lower the overall cost, [Gary Malin, president of Citi-Habitats] said.

“There is a greater degree of price decline than those numbers show,” he said.

Since February alone, Equity Residential has lowered its Manhattan asking rents by an average of 13%, said Michael Levy, an analyst at Macquarie. That reduction came on top of a 15% cut over the previous year.

Wednesday, April 08, 2009

Apartment Rents Fall 4% in SoCal

by Calculated Risk on 4/08/2009 09:18:00 AM

Roger Vincent writes in the LA Times: Apartment rents fall in Southern California

... The average rent in Los Angeles County fell almost 4% in 2008 as apartment occupancy rates dropped and new units came online. The decline should continue this year as more renters lose their jobs, according to the annual USC Casden Forecast expected to be released by the university today.Falling rents. Rising vacancies. Same story for apartments, malls, and offices ...

"In L.A. County alone, 41,000 people moved out of apartments last year compared to the 29,000 people who moved in during the last five years," said forecast director Delores Conway.

...

Orange County is generally stronger than the rest of the region, the report said, though rents came down 2% last year ...

Tuesday, April 07, 2009

Apartment: Vacancy Rate Increases, Rents Fall

by Calculated Risk on 4/07/2009 05:39:00 PM

From Reuters: US apartment market worsens with economy--Reis

... The national apartment vacancy rate rose to 7.2 percent in the first quarter, up 0.60 percentage points from the prior quarter and 1.1 percentage points from a year earlier ...This puts more pressure on house prices, and also raises more questions about the BLS measure of "Owners' equivalent rent" (that is showing an increase).

It was the highest vacancy rate since the first quarter of 2002. That was right before the last downturn bottomed out, but Reis expects the picture to get a lot darker as "we are arguably only at the beginning of the current downturn."

Behind the rising vacancy rate is a build-up of available apartments ...

Asking rents fell by 0.6 percent to $1,046 per month, the largest single-quarter decline since Reis began reporting quarterly performance data in 1999.

With new supply coming online, and families doubling up, it appears rents will decline for some time. Here are some comments from BRE properties in February:

We believe we are looking at a negative rent curve for the next two years.

We believe on a composite basis, market rents in 2009 could fall between 3 and 6% from peak levels in 2008. And the rent cuts in 2010 could be deeper ...

Thursday, April 02, 2009

More Stories of Falling Apartment Rents

by Calculated Risk on 4/02/2009 06:34:00 PM

From Amanda Fung at Crain's on New York: Big landlord takes hit on falling apt. rents (ht Jennifer)

Declining Manhattan rents are taking a toll on Equity Residential, a large real estate investment trust that owns 47 apartment buildings in the New York metropolitan area.And in San Diego from Zach Fox at the NC Times: HOUSING: Rents falling as vacancies rise at major complexes

...

Since February alone, Equity Residential has lowered its Manhattan asking rents by an average of 13%, said Michael Levy, an analyst at Macquarie. That reduction came on top of a 15% cut over the previous year.

A handful of big local apartment complexes have cut rents in an attempt to fill empty units ...

Tradition, an apartment complex near the Aviara Golf Course in Carlsbad, has cut its asking rent for a three-bedroom apartment from $2,015 to $1,799 per month, said Kris Nelson, business manager for the complex.

Tradition has seen its vacancy rate rise from a fairly consistent 3 percent to 8 percent recently, Nelson said.

...

In Temecula, Somerset Apartments has seen its vacancy rate shoot up from 3 percent to 20 percent. Managers responded by slashing rents by 25 percent for two bedroom, two bath apartments ---- from $1,200 to $900 per month.